Nike is an American manufacturer of athletic footwear and apparel, headquartered in Oregon. The company is the world’s largest supplier of athletic footwear and apparel and a major manufacturer of sports equipment. Nike was founded in 1964 as “Blue Ribbon Sports” by Bill Bowerman and Phil Knight, and was officially named Nike on May 30, 1971, after the Greek goddess of victory.

Initially, Nike operated as a distributor for Japanese Onitsuka Tiger shoes, but later began manufacturing its own products. Bowerman’s ingenuity led to the creation of the “Moon Shoe” in 1972, and since then, the company has grown tremendously. Nike is especially known for its “Just Do It” slogan and its Swoosh logo.

Nike went public in 1980 and expanded internationally. The company has acquired several brands, such as Converse and Hurley, but has also sold some of its holdings to focus on its core business. Today, Nike is one of the world’s most valuable sports brands, employing over 76,000 people worldwide.

More from an investor’s perspective

In 2023, Nike achieved a record revenue of 51.2 billion, which was 10% more than the previous year. Nike Direct sales grew by 14%, accounting for approximately 44% of the brand’s total sales. Gross margin declined due to higher production costs, discounts, and unfavorable currency exchange rates for the company. The company returned $7.5 billion to shareholders in share repurchases and dividends. Return on Invested Capital (ROIC) was 31.5%, compared to 46.5% in the previous year. Nike faced supply chain challenges, but despite these, consumer demand remained strong.

