Salesforce, Inc. is an American cloud-based software company headquartered in California. The company offers customer relationship management (CRM) software and applications focused on sales, customer service, marketing automation, e-commerce, analytics, and application development, etc.

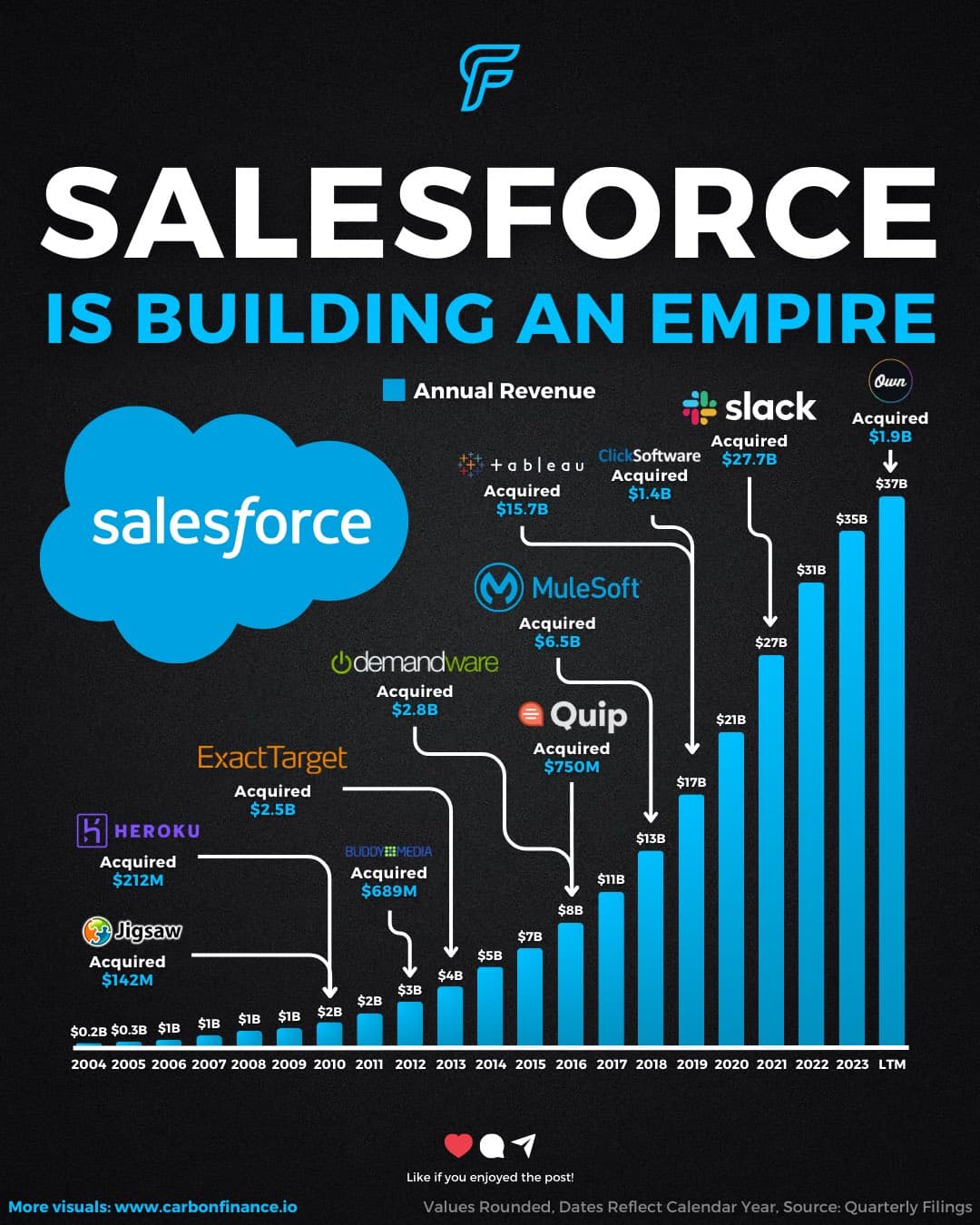

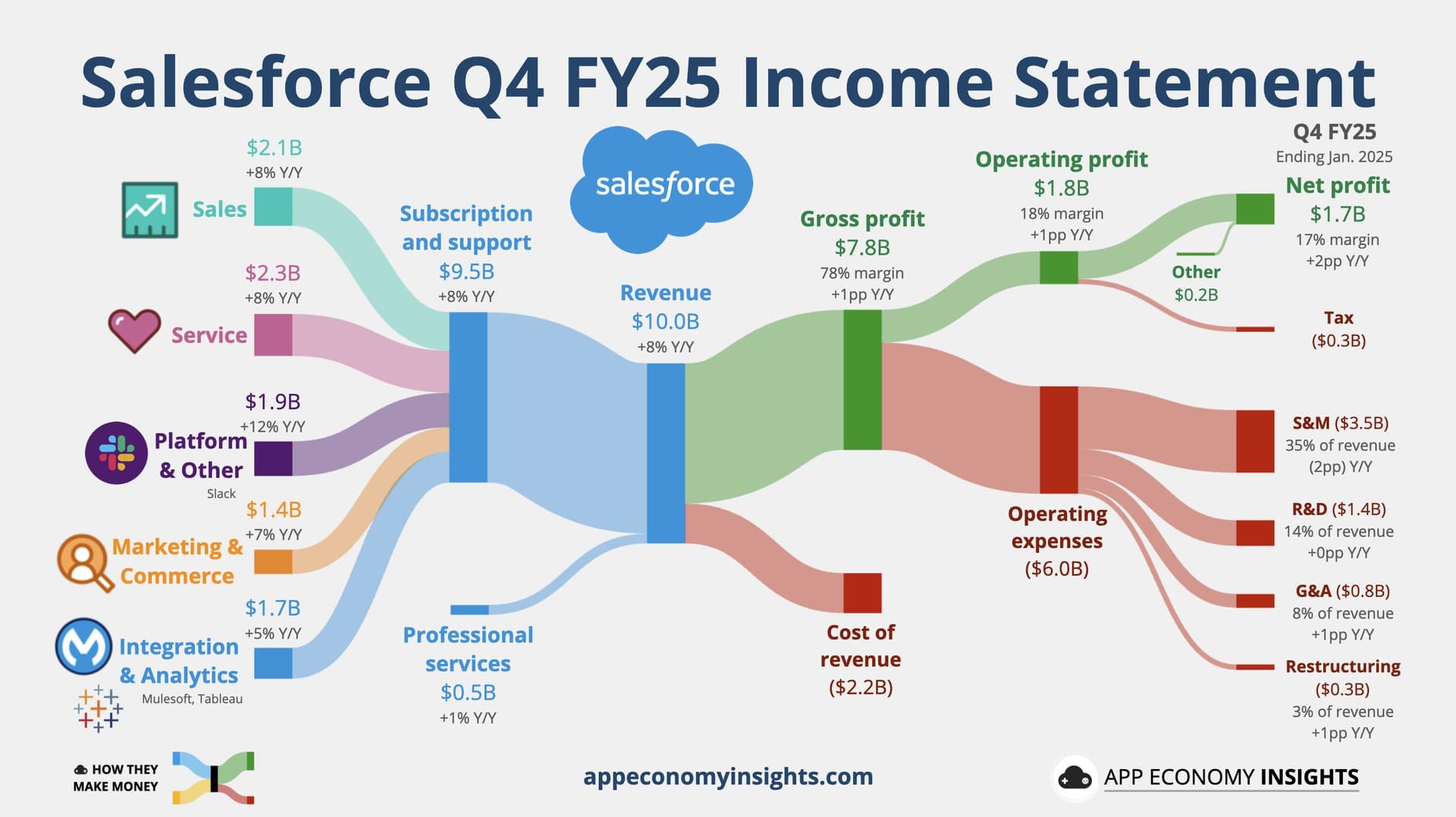

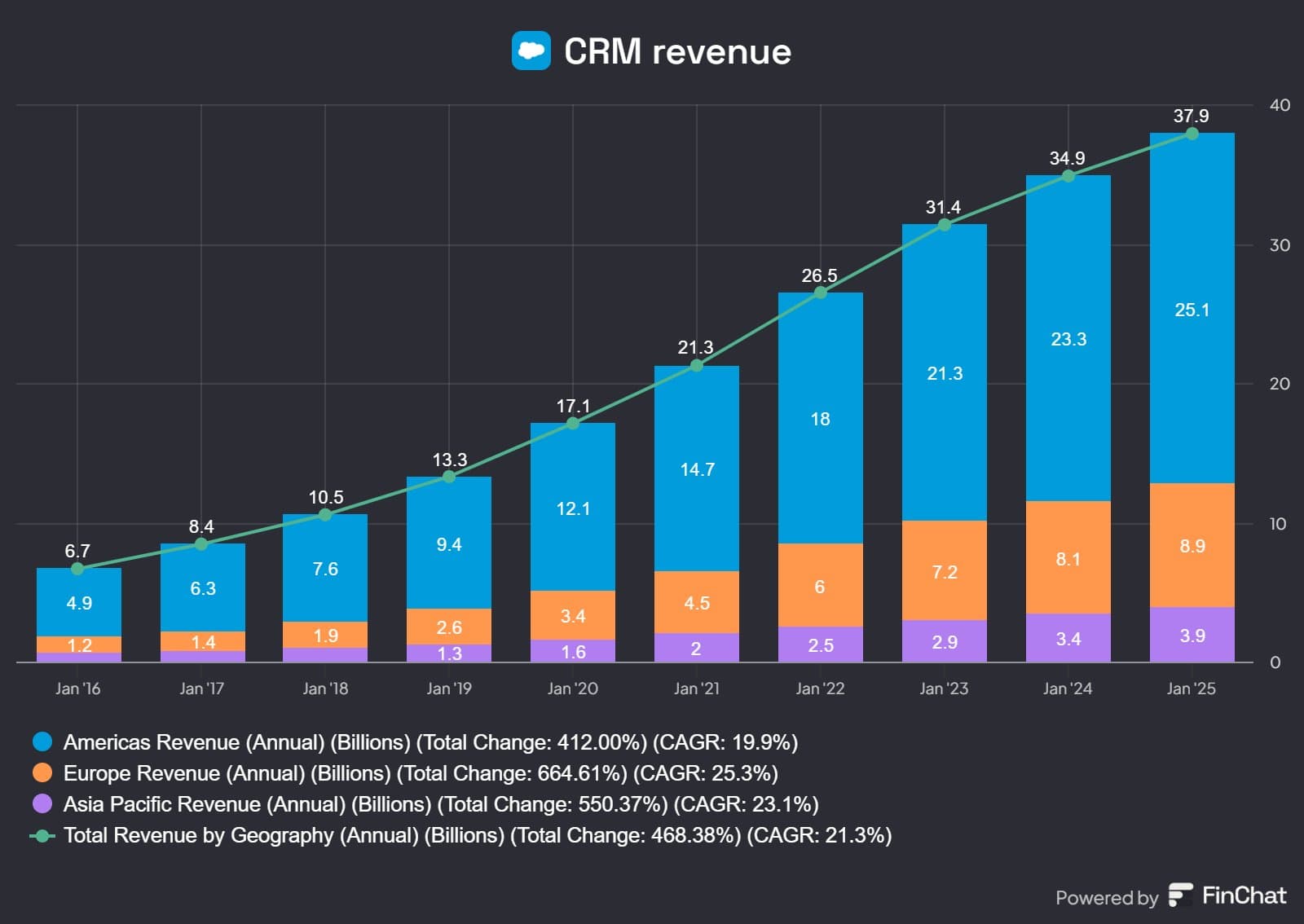

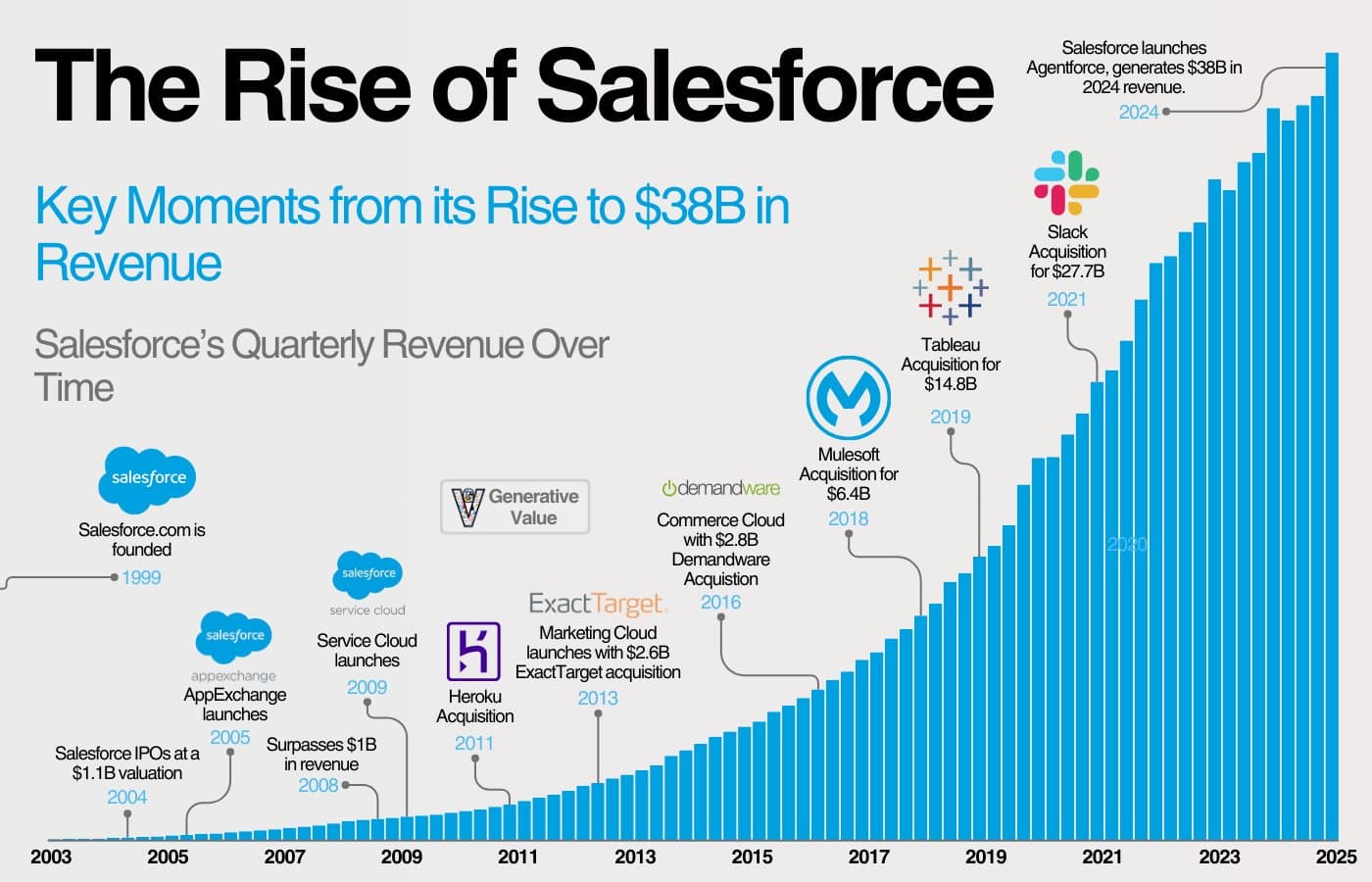

Salesforce was founded in February 1999 by former Oracle executive Benioff. The company grew rapidly and went public on the New York Stock Exchange in 2004. Today, Salesforce is one of the world’s largest software companies. In 2023, the company ranked 491st on the Fortune 500 list, with a revenue of $31 billion.

Salesforce’s most well-known event is the annual Dreamforce conference, first held in 2003. Over the years, the company has expanded its product portfolio and launched several significant services, such as Service Cloud in 2009 and the Trailhead learning platform in 2014. In 2020, Salesforce was added to the Dow Jones Industrial Average index, making it one of the most significant technology companies in the United States.

