Maybe a stupid question, but can this be bought for an OST (Equity Savings Account)? Or will there be some options/warrants etc. that you aren’t allowed to hold there? Sorry, I haven’t had time to look into it, so I’m asking directly here.

A Q&A session will be held in connection with the press conference, so you can ask the companies questions during the broadcast using the chat function! ![]()

I received this response when it was suspected that Lifeline SPAC is in an OST

https://keskustelut.inderes.fi/t/salkkujen-tuotto/1340/2539?u=vanerihands

Here it is being said otherwise about the Equity Savings Account (OST) and warrants, can someone confirm what the situation is regarding these?

I trust this Finnish SPAC, its backers, and the background work they’ve done significantly more than any US SPAC. I intended to sell the shares immediately upon the company’s announcement, but after initial research, I decided otherwise.

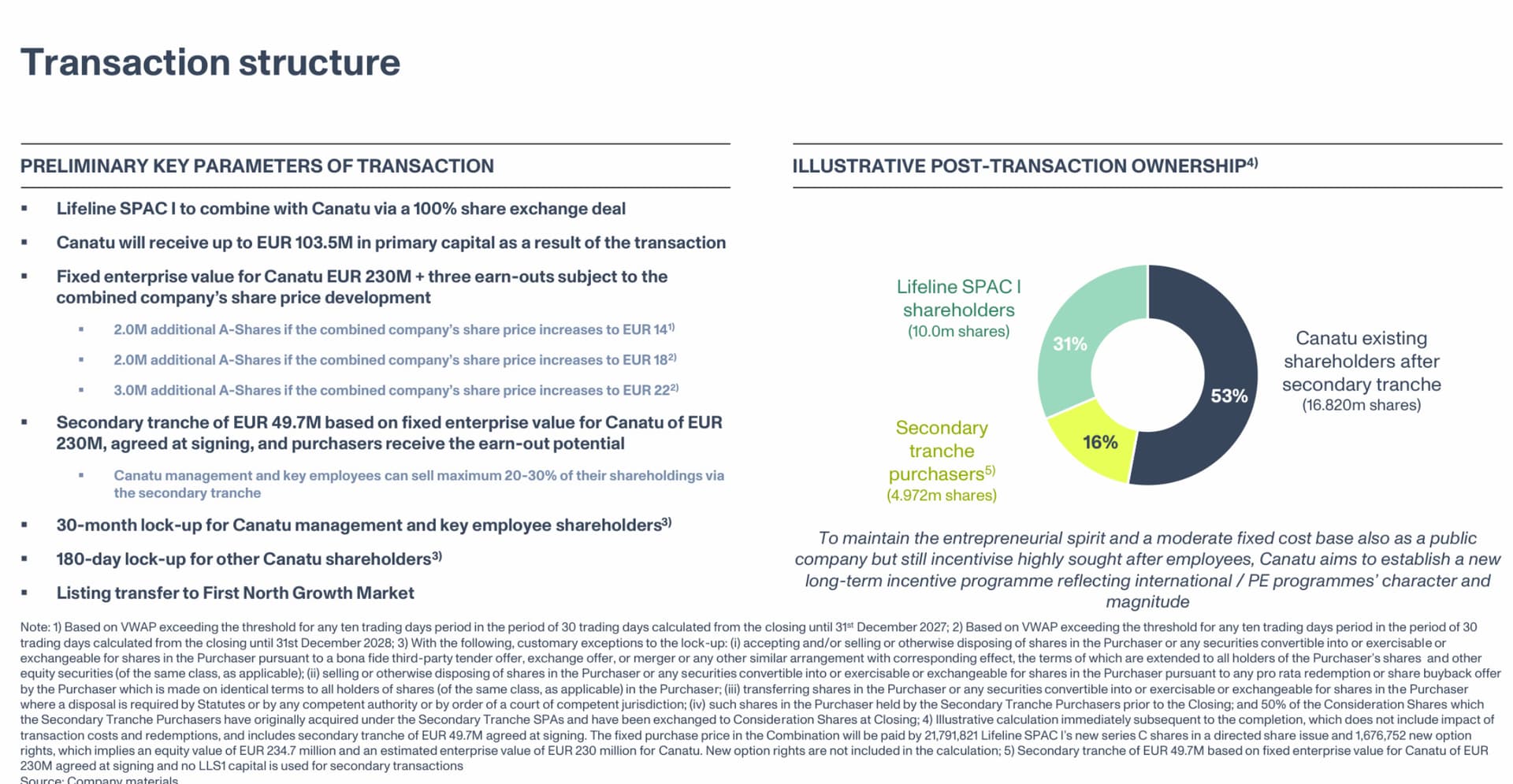

A few quick notes from the live presentation:

- Significant growth opportunities and at the crest of trends (semiconductors 80%, automotive 20%, and medical (research phase))

- The €10 price acts as a kind of downside protection until the merger

- 30-month lock-up for old owners, quite a decent commitment model for them

- TAM by 2030 is €2-4 billion

- Canatu has 188 patents and patent applications across 38 different patent families

- Possible MOAT: The development journey in the industry is very long, 15-18 years to productization, and Canatu is currently at a breakthrough stage

- Two Japanese competitors, Mitsui and Lintec NSTC. Market shares could not be specified

- Customers were not disclosed, but there were several big players in the presentation diagram

EDIT. The presentation definitely left a very confident feeling, and nothing indicates that growth would stop here.

