OptiCept Technologies develops and provides technological solutions specifically designed for the needs of the food and plant industries. The company’s technologies focus on improving the sustainability and utilization of raw materials, enabling more efficient production while reducing both waste and loss. OptiCept’s innovations relate to biological processes that, among other things, extend the shelf life of products, improve taste, color, and aroma, and preserve nutrients in the final product. Particularly through patented Pulsed (?) Electric Field (PEF) and Vacuum Infusion (VI) technologies, the company is able to offer unique solutions that help improve the efficiency and sustainability of production processes. OptiCept operates in international markets, and its headquarters are located in Lund, Sweden.

At this point, I’ll say just to be sure:

I apologize for any potential misunderstandings; the company and the industry are difficult to understand even in Finnish, and I mainly read English-language material (or Swedish :D). Additionally, I had to use a lot of translation help. Any errors are very likely just my own misunderstandings.

An Investor’s Perspective:

OptiCept Technologies is a growth company, as one might expect, focusing on innovative solutions in the food and plant sectors. The company utilizes two technology platforms: vacuum infusion in the PlantTech sector and pulsed electric fields in the FoodTech sector. Both technologies improve the handling and processing of raw materials, leading to longer shelf life, better quality, and reduced waste. The CEPT technology developed by the company is an advanced form of PEF technology that increases extraction efficiency and reduces the presence of microorganisms, such as bacteria and yeasts. This reduces the need for traditional heat treatment methods, such as pasteurization.

OptiCept’s strategy is based on a broad “application area” of technology, covering, for example, olive oil, potatoes, juices, etc. The company’s equipment can process both solid and liquid foods, providing flexibility to reach new markets without additional development costs. For example, the OliveCept system integrates into existing production lines and optimizes productivity by improving extraction efficiency and product quality, bringing significant savings to producers.

In terms of commercialization, OptiCept is in the early stages, which creates challenges for predictability and often requires additional funding, which naturally introduces a significant element of risk and unpredictability. On the other hand, the company has already secured significant customer contracts in both of its business areas and gained customers, including world-renowned companies, demonstrating the technology’s potential. The company’s business model is scalable, but its effectiveness is yet to be proven on a larger scale…

OptiCept’s investment profile is high-risk, as mentioned above, but the company is thought to have the potential for high returns, as it operates in growing markets driven by sustainability trends. If the company can scale up its operations, the scalability will truly come into its own. The company’s technology offers cost-effective solutions that extend product shelf life and reduce waste, making it perhaps somewhat attractive from a sustainable development and eco-friendliness perspective. As a beginner-level investor, I still see this as a very uncertain case; if I were to dabble in these, I guess I would hold several “hit or miss” companies in small slices.

the industry is challenging for me, and I believe that time and more evidence are required for investors to become interested in this company.

Briefly about Q2 and the time following it:

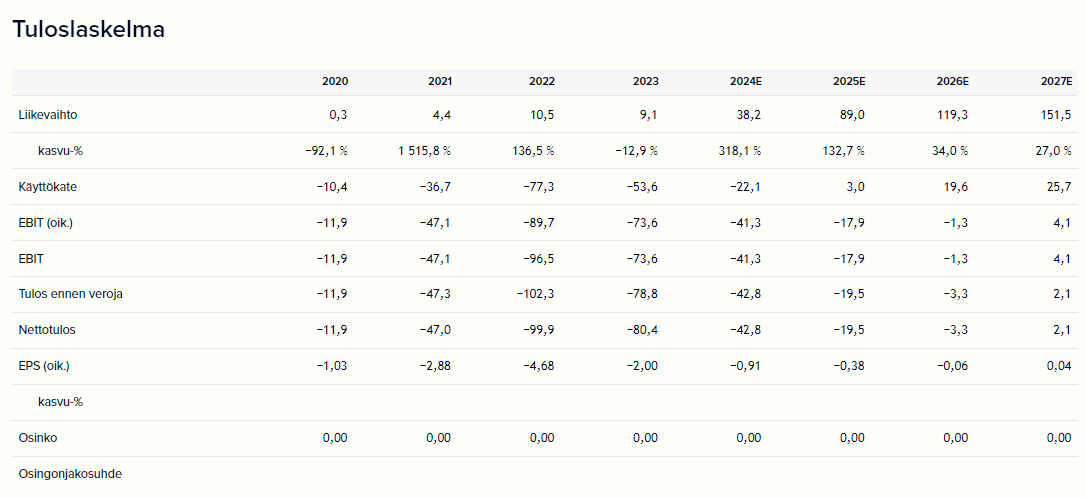

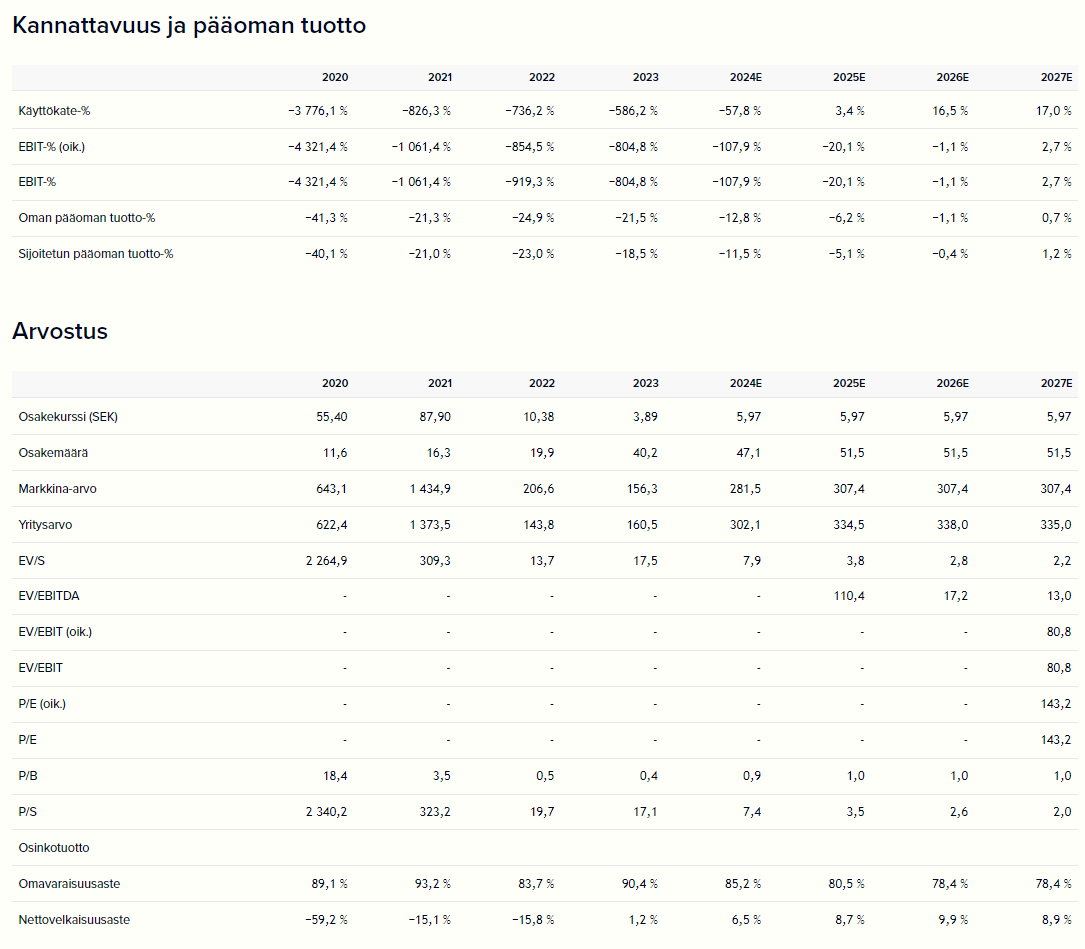

The company’s revenue grew by 117% in the second quarter but still fell short of forecasts. Due to high fixed costs, the operating result remained negative, and cash reserves were approximately 4.0 MSEK at the end of the period. However, the company later received a 10.3 MSEK loan, but at the current spending level, the company may need additional funding at the end of the year or early in 2025, although better cash flow from FPS orders would help. Short-term outlooks have been lowered, but long-term growth expectations remain unchanged regardless. According to Inderes’ estimate, the share value is 3.7–6.8 SEK (share price currently: 6.03 SEK on 29.8.2024 at 19:00), and considering the risks, it doesn’t seem that attractive at the moment.

Copied from the company pages provided by Inderes:

To conclude, I want to say: forget my babbling and read the extensive report provided by Lucas from February, which has no paywalls and is thus readable by everyone.

OptiCept Technologies provides solutions that enhance shelf life and quality in the food and plant industry. Through its innovative technology, which initially seems competitive, the company is actively addressing significant global sustainability challenges. However, the realization of broader commercial success, along with the timing of such a breakthrough, is dependable on future additional financing based on our estimates and involves considerable risk. Consequently, we anticipate a weak risk/return ratio over the next 12 months, despite our optimistic scenario supporting potential significant upside.

https://www.inderes.fi/research/enable-economic-growth-climate-friendly-way

Then here is a brand new company report in Lucas’s style (30.08.2024 at 09:30):

https://www.inderes.fi/research/opticept-q224-gearing-up-for-larger-deliveries