Happy start to the week, it’s greening up now, but how about the guys’ portfolios ![]() Cheers, ytd around 4

Cheers, ytd around 4

https://x.com/StockMKTNewz/status/1992732873053647087

Happy start to the week, it’s greening up now, but how about the guys’ portfolios ![]() Cheers, ytd around 4

Cheers, ytd around 4

https://x.com/StockMKTNewz/status/1992732873053647087

@Jukka_Lepikko’s tweet about the Five Hundred’s dive and bounce ![]()

https://x.com/JukkaLepikko/status/1993426024663539839

It’s still a bit unclear to me where this dip originated from? Several media outlets were touting the AI bubble, but was there anything else? Well, traditionally it has paid off to buy during these, but you never know when that all-cleansing tweet or clickbait headline will hit the airwaves and the resulting plunge will never turn around again.

@Jukka_Lepikko and the US’s wild rises/recoveries ![]()

https://x.com/JukkaLepikko/status/1993724258275799256

The US stock market closed early and stayed in the green. ![]()

@Jukka_Lepikko and Japan’s interest rates ![]()

![]() and also the five hundred

and also the five hundred

Below is Pekka’s tweet about the volatility index and related matters ![]()

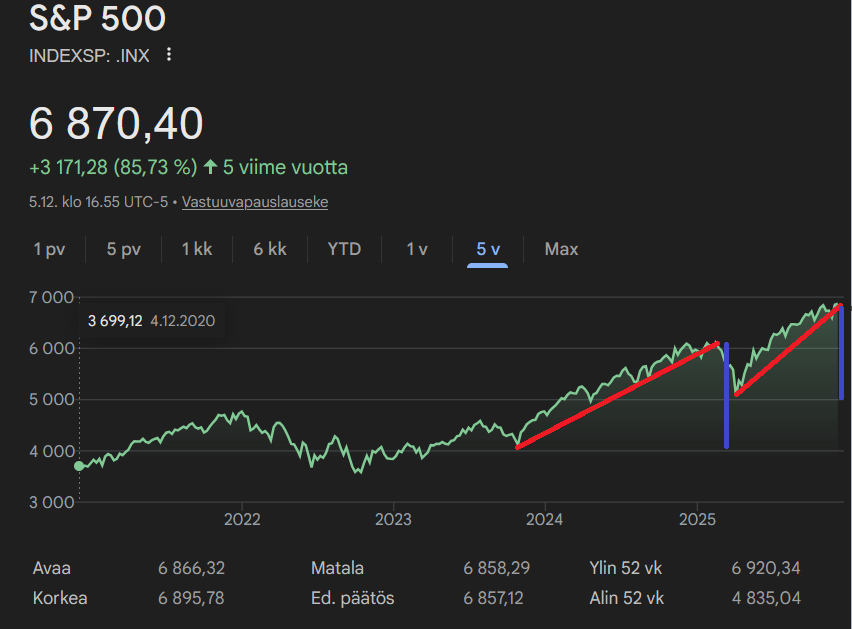

Hi. Thoughts on the current situation of the S&P 500? It seems to stubbornly remain high. It’s hard to interpret this, the latest upward curve is steeper after the previous crash than the earlier upward curve, although the earlier upward curve was longer. Perhaps it would be wise to do the following now: 60% of holdings into short-term bond funds, and the rest into funds (Handelsbanken USA/Handelsbanken Europe/Finland index). Opinions on this? A crash is coming, but even though we’re going sharply upwards, perhaps there’s still a little way to go until the actual tumble?

Looking at the vertical axis, before the previous crash, we rose approximately 2000, now we have risen approximately 1900 vertically after the previous crash.

Your question, combined with the image you drew, brings to mind this Hofstra University image of the bull trap phase.

If we consider this now, we’re talking about an AI bubble and whether it’s producing results at this stage. In my opinion, media interest has not yet awakened. The rise of AI stocks is hardly reported in the media. Of course, there’s normal coverage during earnings season, but headlines like ‘NVIDIA up 100% in a year’ are rarely found. The chart lacks a parabolic rise.

