McDonald’s - The World’s Largest Fast Food Chain

McDonald’s is an American fast-food chain founded by Richard and Maurice McDonald in 1940 in California. It started as a hamburger restaurant but quickly expanded into a franchise network. The Golden Arches logo was introduced in 1953, and in 1955, Ray Kroc joined the company, eventually buying out the McDonald brothers in 1961.

Today, McDonald’s is the world’s largest fast-food chain, with over 40,000 restaurants in more than 100 countries. It serves over 69 million customers daily, with hamburgers and fries as its main items.

The company earns revenue from rents, royalties, and franchisees, as well as from the sales of its own restaurants.

McDonald’s is the world’s second-largest private employer, with 1.7 million employees.

Thoughts from an Investor’s Perspective

Many of the company’s strengths are familiar to most investors, as are its risk factors. ![]()

McDonald’s is the world’s largest fast-food chain, and its success is largely based on a strong, well-known brand and a very broad and strong global market presence.

The company’s opportunities and risks include economic fluctuations and how it manages to adapt to them. Many macroeconomic factors affect the company’s operations (which is not surprising), such as inflation and exchange rates, which impact consumer purchasing power. If McDonald’s operations and pricing go smoothly, it’s a winner, but these fluctuations can also become a problem if the company reacts incorrectly.

Consumer preferences and lifestyles are changing, but McDonald’s has adapted its menu to suit different cultures and responded to health and wellness trends by offering healthier options. The company has a strong position, but various larger trends could, in the long run, lead the company into a negative spiral.

Technological innovations, such as self-service kiosks and mobile applications, have improved the customer experience and streamlined operations. McDonald’s ability to adopt new technologies is a competitive advantage that others may not necessarily have.

McDonald’s ability to adapt to different environments and appropriately comply with regulations strengthens its position in the industry. Adopting technology is also a key factor in the company’s long-term success.

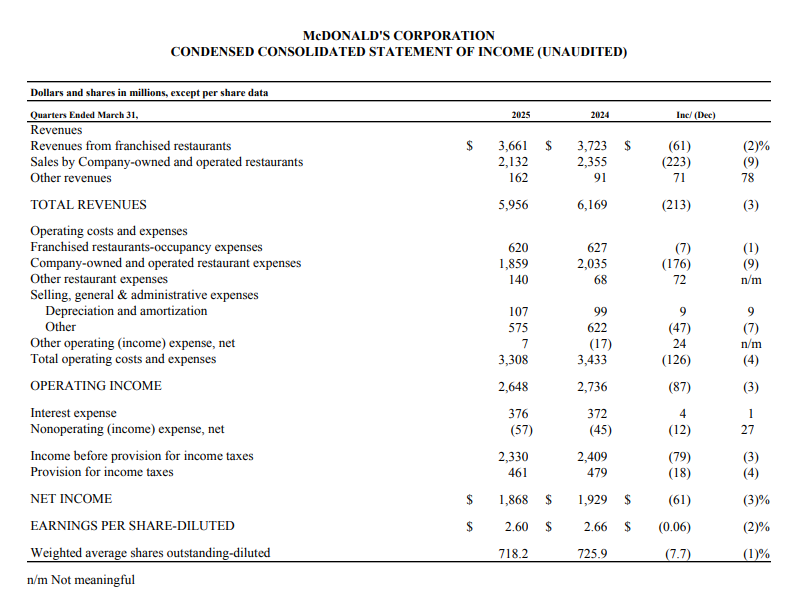

Currently, it appears that the company’s valuation multiples are moderate from an investor’s perspective… on the other hand, opposing comments have also been encountered. Dividends also interest many… ![]()

This fits well here:

https://x.com/DividendTalks/status/1814703718094544930

Then a few more figures

P/E Ratio: 21.08

P/S Ratio: 7.03