Green Monday everyone! ![]()

https://x.com/KobeissiLetter/status/1985123263693865269

The world’s stock market has been at its record levels now, my own portfolio didn’t turn green today. ![]() But on Friday my portfolio rocketed like crazy.

But on Friday my portfolio rocketed like crazy.

https://x.com/KobeissiLetter/status/1985382755169919344

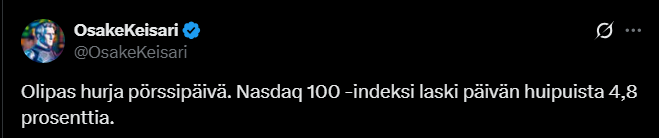

In Japan, stocks reportedly plunged because investors began to fear that the AI craze had gone a bit overboard and prices had risen too high. Major bank executives hinted at a possible market correction, and so investors began selling riskier tech companies… and the decline got out of hand. ![]()

https://x.com/KobeissiLetter/status/1985899063632376008

Things are happening in the US, the beginning of that graph still shows yesterday, but despite that, a lot has happened in the market within one day. ![]()

The news flow triggered a normal correction, which seems to have bounced off the 50-day moving average, and assuming nothing extraordinary happens over the weekend, I could imagine we’ll start climbing again on Monday.

Good companies recover; smaller AI companies that rode the hype to the moon might remain permanently at a lower level.

Surely, no correction has even happened? The SP500 is down 1.59% in a week. Even big companies would be ripe for a proper correction.

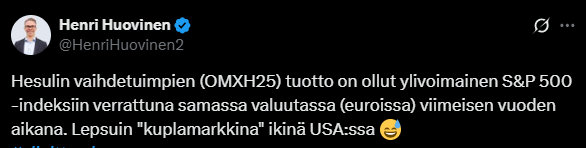

Henri Huovinen’s tweet about Hesuli’s surge and the United States’ “bubble markets” ![]()

https://x.com/HenriHuovinen2/status/1989359059431215305

Thanks for today (or rather yesterday, it’s already Tuesday), it was nice.

![image

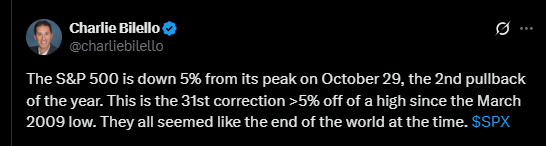

Here is Charlie’s tweet about the S&P 500’s declines, the S&P 500 hasn’t been as diligent in these as my portfolio. ![]()

https://x.com/charliebilello/status/1990819586875207856

Here’s what’s happening in the stock market; “it’s green,” said the Rookie, looking away from his portfolio.

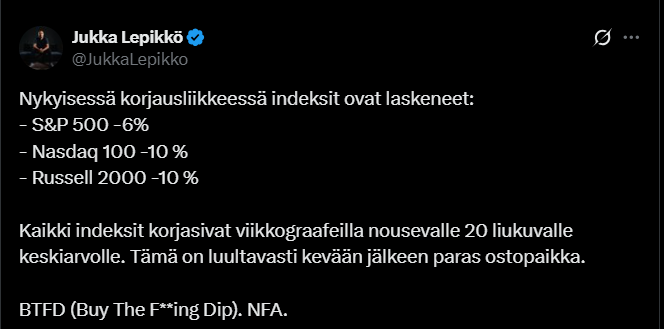

Lepikkö stated in a video a couple of years ago, though he hasn’t revisited the topic since, that “A decline is the fuel for a rise; without a decline that purges potential sellers, there is no rise.” In other words, a rise cannot continue without a decline that periodically cleans out sellers, which we witnessed again.

I have both declining value and declining growth in my portfolio ![]()

Below is a thought-provoking tweet ![]()

The tweet below is a great reminder, and sometimes I, at least, tend to forget the point of this tweet, because I’m a stock picker and not a fund investor. ![]()

https://x.com/dividendology/status/1992280940819702117

The 2008 crash was apparently in a league of its own in its speed and depth. No wonder it felt so bad. The bursting of the tech bubble was a much longer process.