I myself, in Warren Buffett’s words, do not believe I can predict the madness of the stock market, and I am as vulnerable as those wiser than myself, for example, Isaac Newton.

Isaac Newton’s statement on the stock market: Sir Isaac Newton (1643–1727), a renowned physicist and mathematician, significantly participated in one of the largest economic bubbles of the early 18th century, for which he paid a heavy price.

Newton’s Maxim on the Stock Market

Isaac Newton’s most famous saying, directly related to investing and stock market psychology, is:

“I can calculate the motions of heavenly bodies, but not the madness of people.”

Context: South Sea Bubble

Newton’s statement is related to his own catastrophic investment experience in the South Sea Bubble between 1720 and 1721.

This experience led to Newton’s famous statement, which perfectly illustrates how even the brightest minds in the world can fall victim to crowd psychology and speculation in financial markets. Newton avoided discussing the topic thereafter.

I have written some macro/market insights on my blog. (The blog cannot apparently be directly advertised or linked here, but it can be found on Google.) I’m doing it in parts, but regarding the S&P 500 and related thoughts, there’s a section on US valuations. It states in bold that the Shiller P/E (CAPE) used does not have predictive power over a 1-year horizon. The stock market can practically climb anywhere in one year and then fall anywhere. My goal with the writing is to assess future developments and how they affect investment markets. The review is ongoing, and new parts are coming. The aim is to evaluate my own investments in the same way that Rahat Ojennukseen did, including index investments. I am forming a macro and market view. Forecasts often fail, and it will probably be the same for me. If I identify trends and guide my portfolio in the right direction, it will improve my investment success.

As long as states continue debt-fueled stimulus, there will be no proper collapse in the stock markets. These debt euros/dollars flow either through consumption into companies’ earnings or through stock savings into share prices. New money is constantly flowing into the economy, and the pace is only accelerating.

What might be the time horizon of your investments? If you are a long-term investor, it probably doesn’t pay to try to time the market based on gut feelings. You can’t conclude anything based on the lines you’ve drawn, and you don’t actually know if a crash will come next week, next year, or next decade. You’re just scaring yourself out of the market, and then it’s difficult to get back in when you’d eventually have to do it at a higher price.

Also, constantly switching from one fund to another usually doesn’t pay off, partly due to taxation. If you absolutely want to take a view, it’s best to do it with new money, and even then, you should be aware that the odds are against you, and taking a view will likely lead to a worse outcome.

Thanks for this.

Long-term time horizon. I always forget that capital gains are taxed in funds. I personally use the visualization of the S&P500 index to navigate the market situation. The downside is what you said, that I scare myself out of the market. But gradually, I need to make changes to the portfolio. It’s best to make changes with new money because of those capital gains taxes.

However, as a main principle, I believe in a simple rule: prices that are high will likely come down, and prices that are low will likely go up. That is my speculative guideline based on which I make decisions. For example, I personally wouldn’t use an investment loan now because the S&P500 is high. In such personal choices, I believe it doesn’t matter even if it takes 5 years not to be able to use an investment loan. However, certainty is best, as long as it doesn’t lead to scaring oneself completely out of the market.

My portfolio is still in the green for YTD, just need to hold on for a couple more weeks and hope it doesn’t go into the red. ![]()

Starting the week in the green, have a nice start to the week! ![]()

The S&P 500 already went over 6900, up 15% since Trump took office, and it hasn’t even been a year yet.

@Jukka_Lepikko, Viissatanen, DJ and Russeli ![]()

Here are the year-to-date performances of US indices and VIX

https://x.com/Investingcom/status/1999944559984255235

@Heikki_Keskivali and @Jukka_Lepikko in YTD spirits ![]()

https://x.com/hkeskiva/status/2000204024381866490

An exclamation mark caps lock broken news account, but otherwise quite a good account, Kobeissi has written about the S&P 500 and critical days. ![]()

Quite an interesting comparison. Although quite useless, I was in the market during, for example, those five worst days out of ten in 2008, and I can’t figure out, either then or in hindsight, how I could have benefited from them.

You certainly recognize a really bad day when the portfolio sinks, but you would need to know that day in advance to be able to benefit somehow.

These are nice statistical exercises, but there is little help for practical investing.