Amidst all the speculation and media attention surrounding Donut Lab, it’s good to remember that Springvest has over 40 other companies in its portfolio. Furthermore, in my estimation, the majority of the company’s value consists of future funding rounds (option fees and, to a lesser extent, cash fees). Consequently, in addition to individual holdings, it is essential to assess the development of the exit market (which affects the success of exits) and the outlook for the fundraising market (which affects future holdings). Of course, if Donut Lab were to achieve a global breakthrough and dominate the entire battery market (assuming the ownership stake isn’t diluted to nothing and that the technology/IPR is owned by the group), this would also impact Springvest’s value, but in my opinion, based on current information, this scenario involves an unreasonable amount of uncertainty. Regarding Donut Lab’s potential, I don’t have anything new to contribute here or to the good discussion taking place in the Donut Lab forum thread.

Regarding the exit market outlook, I came across this Carner press release, which states that transaction volumes in Finland remained at the previous year’s level in 2025:

If the dealmakers are to be believed, volumes should start growing from here. Of course, investment bankers are somewhat biased when commenting on the outlook (who has ever heard, for example, real estate agents advising homebuyers to be cautious?), but I think other factors also suggest that hopes for improvement aren’t entirely baseless. For instance, according to Pitchbook’s estimate, PE fund deal volumes in Europe grew by 13% last year, which would mean a level already higher than the previous peak years (2021–2022). The direction was also better in the exit market, although these are still below the peak years. Of course, it should be noted that the data concerns later-stage funds (buyout and growth equity), so conclusions about the VC market cannot be drawn directly from this.

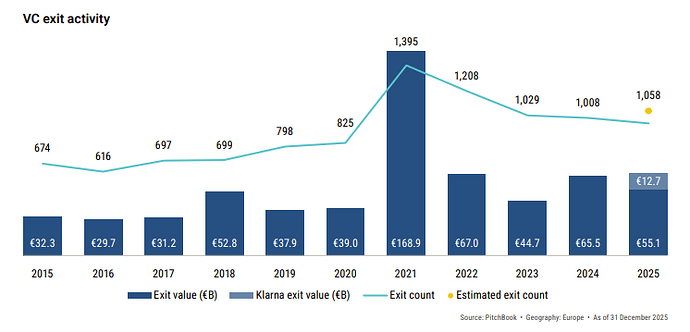

Regarding the European Venture Capital market, the development was not as bright (source: Pitchbook), as deal volumes at the European level were still slightly declining. The total deal value, on the other hand, grew because deals were concentrated on larger companies. Like the rest of the PE market, however, the number of exits already turned to moderate growth. Based on the data, a nascent recovery in the exit market is thus already visible, regardless of the fund class.

In my opinion, the best picture of the Finnish VC market situation comes from the statistics of the Finnish Venture Capital Association (FVCA / Pääomasijoittajat ry), of which the latest figures are from H1/2025. For example, more exits were already seen in early 2025 than in the comparison period. Regarding fundraising for growth companies, 2025 was excellent, but this is explained by two exceptionally large rounds (Oura and IQM). Furthermore, the IPO market seems to be slowly waking up from its hibernation. In surveys, managers indeed expected both fundraising and exits to develop in a better direction in 2026.

I believe the aforementioned observations provide grounds for cautious optimism regarding Springvest’s value creation through exits. However, it is probably not worth expecting any actual boom in the near future, at least not until real economic growth starts to show. Of course, Springvest has numerous companies in its portfolio oriented toward international markets, so growth in M&A activity in the Nordics and elsewhere in Europe is likely a more significant signal. Risks, on the other hand, can be found in areas such as geopolitics.

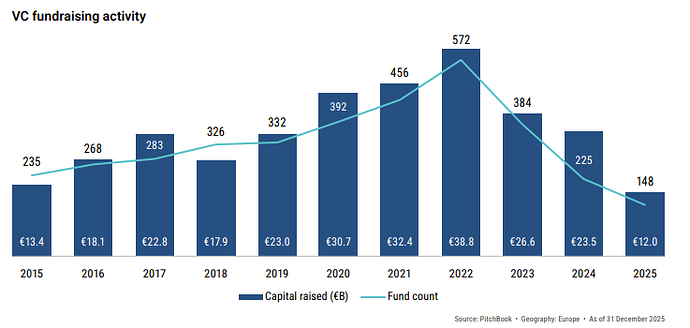

Regarding fundraising, the situation in the VC market (and also the PE market) is still very cool, as both the number of new funds and the amount raised fell for the third year in a row in both Europe and Finland (preliminary estimate). Historically, however, the amount of funding raised through Springvest’s platform has fluctuated significantly less than the general market, which is likely explained by, among other things, the rather limited number of rounds (8–11 per year).