That was good news from Nano regarding the cGMP license for the European market and a bit elsewhere too, even though the market didn’t quite take to it. It was a big step forward. Furthermore, with the ambitious goal of cash burn under €

[quote=“Yamarin, post:707, topic:5229”]if money starts flowing from the US markets from August 2027

[/quote]

I myself might not expect much sales for nanoezalutamide for 2027 yet; its sales will likely start a bit slower, but a larger portion of milestone payments could be expected to fall in 2027. That change in cash burn for 2026 will likely consist of both decreased quality control costs (now done in-house) and milestone payments scheduled for next year. However, if the CEO has stated in a securities interview that the goal is now cash flow positivity in 2027, then significantly more milestone payments should be scheduled for that year than for 2026.

Proprius Partners, founded by Heikkilä and partners, owns the medical technology company Nanoform among

One would imagine that the launch of sales is significantly affected by who one partners with in the market.

“For Enzalutamide, the partners are not Astellas and Pfizer, but generic drug manufacturers Bluepharma, Helm, and Welding.

”They pay 75 percent of the costs and receive 75 percent of the profits. We pay 25 percent of the costs and receive 25 percent of the profits. In addition, we are paid for the work we do,” Albert says.

Generic drug manufacturers can start selling the nanoformed version when Astellas’ and Pfizer’s patent expires. According to the brothers, the original drug developer is always given the first opportunity to market the drug.”

I have a strong hunch that if one were to jump on the Nanoform bandwagon at these prices, the annualized return in 10 years would certainly be in good shape. Of course, this brings us to why these listings tend to fizzle out a bit. When companies list on the small-cap market, it’s almost always because they need money, so it shouldn’t come as a surprise to anyone that it’s needed for their needs because they aren’t making money yet. That’s why it’s extremely essential in these companies to monitor what the goals, opportunities, potential are, and above all, how progress is made towards them. Nanoform has fallen behind schedule but has been progressing constantly. I strongly believe it will soon take off ![]() , because people always wake up to these late. All it takes is one really good piece of news and we’ll soon be at 2€. Since money is probably no longer needed from the markets and the stock price is really low, it’s a truly opportune situation.

, because people always wake up to these late. All it takes is one really good piece of news and we’ll soon be at 2€. Since money is probably no longer needed from the markets and the stock price is really low, it’s a truly opportune situation.

My investing hobby took a bit of a backseat because I burned out and went personally bankrupt (for reasons unrelated to the stock market, damn it; my portfolio would now be 500k€ instead of 100k€, but it’s empty, so the strategy has shifted to be even more return-seeking). This, in my opinion, is the clearest next multi-multibagger in Helsinki. Time will tell, but all my little funds are now tied up in this. Hopefully, I can get back on my feet with Nanoform’s help.

(Edit: if anyone wonders about the difference between these numbers and those in the return% thread: the previous update to the forum was when the first 100k in the portfolio was reached, and then another amount came as profit from my apartment, which I had to sell, and these funds were lost. If they hadn’t been lost, I would have more than doubled this money, which is how I get to the 500k figure. I have calculated this because I was twisting the knife in the wound when I had to learn to let go of money.)

“As I understand it, the company has unique expertise in its field. Cash reserves are easily sufficient for at least next year. The hope is for an acquisition or some significant cooperation arrangement for 2026.”

I myself do not wish for that acquisition. I would rather see the company’s technology break through and displace others. Good companies should not be allowed to leave Finland.

Jesus Christ, what kind of strange urge is it to sell off these most promising companies at a bargain price? Just when we’re about to climb out of the valley of death. Nanoform’s market value right now is about the same as the money raised in the 2020 IPO, and in my opinion, the path to becoming cash flow positive within the next two years is very realistic.

There’s a good reason why Halozyme invested $900M in acquiring Elektrofi. These nanoformulated suspensions pose an existential risk to Halozyme’s Enhanze, and Enhanze brings in quite a lot of money for Halozyme. Enhanze is based on recombinant hyaluronidase added to the drug formulation. Producing recombinant enzymes is expensive, and if another formulation practically guarantees similar properties without that enzyme, why would drug manufacturers choose the more expensive or complex option?

