Tekova, which builds hall-like business premises ranging from shopping centers and commercial premises to multi-purpose halls, is planning to list! Let’s open a dedicated thread for it! ![]()

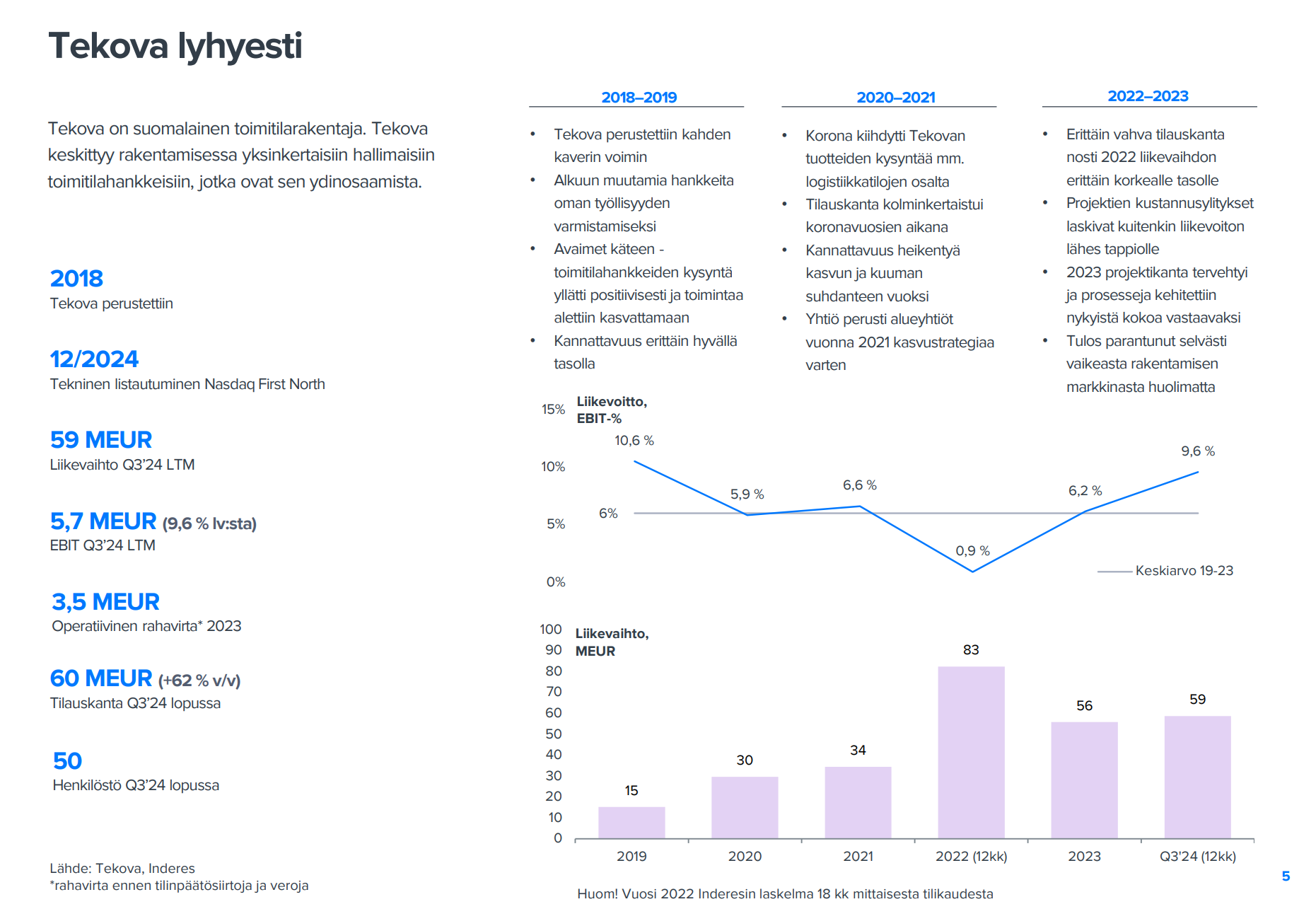

Tekova is planning to list on the Nasdaq First North Growth Market Finland marketplace. The planned listing would be implemented in December as a technical listing, meaning no share issue or sale would be arranged in connection with it.

Inderes’ interview is already available on InderesTV: Tekova suunnittelee listautumista - Inderes

Tekova in brief

Founded in 2018, Tekova specializes in the construction of commercial, office, logistics, production, and sports facilities. During our operating history, we have completed approximately 100 projects. We have succeeded in business premises construction by focusing on hall-like business premises projects tailored to our customers’ needs, with a simple development process.

The guarantee of Tekova’s quality is our own skilled personnel in project development, as well as in design and project management. Construction is carried out in cooperation with reliable partners.

Our clientele primarily consists of private sector customers. Our clients have included national commercial chains and real estate investors, as well as companies investing in individual projects. Tekova’s good reputation and recognition in the industry are based on a customer-oriented approach and successful projects.

More from the company’s own investor pages: https://sijoittajat.tekova.fi/fi