Tekova’s CEO, former Lehto business director, etc., all good. The picture is unusually clear. I wouldn’t touch this with a ten-foot pole. I didn’t own Lehto, so I’m still in the clear…

So, the assumption is that mistakes cannot be learned from? The construction industry is currently in a tight spot, but those who survive this difficult time could expect a fairly good upswing within a couple of years.

Lehto did quite well when they made those simple boxes. “Cost-driven construction”. The CEO said something about wanting to hold the designer’s hand because that’s when you can best influence costs.

Later, they lost their money on factory-made apartments and renovation projects.

10% up from the midpoint of the result

Tekova’s strong order book for the end of the year - Inderes

Am I reading this correctly? The EPS forecast was €0.11 and now the share price is €0.78 → P/E around 7. When you add a positive profit warning on top of this, it really seems to be in the bargain bin.

Tekova raises its guidance

today at 2:09 PM ∙ Arvopaperi

Real estate company Tekova is raising its revenue guidance and refining its operating profit guidance for the financial year ending December 31, 2024.

Some of the group’s construction projects progressed faster than anticipated during the end of the year, and additionally, one project was handed over before the contractually agreed completion in 2024.

In the updated guidance for 2024, the revenue for the 2024 financial year is estimated to be approximately 62-67 million euros. The operating profit (EBIT) for the 2024 financial year is estimated to be between 5.5-6.5 million euros.

In the previous financial guidance for 2024, the revenue estimate for the 2024 financial year was 55-65 million euros and the operating profit was 4.5-6.5 million euros.

Was this positive report somehow bad news?

To my eye, quite strong numbers.

So when the order book has risen by 70% in the last quarter, it can be difficult to interpret the matter as negative. Well, of course, some other player has lost these orders, so it is negative from their perspective.

Tracking

Recommendation

Buy

Target Price

0.95 EUR

Updated

07.02.2025

Recommendation changed to BUY at Inderes.

TEKOVA is on the front page of today’s Helsingin Sanomat. They had bought the entire front page. At least that brings visibility. Good thing, because a technical listing doesn’t generate widespread awareness. Perhaps people will notice to look closer at that positive earnings warning and the 70% increased order book.

TEKOVA is featured on the front page of Helsingin Sanomat today. They had bought the entire front page. At least that brings visibility. Good thing, because a technical listing doesn’t generate widespread awareness.

Below is the press release issued on Sunday evening regarding Tekova’s new contract. ![]()

Tekova to Build AI Data Center Expansion in Mäntsälä, Contract Value Approx. €17.2 M

Tekova Plc, Company Announcement February 16, 2025 at 6:45 p.m.

Tekova Plc and Nebius DC Oy have signed a contract for the construction of a new phase of Nebius’ data center in Mäntsälä. The contract value is approximately €17.2 M (VAT 0%) and the project size is approximately 20,000 m2.

Nebius DC Oy is a Finnish subsidiary of Nebius Group N.V., which operates the data center in Mäntsälä. Nebius Group N.V. is a Nasdaq-listed international AI technology company headquartered in Amsterdam.

Construction work for the project has commenced and is expected to be completed during 2026. Tekova’s contract includes the civil engineering works for the project. Building services and equipment procurements related to operation will be carried out as separate procurements by the Client.

“This project is extremely significant for Tekova. It is the largest in Tekova’s history, both in terms of contract sum and area. This demonstrates Tekova’s capability to negotiate and execute projects with large international players. We believe this opens up good opportunities for the company to negotiate and execute data center projects in the future as well,” states Jaakko Heikkilä, CEO of Tekova.

“The expansion of the Mäntsälä data center’s capacity is a key part of developing our global AI infrastructure. We are pleased to strengthen our operations in Finland and collaborate with local partners to implement this strategically important project,” says Andrey Korolenko, Nebius’ Chief Product and Infrastructure Officer.

Tekova announced it was negotiating the project in its company prospectus published on December 13, 2024.

Here are also Olli’s comments regarding the Sunday announcement mentioned in the message above. ![]()

Tekova announced on Sunday that it had signed a contract for a data center project to be built in Mäntsälä, worth 17.2 MEUR and 20,000 square meters in size.

