Here are OP’s Hännikäinen’s thoughts, especially on Eurozone inflation figures

https://x.com/JariHnnikinen1/status/1995800896890970347

Here are OP’s Hännikäinen’s thoughts, especially on Eurozone inflation figures

https://x.com/JariHnnikinen1/status/1995800896890970347

Semirikkoutuminen tili, also known as Kobeissi, has made an interesting tweet stating that the US industrial sector is clearly under pressure.

Production has remained on the contraction side for a long time due to an unpleasant spiral (all negative factors accumulating), and new orders and employment show the same downward trend.

At the same time, cost pressures have again turned upwards after an earlier calming period.

Overall, the industry is suffering from a stagflation-like combination, meaning economic momentum is slowing down, but prices continue to rise. ![]()

Tariffs are starting to have an effect as expected. This is probably not a surprise to anyone but Trump and MAGA supporters.

Good morning!

Today’s macro piece discussed the Fed’s leadership shuffle. Trump promises to announce his nomination for the new chairman early in the year, and I (too) consider Kevin Hassett, known as a media darling and a fan of Trump’s policies, a strong contender. Whoever the chairman is, they will face an exceptionally contentious Open Market Committee.

An Economist article about Hassett. From the perspective of the Fed’s independence, he is not necessarily the best choice and would certainly push Trump’s agenda like a bulldog. This is, of course, not surprising from a Trump-nominated candidate - he wouldn’t nominate any other kind of candidate - but it’s difficult to say anything about his true competence when the discourse nowadays is purely propaganda, disregarding facts.

Hassett has become a regular presence on cable news, defending Trump’s policy priorities, downplaying unfavorable data, and echoing the White House line on everything from inflation to the legitimacy of federal statistics. Earlier in November, the NEC director insisted that inflation had “come way down” and that the price trajectory was “really, really good,” even as official data showed that the consumer price index had increased for five consecutive months.

This means that competence per se is not only secondary but probably also a disqualifying factor, as a competent person might genuinely want to do something smart, if only out of professional pride, if not deep moral conviction.

That danger is not present now.

He has also echoed Trump’s attacks on the central bank and the statistics it relies on: accusing Fed officials of putting “politics ahead of their mandate”; calling the central bank “late to the game” in cutting rates; and suggesting there is a partisan “pattern” in the jobs data produced by the Bureau of Labor Statistics. When Trump fired BLS Commissioner Erika McEntarfer and accused her of “rigged” numbers, a smiling Hassett went on TV framing the move as a matter of accuracy and process.

Under Hassett’s leadership, the Fed is not a credible organization in its decisions. The consequences of the decisions are, of course, serious and impactful, but the organization itself is not to be taken seriously.

Unlike Hassett, however, “Bernanke never compromised himself as head of the council,” Baker told Fortune. “He defended Bush’s policies, which is what you expect, but he didn’t say things that were just blatantly untrue.”

Hassett’s willingness to provide intellectual cover for Trump’s grievances extends beyond data. He has also floated a legal theory for how the president could fire Powell before his term ends.

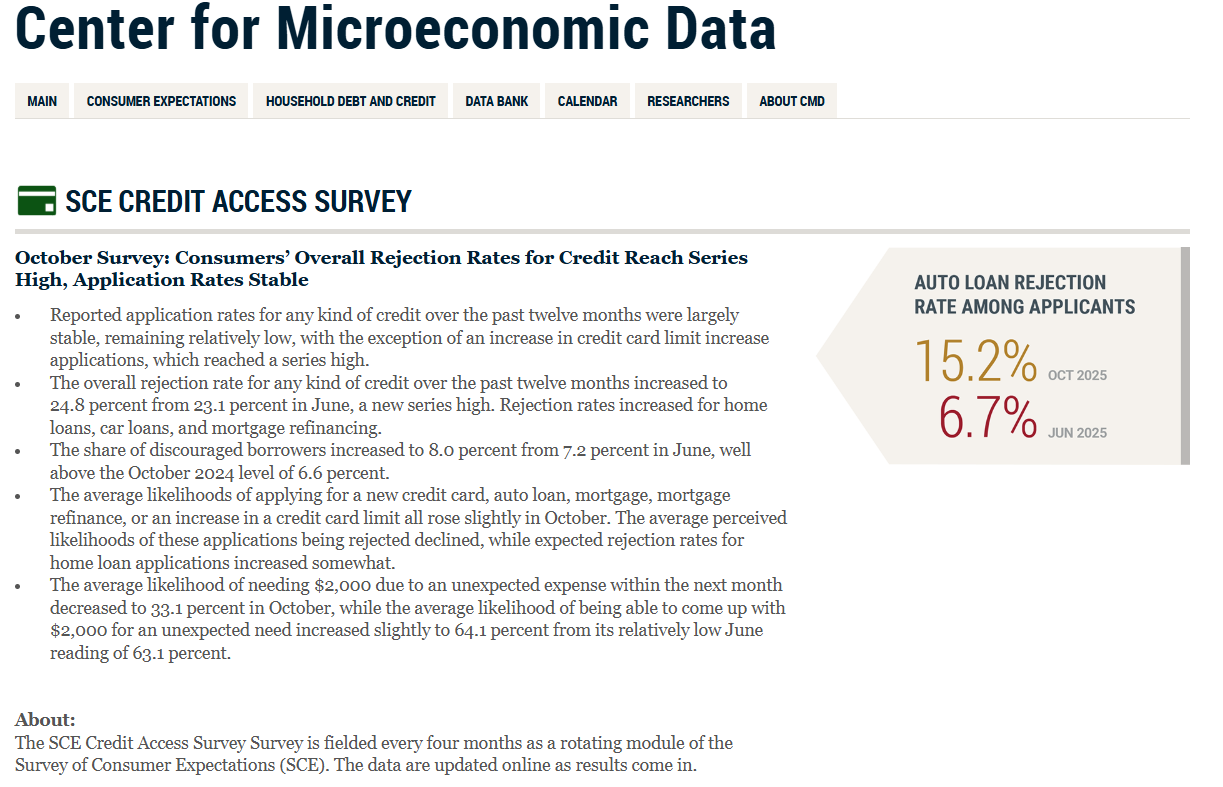

But what does it matter who leads the Fed? If the so-called trust in the Fed erodes globally, what will states do with the US Treasury bonds they hold?

Furthermore, Hilsenrath added that while a yield near 4% might seem manageable, it is actually “exceptionally low” given that inflation remains above the Fed’s 2% target and budget deficits are near $2 trillion. If the bond market loses faith in the Fed’s independence, that disconnect could correct violently, sending rates soaring.

Well, Hassett alone doesn’t decide the Fed’s actions, but as chairman, he would be “greatest among equals”.

