After a long time, I scanned through Lifeline Ventures’ own portfolio companies.

https://www.lifelineventures.com/companies/

Filtered for current companies (Current), a large part of the list has already been acquired or listed elsewhere. It’s probably not worth bringing those up here anymore.

A few picks where the valuation would be sufficient for listing via a SPAC - or at least there could be potential. I skipped the biotech companies; I don’t know how to assess their potential.

Figures from Finder

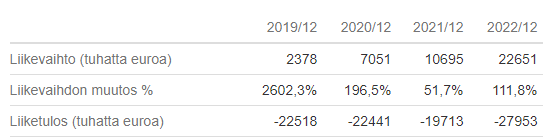

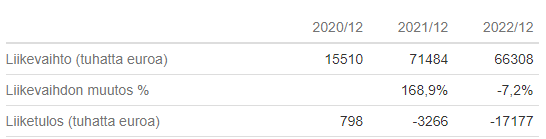

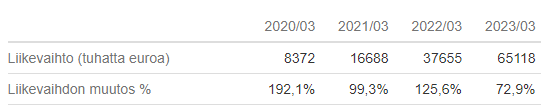

Aiven

Aiven provides fully managed cloud database and messaging services hosted in the cloud of the customer’s choice, including Amazon Web Services, Google Cloud Platform, and Microsoft Azure. Its mission is to allow developers to focus on building awesome applications without worrying about data infrastructure management

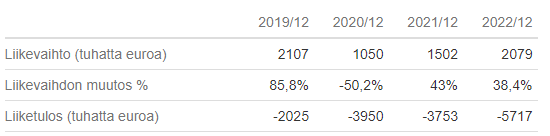

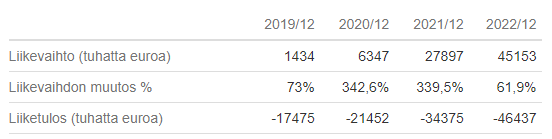

Ductor

Ductor’s groundbreaking technology prevents ammonia inhibition in biogas production. This is done by adding one fermentation step, prior to biogas fermentation, as well as a nitrogen stripping unit. Ductor’s patented microbiological innovation eliminates the nitrogen dilemma by turning problem waste into profitable recyclable goods.

Figures in Finder are only for the parent company; there is a lot of activity elsewhere in the world, and no information on group figures. An interesting green tech option that, for instance, sought funding through Springvest in 2019.

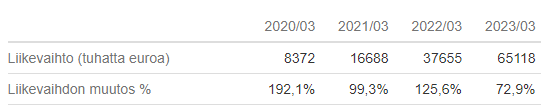

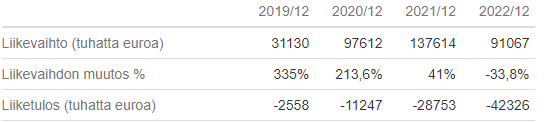

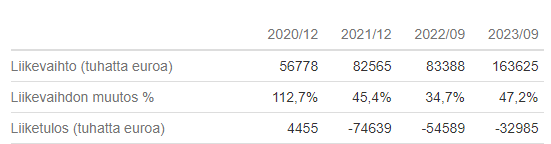

Iceye

Iceye empowers others to make better decisions in governmental and commercial industries by providing access to timely and reliable satellite imagery. Iceye is the first organization in the world to successfully launch synthetic-aperture radar (SAR) satellites with a launch mass under 100 kg.