Anyway, the ownership of Proprius Partners reminded me of this Heikkilä & Vilén episode from the early days of the corona bubble. Nanoform is mentioned somewhere around 20 minutes in. It didn’t become a tenbagger in the first five years, but now we get to start a bit lower for the next five-year period ![]()

Excuse my rant ![]()

Owner lists updated today. No major changes in the top 25. The biggest sellers are the same two rascals as last month:

HANDELSBANKEN FUNDS -153k pcs

DANSKE INVEST -196k pcs

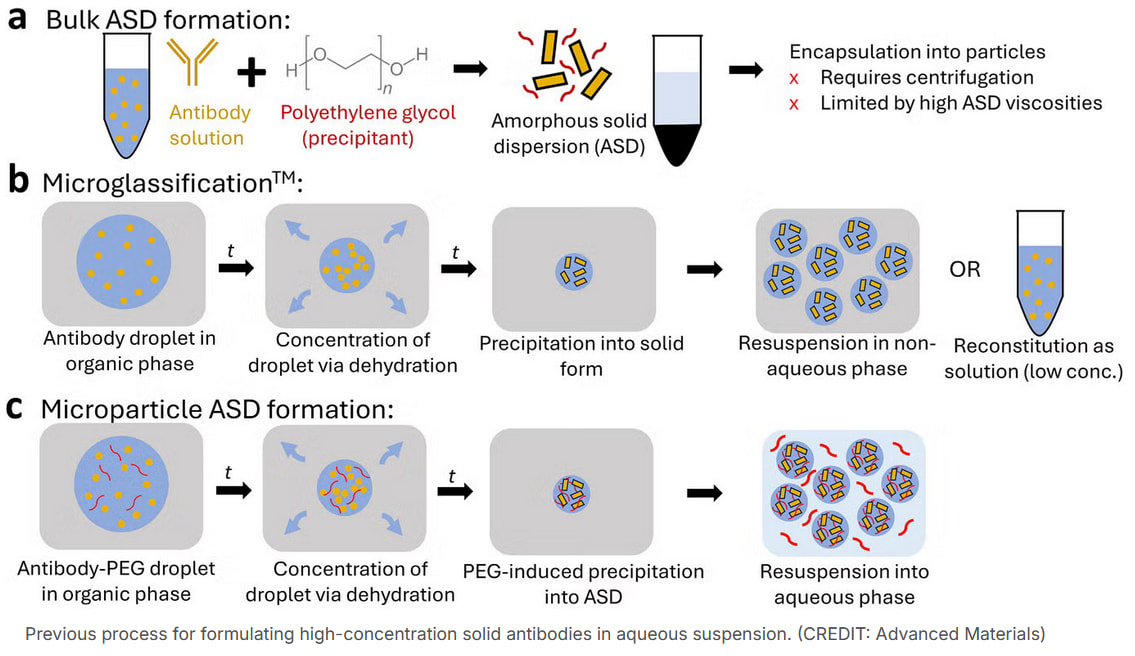

I came across this news regarding subcutaneous antibody injections: https://www.thebrighterside.news/post/antibody-injections-could-replace-slow-iv-drips-in-treating-many-diseases-mit-scientists-find/. That is an abridged version of a published research article. In it, researchers have precipitated antibodies with polyethylene glycol (PEG) and managed to suspend the antibody particles in water at a high PEG concentration. This PEG concentration dilutes after injection, allowing the antibodies to dissolve.

Nanoform’s method is probably closer to that microglassification method in the image. Nanoform’s tested non-aqueous solvents have been mentioned previously in this slide. However, this news had a good point regarding potential problems associated with non-aqueous solvents.

\u003e"Some groups experimented with non-water solvents to achieve even higher loads. Those mixtures carried more drug, but they came with strong drawbacks that included pain at the injection site and added toxicity concerns. The ideal solution for patients and caregivers is a formulation that stays fully aqueous, holds a high dose and feels similar to common injectable medicines."

So, this might also need further adjustment during early-phase pre-/clinical trials if there are any tolerability issues related to the injectable solvent.

What expectations and thoughts does Tuesday’s CMD evoke here?

“During the event, Nanoform’s management will present Nanoform’s key priorities for the next strategy period, as well as new business and financial targets.”