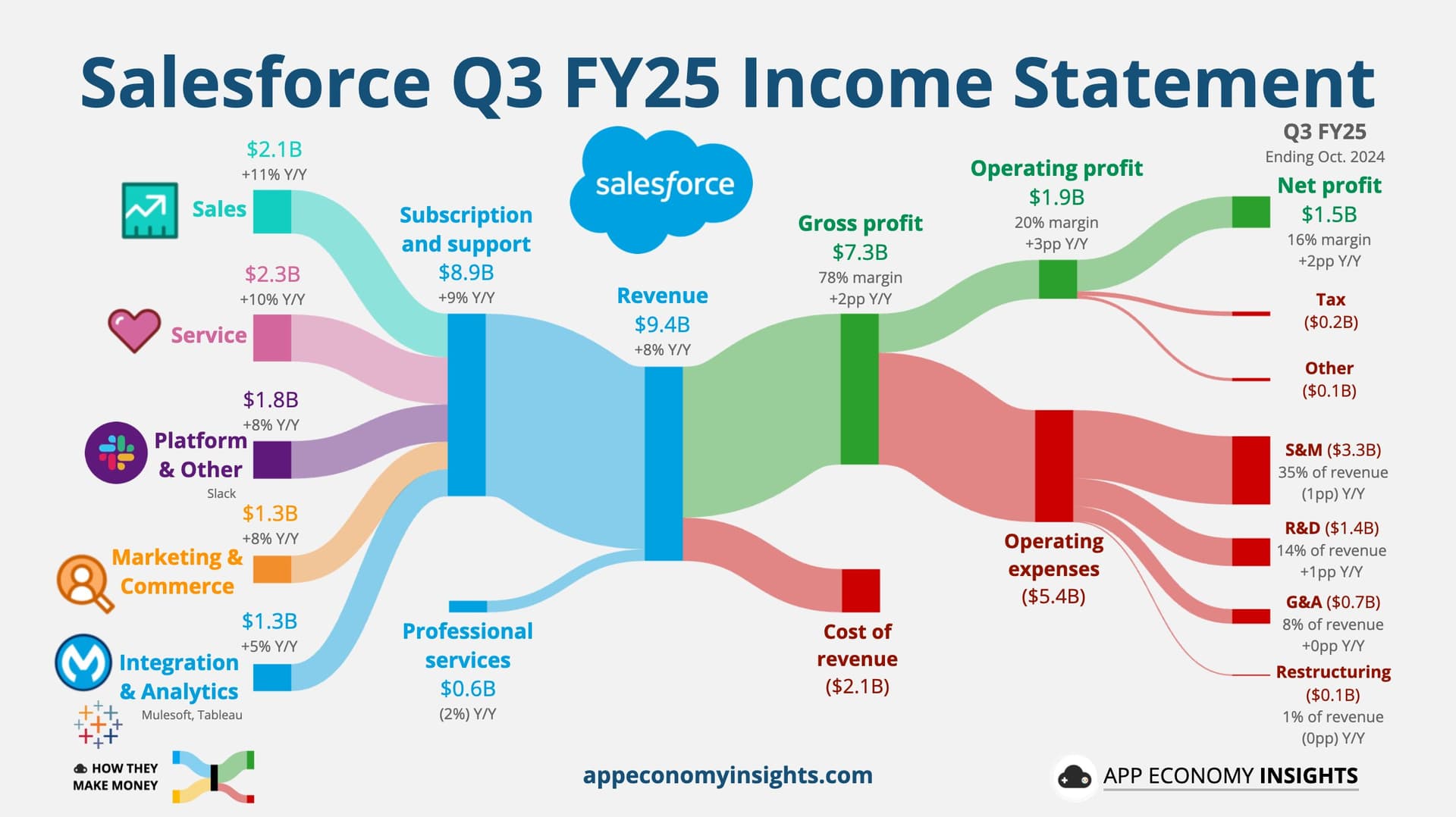

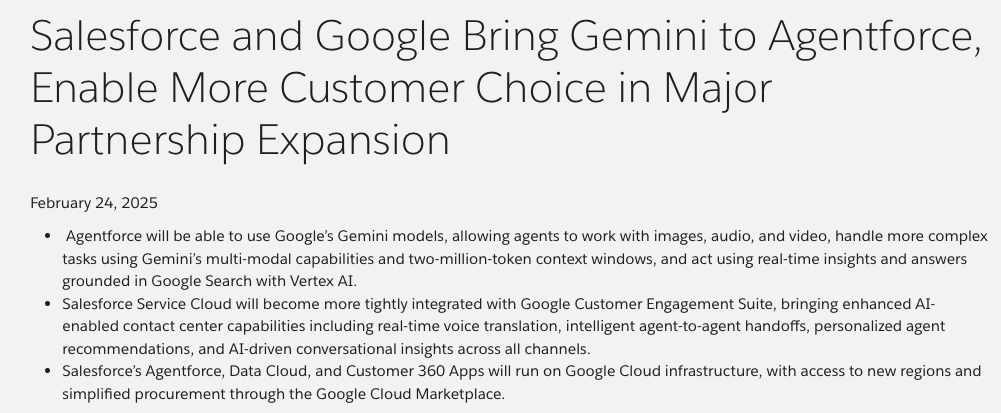

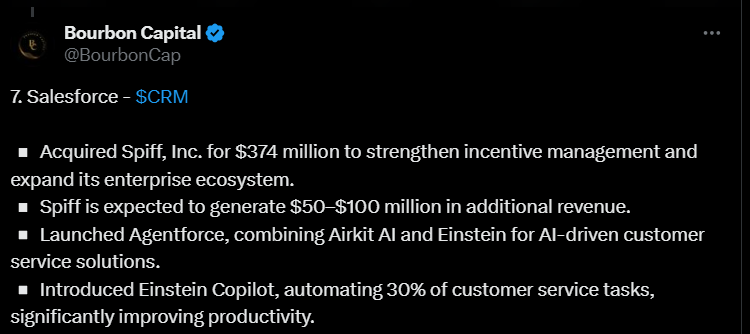

In 2021, Salesforce completed its largest acquisition when it acquired the Slack collaboration platform for $27.7 billion. With this acquisition, the company strengthened its position in the business application market. Salesforce has continued to innovate and in 2024 introduced a new AI-powered application called Einstein Copilot for healthcare needs.

In recent years, Salesforce has faced some challenges, as evidenced by layoffs and management changes. Last year, the company announced it would reduce its workforce by approximately 10% as part of a restructuring. On the other hand, despite this, Salesforce continues to grow and focus on innovation.