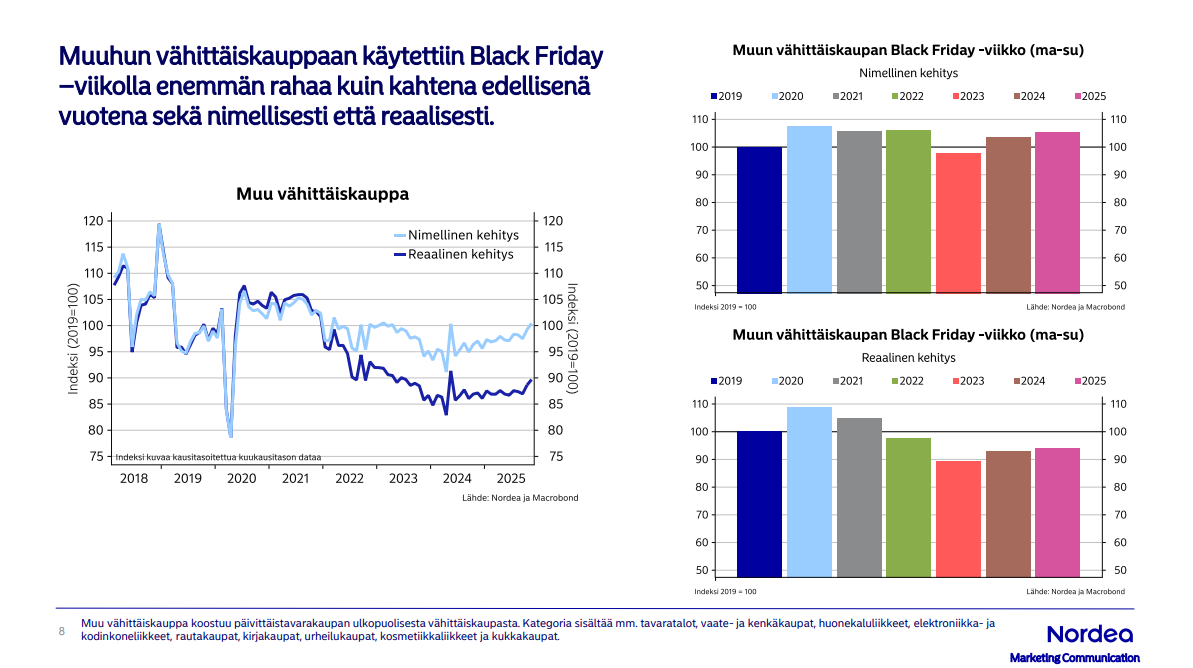

Nordea released Black Week Extra card data yesterday. Development is positive, though not rocketing. Other retail continues to emerge as the most positive:

@Jukka_Lepikko and Tuomas Tuominen were in a strategic AI mood ![]()

Topics:

0:00 Intro 10:00 Markets Now 14:39 Bitcoin 17:06 Strategy (MSTR) 27:18 Market Review (AI Sector Review)

In his recent video, Damodaran discusses the valuation of the largest companies by market capitalization (the introduction covers historical market cap milestones, followed by the valuations themselves). Duration 35 min.

Nordea’s Jan tweeted about the US private sector employment development, and also a bit about interest rate cuts. ![]()

One wonders if things are starting to slip across the pond… meaning everywhere.

Industrial turnover grew by 4.0% in October 2025 | Statistics Finland

Service turnover grew by 3.6% in October 2025 | Statistics Finland

Good momentum for the start of Q4.

Construction figures will be available next week, but it seems that the economy has bottomed out and we are finally on our way up. However, it should be remembered that economic turnover figures are reflected in the gross domestic product with a slight delay of 1-2 months. In any case, the direction is finally up ![]() .

.

PCE inflation report September 2025:

A key inflation measure was lower than expected in September, the Commerce Department said Friday in a report delayed by the government shutdown that gives a further green light for the Federal Reserve to lower interest rates.

Delayed September core inflation data was below expectations. It gives a green light for a rate cut.

What’s in store for next week? ![]()

https://x.com/eWhispers/status/1996950591851933790

Phew, what a busy week ![]()

And here are next week’s macro events ![]()