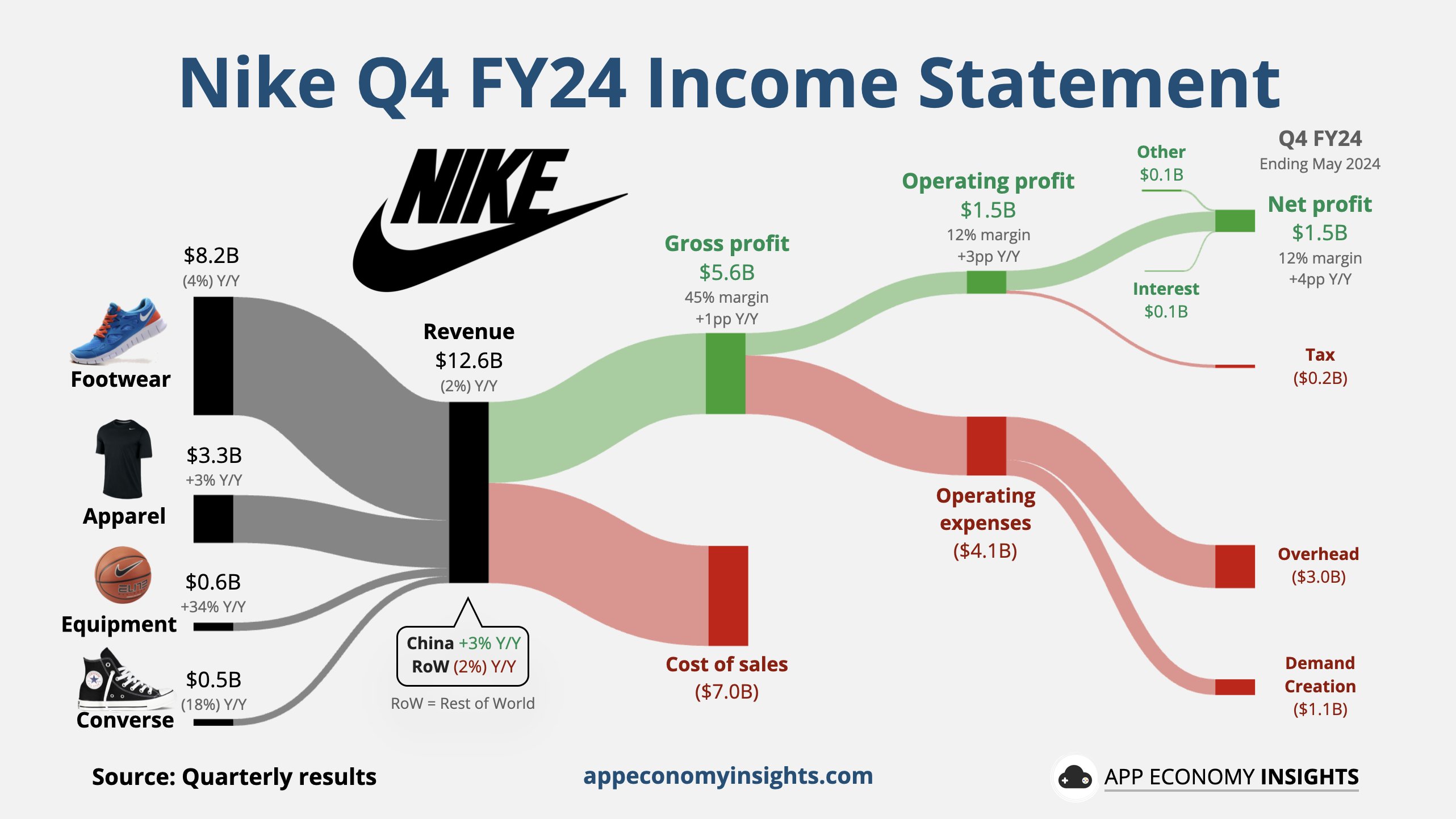

In 2023, Nike’s sales were distributed regionally as follows: North America (42.2%), Europe, Middle East & Africa (26.2%), Greater China (14.2%), Asia Pacific & Latin America (12.6%). By product category: footwear (64.7%), apparel (27%), Converse (4.7%), equipment (3.4%).

So, how did Nike do recently?

