If this isn’t fully priced in yet and we’d see a decent dip. I’d gladly buy more cheap timberland + the business thrown in for free.

Last year’s reported EBIT was a couple of billion.

Now, the expected EBIT is 1.15-1.25 billion. A drop of over 50% would take the result below one billion, meaning there would be room for a decline in the near-term forecasts, but that is, of course, only one year of the company’s value, which is formed by decades of cash flow…

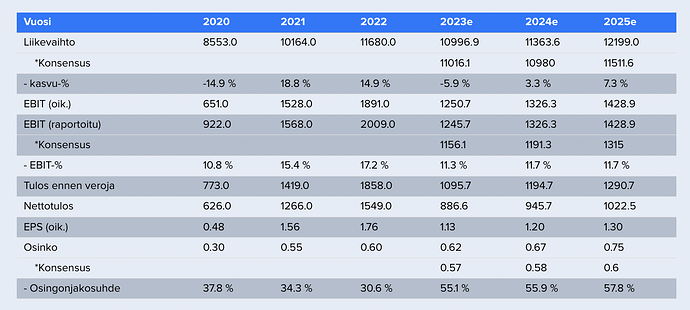

Here you can find the forecasts, if anyone has forgotten. ![]()

That will become clear soon.. ![]()

Stora published its results in the morning.

As key information, in addition to the updated guidance already reported:

"Q1/2023 (compared to Q1/2022)

• Revenue decreased by 3% and was EUR 2,721 (2,798) million.

• Operational EBIT decreased by 53% and was EUR 234 (503) million.

• Operational EBIT margin decreased to

Here are Antti’s comments - Via Dolorosa.

https://www.inderes.fi/fi/uutiset/stora-enso-q1-aamutulos-lahiajat-tarvotaan-karsimysten-tieta

Stora Enso’s Q1 result significantly fell short of strong comparable figures as expected, but even our forecasts, updated after last week’s profit warning, proved to be a bit too high.

Well, expectations weren’t great, but we fell short of those too.

”Q2/2023 (compared to Q2/2022)

• Revenue decreased by 22% and was 2,374 (3,054) million euros.

• Operational EBIT decreased by 93% and was 37 (505) million euros.

• Operational EBIT margin decreased to 1.6% (16.5%).

• IFRS operating result decreased to -253 (399) million euros.

• Earnings per share was -0.29 (0.38) euros and earnings per share excluding fair value changes was -0.27 (0.42) euros.

• Cash flow from operations was 146 (404) million euros. Cash flow after investments was -70 (247) million euros.

• Net debt to operational EBITDA (previous 12 months) was 1.7 (1.0). Target is below 2.0.

• Operational ROCE excluding Forest division (previous 12 months) decreased to 10.7% (21.7%). Target level is over 13%.

Q1-Q2/2023 (compared to Q1-Q2/2022)

• Revenue was 5,095 (5,852) million euros.

• Operational EBIT was 271 (1,008) million euros.

• IFRS operating result was 5 (793) million euros.”

And Antti’s comments:

Edit: Antti’s comments on the results included.

OP - Q3/2023 Earnings Season: Stora Enso’s result in line with consensus estimate

Stora Enso faced a couple of new variables. Even if the compensation for the damages were to fall on the forest machine entrepreneurs, Stora Enso would still have to pay some kind of protection money to environmental organizations.

Stervi’s crisis communications department will definitely lose sleep over this case, and the machine operator will know what he’ll be remembered for for a couple of generations.

But there will likely be no real impact on business; a few

Police investigate Stora Enso’s logging in a flying squirrel’s breeding area – This is how the company comments

It would seem like smoke without fire, but the topic easily generates a clickable headline.

Have others noticed that Annika’s departure was due to the reasons presented in the article below? Also, quote separately if you can’t find credentials. For me, this came as a slight surprise, although I have heard talk in that direction. Especially regarding the chairman who is strict about cost control. ![]()

”A year ago, Stora Enso fired CEO Annica Bresky. In addition to the company’s weak financial performance, the reasons, according to the Swedish financial newspaper Dagens Industri, were Bresky’s progressive agenda and strong opinions on environmental issues. Dagens Industri, citing its own sources, reported that during Bresky’s tenure, Stora Enso had promoted views in Brussels that aligned more with the EU Commission’s line than with the forest industry’s interest groups.

Stora Enso’s Chairman of the Board, Kari Jordan, who is strict about costs, wanted a traditional forest industry expert as the company’s top person instead of a reformer. Such a person was found in Hans Sohlström, who had worked as CEO of Ahlström-Munksjö.”

Stora’s Q4 results are out.

Q4/2024 (compared to Q4/2023)

• Sales increased by 7% to EUR 2,322 (2,174) million.

