DNB likely caused a sell-off for today.

DNB Carnegie lowers the target price for Smart Eye to 108 kronor (112), reiterates buy

DNB likely caused a sell-off for today.

DNB Carnegie lowers the target price for Smart Eye to 108 kronor (112), reiterates buy

Sometimes, when it’s difficult to discern change from number tables, a picture tells more than a thousand words. This image shows Smart’s revenue, with the last two bars representing the forecasted revenue for 2026-2027.

When the company’s gross margin is ~90%, good things should also happen on the bottom line.

What does Jukka think about the realism of those forecasts?

Previously, forecasts/expectations have been missed because OEMs have been slow to adopt the technology.

Now, next year’s exceptional growth is largely explained by driver monitoring becoming mandatory in Europe in the summer. Every car sold must have this technology. While advanced driver monitoring previously focused on lower-volume premium price ranges, in the future it must also be found in more affordable mass-market models.

All this means that Smart’s DW backlog will finally start to clear on a large scale. The forecasts therefore seem very realistic.

The system is in itself very stupid if it complains “don’t fall asleep” when you don’t constantly turn the steering wheel back and forth on straight roads and artificially drive the car from side to side. This stupidity is also due to EU regulation.

This system is different from what will become mandatory starting summer 26. DMS is based on driver monitoring via camera, not hand movements.

DDAW (Basic Monitoring): Mandatory 2024. This is the system that already exists in many cars and provides a general warning about fatigue or erratic driving.

ADDW/DMS (Advanced Monitoring): Coming 2026. This system takes monitoring further and can directly detect inattention (looking at a phone, deep contemplation, etc.), which requires the eye and face tracking you mentioned, using a camera.

I should make it a project to read the entire thread

Martin mentioned that the current bank credit limit is expensive. Now, they are apparently seeking cheaper money from the bond markets. Business as usual. It’s great if these markets are already open to the company.

Smart Eye Aktiebolag (publ) (“Company” or “Smart Eye”) today announces that Skandinaviska Enskilda Banken AB (publ) has been mandated as sole bookrunner to arrange a series of fixed income investor meetings commencing on 8 December 2025, to explore the possibility to issue senior unsecured bonds in an expected amount of SEK 300,000,000 under a framework of SEK 600,000,000 and with a tenor of three years (the “Bonds”). A capital market transaction may follow subject to, among other things, prevailing market conditions.

The proceeds from the issuance of the Bonds shall be used to (i) refinance existing debt, and (ii) finance general corporate purposes (including transaction costs and acquisitions).

This information is such that Smart Eye is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact person set out below, at 2025-12-08, 10:00 (CET).

Redeye comments on Smart Eye exploring the issuance of a SEK300m senior unsecured bond. We interpret this as a strong signal that the company is close to securing long-term funding on improved terms. In our view, the contemplated transaction would materially reduce financing risk ahead of EU GSR implementation and comfortably bridge the company to free cash flow positivity in 2026. Although formal terms are not yet known, we see today’s news as clearly positive and reiterate our Base Case of SEK115 per share.

We judge that today’s announcement could act as a sentiment catalyst. The share has been relatively weak since the Q3 report, partly driven by uncertainty around the company’s liquidity profile. With this transaction now in motion, and likely to be finalised in the coming days or weeks, we believe the news could give some relief to the share price.

Although the transaction is not yet formally completed, we remain clearly positive to the development, and maintain our Base Case of SEK115 per share.

I think it’s a positive sign that SEB is the arranger of the emission. At least my impression is that SEB has a reasonably good track record in the emission market, and it is, in any case, a large bank with a wide reach. It would be a different matter if some “boutique” firm were arranging it, e.g., Pareto, Arctic, etc.

Interest 7% +3m STIBOR reference rate, which is approximately 1.9% at the moment.

Smart Eye has successfully issued a SEK300m senior unsecured bond at 3M STIBOR + 7%, which we view as highly favorable given the company’s stage and current cash flow profile. The transaction materially strengthens the financial position, removes all remaining funding risk ahead of EU GSR, and provides flexibility to act opportunistically. We reiterate our positive stance and expect a positive share price reaction.

According to Smart Eye, the transaction attracted strong demand from a broad base of Nordic and European investors and was significantly oversubscribed.

As we have explained previously, our estimates pointed to Smart Eye reaching FCF positivity by Q3 2026 with around SEK50m in liquidity still available. With this bond now in place, the company has completely removed the risk of needing additional funding before breakeven, and has also secured room for opportunistic action should an extraordinary M&A opportunity arise. However, we do not expect near-term acquisition activity.

