A new car class, M1E, is coming to Europe with the same concept as Japan’s Kei-cars—a class of small electric cars costing around 15,000–20,000 euros, aimed at promoting low-emission targets while increasing vehicle manufacturing within the EU. For M1E class cars, manufacturers would receive super-credits toward reaching emission targets, and European consumers could receive significant subsidies for purchasing the cars, such as scrapping premiums, direct support specifically for low-income earners, and, for example, cheaper parking fees. Stellantis and Renault have been lobbying hard for the vehicle class to also have lighter safety regulations, meaning they are also trying to negotiate DMS (Driver Monitoring System) out of the mandatory equipment list. EU statements so far have been of the tone that even low-income earners deserve to drive safe cars, and if we consider the European automotive industry, ADAS systems certainly provide significant employment in Europe. A decision on safety equipment has not yet been made.

If significant subsidies are provided for purchasing these cars, then, for example, the insurance premium represents a quite significant portion of the monthly cost of a car acquired through private leasing. If safety features have an impact, then that roughly thousand-euro investment would quickly pay for itself through lower insurance premiums. We shall see.

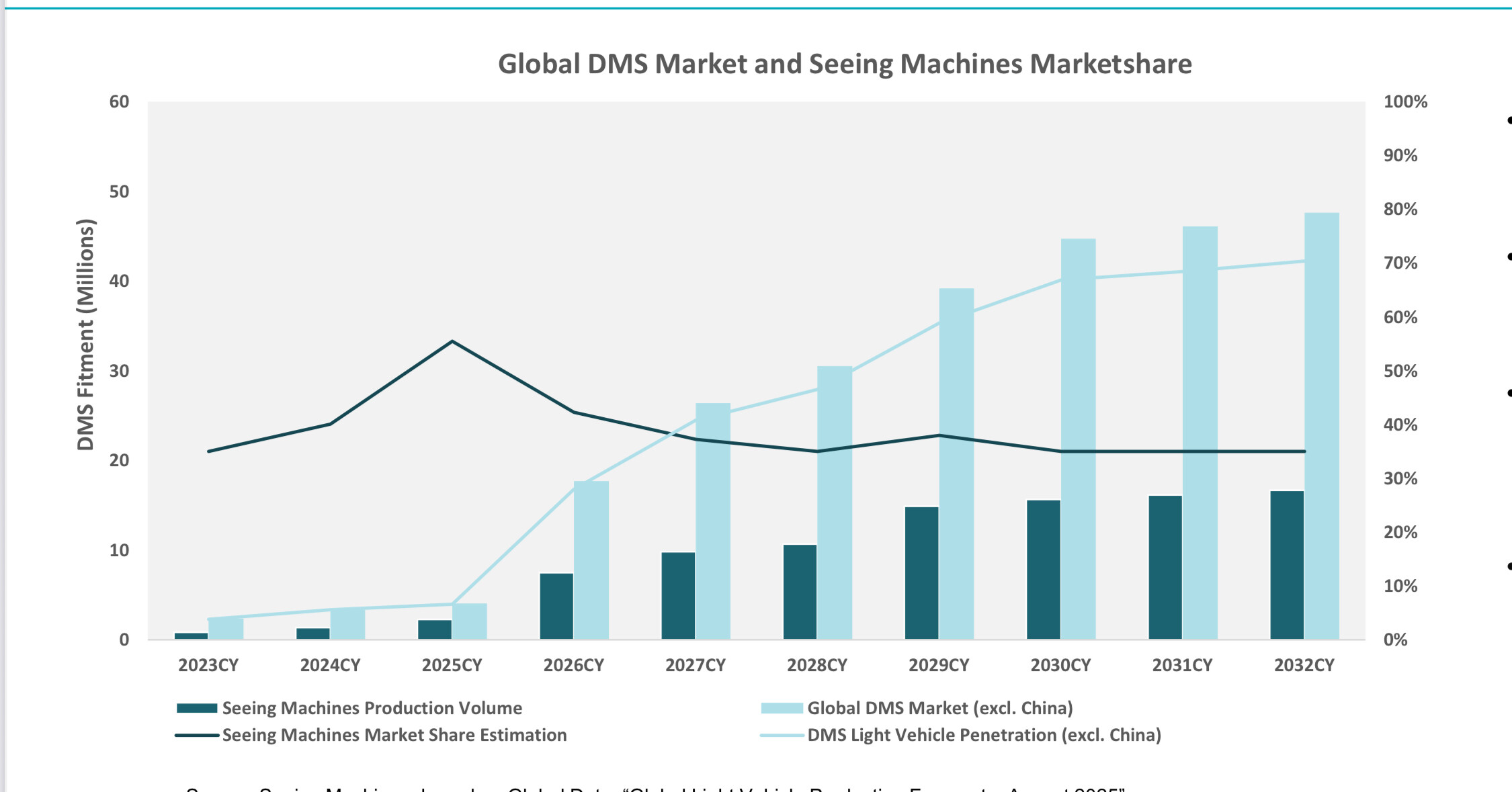

Since I’m already on a gloomy note, let’s continue. Smart Eye has set its target and guidance for a market share of over 40 percent. Market share is measured by Design Wins, and in this regard, I don’t think there is cause for concern. However, if we look at Smart Eye’s three largest potential customers, they are mostly located outside Europe—namely GM, Ford, and Toyota. Similarly, of those currently in production, the Hyundai Group is clearly the largest, and they are also stronger outside Europe than within it. Only the fourth largest, Stellantis, sells primarily to Europe. Stellantis is a shared account with Seeing Machines. Smart has a good number of Design Wins with Stellantis—about 60—and I calculated that Stellantis has about 100 car models that the Design Wins could apply to. Some Design Wins extend into future years, but one could perhaps think that Stellantis is split roughly in half with the competitor. As a result of all this, Smart’s market share in Europe is clearly smaller than in other developed markets, excluding China. I am confident that growth will be sufficient for positive cash flow with a reasonable margin already this year, but a large part of the growth will come even later. Seeing Machines describes the changes in the market and market shares for cars in production as shown below. Smart Eye’s market share isn’t a perfect mirror image, as BMW shifted/is shifting to Tobii, the Chinese share will grow in the market, and perhaps Mobileye will manage to capture a slice for themselves, but it’s quite close regardless.