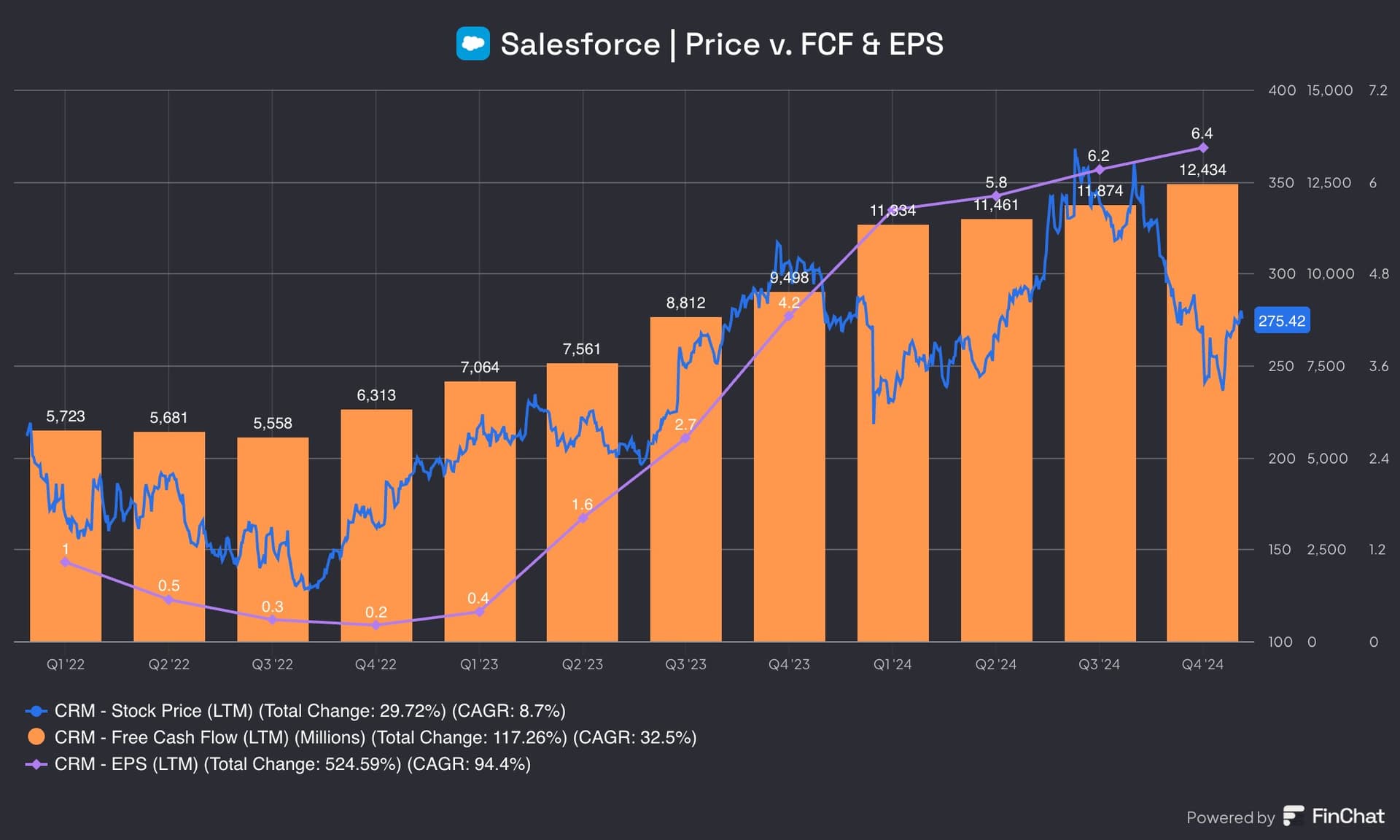

Investor’s Perspective:

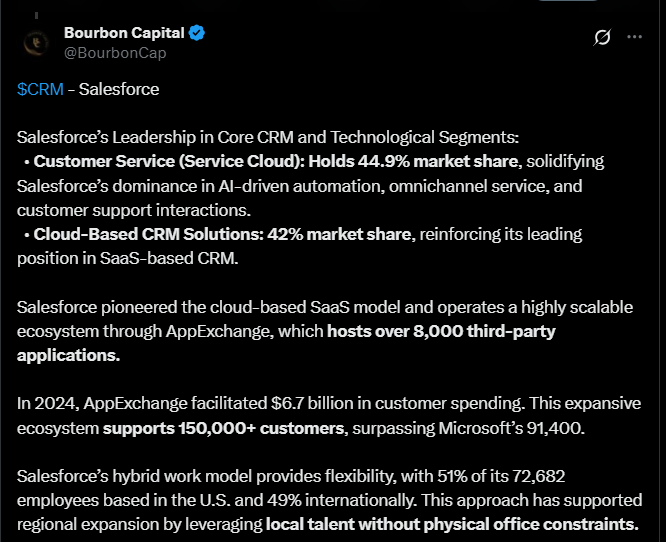

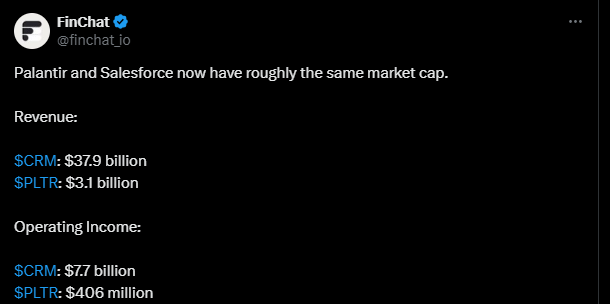

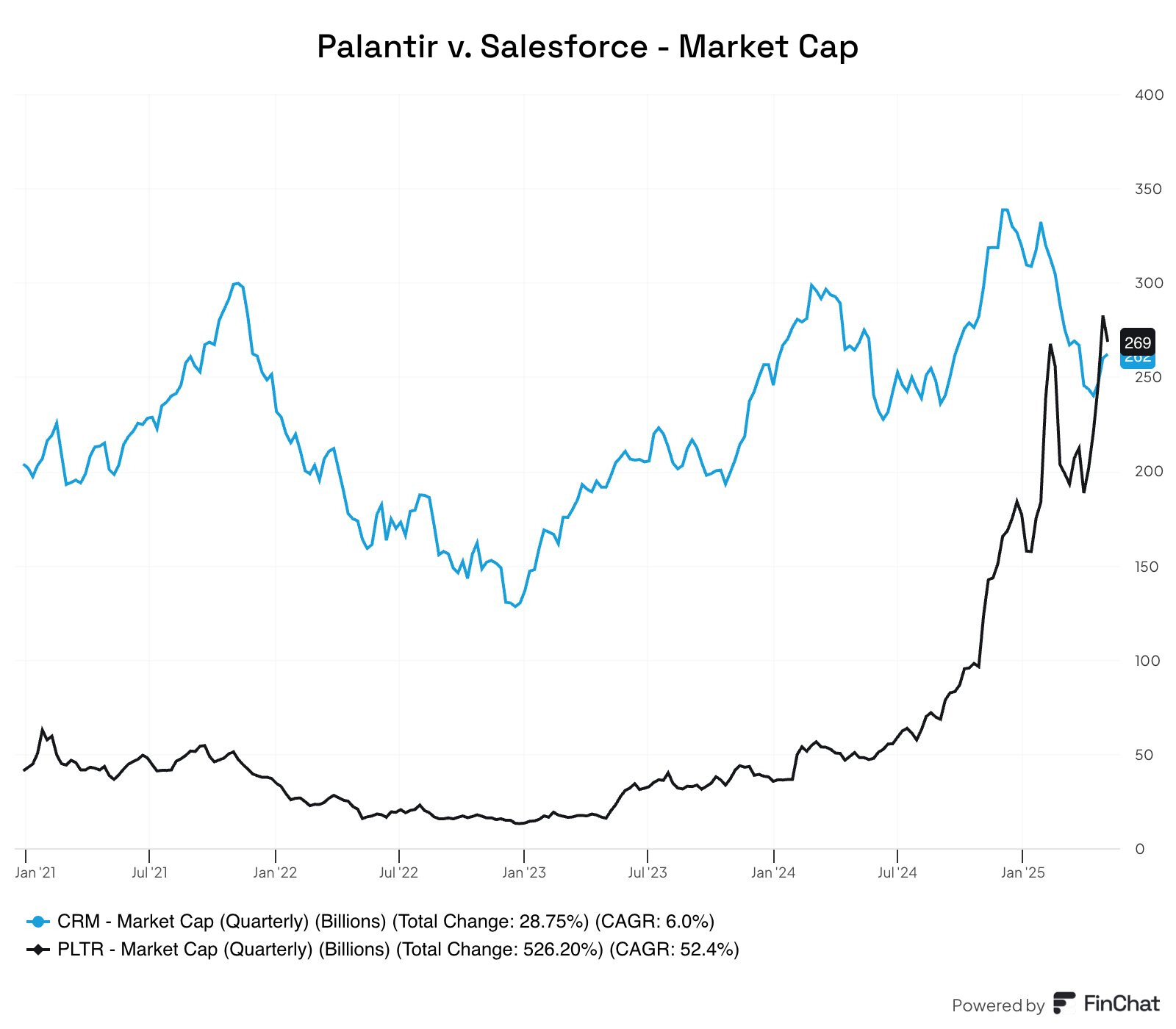

Salesforce is one of the world’s largest software companies, and its position in the CRM market is strong. In recent years, however, the company has faced challenges, and its stock value has fallen significantly from its peak.

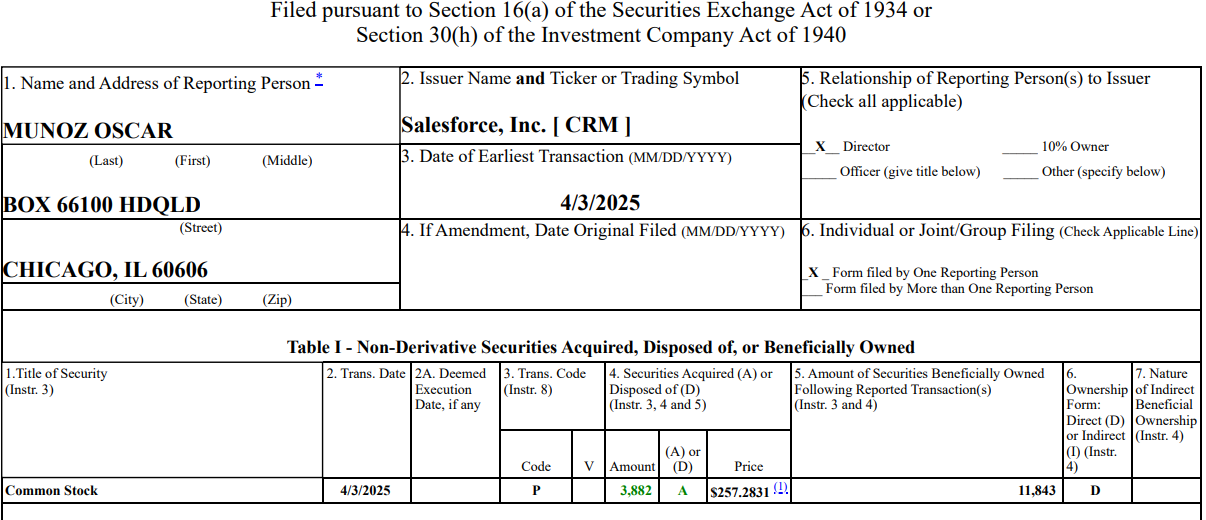

Salesforce’s valuation is currently considered low by some, and the company’s free cash flow yield is high, which does not necessarily mean that the company is an undervalued investment, as a bearish view might suggest. The company has at least partially pulled itself together under pressure from various investor groups, leading to a reduction in stock-based compensation, which some believe indicates problems in the company’s governance.