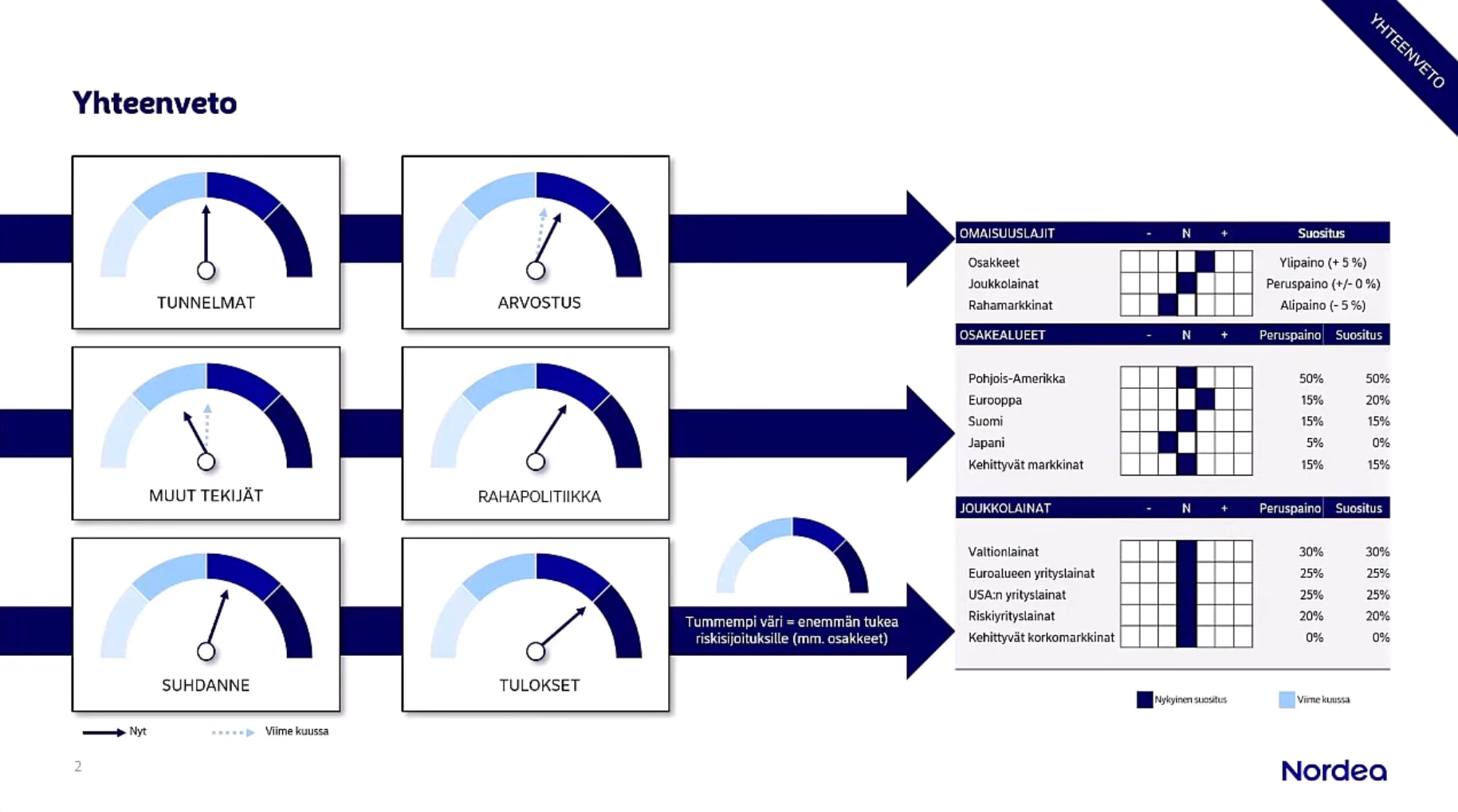

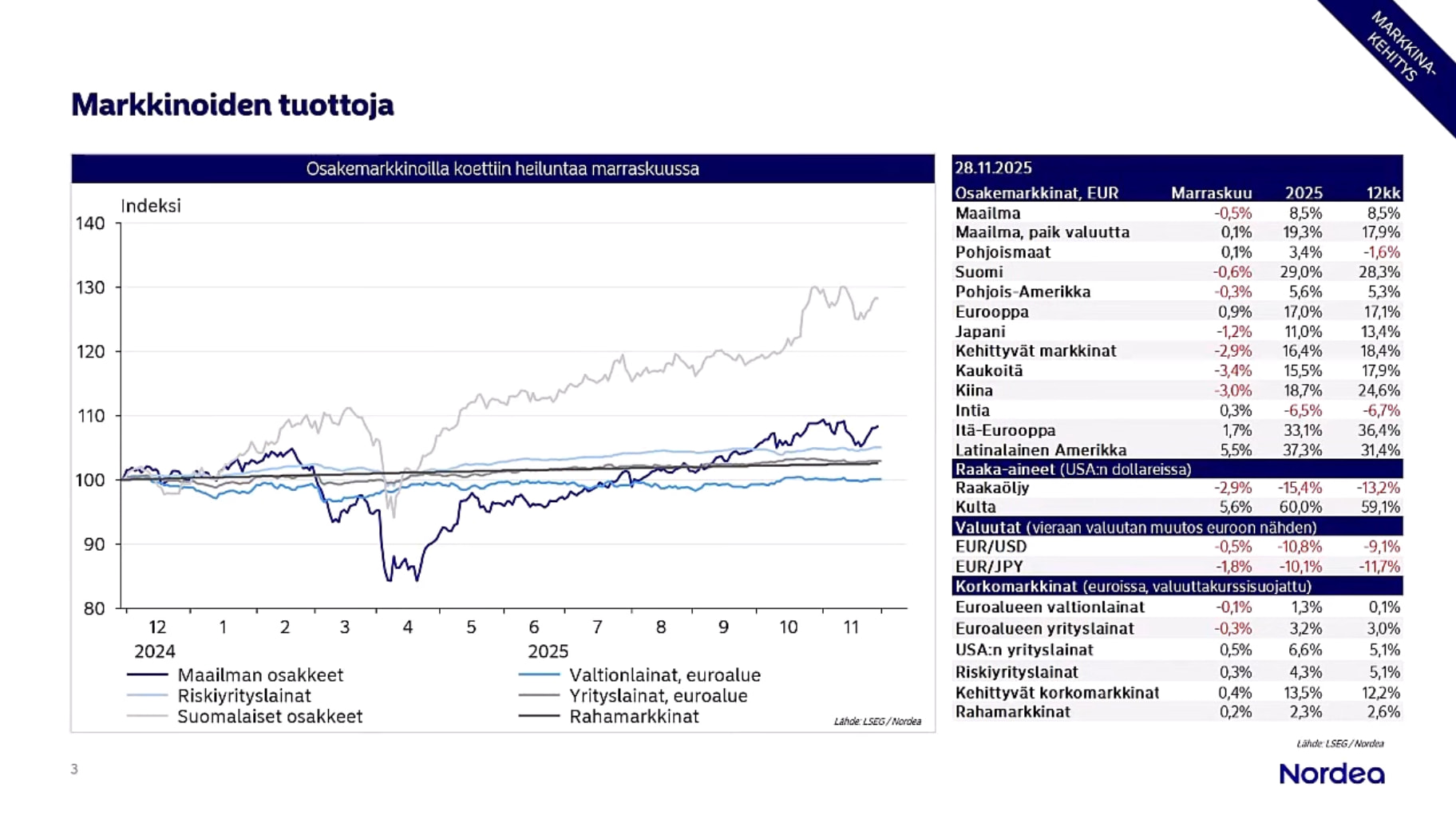

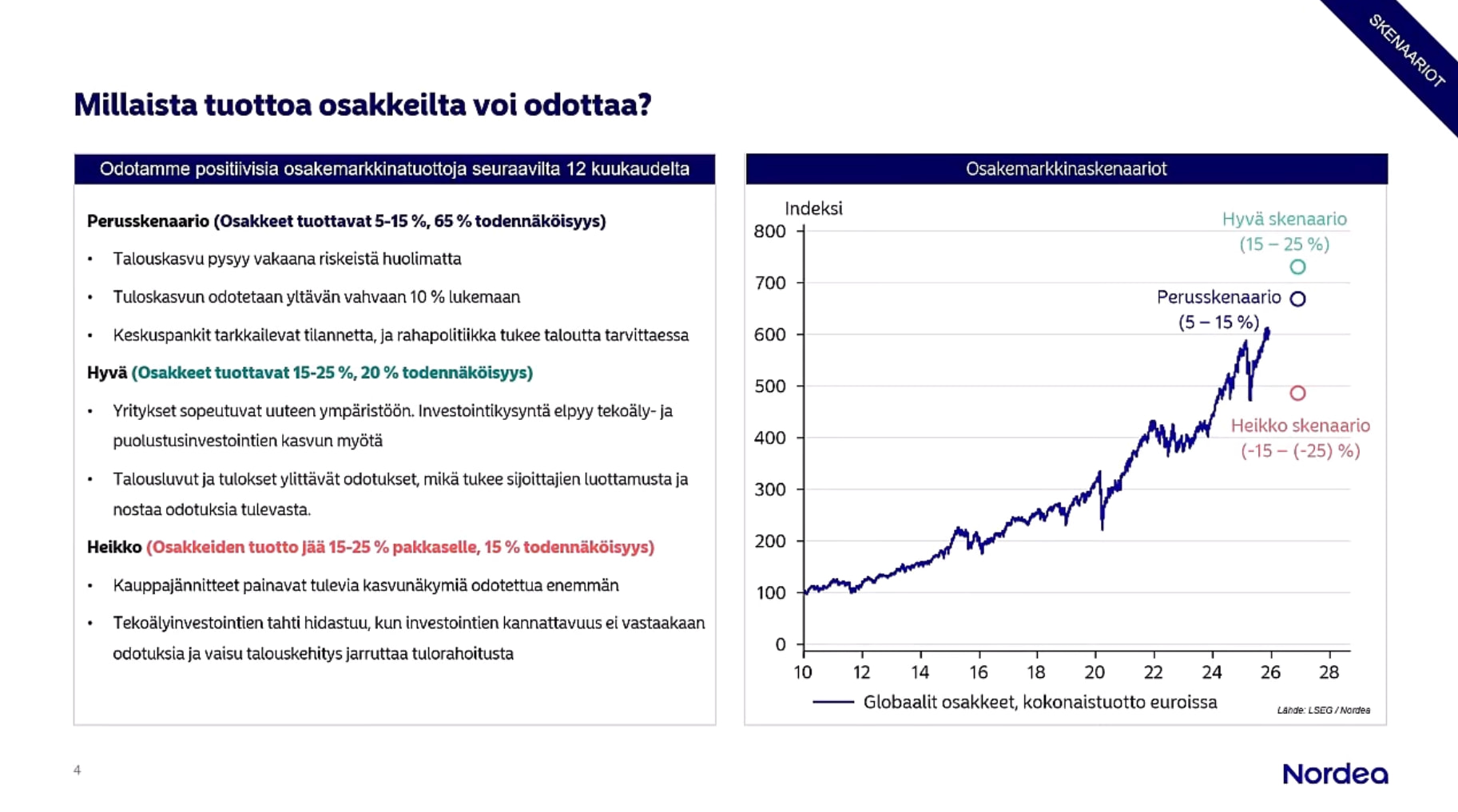

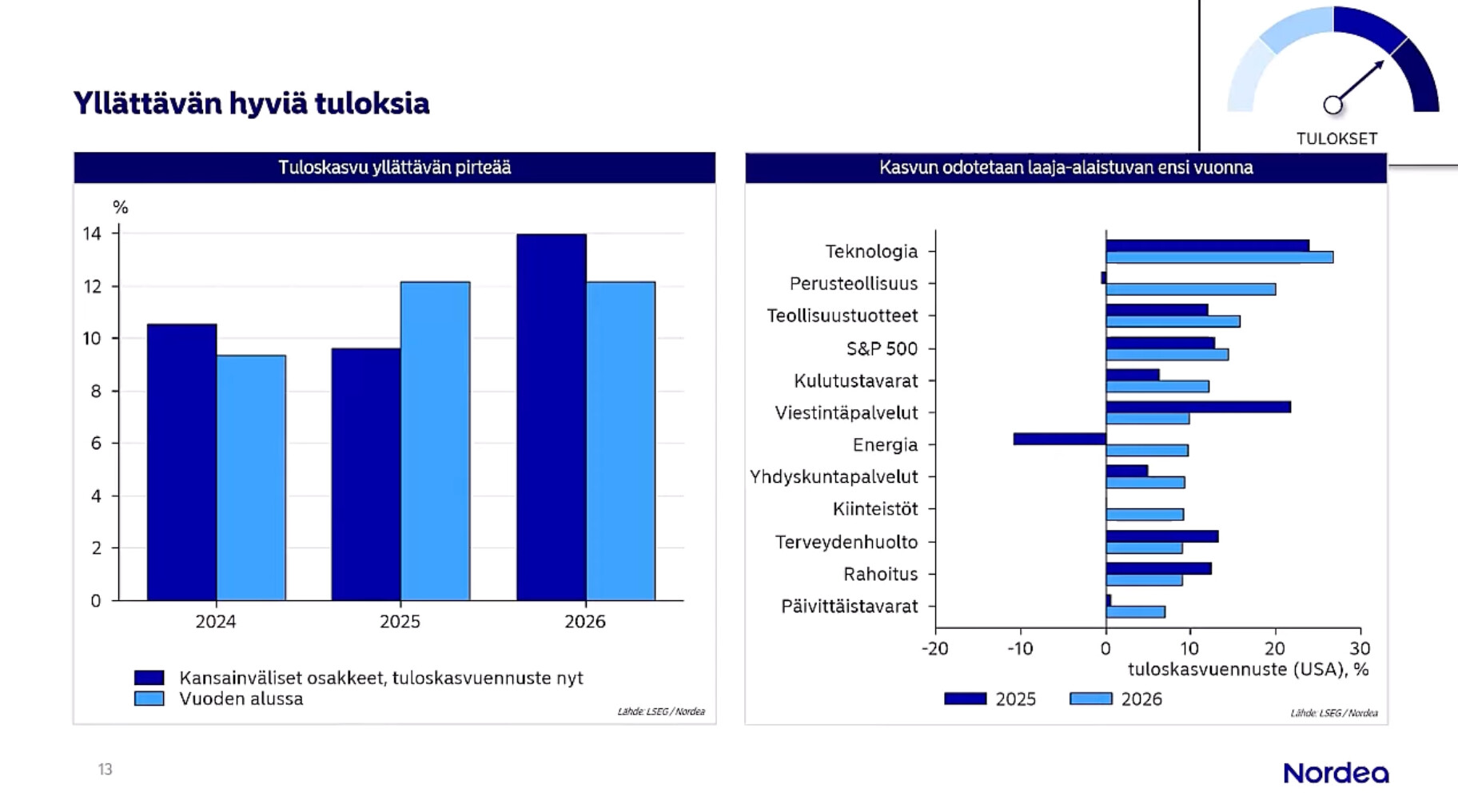

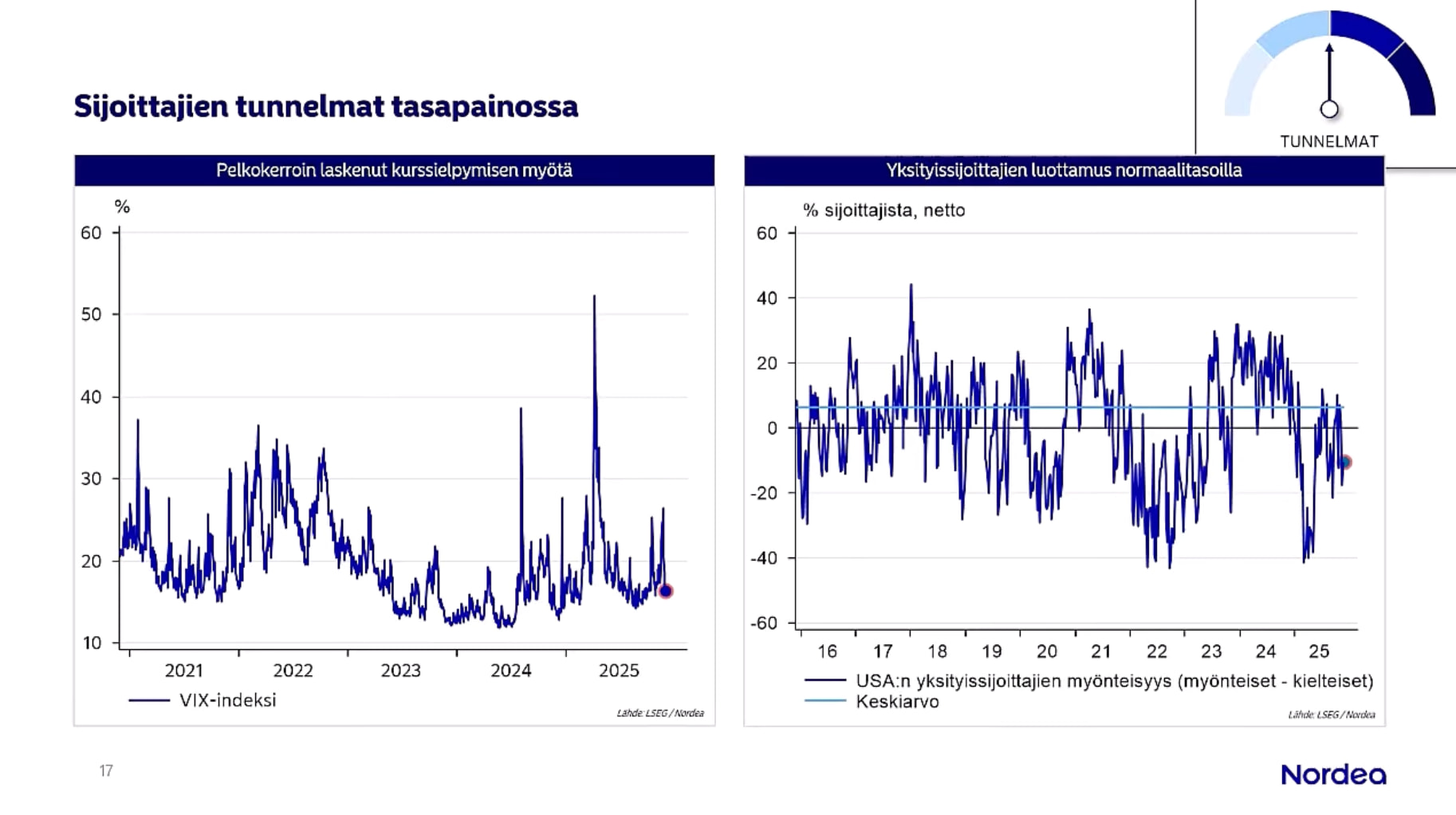

Nordea has published its December “International Investment Strategy” webinar. ![]()

Below are a few highlights in the form of images. ![]()

Nordea also published its weekly report, which strongly looks at the outlook for next year: https://www.nordea.fi/Images/146-554989/Viikkoraportti-01122025.pdf. Below is a summary. ![]()

2026 – another good investment year?

2025 is proving to be a good investment year. Despite uncertainties, stock markets have performed at a fairly normal pace, and bond returns have also been good. The economic and earnings outlook for 2026 is quite