The HALT Act was already passed in the US in 2021, requiring impaired driving prevention technology in passenger cars and trucks. Three years were given for the implementation of the law, but the traffic safety agency (NHTSA) has deemed that the technology was not yet ready, and implementation has stalled. This year, in addition to Smart, alcohol detection technology has been launched by Seeing Machines, Sightic, and Mitsubishi Electric. However, the political environment might not be favorable for increasing regulation.

Nevertheless, an initiative was introduced in Congress yesterday to accelerate the law. According to the initiative, all manufacturers selling more than 250,000 cars a year in the US would have to deliver 10,000 cars equipped with an ignition interlock and another 10,000 cars where impaired driving prevention is based on DMS. I chatted with various AIs about whether such a bill would pass, and the AIs were strongly of the opinion that it will. The schedule would be fast, meaning substance detection would have to be delivered as early as six months after the law’s implementation. There is strong public support for technology to prevent impaired driving. In my view, full implementation of the original law would be an even bigger deal for Smart than the mandatory GSR2 for DMS in Europe. The acceleration law could therefore come into practice even within the next year. It was previously reported that the criteria for Top Safety Picks from the Insurance Institute for Highway Safety / Highway Loss Data Institute will also include substance detection in the coming years.

Press release about Smart Eye’s participation in CES: Smart Eye Brings Breakthrough Impairment Detection and Advanced In-Cabin Intelligence to CES 2026 - Inderes

Quite interesting concepts, especially the “breathalyzer” could have good financial potential in the future. However, cars are already becoming quite expensive due to the technology they contain, so without the help of legislation, these are unlikely to be purchased voluntarily for cars to a great extent.

It will also be interesting to see if Smart Eye starts to be considered an AI company.

Eye recognition could also have interesting application possibilities in cars, but on the other hand, I’m wondering how it can be monetized. Maybe it could eventually serve as a car “key” or handle grocery shopping by talking to the car and using identification to authorize credit card purchases. Another thing is whether people actually want to do these kinds of things in a car, and it’s also one more distraction while driving. Perhaps as autonomous driving increases, there could be greater potential for it.

The year 2026 is a pivotal year for Smart Eye and, if performance continues according to plan, the stock price is set to rise. I believe the market value could easily double if the bull market continues in the USA and cash flow turns positive. If not, the company will likely flop badly. In any case, I’ll stay with the company this year, and if the promises aren’t fulfilled, it will be sold from my portfolio.

Nothing major, product development has been moved forward with Green Hills

A few more press releases.

Summary by AI.

Smart Eye & Renesas: The “Smart Brains” of Cars

Smart Eye and Renesas announced an integration at CES 2026, bringing driver monitoring software directly to Renesas’s latest R-Car X5H processor chip.

And another by AI.

Smart Eye & Airy3D: 3D Monitoring with a Single Sensor

Otto’s comments on CES announcements and expectations for Q4

CES came and went. The Smart Eye crew seemed to be there with a good vibe. There were some nice announcements too; I was particularly pleased to see them getting pre-programmed onto Renesas chips. Renesas boards are used at least in Toyota, Honda, and Bosch ADAS systems.

Qualcomm signed two deals during the trade show. A software-defined vehicles era agreement with Hyundai, which also includes ADAS, and an intelligent cockpit agreement with the Volkswagen Group. ADAS will come to the VW Group as a collaboration between Cariad and Bosch. In connection with the Q3 interim report, Martin mentioned that there are large RFQs (Requests for Quotation) on the table, and here are at least two big options. Hopefully, they succeed. I can’t say whether these will come as Tier 1 or Tier 2 through Hyundai Mobis and Bosch. Seeing Machines does not have any Tier 1 design wins yet.

I wrote in October that there might be a hiccup in Smart Eye models currently in production as a result of the end of US EV subsidies, and that’s exactly what happened. For Hyundai, the collapse in EV sales was offset by the strong sales success of the new Palisade model, but in my estimation, GM’s sales fell short of Q3 levels. It seems sales in Korea also fell slightly short of Q3, meaning Q4 growth will likely come from Europe and China, which look better but are harder to estimate. AIS growth should be significant, and regarding the aftermarket product, it was encouraging to hear in the trade show update that intoxicated driving detection has already been included in deliveries for a couple of quarters.

GM comparison Q4 - Q3. If Super Cruise is not standard, the share of cars for sale was searched on Cars.com with the keyword “Super Cruise,” and an attempt was made to estimate the take rate column. The first columns show total sales by car model.

| Model | Q4 2025 | Q3 2025 | Take rate (Q4 2025) | Take rate (Q3 2025) |

|---|---|---|---|---|

| Chevrolet Blazer EV | 1 812 | 8 089 | 290 | 1 296 |

| Chevrolet Equinox EV | 5 111 | 25 085 | 256 | 1 254 |

| Chevrolet Silverado EV | 1 896 | 3 940 | 1 896 | 3 940 |

| Chevrolet Suburban | 16 140 | 12 606 | 1 937 | 1 513 |

| Chevrolet Tahoe | 28 520 | 25 587 | 3 422 | 3 070 |

| Chevrolet Traverse | 44 646 | 38 853 | 13 394 | 11 656 |

| GMC Acadia | 13 365 | 12 485 | 2 673 | 2 497 |

| GMC Hummer EV (pickup+SUV) | 2 555 | 5 246 | 2 555 | 5 246 |

| GMC Sierra EV | 1 849 | 3 374 | 1 849 | 3 374 |

| GMC Yukon | 24 855 | 19 991 | 7 457 | 5 997 |

| Cadillac CT5 | 4 393 | 4 000 | 4 393 | 4 000 |

| Cadillac Escalade (ICE) | 13 659 | 11 332 | 13 659 | 11 332 |

| Cadillac Escalade IQ (EV) | 2 085 | 2 264 | 2 085 | 2 264 |

| Cadillac Lyriq | 4 345 | 7 309 | 4 345 | 7 309 |

| Cadillac Optiq | 2 361 | 4 886 | 2 361 | 4 886 |

| Cadillac Vistiq | 2 210 | 3 924 | 2 210 | 3 924 |

| Buick Enclave | 11 130 | 8 239 | 2 919 | 2 161 |

| TOTAL | 180 932 | 197 210 | 67 701 | 75 719 |

Hyundai USA sales. Estimated Smart Eye deliveries by trim levels in the take rate column if DMS is not standard.

| Model | Q4 2025 | Q3 2025 | Take rate Q4 | Take Rate (Q3) |

|---|---|---|---|---|

| Tucson | 68991 | 51929 | 32426 | 24407 |

| Santa Fe | 40244 | 37082 | 30183 | 27812 |

| Palisade | 31147 | 35585 | 29590 | 10676 |

| IONIQ 9 | 1012 | 3164 | 1012 | 3164 |

| IONIQ 5 | 5948 | 21999 | 5948 | 21999 |

| Santa Cruz | 4866 | 6412 | 1460 | 1924 |

| Genesis GV70 | 9750 | 9592 | 9750 | 9592 |

| Genesis GV80 | 5750 | 6831 | 5750 | 6831 |

| Genesis GV60 | 903 | 968 | 903 | 968 |

| Genesis G80 | 937 | 910 | 937 | 910 |

| TOTAL | 169548 | 174472 | 117959 | 108283 |

So, according to this estimate, Hyundai would see as much growth as GM shrinks.

A new car class, M1E, is coming to Europe with the same concept as Japan’s Kei-cars—a class of small electric cars costing around 15,000–20,000 euros, aimed at promoting low-emission targets while increasing vehicle manufacturing within the EU. For M1E class cars, manufacturers would receive super-credits toward reaching emission targets, and European consumers could receive significant subsidies for purchasing the cars, such as scrapping premiums, direct support specifically for low-income earners, and, for example, cheaper parking fees. Stellantis and Renault have been lobbying hard for the vehicle class to also have lighter safety regulations, meaning they are also trying to negotiate DMS (Driver Monitoring System) out of the mandatory equipment list. EU statements so far have been of the tone that even low-income earners deserve to drive safe cars, and if we consider the European automotive industry, ADAS systems certainly provide significant employment in Europe. A decision on safety equipment has not yet been made.

If significant subsidies are provided for purchasing these cars, then, for example, the insurance premium represents a quite significant portion of the monthly cost of a car acquired through private leasing. If safety features have an impact, then that roughly thousand-euro investment would quickly pay for itself through lower insurance premiums. We shall see.

