Tamtron seems interesting, although I think many have raised quite good risk factors and other points that will likely have a negative impact on the company’s valuation.

The company seems to be performing relatively well even in a more challenging economic situation, at least in terms of what’s left on the bottom line. The company’s situation is positively stable, meaning a fairly diverse customer base, and geographically the situation isn’t bad either, although there would certainly be some room for improvement there, as the company is currently “concentrated” in the Nordic countries. Of course, the company’s performance and survival in different conditions prove something, along with the “security-providing” maintenance side (From the extensive report: We estimate that Tamtron services about 80% of its sold equipment fleet itself). And well, I suppose the economic cycle will turn eventually, so won’t that have a big impact on Tamtron too.

SaaS would of course be a great plus if it was running smoothly, but there’s no evidence of this yet, or at least not enough proof. Or well… a quote from the latest company report:

A significant recycling industry operator, FCC Environment, signed an agreement to implement a SaaS solution for over 80 truck scales in Central Europe in 2024, and the rollouts will take place gradually in the coming years, supporting SaaS growth.

In my opinion, the company looks like an interesting investment; as long as the company makes more noise about itself more often, “ownership diversifies,” and the economic cycle turns, the stock would be a real treat… and boom-shakalaka, if SaaS still proves itself. The industry is also on a growth trend and the company has good products… and yeah, if it were to expand its geographical reach even further.

There is some wishful thinking and general “if” stuff involved, and I see the company partly as a bit of a diamond in the rough, meaning there could be potential for even more, but it’s another matter whether that potential is realized.

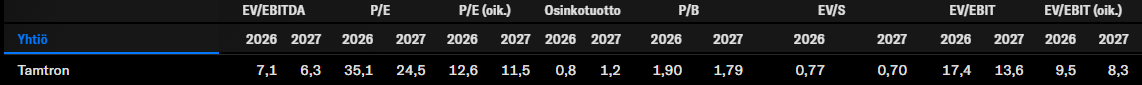

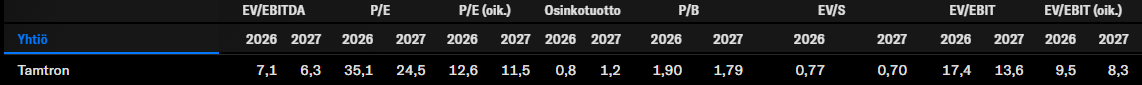

Looks pretty good:

I’m asking myself: