It’s truly sad if patents can be undermined like this. It means it’s no longer worth it for pharmaceutical companies to develop new drugs. This can’t be good for humanity, even if everyone gets cheap medicine for a moment. And I’m not speaking as a shareholder, because yesterday I realized I should get rid of my shares.

Based on the share price reaction, I’m once again surprised at how Eli Lilly can be so immune to news like this. Logically, such a cheap product would also eat into Eli Lilly’s market share?

Edit: Well, it looks like Eli Lilly did move downwards on this news after all.

Congratulations to those companies that have invested many billions of dollars in GLP-1/GIP candidates in recent years. If and when they ever reach the market, at this rate similar drugs will be available in stores for the price of a carton of eggs ![]()

Edit: Free-range eggs, not organic eggs..

Novo Nordisk issues statement on illegal mass compounding and

deceptive advertising by Hims & Hers

Bagsværd, Denmark and Plainsboro, NJ, 5 February 2026 – Novo Nordisk today issued the following

statement regarding the announcement by Hims & Hers that they will unlawfully mass-market an

unapproved, inauthentic, and untested knockoff semaglutide pill.

“The action by Hims & Hers is illegal mass compounding that poses a significant risk to patient safety.

Novo Nordisk will take legal and regulatory action to protect patients, our intellectual property and the

integrity of the US gold-standard drug approval framework. This is another example of Hims & Hers’

historic behaviour of duping the American public with knock-off GLP-1 products, and the FDA has

previously warned them about their deceptive advertising of GLP-1 knock-offs.

The American Diabetes Association®’s Obesity Association™ recently published new standards of care,

which discourage the use of compounded GLP-1s due to safety, quality, and effectiveness concerns.

Only Novo Nordisk manufactures an FDA-approved Wegovy® pill formulated with SNAC technology,

which facilitates semaglutide absorption when administered orally. The Wegovy® pill is available in all

doses, in full supply, nationwide in the US. Compounded semaglutide is not approved by the FDA and

may contain impurities, unnecessary additives, and untested doses.”

https://ml-eu.globenewswire.com/Resource/Download/300bdcca-d316-4e74-8d4c-8f6fcbb0dfec

Admittedly, I was asking in my own posts what new negatives could possibly still emerge… and sure enough, they did.

I really thought that Novo’s Trump price-cut deal included Wegovy getting pushed through the process quickly AND that the authorities would crack down on the copycats.

It remains to be seen how many reasonably sane people in a normal socioeconomic position will actually buy those copycat pills. Thinking about it myself, I certainly wouldn’t start popping some sketchy pills, even if I’m fine with buying red-labeled (discounted) products at the grocery store. There’s surely an underclass in the US that would settle for copycat pills, but thinking about it more calmly now, maybe it’s not quite an existential threat to Novo after all. Still, it’s annoying news, as the share price reaction proved.

Hims has been selling massive quantities of an injectable Wegovy copy for a long time, and that’s how it became a stock market star. Or a shooting star. At first, the reason was drug shortages, which meant they could be sold legally, and since then they’ve come up with personalization as a pretext to continue sales.

If we move back from the panic to the numbers, there aren’t really many expectations built into the stock anymore. EV/EBIT 10.1x, P/E 13.3x and P/OCF 11.4x. ROE 60% and gross margin 82.85%. Of course, when you factor in this year’s expectations, it smells like a value trap, but on the other hand, if the difficulties start to be behind us after this year, then it wouldn’t be priced that aggressively. Hopium, perhaps.

What annoys me most right now is that even if Hims were forced to stop selling those copycat drugs and were fined, it will surely take time.

And Hims is now snatching away the advantage that Novo was supposed to have over Eli Lilly—the fact that the pill hit the market months earlier. And now Hims comes in to scavenge and mess around in this scramble.

I find it hard to believe that it’s particularly legal and that Hims would win, but if they do, then well done USA, I guess.

Does Trump have his finger in the pie regarding Hims, or is this partly a case of “Greenland revenge” against a Danish company? I believe this perspective should be taken into account more broadly regarding Novo in the US market. Trump is completely ruthless and may seek to damage Denmark’s most important companies.

A quick browse through X suggests that Hims’ pill is snake oil

https://x.com/a_may_md/status/2019435502739329255?s=46&t=GTy5C411glEhjqehClhMpA

You probably meant me? ![]()

This guidance was indeed a disappointment in my books: I was expecting flat earnings development (± 5%), but we got guidance that was 10 percentage points lower. It’s hard to say if this is “pessimistic” guidance under a new CEO or not—time will tell as there’s no history to rely on.