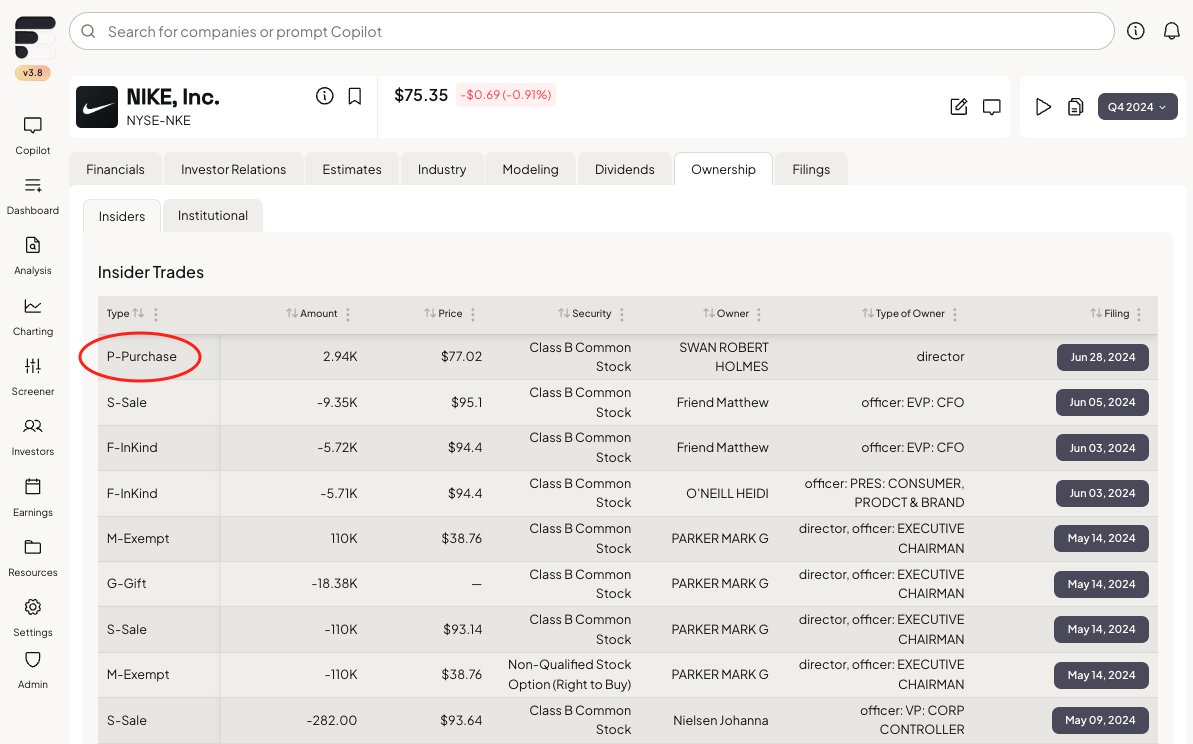

https://x.com/EconomyApp/status/1806461761970897156

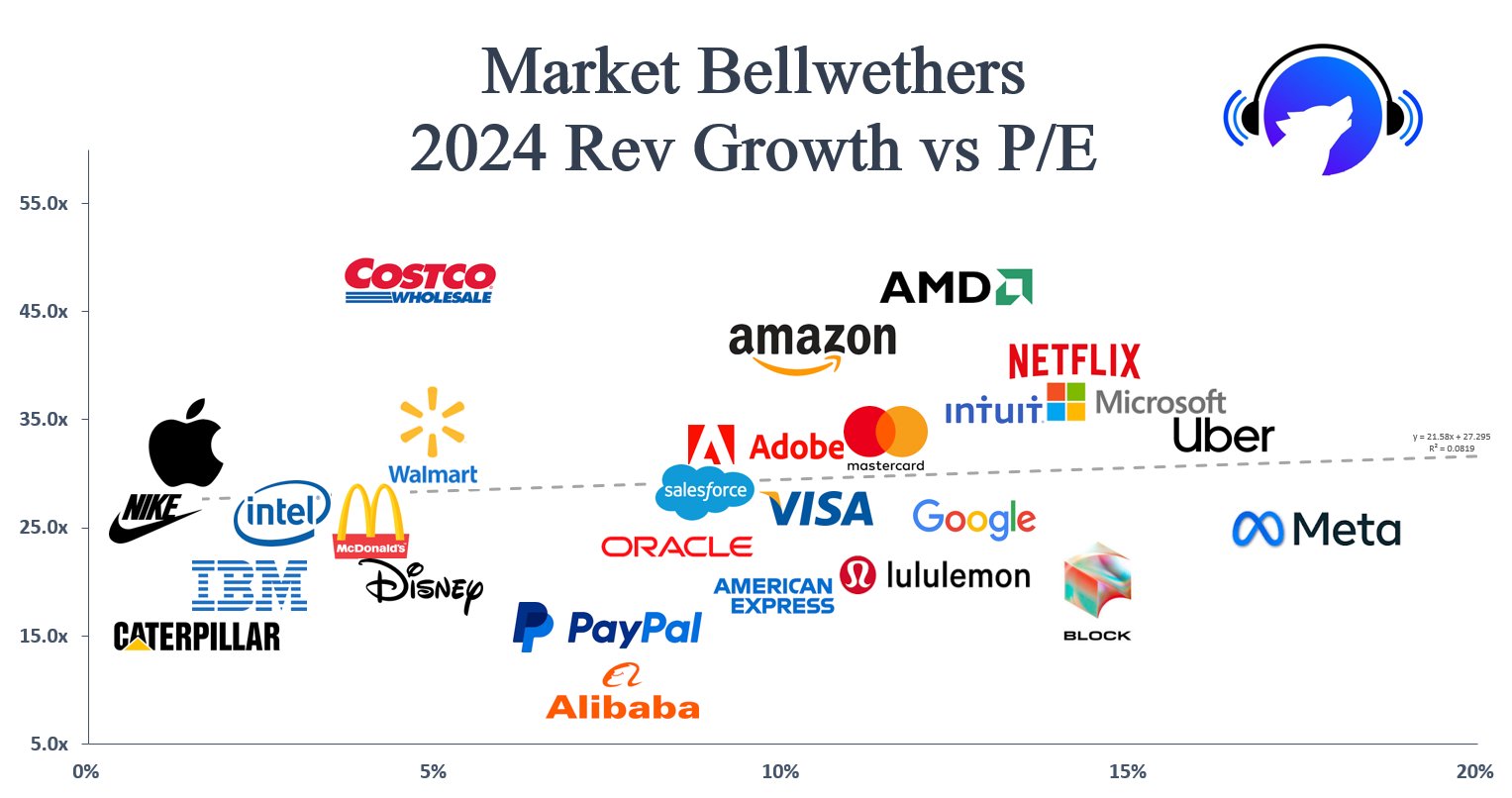

It is predicted that the company’s revenue will decline in fiscal year 2025. This raises investor concerns about Nike’s ability to stop losing market share to new competitors such as On and Hoka. According to analysts, Nike must keep up with developments through product innovations, among other things. The company has initiated cost-saving measures and new product launches, but competitors’ market share has grown significantly. Nike’s market share in the United States has declined, which may indicate that the company is in real trouble.

On the other hand, we are in the fashion industry, so the direction can change quickly… and surely Nike has the potential to innovate its way to the top and grow effectively.