Hopefully something else than the growth in the number of new projects signed. It would be nice to get some actual numbers already. That cash burn of less than 10 million for next year was a good start, but it wasn’t enough for the market yet. More substance is needed.

Edit. It would be interesting to know about the utilization of the new production line and its potential in the near future.

I’m interested in what the company’s goal is for increasing capacity. I went through the 2024 financial statements and noticed a couple of points from the risk assessments:

-

If the Company is unable to significantly increase its production capacity and sales operations, it will not be able to nanoformulate the expected number of drug substances.

-

The Company currently has limited presence in the US market, and failure to expand its presence in the US could prevent the Company from achieving its business objectives.

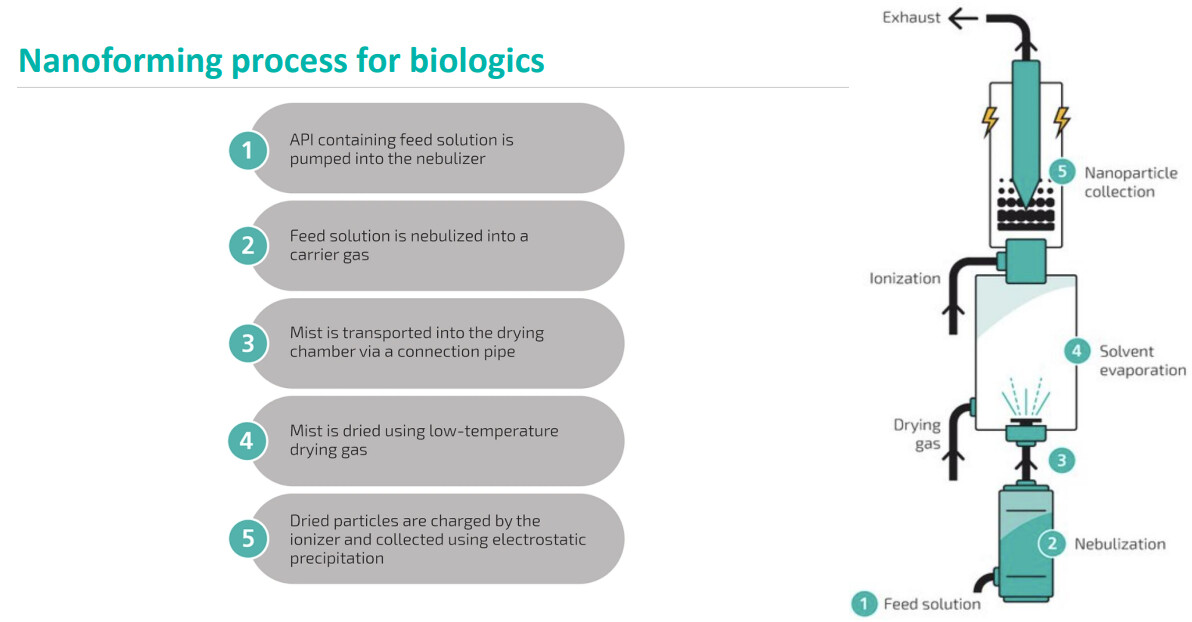

Related to these, are there plans to set up more biologics lines and on what schedule? In the comments of the previous earnings report, it was mentioned that the demand for nanoformulation projects of biological compounds is currently growing rapidly. Takeda’s projects probably help bring attention to this. However, if I recall correctly, there is only 1 biologics line. Also related to point 2, does the company intend to open production lines in the US or Asia?

Onko Nanoform-porukka seurannut LIDDSin tarinaa länsinaapurissa?

Firmalla oli useita tutkimuksia ja kumppanuuksia mutta lopulta mikään ei kantanut hedelmää.

Näiden drug delivery teknologioiden vertailu itsessään on lähes mahdotonta, koska IP on tietysti liikesalaisuus. Siksi Nanoforminkin kohdalla odotan, että saadaan ensimmäisiä kunnon kliinisiä tuloksia jotka osoittavat robusteja hyötyjä nanoformuloinnista.

Drug delivery puolella betsini on Xspray, hyvin ei senkään kanssa tosin ole käynyt.

Summary

LIDDS’ business model is to utilize LIDDS’ patented drug delivery technology to create more efficacious and safer treatments that result in greater value for patients, the company and its stakeholders. With a unique and well-positioned drug delivery technology and a strong pipeline, the attractiveness of LIDDS towards global partners with commercialization capacity will increase. The objective is to out-license the internally developed programs no later than Proof-of-Concept (PoC) in humans. Furthermore, LIDDS intends through solid scientific data and success to become a preferred drug delivery partner for global pharmaceutical companies interested in in-licensing the NanoZolid technology for their internal development programs. The business value for LIDDS will be through R&D milestone payments and royalties on commercial products. There is also an opportunity to extend IP life for out-of-patent drugs through reformulation with the NanoZolid technology.

However, entirely valid criticism. In my opinion, Xspary’s technology seems to be closer to Nanoform’s. Xspary’s technology apparently produces precisely those ASD particles to which Nanoform now compares its own nanoformulated compounds. I don’t know if Xspary’s technology is specific to protein kinase inhibitors, and therefore more focused on them.

LIDDS, on the other hand, seems to have a somewhat more niche technology regarding drugs administered directly to tumors. Nanoform also has similar projects, e.g., with TargTex and Revio (drugs administered for glioblastoma), but at least the success probability of that first candidate is likely quite low, as it is apparently a new drug substance, and I, for one, would not consider it at this stage.

Anyway, Nanoform’s first drug candidates are already approved generic drug substances (e.g., enzalutamide), making their market entry seem reasonably probable. Still, it’s not guaranteed that they would reach projected sales volumes. However, this must be sold at a lower price than the original to capture market share.

In my opinion, there is very significant potential in the formulation of biological macromolecular compounds. Here, especially monoclonal antibodies would be the big target. It seems there’s a lot of push for subcutaneous formulation of these, and at least based on Halozyme, there’s commercial potential too. This Nanoform biosetup actually seems to be somewhat similar to Elektrofil’s, without knowing much about either.

Well, tomorrow is CMD, and after that, we’ll know a bit more about future plans.

3 Nanoformed medicines launched by 2030

Income* growth >50% CAGR** 2026-2030

EBIT margin >30% by 2030

Presentation attached,

100 pages of material, some of which is Greek to many of us.

Below, however, is more understandable information, about targets

I’ll have to look at it more closely when I have more time, but this part at the beginning caught my eye.

In the Non-GMP to GMP conversion, there’s quite a big change between the realized numbers of the previous period and the targets for the upcoming period. This creates a significant bottleneck for all other operations, because those GMP projects are the only ones from which any significant sums of money can be obtained.

➢ Nanoform realized number 2020-25: ~5%

➢ Nanoform target for 2030: 20-25%

Why is that figure for the 2020-2025 period so poor, and by what actions is it expected to improve so much? This is probably partly due to the poor funding situation for biotechs during this period, but is it also possible for Nanoform to be more selective with development projects in the future and cut out the weakest projects already at an early stage?

“Nanoform from the First North list. They had their CMD on Dec 16, 2025, and their 10th-anniversary celebrations during the same week. I attended the former. I was impressed during the factory tour in Viikki; these guys know what they are doing and they have something globally unique on their hands.

At the helm of the company, Blues Brothers style, are the Hæggström brothers. One is the founder-CEO and the other is the CFO. And even the regular employees are international pros. Can you see the light?

The IPO price about five years ago was €3.45 per share. Now the stock has been hovering around the one-euro mark, even though the company’s performance is on a completely different level than it was during the listing. They acted smartly in the IPO by raising so much capital that they still have cash left, and as I understand it, they won’t need to turn to the shareholders’ wallets next year either.

A large portion of the owners are from abroad. Patient Nordic institutions that understand the logic of the drug development industry.

This could break through properly as early as next year or slightly later. But I’m jumping on the nano-wagon now while the price is around one euro.

From my previous ”Stock of the Year” picks, SSH and Bittium have proven to be excellent choices over a 3–5 year period from the time of selection. I believe there is no two without a third.”

Status update on the trend line above. Now things are getting interesting ![]()

This post can be moved if it doesn’t fit this thread.