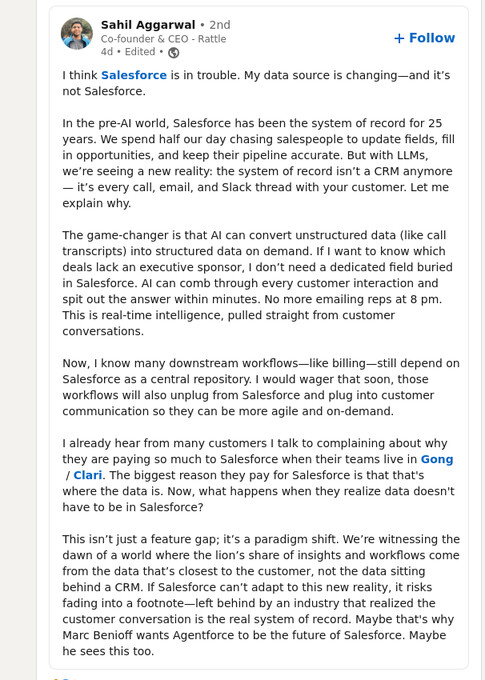

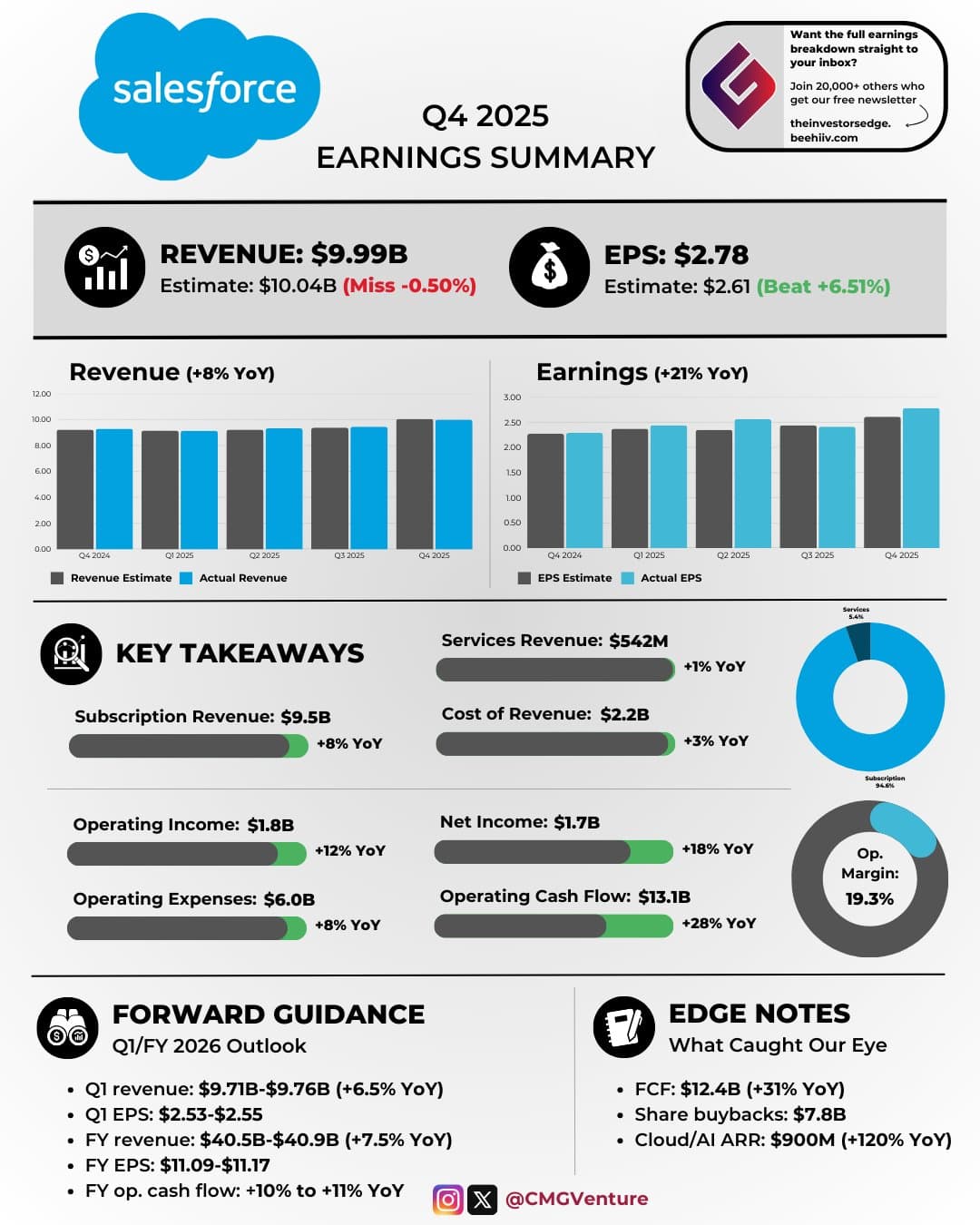

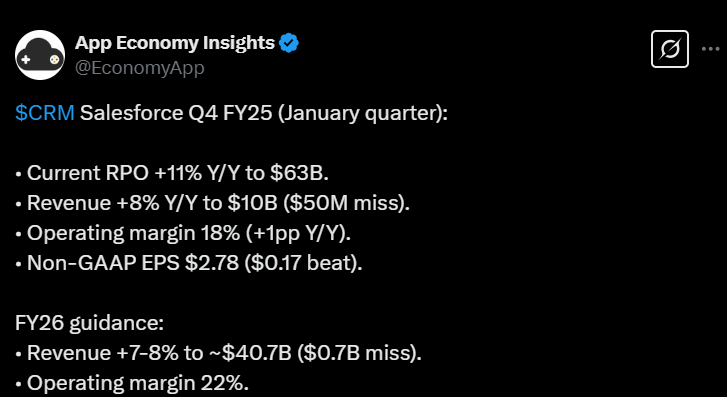

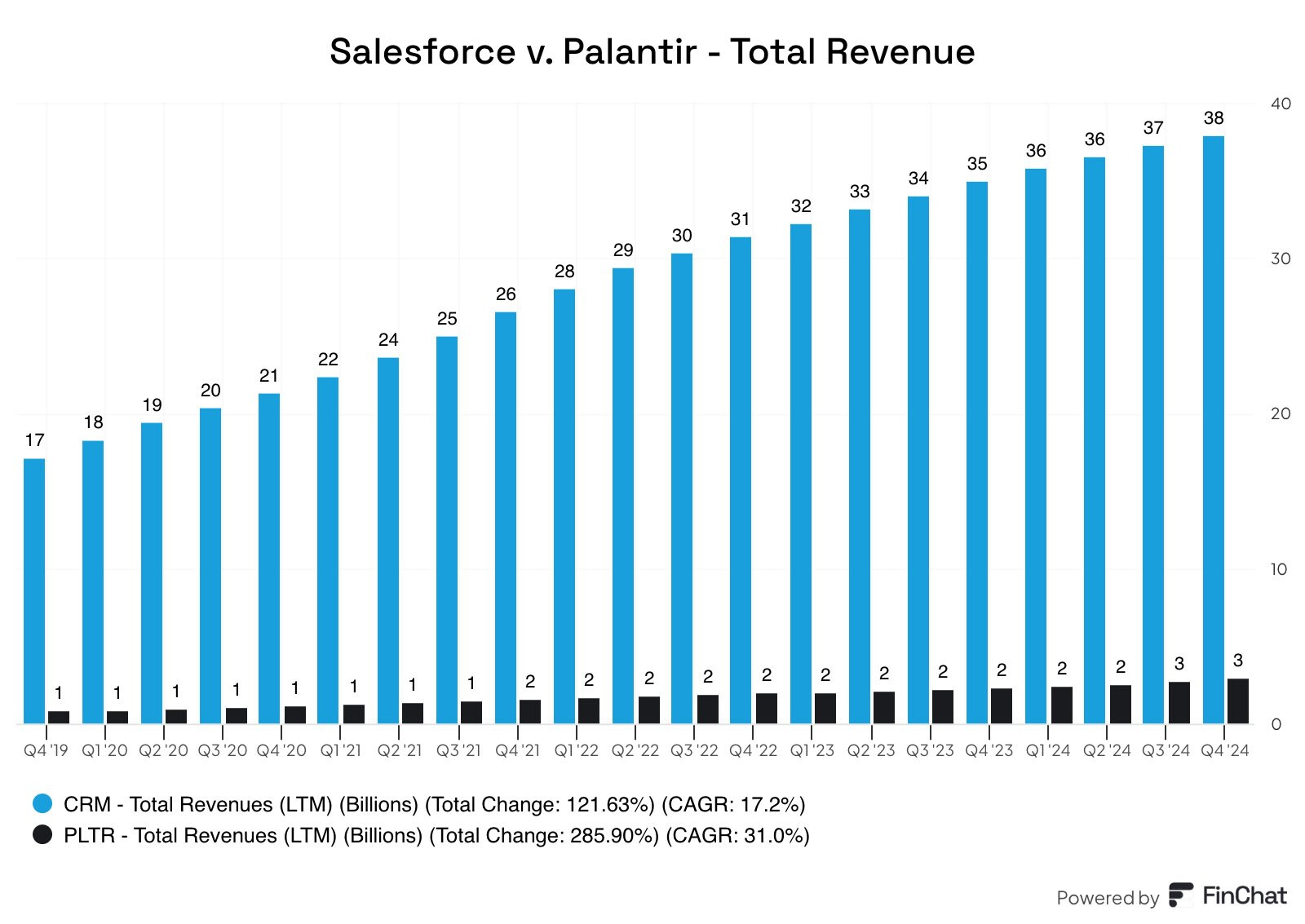

Salesforce has continued to grow, and its financial indicators are strong, but despite these figures, it is important to note that competition in the CRM market is extremely fierce. The company dominates the market and has a significant market share, but its competitors are constantly developing new and attractive alternatives that could threaten its position in the long run.

The company’s strong margins and cash flow may give it room to maneuver, but it is worth considering how sustainable its business model is in a changing economic environment, as competitors innovate aggressively. Salesforce has made many share buybacks, but this may not be a long-term solution if the company’s growth slows or the markets become even more challenging.