The big fundamentals or my previous thoughts haven’t changed specifically, but all the numbers did come down a notch. And when you take such a clear step back for one year, the “time to print money” decreases significantly. I mean, until the patents expire, this company makes good money, and after that, there will be quite a lot of challenges in maintaining earnings at that current level. And this lost year is reflected in the company’s valuation, quite deservedly so. The market prices such a year of clearly negative growth quite ruthlessly with an “extrapolation” attitude, compared to my “base scenario” where earnings would have remained flat.

Another absolute negative factor I’ve underestimated is Trump. 3-6 months ago, I didn’t believe he was as unhinged as he actually is now. Unfortunately, there is a fear factor involved that should (and does) reflect in Novo’s price.

I don’t believe HIMS’s messing around will have a major impact even on this year’s figures—HIMS’s oral (p.o.) semaglutide isn’t going to work, and I doubt anyone will want to buy it after the first 1-2 months, even if they’re allowed to sell it, once it’s discovered that it doesn’t work.

Eli Lilly is at absolutely insane prices, and it’s otherwise a good place to burn money if you have extra in your pocket!

Novo issued a statement regarding the Hims & Hers situation. Quite strong wording. Hopefully they achieve something.

How long do these types of lawsuits typically take?

No idea. But they also mentioned regulatory actions, so you’d think that if they get the FDA on their side, the measures could be quick. Then again, if not, going through all levels of court would likely take years and could end up with Hims not being able to afford to pay..

A hell of a long time. That’s why I sold mine today at a massive loss. An American law professor once said that they definitely have the best 17th-century legal system.

How long do these types of lawsuits usually take?

In my opinion, 1–3 months is a realistic timeframe to see the first significant court reaction (e.g., a preliminary injunction on sales/marketing, if Novo seeks one). In theory, a decision could come sooner, but in practice, these are rarely resolved “immediately.”

A final ruling (or a settlement equivalent to one) typically operates on a completely different timeline: easily 12–24 months, sometimes even longer.

This news certainly came at an extremely bad time, as it effectively erodes the lead Novo’s Wegovy pill had over Eli Lilly—at least in the eyes of investors—and increases uncertainty regarding the sustainability of pricing and demand.

My investment thesis here has clearly weakened, and I am seriously considering dumping my shares as early as tomorrow.

That’s some dirty play. Somehow, I still believe that Novo has every chance of succeeding in this. Novo is much larger than Hims & Hers. Novo’s market cap is approximately 190 billion dollars, while Hims & Hers’ market cap is about 5.55 billion euros.

That size difference alone speaks in Novo’s favor. Money certainly has power.

Mike Doustlar is Novo’s first non-Danish CEO. He is Austrian-Iranian. He has a degree from Harvard Business School in pharmacology and biotechnology. This will likely be an advantage in this situation.

I can share some insights into these patent matters from my perspective. There are many loopholes regarding what patents are applied for; it really comes down to the specific wording. It might only be a manufacturing method, as patents aren’t granted for everything. Semaglutide itself is not necessarily entitled to a patent.

A patent held by the company I represent was also challenged a while ago. The challenging company is significantly larger and is trying to use “war of attrition” tactics to have the patent overturned or circumvented. By disputing the patent, you enter a gray area regarding where a competing product can or cannot be sold. These are not straightforward processes when they go through the legal system.

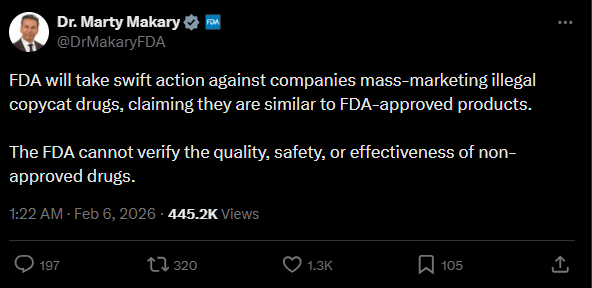

I don’t know how “legit” this official’s alleged X post is, but Hims tumbled further in the after-market.

https://x.com/DrMakaryFDA/status/2019552255310020616

Novo +1.4% in the after-market. The tickets to this circus were expensive through Novo, but since they’re bought, I’ll have to keep on wondering.