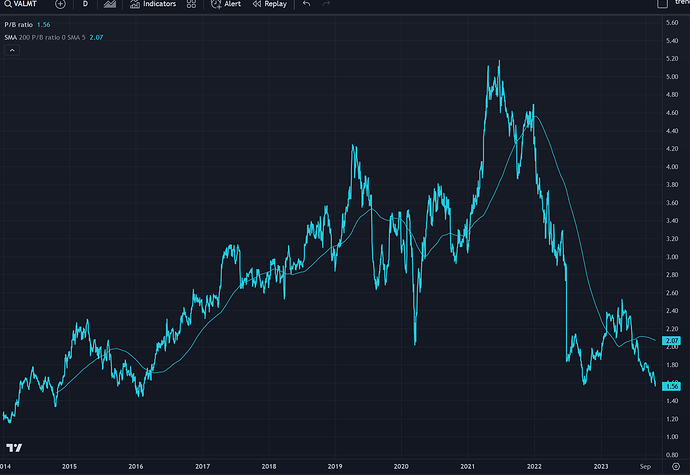

Joining the discussion from the sidelines; I personally bought Valmet once in 2023, when the price seemed to reflect a lot of bad news and there was a margin of safety in the valuation. Valmet seems like a good company and the stock has a lot of potential.

However, I haven’t managed to be extremely enthusiastic about Valmet, and my Valmet holding is quite small compared to many other stocks.

Here are some of my own doubts regarding Valmet, which might spark thoughts in other Valmet shareholders, or perhaps someone can dispel my doubts:

Geopolitics: Valmet gets ~11% of its revenue directly from China. There are 2,300 / 17,500 employees in China, along with 6 production facilities and 3 R&D centers! China is a huge market and a global player probably “must” be there, but this is a big warning sign.

Valmet has many business areas, but pulp is a massive part of the business directly and certainly also in terms of maintenance. Things aren’t going well there right now, and it’s not good for Valmet if customers start tightening their purse strings (postponing/canceling investments, in-house maintenance vs. buying from Valmet, etc.).

Circular economy, green transition, etc., are big opportunities for Valmet directly and indirectly. But there are also risks; when the regulatory bureaucrats in Brussels get really excited, anything can happen…

Value chain position: the heavy industry’s preferred supplier. Valmet has a lot of expertise, and they have historically been able to monetize their products and services quite well, with apparently long-standing customer relationships. However, that position is quite precarious, as customers likely lack the ability and willingness to pay top dollar; maintenance certainly provides recurring billing, but they constantly need to sell something new with a good margin somewhere. This concern has historically been unfounded, but it’s not exactly a fantastic place to make money when customers have heavy, debt-laden balance sheets and their demand depends on consumers—and Valmet’s money then has to come from maintenance and installations for machines at UPM and the like.

Valmet’s largest owner is Solidium. One can consider the case of Fortum, for example, whether it’s an ideal situation to be a shareholder in a company driven by the Finnish state…

Insiders:

- CEO Laine is apparently good. But he’s leaving. A new CEO is both a threat and an opportunity.

- Chairman of the Board Mäkinen only has a small stake in the company. I don’t know much about him, but from what I’ve seen of his career at various companies, he has never impressed me.