After a positive profit warning, I expect a clear dividend increase. This company is personally owned, so it’s very certain that the personal owners want a good dividend. Based on the information available about the company in public, it seems that the organization is lean and scalable without any significant investments. It’s possible to pay out a good portion of the profits.

Kopsa’s comments on Tekova publishing its Q4 report next Thursday (Feb 27). ![]()

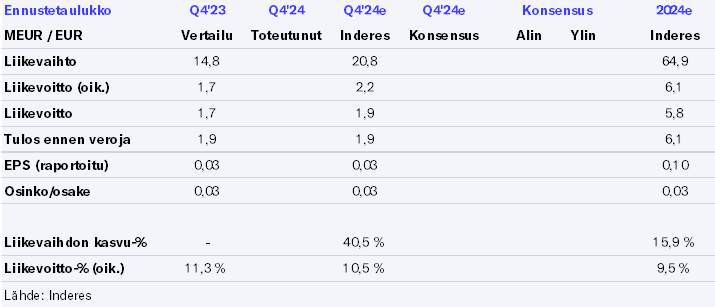

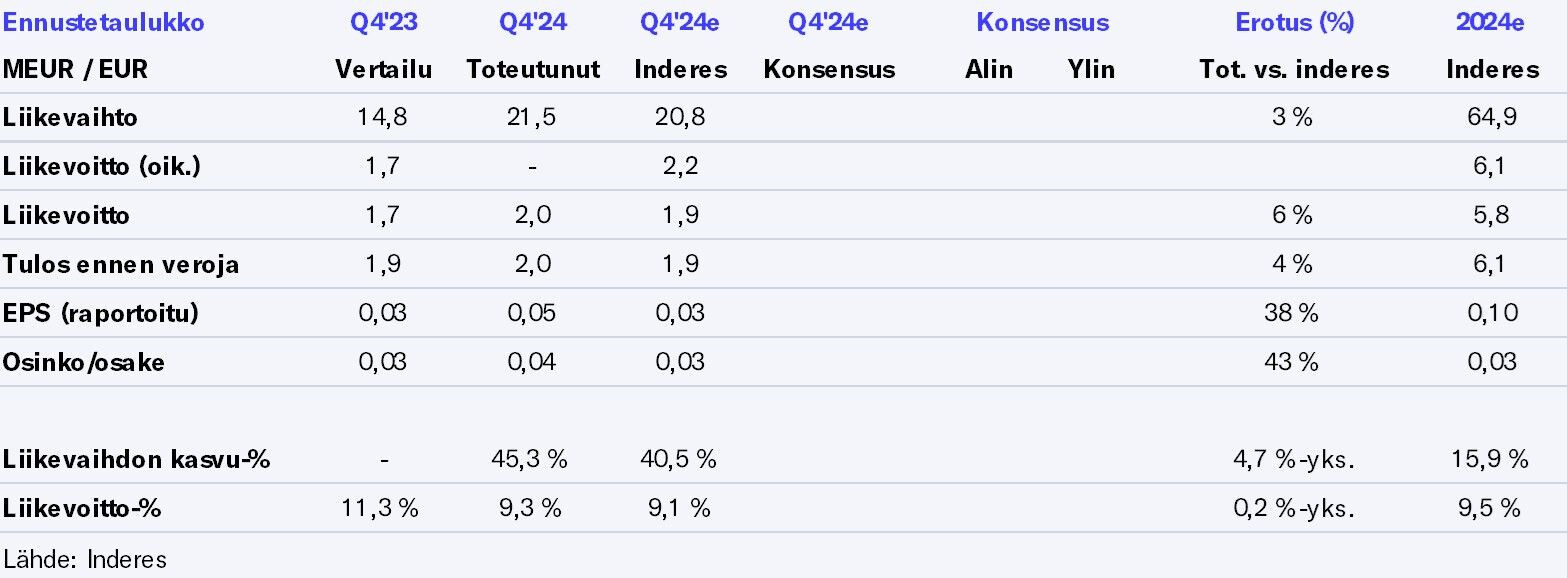

Tekova’s business development in the last quarter of the year and for the full year 2024 has been very strong, based on preliminary information. Based on already known received orders, Tekova is also growing strongly this year, but the report will be scrutinized for indications of the growth rate and the sustainability of profitability. The valuation is cheap going into the results, provided Tekova can, through its actions or outlook, meet or even exceed our forecasts for the coming years, which anticipate stable earnings.