bright, so we expect stocks to continue to perform well. Investors should be prepared for slightly more volatile price fluctuations than usual, caused by high valuation multiples and the occasional questioning of the outlook for AI companies. We maintain an overweight position on equities in our investment recommendations.

Ed Yardeni’s strategy for the last 15 years has been bullish on “Mag7” (note: 15 years ago, tech giants were not referred to as the “Magnificent Seven”), but now he has slightly changed his tune.

That news article is a bit hollow in content, but Bloomberg had more detailed justifications from Yardeni:

Yardeni Research now recommends effectively going underweight the Magnificent Seven megacap technology stocks versus the rest of the S&P 500, expecting a shift in earnings growth ahead.

“We see more competitors coming for the juicy profit margins of the Magnificent 7,” and expect that the productivity and profit margins of the rest of the S&P 500 will be boosted by tech, said Wall Street research veteran Ed Yardeni. He added that in effect, “every company is evolving into a technology company.”

The firm recommends market-weighting of the two sectors by adding to overweights in financials and industrials, and overweighting healthcare.

The Magnificent 7 merits special caution as “they’re competing more aggressively against each other and they’ve got more competition coming out of nowhere” Yardeni said in an interview with Bloomberg Televisionon Monday. In particular, he cited the recent doubts about OpenAI’s dominance as well as the emergence of China’s DeepSeek earlier this year

