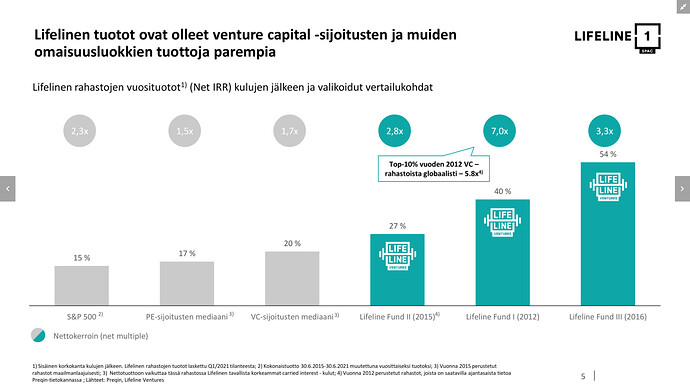

Following the VAC SPAC, the next one is heading to the exchange. Technology and growth focus, 70% subscription commitments already secured. Lifeline Ventures partners are behind the scenes, as you might guess from the SPAC’s name.

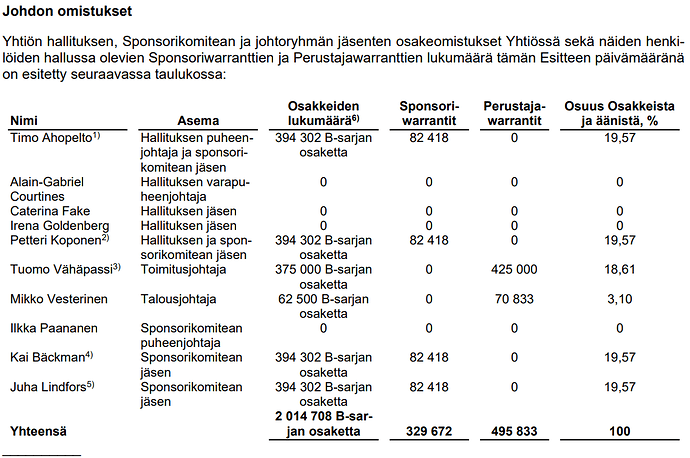

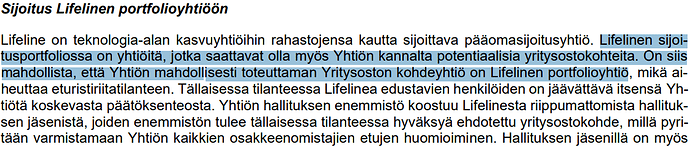

The company’s sponsors are the partners of the venture capital firm Lifeline Ventures,

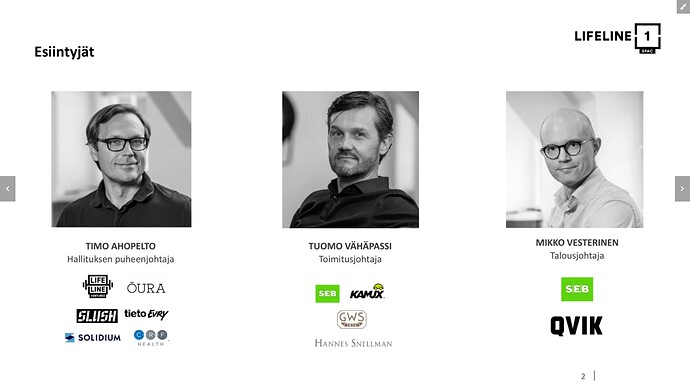

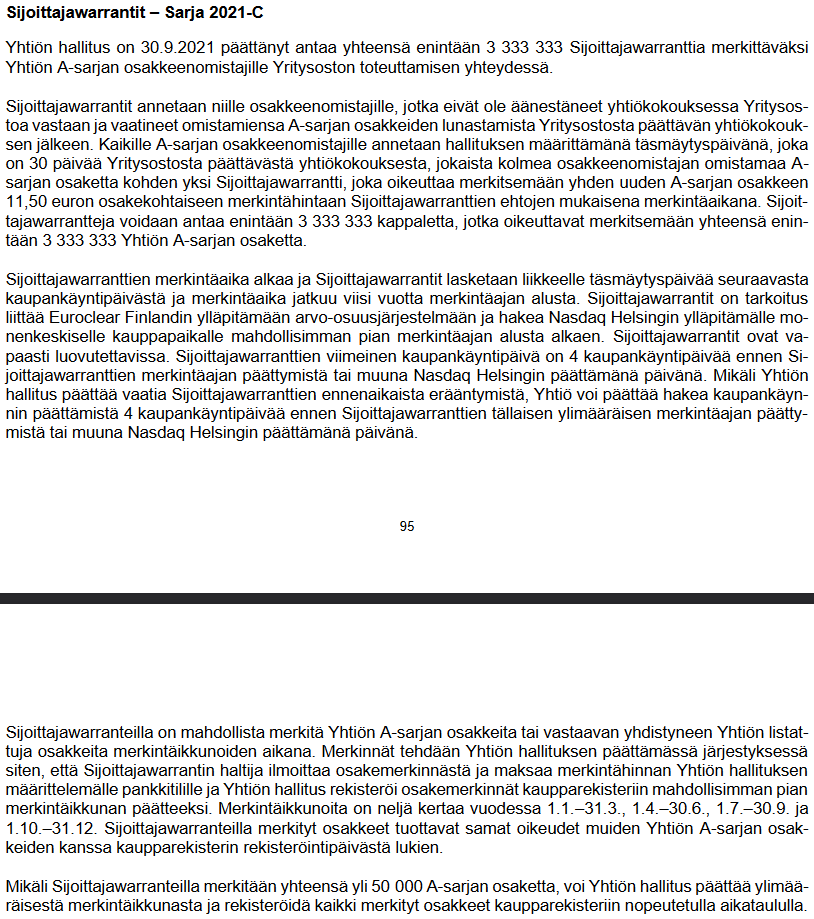

Lifeline SPAC I is a limited company founded in 2021, whose sole purpose is to raise capital through an Initial Public Offering, list on the SPAC segment of Nasdaq Helsinki’s regulated market, and merge with an unlisted company within a set timeframe of 24–36 months.

Ahlström Invest B.V., G.W. Sohlberg Ab, Varma Mutual Pension Insurance Company, Mandatum Asset Management Oy, certain funds managed by Sp-Fund Management Company Ltd, Rettig Group Oy Ab, Visio Asset Management Ltd, and certain assets managed by WIP Asset Management Ltd (together the “Anchor Investors”) have provided subscription commitments in the IPO, under which they have committed, under certain conditions, to subscribe for shares being offered for a total of EUR 68.9 million at the subscription price of the offered shares. The Anchor Investors’ subscription commitments correspond to 68.9 percent of the shares being offered, assuming the IPO is fully subscribed.

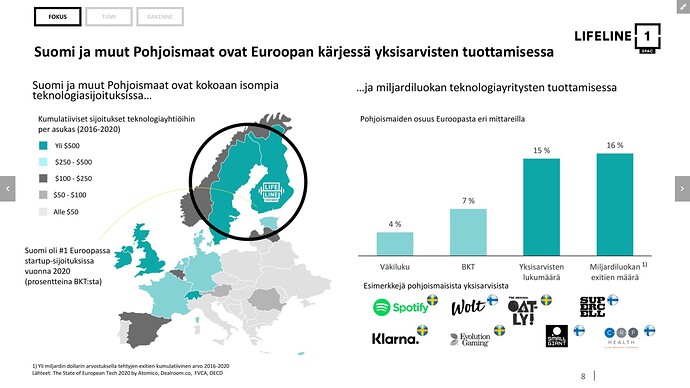

The company’s strategy is primarily to identify an unlisted company operating in the technology sector with high growth potential and merge with it. Target segments include, for example, enterprise software, health tech, climate tech, digital consumer products and services, as well as robotics and hardware. These technology segments are globally extensive and also have very strong growth prospects.

The company aims to select technology-oriented, late-growth stage companies with a proven business model and high growth ambitions as its target company candidates. Examples of such companies include those seeking to increase growth by developing their marketing or aiming for geographical expansion, product development expansion, or otherwise significantly scaling their operations. Growth-stage companies in line with the company’s investment strategy typically require further operational and other development work before they can be expected to generate profit for their investors, but as a counterbalance to the high risk, there is typically a possibility of achieving higher returns in the long term.

https://www.lifeline-spac1.com/fi/itf-tiedote/

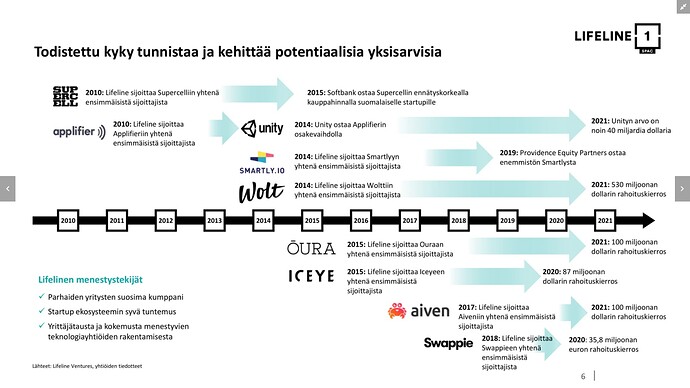

Lifeline Ventures—you can get an idea of where the people behind this SPAC have invested money from there: