You shouldn’t be too cautious, though.. But to each their own!!![]()

![]()

![]()

Companies providing professional services in the real estate sector are also getting their share of the market’s AI fears:

Edit: …and of course also HR & payroll software and service companies (note: one-year development shown here)

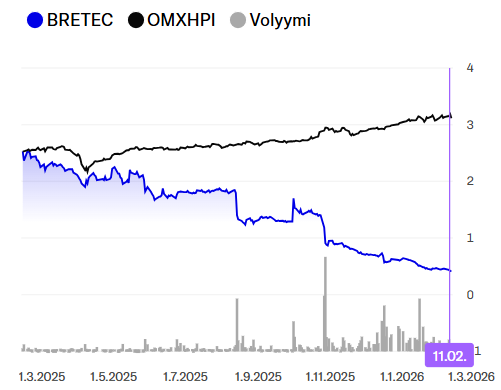

Bioretec, the infamous technical analysis pattern – the crocodile’s maw. Let’s see if the earnings report provides the “crocodile’s tooth” to complete the pattern, or if the whole jaw collapses for good.

Here are today’s earnings reporters after 90 minutes of trading.

Today looks a bit better than yesterday, with the exception of a couple of disasters. Strong results were delivered by, among others, HKFoods and Kalmar as well as Exel, and very promising ones by Boreo and Loihde, so there might finally be light at the end of the tunnel for beaten-down small caps. Dividend hype lifted Posti by nearly as much as its 10% dividend yield.

Mr. Market certainly has a trigger-happy sell finger with these Helsinki rascals. Relais was down by as much as -15% at one point today, but has risen over +10% from the lows.

Nordic steel giant SSAB exceeded February 2024 levels this week and briefly hit an ATH of 7.760 (Wednesday’s closing price 7.590).

Shares bought 1 year and 1 month ago showed a return of +107% (now +78%).

It has come down from the peak very quickly, about -14% in a couple of days. Does anyone have any insight into what is causing such swings?

AI? ![]() Ukraine? At least for the last couple of days, it has moved in a different direction than European defense companies.

Ukraine? At least for the last couple of days, it has moved in a different direction than European defense companies.

Edit: Thyssenkrupp released its results yesterday and the share price dropped -12%. Salzgitter and ArcelorMittal are also down. I assume it’s related to this.

Edit (Sun Feb 15): and all these price movements could be related to this:

It seems quite speculative, perhaps more volatility ahead.

I’m not particularly familiar with these companies, but generally speaking: isn’t it true for some of them that prices are being cut due to pressure from AI, while at the same time, their own software development costs are falling? The end result being that their margins stay roughly the same.

Then it’s noticed that R&D’s share of the company’s total expenses was only 20% to begin with, and 5% after the savings. A 10% price cut wasn’t enough to increase market share when a competitor decided to keep investments at the previous level and innovated more than before.

In that case, it depends on whether the cheaper option is good enough for the customer’s needs.

Of course. But the point was to highlight slightly different ways this can be approached. If the goal is to invest the minimum, then AI can enable cost-cutting.

At the same time, it allows more willing participants to compete in the industry, as a product of a similar level can be created with a small investment.

Few people talk about how it might suddenly be possible to continue with the same amount of investment as before, but achieve things that previously only a large American competitor could. Perhaps cost-cutting just comes more naturally to us than investing.

Tieto is really on a tear right now. Luckily I still have some left to sell. The surge certainly was a surprise! I guess this isn’t a perpetual loser after all.

Varma has loaded up on PayPal! There go the pension funds down the drain—or will they after all? It recovered a bit today.

LähiTapiola economist’s tweet about coffee talk in 2026 ![]()

https://x.com/HannuNummiaro/status/2022218540820873229

Now I really have to ask out loud, what are coffee talks?

It refers to what people are chatting about in the workplace breakroom ![]()

![]()

I wonder if the bottoms for the most battered software firms are already behind us, or if this is just a temporary bounce before plunging even lower? Time will tell…

Personally, I would hope they drop more, as I haven’t had much time to buy yet. Software firms have been so expensive that I haven’t even looked in that direction. Now it feels like they are reasonably priced or maybe even on sale. Blood is running in the streets—or if not in the streets, at least from the nose. That’s a good time to take a look, when sentiment is low.

CSU has formed a couple of “Lepikkö candles” indicating buying pressure. (I own)

Adobe is also rising from its lows. (I do not own)

@CitizenJ I’m asking out of laziness because I know you know. Was there a UCITS software ETF available?

I haven’t found a UCITS equivalent for IGV, but WTEJ probably does the job in countering SaaSmageddon.

BVP Nasdaq Emerging Cloud Index is designed to track the performance of emerging public companies primarily involved in providing cloud software to their customers.