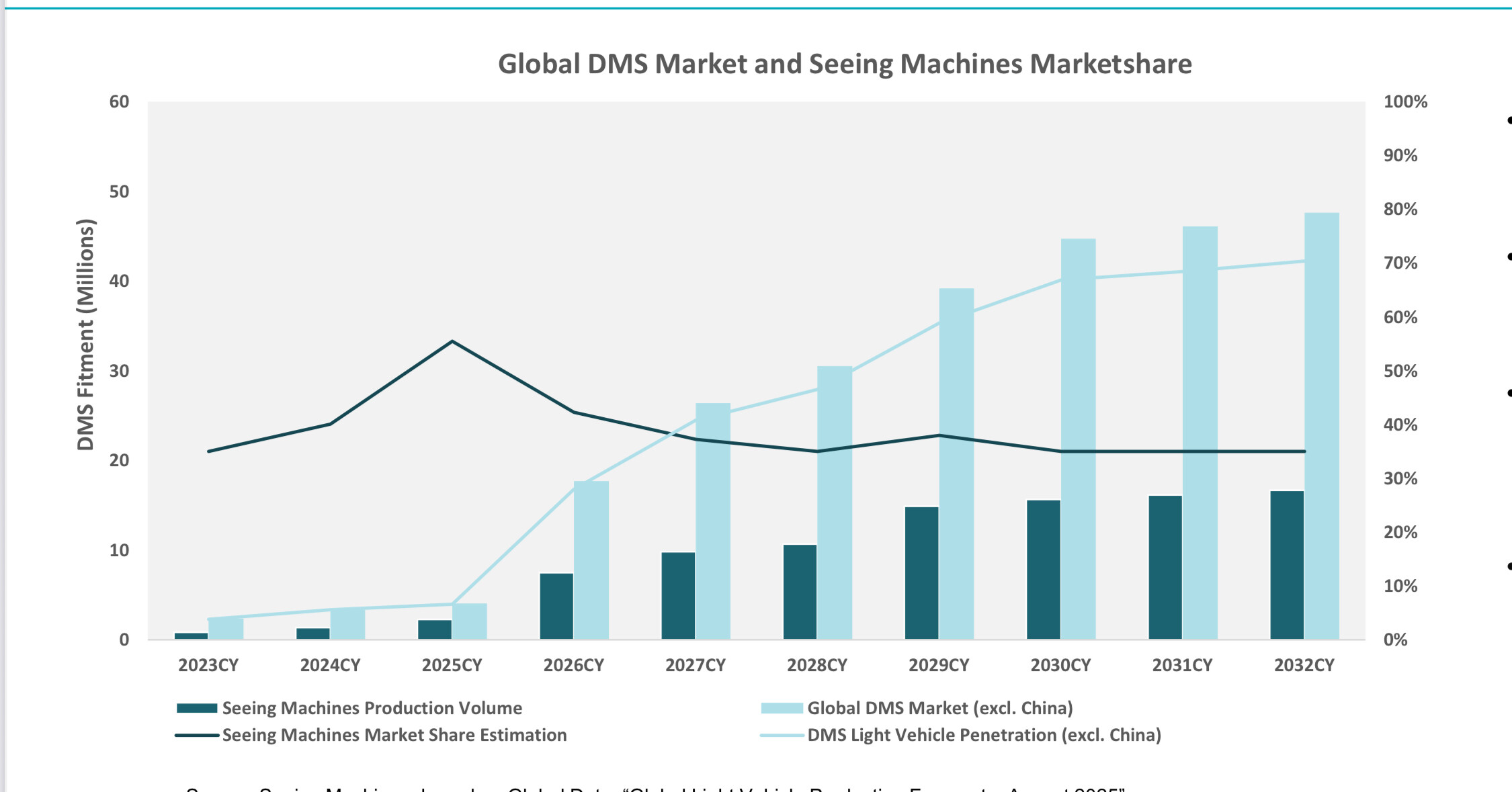

Since I’m already on a gloomy note, let’s continue. Smart Eye has set its target and guidance for a market share of over 40 percent. Market share is measured by Design Wins, and in this regard, I don’t think there is cause for concern. However, if we look at Smart Eye’s three largest potential customers, they are mostly located outside Europe—namely GM, Ford, and Toyota. Similarly, of those currently in production, the Hyundai Group is clearly the largest, and they are also stronger outside Europe than within it. Only the fourth largest, Stellantis, sells primarily to Europe. Stellantis is a shared account with Seeing Machines. Smart has a good number of Design Wins with Stellantis—about 60—and I calculated that Stellantis has about 100 car models that the Design Wins could apply to. Some Design Wins extend into future years, but one could perhaps think that Stellantis is split roughly in half with the competitor. As a result of all this, Smart’s market share in Europe is clearly smaller than in other developed markets, excluding China. I am confident that growth will be sufficient for positive cash flow with a reasonable margin already this year, but a large part of the growth will come even later. Seeing Machines describes the changes in the market and market shares for cars in production as shown below. Smart Eye’s market share isn’t a perfect mirror image, as BMW shifted/is shifting to Tobii, the Chinese share will grow in the market, and perhaps Mobileye will manage to capture a slice for themselves, but it’s quite close regardless.