For now, it can be said that Salesforce is financially stable and its market position is strong, but it is also important to consider the risks and challenges the company may face in the future. These include, among others, the aforementioned fierce competition and questions about governance practices. Therefore, the company’s future prospects are not unambiguously positive, and this worries investors. It is not enough that the numbers look good now if it is felt that the company may not be sufficiently prepared for the rise of competitors and potential internal problems.

It would be nice to get concrete understanding and insight into why it is thought that Salesforce’s competitors are getting closer to Salesforce. However, on the other hand, I have understood that the “product/platform” has been successful in its ease of use and flexibility. And what and what kind of problems there have been in governance, given the turnover and the addressing of stock-based compensation.

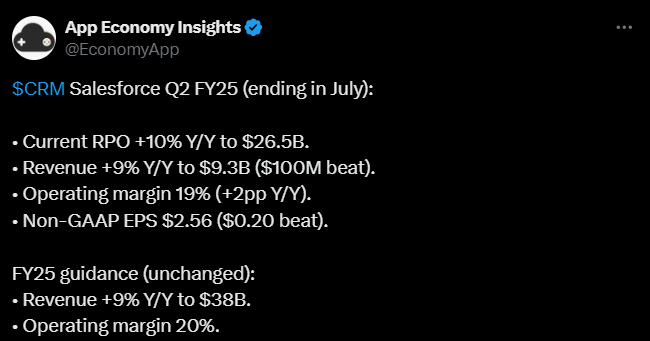

Q2/2024

https://x.com/EconomyApp/status/1828888998254891172

Reading Material from company pages.

(Fiscal Year ended January 31, 2024 )