The interesting thing here is the dividend. Inderes has previously assumed that the majority of increasing profits would be invested in the company’s growth. Now that the company has already made a growth leap, the dividend is likely quite reasonable, and the company’s extensive private ownership further increases the desire for dividends.

Results released:

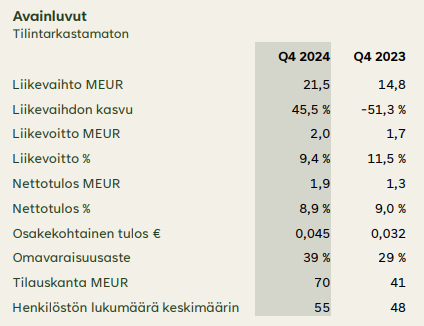

Revenue was 21.5 (14.8) million euros and grew by 45.5% (-

51.3%)

• Operating profit (EBIT) was 2.0 (1.7) million euros and the EBIT margin was 9.4% (11.5%)

• Commercially strong October-December: 9 new contract agreements were made

with a total value of EUR 32.4 million. The order book continued to strengthen, and was at the end of the review period

approximately 70 (41) million euros

• Earnings per share were 0.045 euros per share

• Tekova Oyj was listed in December. Trading in the company’s shares began on 17.12.2024 on First

North Growth Market Finland –market place

• During the review period, 3 completed projects were handed over to customers

• The number of personnel at the end of the review period was 58 (46)

• The company’s Board of Directors proposes to the Annual General Meeting that for the financial year, a dividend of

0.040 euros per share be paid

Olli’s forecasts were exceeded, at least regarding revenue and EPS

In the guidance, the lower end of EBIT perhaps seems a bit cautious

In addition to the euros, the following caught my eye from the CEO’s review; even though there hasn’t been an absolutely huge number of projects, the qualitative figures are impressive:

According to the customer satisfaction survey conducted for projects completed during 2024, the NPS score was 100, which can be considered exceptionally good. (For projects completed in 2023, the NPS was 70.)

A total of eight projects were completed during the year, all of which were handed over to customers as so-called 0-defect deliveries. The Group reports projects as 0-defect deliveries when their acceptance occurs without a separate post-inspection according to YSE. Good project management, high customer satisfaction, and a manageable workload are also reflected in the well-being of the personnel. According to the employee well-being survey conducted in autumn 2024, the eNPS score was 49.

In my opinion, an excellent report from a recently listed construction company.

- dividend 4.7%

- order book excellent, plus a single large order in February from an interesting industry

- earnings guidance slightly cautious, but there’s room for positive surprises

I would be surprised if the share price doesn’t develop positively in the future.

Thanks Tekova. Excellent performance. The best thing in the report was that a compact product has been found, which is customized according to the customer’s wishes. This way, both parties know what they are getting. Here we see that not all construction companies are doing badly - rather excellently when they know how to do the job.

In connection with this, one more excerpt from the CEO’s comments:

\u003e Achieving an excellent financial result was also helped by the fact that, due to the general downturn in the construction sector, materials and subcontracts for projects could be acquired cheaper than anticipated.

I could imagine that this partly affects the cautious operating profit guidance? Somewhat paradoxically, as conditions in the construction sector improve, Tekova’s profitability comes under pressure when the demand and price for resources start to rise. Does @Olli_Koponen have a view on how significant a factor this is for Tekova’s profitability?

Here is our comment on the morning results:

https://www.inderes.fi/analyst-comments/tekova-q424-pikakommentti-vahvalle-kasvulle-selkeat-ajurit

A very good result in line with expectations. A large beat on the bottom line due to peculiarities in minority interests. Guidance also in line with expectations. Growth ahead.

It is certainly significant and one of the biggest reasons why margins in our forecasts will decrease in the coming years.