• Adjusted operating profit rose to EUR 121 (51) million.

• Adjusted operating profit margin increased to 5.2% (2.3%).

• IFRS operating profit was EUR -279 (-326) million. The result includes EUR -768 million in items affecting comparability related to impairments recorded in connection with the annual impairment test, and EUR 368 million in fair value changes and non-operating items mainly related to the increase in the fair value of standing timber (biological assets).

• Earnings per share were EUR -0.43 (-0.36) and earnings per share excluding fair value changes were EUR -0.81 (-0.64).

• The value of forest assets increased to EUR 8.9 (8.7) billion, corresponding to EUR 11.28 per share.

• Cash flow from operations was EUR 325 (323) million. Cash flow after investments was EUR 88 (-9) million.

• Net debt increased by EUR 540 million, mainly due to the Oulu mill’s board investment, and was EUR 3,707 (3,167) million.

• Net debt to adjusted EBITDA (last 12 months) improved to 3.0 (3.2). The target, below 2.0, remains unchanged.

Dividend proposal EUR 0.25 (0.20), to be paid in two installments.

Chief Analyst Viljakainen has already written quick comments on the morning’s results. ![]()

The company’s Q4 results continued their recovery from a very low level. The Q4 operational result met consensus estimates and exceeded our own. Cash flow was strong during the quarter. The company ceased providing guidance, which we found disappointing. Based on market outlooks, however, the company’s prospects are somewhat weaker than expected. Stora Enso surprised us by raising its dividend proposal to EUR 0.25 per share, despite a subdued earnings year and a debt-to-equity ratio clearly above the target level. Overall, we find the report two-sided, and drawing conclusions will require further digestion throughout the day.

CEO Hans Sohlström’s review from today’s Annual General Meeting! ![]()

Stora Enso doesn’t export much to the USA, but will the situation change when the Oulu machine starts? A lot of board has been exported from Europe to the US, and there would also be local supply, so it might worsen overcapacity in Europe.

Viljakainen diligently prepared a new company report on Stora Enso late last night. ![]()

We reiterate our Add recommendation for Stora Enso, but lower the company’s target price to EUR 9.00 (previously EUR 11.00). Industrial business appears to be an uphill battle for Stora Enso in the coming years as well, as the indirect effects of an emerging trade war are a new problem for the company on top of existing ones. Due to macro reasons, we have significantly cut our forecasts for the coming years and further raised our required rate of return due to the still high risks. Based on earnings, the stock is not cheap in the short term. However, we believe there is value in the balance sheet (2024 TOT P/B 0.6x), which we believe long-term investors can still own the stock for. The realization of return expectations naturally requires actions from the company, as without them, the risk of low balance sheet valuation becoming chronic is significant.

I also see it as a balance sheet play, that there’s more forest than the company’s value + debts, plus 10% of industrial power, and then of course the company itself. And in the world of renewable energy, I

Future plans for Stora Enso

It´s a really good idea to make both the packaging group and forrest owning part will be more visible. It is also a good idea, at least as I see it, to simplify the listing of the companies. Today the share register is held in Sweden and Finland, creating tax problems for owners and tax authorities in both countries.

Could it be a good idea to let the new forrest part to be listed in Sweden, where SCA is located and the packaging group to be listed in Finland, where we also find Huhtamäki.

It would be nice to have a discussion about this subject. (My finnish is miserable, but I can read it.)

Anders

This valuation of SE is astonishing. Is the market really so short-sighted and phobic that it assumes profitability has permanently dried up? Or is it just missing that new tech AI bumtsi bump, where money seems to be fleeing regardless of valuations? Basic industry/materials seems to be self-evident basic stuff, like air, costs nothing, produces nothing - even though it is actually a prerequisite for life. For example, Outokumpu with its chrome reserves is in a similar situation.

Here are Peter Seligson’s recent views on SE, page 14:

And here is Handelsbanken’s view:

‘‘By applying average multiples to 2025 earnings forecasts, we arrive at a total value of 17 euros/share. With a more conservative view on forest assets – a 20 percent discount on book value – we land at approximately 13 euros/share, which still implies an expected return of over 30 percent from the current price. With good chances for a positive decision on the spin-off, we reiterate our buy recommendation and maintain the target price at 12 euros.’’

In my opinion, the market can’t see the forest for the trees.

That looks cheap, as many have calculated as a sum of parts over the past few years. However, Stora Enso’s capital allocation has been so poor for many years that many stay away. Separating the forests would probably bring value to light, as long as overly complex wood supply agreements are not built into the deal.

I put together an analysis of the forest industry situation for @salkunrakentaja.

“Companies do not yet see light at the end of the tunnel”

What do the prospects for different sectors look like?

Pulp

Board

Sawn timber

Paper

And how do the valuations of companies differ from each other?