Did Springvest have indirect holdings in the ESOX group that was at the CES trade fair? For example, the Theron motor is the same as the Donut motor but for military use, so I suppose they have something in common.

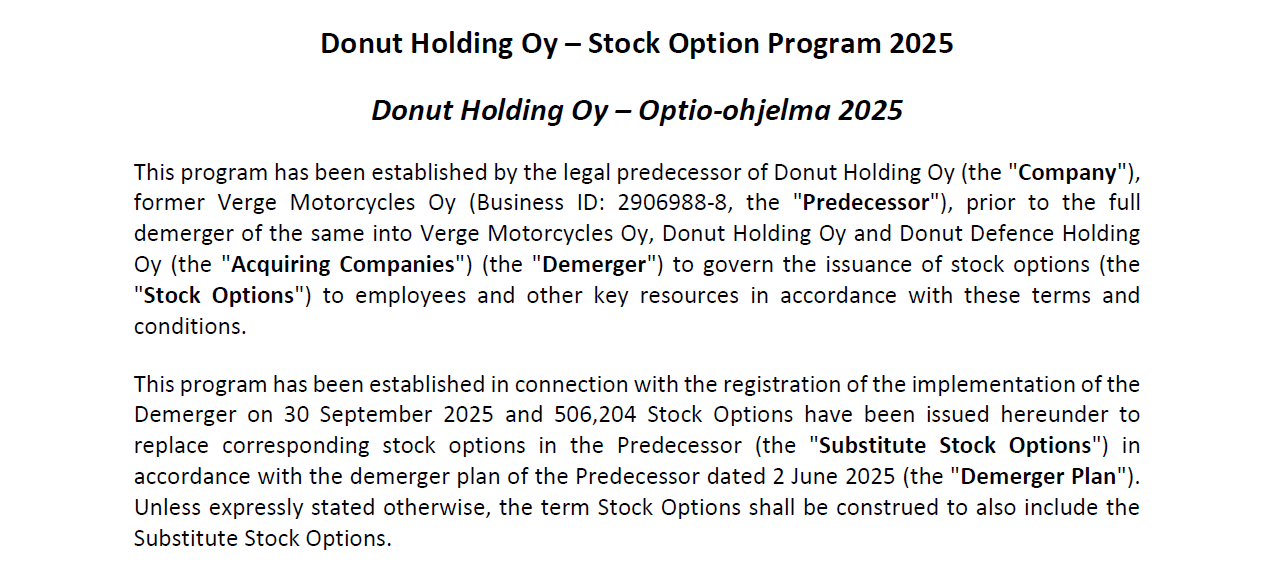

It belongs to Donut Group, the same corporate group as Verge. Donut Defence Oy was formerly known as Esox Group Oy. The company was formed during a demerger at Verge in the autumn of 2025, in which Verge’s business operations were split into different entities.

According to Verge’s 2024 financial statements, the parent company Verge Motorcycles Oy owns 100% of Donut Group Oy, which in turn owns 100% of Esox Group Oy.

Hi @Kasper_Mellas!

In a recent report, you write that Springvest owns 0.6% of Donut Lab. Is that ownership stake factual information regarding the current situation, or are you just repeating some previous assumptions about the ownership share?

@Kasper_Mellas And are there any special conditions in this ownership stake? As we saw in the case of the Dispelix sale, Springvest’s shares were last in the liquidation preference, and no returns were generated in the exit situation. In this case, could there potentially be some buyback or other upside cap features? It would be good to interview Springvest’s CEO about this?

It’s not factual information but based on media reports. So, this falls under the uncertainty factors. The ownership list for Verge Motorcycles published by Kauppalehti is from before the funding round, so it doesn’t show Springvest’s ownership stake in said company.

Unfortunately, I don’t have an answer to this either. We’ll definitely ask during the H2 results interview ![]()

In my opinion, the uncertainty factors related to that ownership are well-listed here (in addition to the value of the technology/battery production itself, of course). Of course, the CEO has already had time to state in the media that the technology belongs to them, not Nordic Nano Group. New funding rounds, on the other hand, are either a plus or a minus for current shareholders depending entirely on the terms of the offerings.

Well, in my opinion, this should be highlighted in the analysis. And of course, this would be a good opportunity to provide added value to your clients by verifying the matter and bringing it to our readers’ attention. There are other kinds of comments circulating about the issue, and debunking those rumors would be a value-adding activity (or if the ownership stake is incorrect, bringing the correct stake to light).

It is known that Verge Motorcycles has split into three new companies. And according to information from Kauppalehti, in connection with the demerger, Springvest has received shares in these three new companies in proportion to the Verge shares they previously held. As a demerger generally works. So, even though I haven’t seen Donut Lab’s shareholder list, all signs point to Springvest owning that 0.6%. However, I flagged this as containing uncertainty because I was unable to verify the information 100%. I did try to point out in the report that various uncertainties are associated with this arrangement from the perspective of a Springvest shareholder. Hopefully, we will get answers to these in the earnings report or the management interview.

Here’s the latest company report as well. ![]()

Based on information that has emerged regarding Springvest’s portfolio company Donut Lab, the return potential of the holding is significantly higher than our previous estimate. Accordingly, we are raising our target price for Springvest’s share to EUR 9.5 per share (prev. €8.0). However, we are lowering our recommendation to the Sell level (prev. Accumulate), as we believe the price tag the market has placed on Donut Lab is excessive despite its potential.

Isn’t this something that should be checked with Springvest or Donut Lab immediately? Aren’t the shareholder registers of all limited liability companies basically public, meaning you can get them by asking?

A very large part of Springvest’s value—I’m tempted to say the majority—is currently based on speculative rumors/information/guesses about owning Donut Lab. If that information isn’t true, then the stock’s value is something else entirely.

This should be priority 1 right now and should be clarified immediately instead of waiting for any H2 interviews; otherwise, the entire analysis of the company’s value is without foundation.

Springvest is in a silent period/closed window from January 11, 2026, to February 10, 2026, so they won’t be commenting on anything. But could those ownership stakes be dug up from some Asiakastieto reports or something, I don’t know?

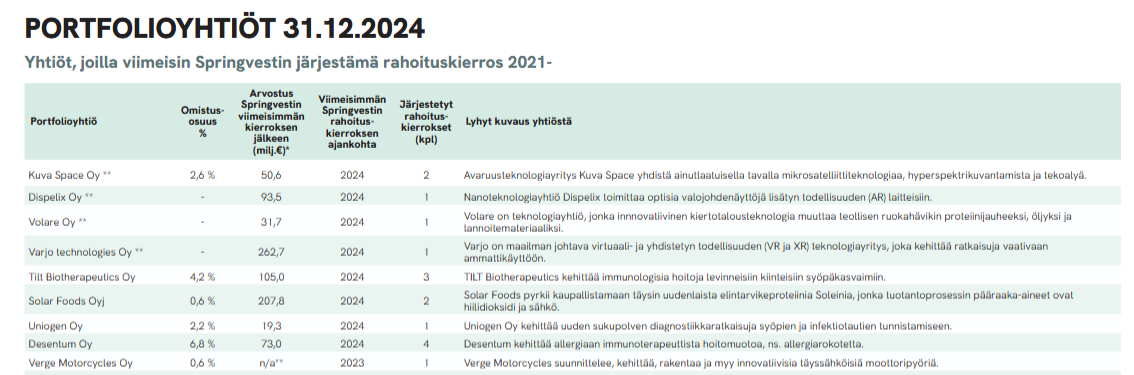

Verge Motorcycles’ latest 2024 financial statements and the trade register data for the new company reveal that Springvest’s ownership has undergone significant dilution without additional investments into the company.

At the end of 2024, the number of shares in the company was 278,767, and there were plenty of special rights + other authorizations:

Currently, the number of shares is 441,179, and after the exercise of authorizations, the share count already exceeds one million.

Donut Holding’s situation is somewhat similar.

A significant amount of additional capital was also raised during the first half of 2025:

There was also this news in Kauppalehti yesterday:

Are they talking about just Verge there, or has a significant amount of money been raised for Donut Lab (as well)?

It is clear that if a significant amount of money had been raised for Donut Lab, and Springvest had not participated in the share issues in the same proportion, the ownership stake would be something quite different from what was once acquired.

I’m not saying that Springvest couldn’t own 0.6% of Donut Lab. I’m just saying that the matter should be checked, specifically reflecting the situation as it stands today.

Sprinvest has reported its ownership in Verge as 0.6% as of June 30, 2025, meaning that the dilution occurring from this point forward is significant.

Springvest’s reported ownership stake was also the same 0.6% as of December 31, 2024:

So, has Springvest also invested more money in Verge in proportion to its ownership stake in H1 2025, or why else would the ownership stake not have been diluted?

But this happened in September 2025 when the company split into three new companies. So this is one of those three.

Indeed, and all three have the same registered number of shares at the moment.

The information in that H1 report should be checked with Springvest to see if it is up to date and if it takes into account the dilution caused by the new convertible loans.

So, significant dilution has likely occurred. Donut Lab’s option program also looks like this

Springvest will not comment on the matter, but I have also inquired with Donut Lab. Let’s see if we get a direct answer from them.

A listed company won’t comment on the validity of something that presumably just boosted the company’s share price by +80%?

Right.