Hey!

For your attention:

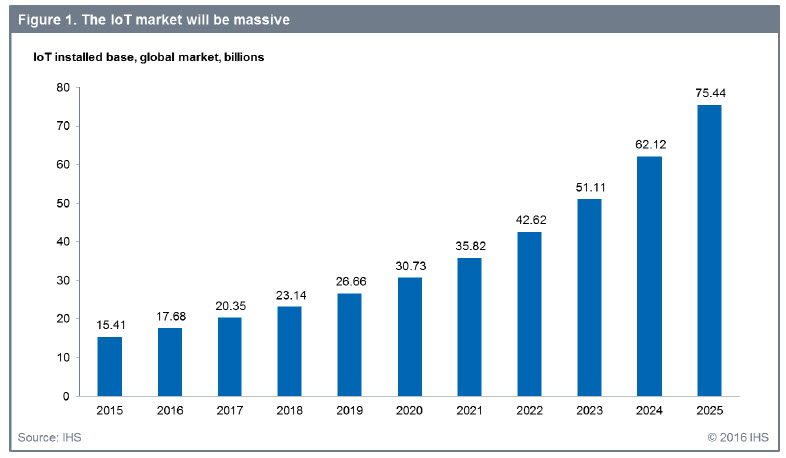

The cybersecurity sector is one of the fastest-growing industries in the world. The integration of various technologies, such as the Internet of Things, Big Data, and machine learning, is still undergoing disruption and growing rapidly, even though the hype around them has somewhat subsided. The growth curve of IoT devices is still vertical (see image below). My cybersecurity professor at university mentioned that IoT devices were manufactured for long periods without any security solutions, but now there’s an awakening to that as well.

Has the coronavirus had an impact on the sector?

Not really; almost all companies have been able to succeed with a 100% remote workforce.

Source for statistics

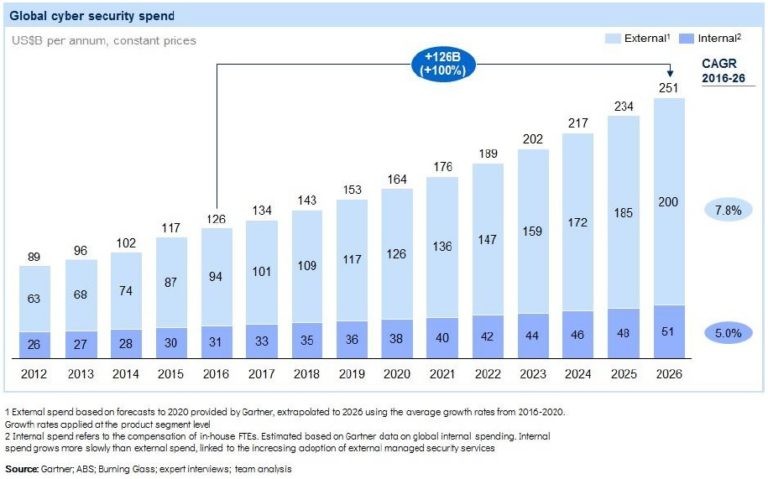

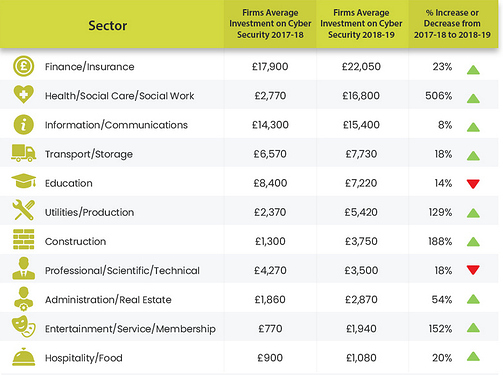

Companies’ investment in ‘cloud security’ is predicted to rise at an annual rate of 26.5% (Forbes article on the sector’s outlook). Also an interesting fact: Remote work has increased the risk of cyberattacks. In a Monster article, employment in the field is discussed – the answer is brutal:

Cybersecurity jobs are in high demand and it doesn’t seem like the need for more security professionals is going anywhere in the foreseeable future. Cyber attacks are only becoming more common and more harmful, and even though we tend to only hear about the attacks of high-profile entities, no company – or individual for that matter – with an online presence is immune to attacks.

Image of the sector’s growth rate (2019, Image source)

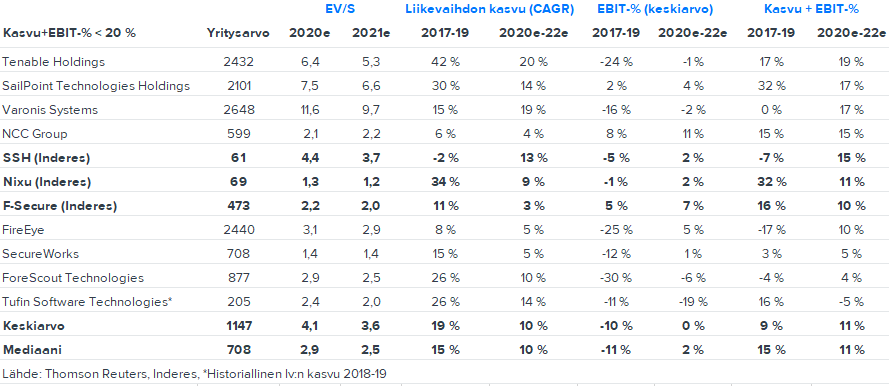

I was surprised how the forum has embraced many attractive hypes; there’s the hydrogen business, Nikolas and others - but nothing is said about cybersecurity. In Finland, Nixu, F-Secure, and SSH are pure cyber companies. However, they don’t even come close to the figures of their foreign counterparts, and for this reason, it’s worth looking at the situation from across the pond, for example. It was nice to notice that the InderesPod cybersecurity episode also dedicated some time to these foreign companies.

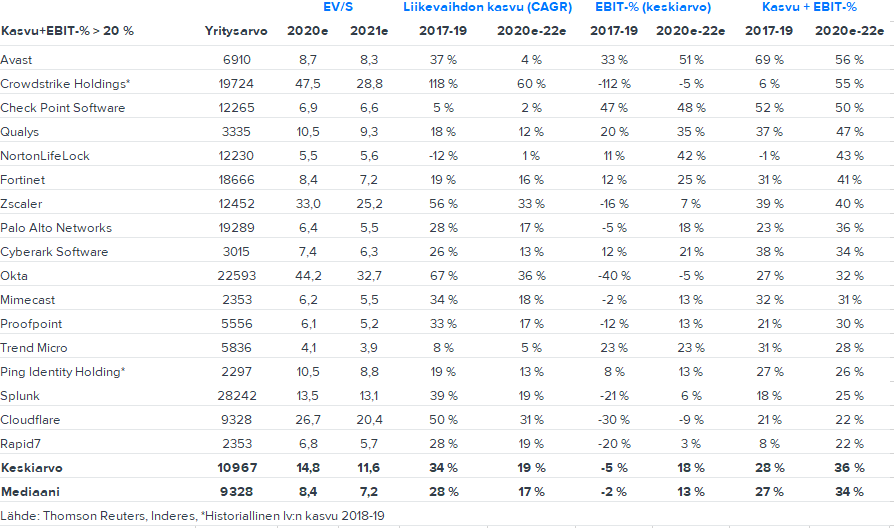

What companies can be found on NASDAQ or NYSE (+P/B)?

As stated, the cyber sector has been booming during the coronavirus pandemic. The entire sector, and especially market leaders, have been among the biggest winners as COVID-19 has ravaged the world. Those companies with sky-high P/B ratios are growing revenue by approximately +85% (and EPS by comfortable amounts) per year.

A few interesting companies:

- CrowdStrike Holdings (P/B 29.7)

- Zscaler (P/B 42.95)

- Okta (P/B 59.01)

It’s worth checking them out, even if those numbers are currently sky-high.

Then there are also more moderately growing companies, such as:

- SecureWorks (P/B 1.4)

- A small company, which Dell owns about 75%, if I remember correctly

Large and more stable companies without P/B ratios:

- Palo Alto Networks

- Fortinet

- CyberArk Software

- Splunk

Why do I invest in the cyber sector myself?

Here’s the answer: Companies’ results are really easy to predict due to the subscription-based business model (cf. Admicom). SaaS companies also generally have excellent profitability, and this also applies to these cyber companies. Currently, many companies are heavily investing in growth at the expense of profitability, but in the coming years, when growth investments ease, profitability will grow sharply.

My first post, I don’t know how it went. ![]() If you have any questions, I’ll be happy to answer them. I’ve been following the industry for about a year now, so I’m not a professional, though. If there are cyber professionals on the forum, welcome to discuss!

If you have any questions, I’ll be happy to answer them. I’ve been following the industry for about a year now, so I’m not a professional, though. If there are cyber professionals on the forum, welcome to discuss!

Finally, a very comprehensive package to read provided by Seeking Alpha:

https://seekingalpha.com/article/4288469-picking-winners-in-cyber-security-space