It’s easy to agree with Yardeni’s concern. Large tech companies have always competed with each other, but without truly encroaching on each other’s core territory. All have, as side projects, coveted Apple’s access to consumers’ pockets without success. Amazon takes some advertising revenue from Alphabet and Meta with its ads. There’s enough to share in the cloud from Azure and AWS to Alphabet, etc. But the AI race of recent years has undoubtedly increased the pace and collision courses between the megatechs, even though all have happily grown simultaneously so far.

Here are Nordea’s Jan von Gerich’s comments regarding Euribor. ![]()

That’s the core of the matter right there: “Amazon takes a bit of Alphabet’s and Meta’s ad revenue with ads. In the cloud, there’s enough to share from Azure and AWS to Alphabet, etc.”

But who will capture AI? So far, all the big players are losing money with that apparatus. These companies know ad monetization better than anyone, but the implementation of new functionalities is a bit hit or miss. Zuckerberg and the metaverse just as one example.

What is the claim based on that all major companies are losing money with AI?

Here are Marianne’s pre-decision comments, as the Fed announces its interest rate decision on Wednesday. ![]()

So, in this thread, there will be live coverage of the interest rate decision on Wednesday, welcome to follow! ![]()

As usual, comments on the interest rate decision will be available in the Investment Forum’s ‘Market Direction’ thread at 9 PM Finnish time.