The goal of the backers was to secure a win-win deal, and based on the initial view, they have succeeded at least very well.

Generally, there are many opinions on compensation models tied to share prices, but I believe this deal wouldn’t have happened at all without it, so I think the assumed compromise is quite reasonable. And if the share price rises, it’s obviously still a win-win for everyone.

The CEO’s presentation left me with a good feeling. There are several good growth prospects and the potential for growth leaps as well. This looks like it’s becoming my largest holding. I’ll trim the position a bit once we’re on the better side of 20.

I asked Nordnet about the matter and received the following response, so no worries

”Hi!

Lifeline Spac shares can be bought and held in an equity savings account normally.

Any warrants that may potentially detach from the share will also be recorded in the equity savings account normally.

According to the legislation for equity savings accounts, only direct shares may be held in the account. In practice, this means Nordnet has a statutory obligation to inform you that holding warrants in an equity savings account is not permitted, and you will receive a message regarding this.

You should as soon as possible either sell the warrants, if they are listed on the exchange, or exercise them into new shares.

At least for now, the company has not yet provided further information regarding the possible stock exchange listing of the warrants or the exercise terms, such as the timeframe.”

Thanks for the info! If warrants are issued, then the timing of the exercise doesn’t really matter as such if you want to stay with Canatu for the long term? So no problem even if I exercised them right away? Am I understanding correctly? I’m mainly wondering so that a situation doesn’t arise where the warrants would have to be sold forcibly at an unfavorable time…

@Pohjolan_Eka wrote at the beginning

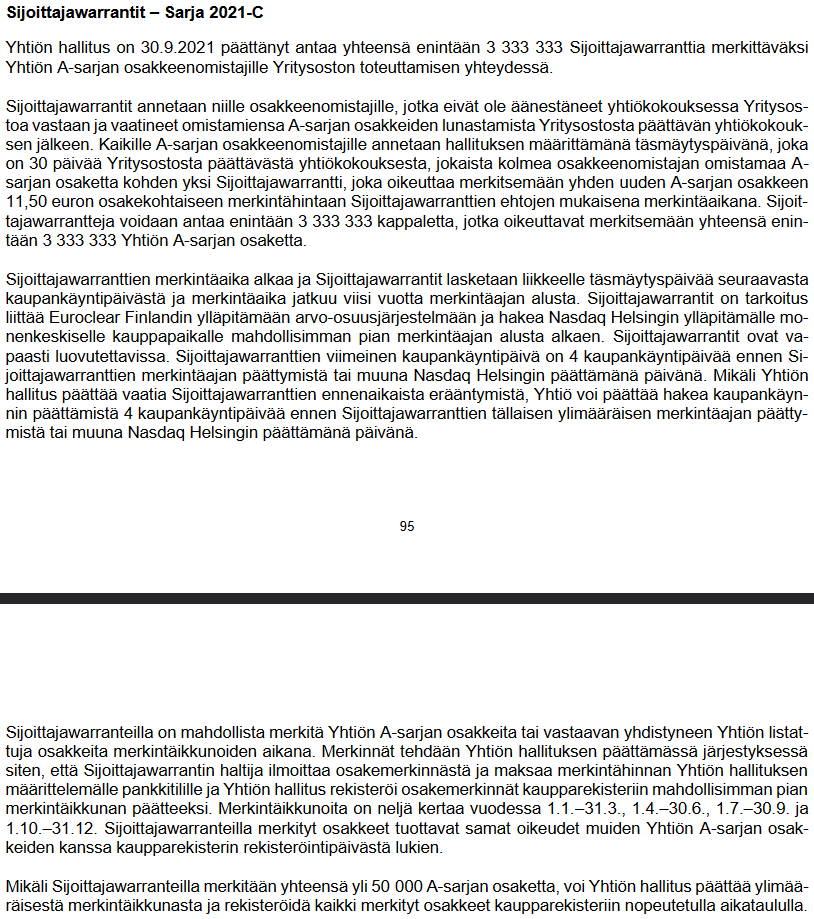

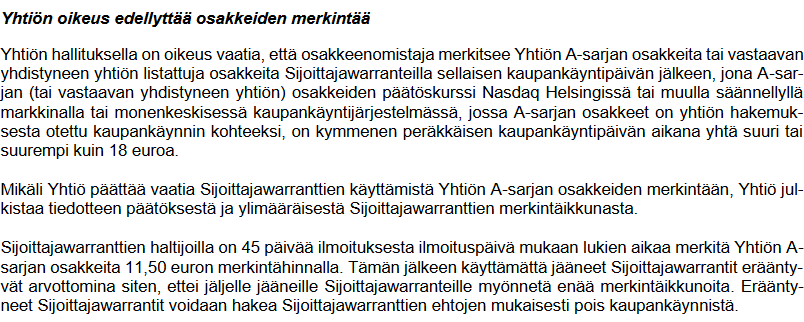

Yes, meaning the retail investor receives warrants if they vote in favor of the merger. A bit of a manipulative way to encourage voting as management wants, but it’s good that we aren’t left completely empty-handed as was the case with Virala. Warrants can be held for 5 years or until the €18 share price is exceeded for ten days:

Warrants can be held for 5 years in a book-entry account, but not in equity savings accounts (OST). There is also the 18 euro rule here.

Hi, I’ve had an investment “career” for years now, but this warrant case is completely foreign to me.

Tyhmiä kysymyksiä lisää, eli case: I just bought Lifeline for my Equity Savings Account (OST), because I think Canatu is an extremely interesting company yadda yadda.

So do I need to subscribe to something somewhere at some point, or can I just enjoy the ride now? ![]()

thanks ![]()

I don’t have any experience with them either, but I’ve understood that if you accept the Canatu deal, you will receive warrants. You get one warrant for every three shares. Since they will be deposited into an Equity Savings Account (OST), they cannot be held there, so they must either be sold or used to subscribe for new shares at a price of 11.50 euros.

So is it worth selling these now and buying them on the book-entry account side so there is no need to ‘‘fiddle’’`?

line SPAC I Oyj: arvopaperimarkkinalain 9 luvun 10 pykälän mukainen liputusilmoitus"

* “Oyj” → “Plc”

* “arvopaperimarkkinalaki” → “Securities Markets Act”

* “liputusilmoitus” → “flagging notification” or “notification of major shareholding”. “Flagging notification” is very common in Finnish-English financial translations (standard term used by Nasdaq Helsinki and FIN-F

Sounds really complicated.

@Pohjolan_Eka is writing something, let’s wait.. ![]()

edit. When I bought this, I assumed that the name would just change to Canatu once the deal is finalized, but now I’m completely lost again. Mainly regarding which account it’s worth buying this into.

You’re in good company, because this is the first SPAC in the stock exchange’s history that will issue warrants. A warrant is a security that gives the right, but not the obligation, to subscribe to new shares of the target company under predetermined conditions. So, it’s a bit like a kind of personal directed share issue.

In practice, for a sensible investor, the options are either to subscribe for shares during the warrant’s validity period or to sell the warrant to another investor on the exchange. Determining the value of a warrant and thus the correct selling price is a slightly more complex trick, which is influenced by, among other things, the warrant’s validity period and the stock’s price volatility, and since most investors don’t know how to calculate it, my strong gut feeling is that these will be sold on the exchange at an undervalued price from retail investors to professional players.

With the equity savings account (OST), the challenge, as @Vanerihands mentioned, is the law, because you are not allowed to keep these warrants there permanently; therefore, very soon after receiving them, they must either be sold or used to subscribe for additional shares. Generally, SPAC prices crash hard right after the merger, so it’s more likely that the OST will have to sell those warrants. Of course, you can simultaneously be on the buyer side with a book-entry account (AOT) if you want to keep the warrants. At least that’s how it works with Nordnet. If you use someone like OP or Nordea, I don’t know what kind of paperwork hell will follow ![]()

The easiest way, of course, is to buy those shares directly into a book-entry account (AOT).