Just raised funds from a funding round, e.g. Solidium heavily involved

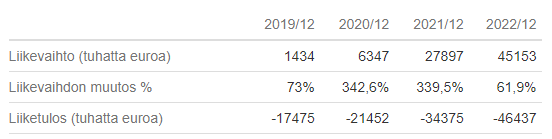

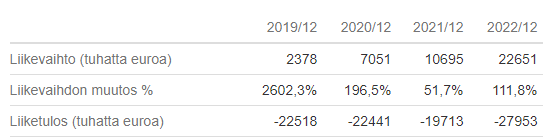

Oura Health

Oura is an award-winning wellness ring and app, designed to help people get more restful sleep and perform better. The independently validated science behind Oura and the design of the Oura ring make it the perfect companion for busy professionals, athletes and anyone who wants to get insights into their sleep, recovery and readiness to perform.

unlikely for the Helsinki stock exchange  Nasdaq is perhaps more likely as a target, but the size is valid nonetheless. It’s making a loss, so increasing capital to finance growth might be necessary

Nasdaq is perhaps more likely as a target, but the size is valid nonetheless. It’s making a loss, so increasing capital to finance growth might be necessary

P2X Solutions

As a developer of an emission-free welfare society P2X Solutions is a forerunner of the energy future – the company’s vision is to produce green hydrogen and refine it further into synthetic fuels in a cost-effective manner. P2X will construct a 20 MW electrolyzer plant, which runs on electricity produced by renewable energy and thus the final product will be green hydrogen. Part of the green hydrogen will be further refined utilizing Power-to-X technology.

Green hydrogen, production facility in progress. Swiss Alpiq just became the main owner. P2X continues as an independent company.

Virtually no revenue yet in the 2022 figures

Smartly.io automates every step of social advertising to unlock greater performance and creativity. Its advertising and creative automation platform makes online advertising easy, effective, and enjoyable. Smartly.io works closely with 650+ brands including eBay, Uber, TechStyle and Skyscanner, managing over $1 billion in annual ad spend.

Solar Foods

Solar Foods is a Finnish food tech company that creates innovations for producing food without agriculture. With its revolutionary biotech solution Solein, Solar Foods enables natural protein production anywhere by using air, water, and electricity. The unique bioprocess of Solein provides a new platform technology for nutritious food ingredients, plant-based meat alternatives or even cultured meat.

More on this from a couple of posts ago. A small round of additional funding was raised, which will last for half a year. More is needed if they intend to scale.

Sulapac

Sulapac® is a biodegradable and microplastic-free material made entirely from renewable sources and certified wood. It can be used as packaging for everything from cosmetics to foodstuff to gift boxes and more. It has all the benefits of plastic, yet it biodegrades completely and leaves no trace once it’s gone.

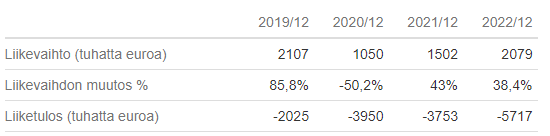

revenue is still small, scaling is needed for global expansion. There was a round through Springvest in 2023

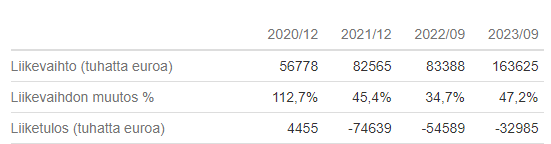

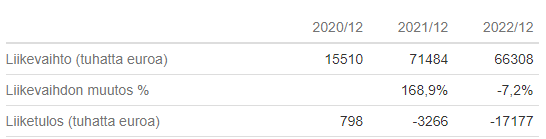

Swappie

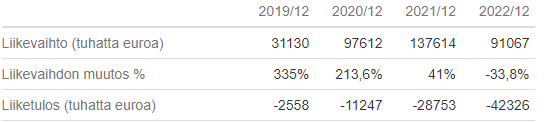

Swappie is changing the European market in consumer electronics by building the world-leading marketplace for refurbished devices. The company’s marketplace offers easy and safe buying and selling of used smartphones. Swappie buys phones from customers and companies, refurbishes them in-house and sells them in top condition and with a proper warranty.

Varjo

Varjo was founded by a team of industry professionals with decades of experience and a vision of seamlessly merging the virtual and real worlds. The Bionic Display™ in Varjo’s VR devices delivers an unprecedented human-eye resolution of 60 pixels per degree. It revolutionizes professional VR by bringing every detail, texture, contour and color into 20/20 focus.