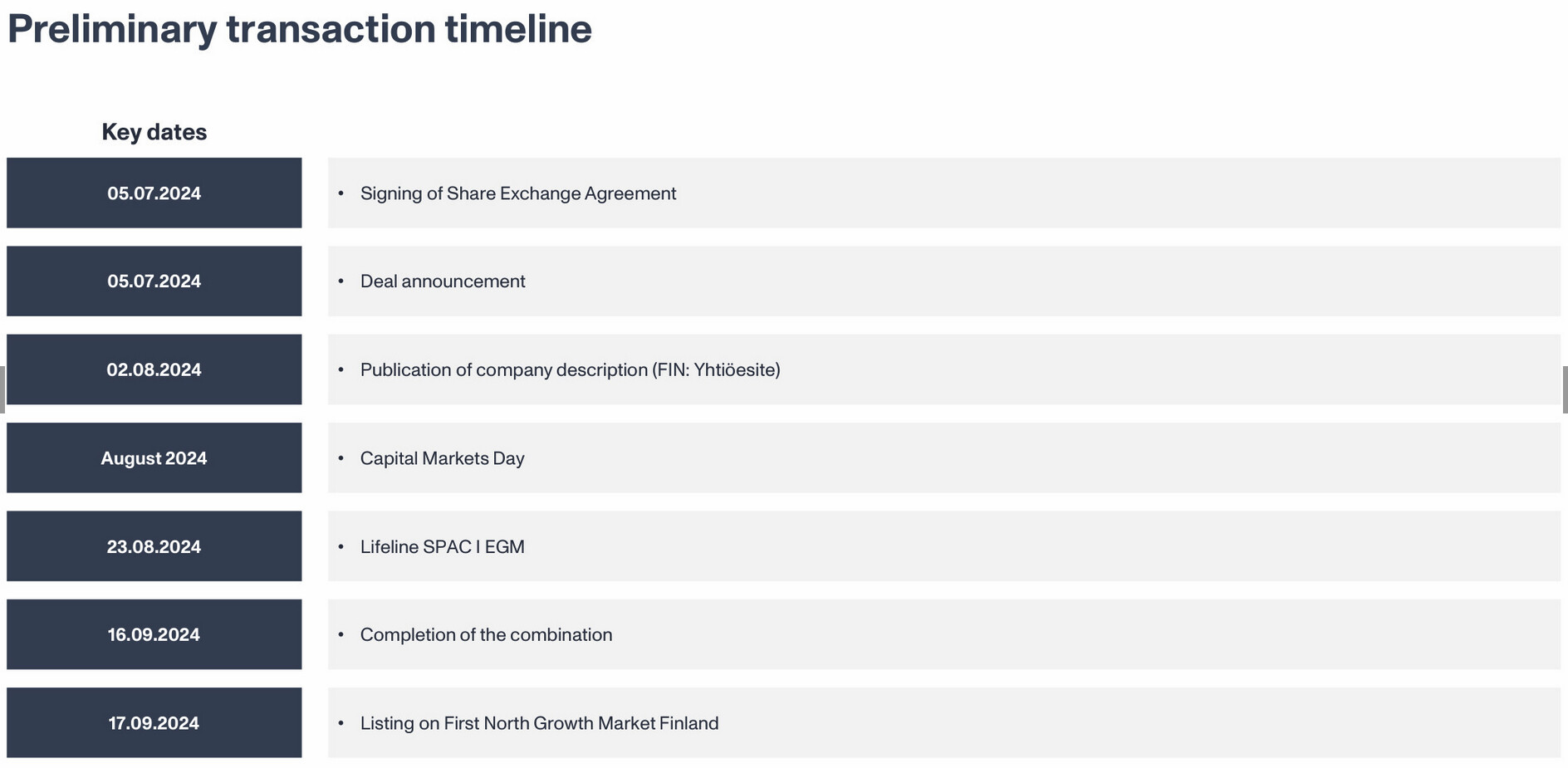

There’s no huge rush right now. The prospectus will only be released in a month, and the merger won’t happen until the autumn:

Is it worth owning the company only once it lists as Canuto in the autumn?

I already sold those from my equity savings account.. ![]() (what a mess)

(what a mess)

Or is it the same to just buy them now in a book-entry account?

I bought 1,000 shares of Lifeline today for a standard book-entry account. If I’ve understood correctly, I don’t need to do anything, and the Lifeline shares will automatically convert to Canatu in my portfolio this autumn? Correct me if I’m wrong.

Towards the end of next month, there will be a general meeting to vote on the approval of the merger.

If you wish, you can vote against the merger and demand your money (approx. €10/share) back to your account.

Otherwise, you will receive investor warrants:

Forum rules prohibit investment advice, so everyone must consider this decision for themselves ![]()

Here is a 30-minute interview in Finnish, recorded after the press conference:

After a long search, Lifeline SPAC I has found a suitable target and is merging with the deep tech company Canatu Oy. Lifeline SPAC I CEO Tuomo Vähäpassi, Lifeline SPAC I CFO Mikko Vesterinen, and Canatu CEO Juha Kokkonen comment on the news in the interview.

Topics:

00:00 Introduction

00:42 Sentiments after finding a target

01:41 Why Canatu?

08:00 Next steps regarding the transaction

09:15 Transaction structure and impact on Lifeline SPAC I shareholders

10:26 Lifeline SPAC I’s role in the future

12:25 Introduction of Canatu’s CEO and the Canatu team

15:10 What does Canatu do?

17:13 Competitive advantages of Canatu’s carbon nanotube technology

18:44 Market potential for Canatu in the semiconductor and automotive industries

21:59 Other relevant industries

25:28 Canatu’s strategy

26:30 Financial targets and how they will be achieved

27:48 How will the capital raised through the listing be used?

I’m only asking from a practical standpoint ![]()

Above, flatbeat already asked the essentials.