Opening a thread for the medical product manufacturer Kuros Biosciences AG.

What does it do?

A medical device company that manufactures synthetic bone grafts. Its flagship product is MagnetOs, which is being rapidly expanded for global use.

“MagnetOs is an advanced bone graft substitute developed by Kuros Biosciences, designed to promote bone healing and fusion in various clinical situations, especially in spinal fusions.”

The business is therefore strongly developing around a product family built on a single product/technology.

Product competitive advantages?

Surface Technology:

MagnetOs technology and features: MagnetOs’ unique distinguishing feature is its NeedleGrip™ submicron surface technology. This surface technology guides wound healing into a bone-forming pathway and is capable of promoting bone growth even in soft tissue. The science behind this is called osteoimmunology, which is a growing field of research. This leads to more predictable fusion for surgeons and patients.

Clinical Evidence

Studies have demonstrated the superiority of MagnetOs compared to autograft in instrumented posterolateral fusion:

![]() MagnetOs achieved a 79% fusion rate compared to 47% with autograft.

MagnetOs achieved a 79% fusion rate compared to 47% with autograft.

![]() Particularly noteworthy is that in the subgroup of smokers (a very challenging patient group for achieving fusion), MagnetOs achieved a 74% fusion rate, whereas with autograft it was only 30%.

Particularly noteworthy is that in the subgroup of smokers (a very challenging patient group for achieving fusion), MagnetOs achieved a 74% fusion rate, whereas with autograft it was only 30%.

◦ Kuros is committed to producing the highest level of clinical evidence, which is rare in the synthetic bone graft market, where the FDA typically does not require clinical data for 510(k) clearance.

◦ Over 20 controlled clinical studies (Level I-IV) have been initiated or completed, including seven Level I studies. This creates comprehensive evidence of the product’s efficacy.

◦ MagnetOs has demonstrated the ability to produce well-organized and mature mineralized bone, and graft resorption is consistent with bone remodeling.

Note: To my understanding, OssDesign (a competitor of sorts), for example, has also had quite good fusion rates.

Excellent safety profile:

◦ MagnetOs does not contain human cells or growth factors, which reduces concerns about disease transmission.

◦ This differs significantly from many competitors, such as BMP-2 (Infuse®), which is associated with safety concerns such as atypical bone formation, radiculitis, dysphagia, inflammation, and potential cancer risks.

Ease of use and extensive product family:

◦ All MagnetOs formulations are stored at room temperature and are ready for use, offering efficiency and easy storage for hospitals and surgeons.

◦ The product is easy to mold and stays reliably in place.

◦ The MagnetOs product family includes MagnetOs Granules, MagnetOs Putty, MagnetOs Easypack Putty, and MagnetOs Flex Matrix, addressing the diverse needs of surgeons in various clinical situations.

Versatile applications:

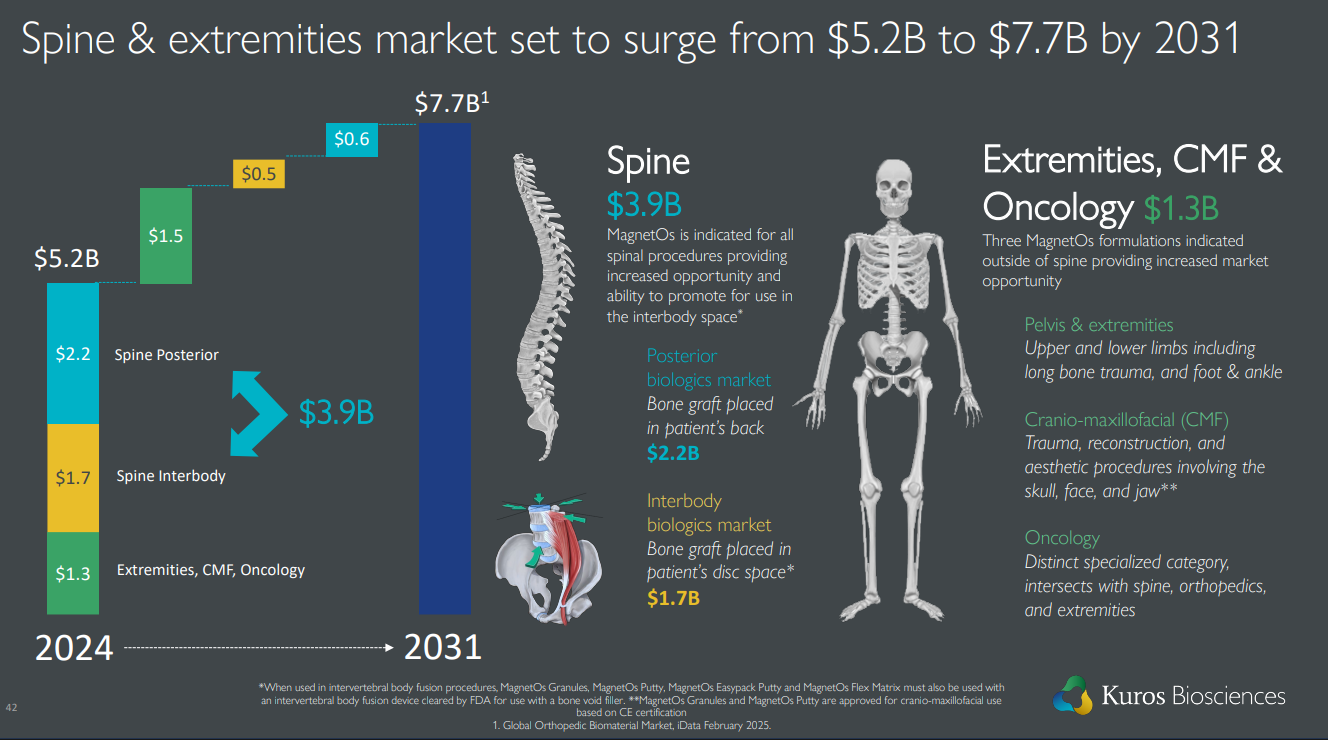

Spinal fusion: It is used as a bone void filler in spinal fusion applications (PLF and interbody fusions). Notably, interbody space clearance significantly expanded its market potential. Most MagnetOs products can be used in “standalone” fusions, meaning they do not need to be supplemented with the patient’s own bone (autograft).

◦ Extremities and pelvis (orthopedics): MagnetOs Putty and Granules are used as bone void fillers in orthopedics (including long bones, foot and ankle, pelvis) in both the EU and the US.

◦ Dentistry: MagnetOs Granules and Putty have received clearance for dental indications in the EU.

◦ Craniomaxillofacial trauma (CMF): Indications also in the skull, face, and jaw.

◦ Oncology: A separate specialized category that intersects with spine, orthopedics, and extremities.

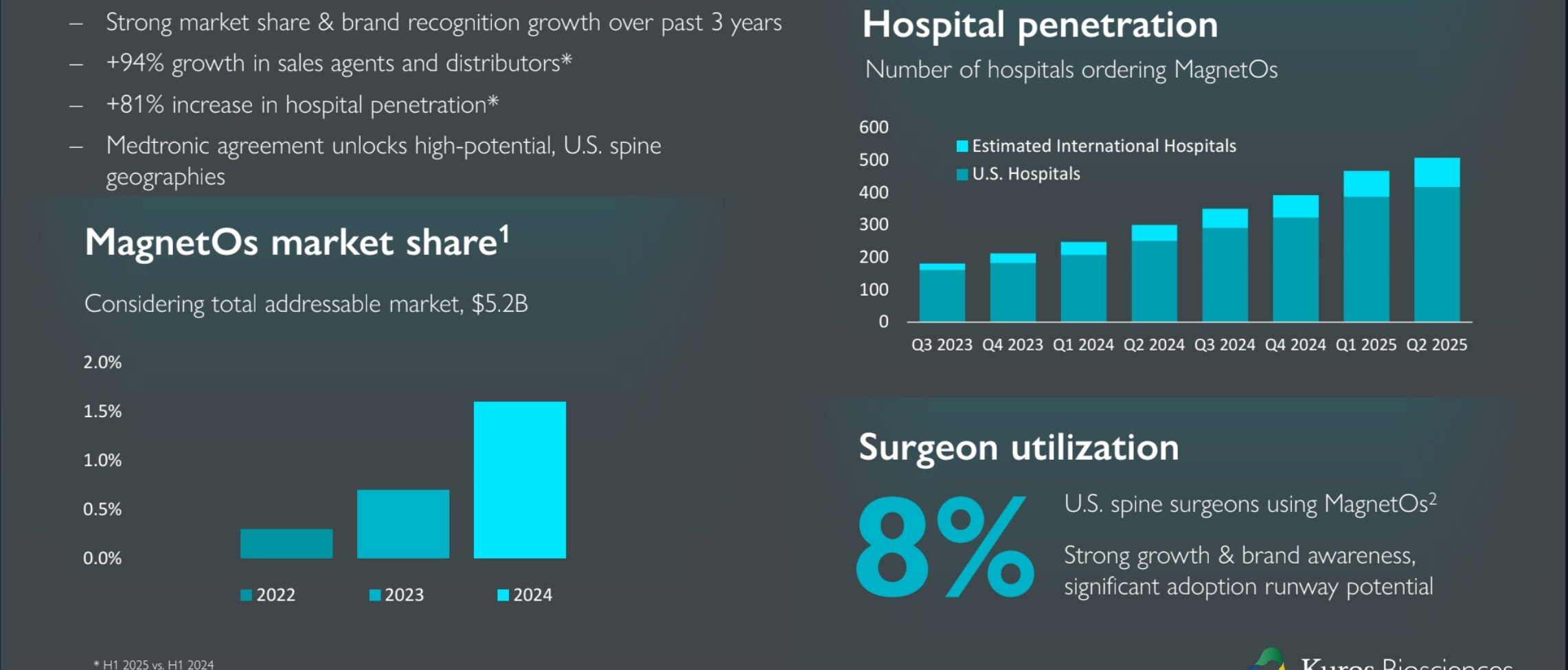

Strong commercial success and strategic focus:

◦ Total MagnetOs sales were CHF 75.6 million in 2024, an increase of 125% from 2023 (CHF 33.6 million).

◦ The product has been used in fusion surgery for over 25,000 patients.

◦ The company has strategically focused on its MagnetOs product portfolio by discontinuing the Fibrin-PTH program.

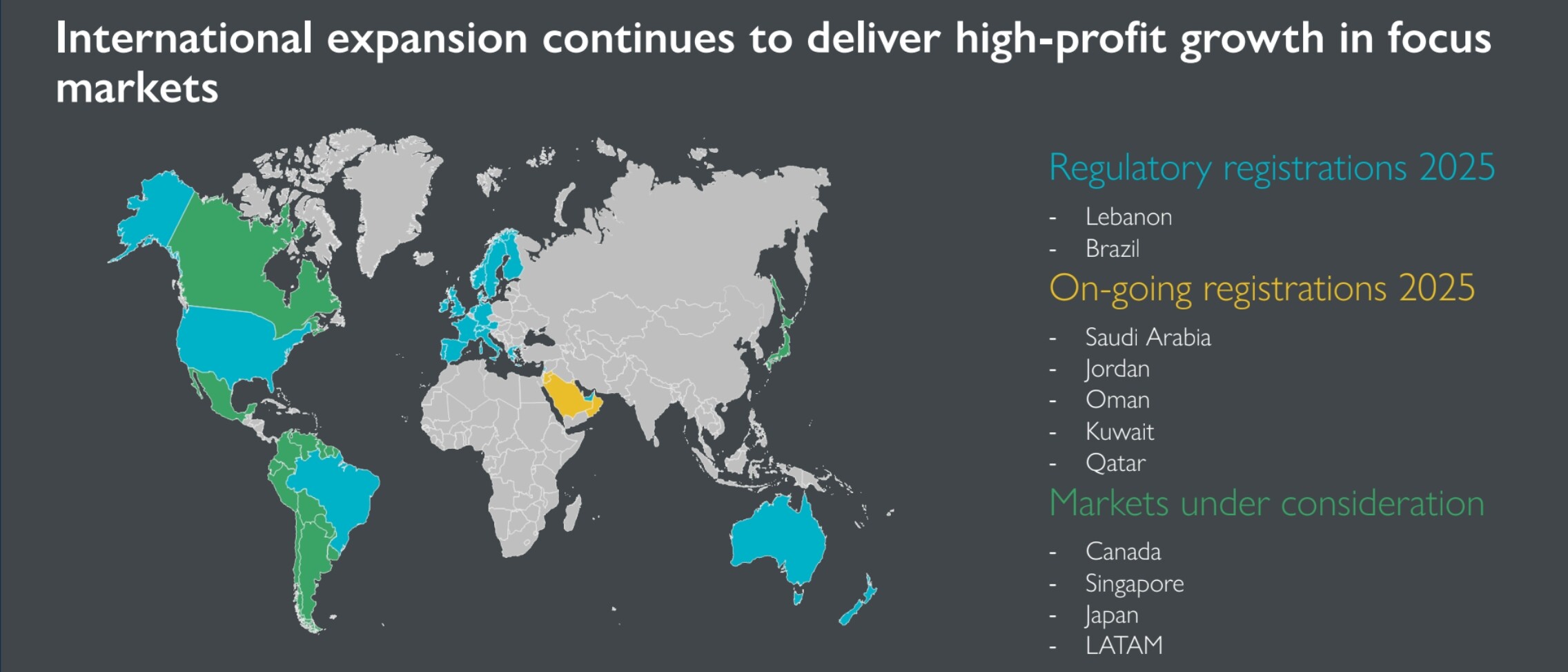

◦ Kuros has expanded its distribution network to over 20 countries and aims for further expansion.

◦ A five-year strategic agreement with Medtronic’s spine division expands MagnetOs’ availability in key US spinal surgery regions without Kuros having to expand its own sales force.

The company also continuously innovates. For example, ‘Minimally Invasive Surgery (MIS)’ instrumentation for installing their product has just been introduced to the market:

Source materials?

CMD / May 2025: https://kurosbio.com/resources/capital-markets-day-webcast-presentation-deck/

Reports and presentations: https://kurosbio.com/resources/?resource_type=reports-presentations

Target markets?

The target markets for their products are an order of magnitude larger, approximately $5-7 billion. The company has just reached a market capitalization of $1 billion. By all accounts, the company should still have room to grow far into the future if the product performs well. Less than 2% of the TAM has been achieved.

Geographical expansion has just begun:

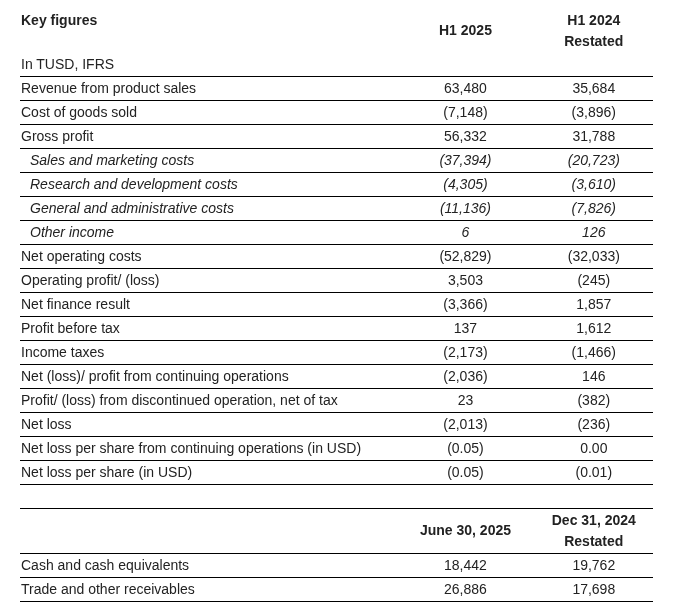

Financials?

The company is net debt-free, has grown rapidly, and continues to guide for strong growth in the coming years.

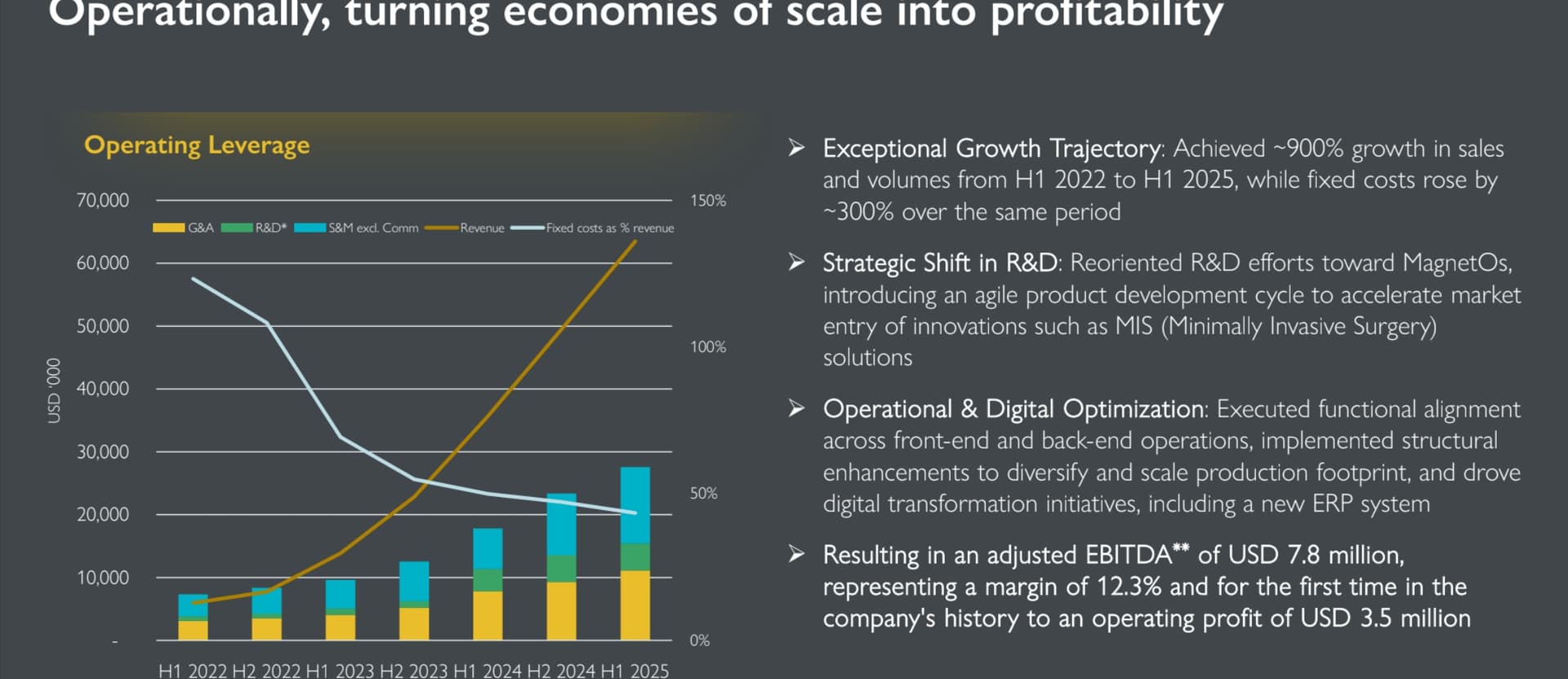

In the recent H1/2025 review, the company demonstrated strength in both revenue growth (77%) and profitability. Operating profit turned positive.

Financial Highlights

• Total Medical Device sales rose by 78% to USD 63.5 million in H1 2025 (H1 2024: USD 35.7 million)

• Direct MagnetOs™ sales increased by 77% to USD 62.7 million in H1 2025 (H1 2024: USD 35.4 million)

• The Group achieved its first-ever operating profit, reaching USD 3.5 million, compared to an operating loss of USD (0.2) million in H1 2024

• Total Group EBITDA reached USD 5.1 million in H1 2025 (H1 2024: USD 0.8 million) and total Group adjusted EBITDA* amounted to USD 7.8 million in H1 2025, equaling a margin of 12.3% (H1 2024: USD 4.5 million at 12.6%). After amortization, depreciation, the net finance result, income tax and the profit/loss from discontinued operations, the Group reported a net loss of USD (2.0) million in H1 2025 (H1 2024: USD (0.2) million)

• Cash position remains strong while funding strategic growth initiatives and investing in working capital, with cash and cash equivalents totaling USD 18.4 million as of June 30, 2025 (December 31, 2024: USD 19.8 million)

• Reporting currency changed from CHF to USD to align with the Group’s primary market and operational footprint in the U.S.

A new guidance for 2027 was also provided, projecting $220m – $250m in revenue. A production facility in the United States is being prepared for the company by the end of 2026, which will significantly support this.

The Group continues to expect sales growth of at least 60% in 2025 and anticipates sales of between USD 220 million and USD 250 million by 2027

The H1 review, including slides and Q&A section, can be found on the Quartr App, among other places.The company has guided for 60% growth this year, which was significantly exceeded in the early part of the year. In the Q&A, the CEO guided that they do not see growth slowing down in H2 and it is expected to be “similar to H1 in proportion to previous years”. This would suggest that the company has a good chance of reaching its guidance this year.

Other Sources:

Inderes’ @Antti_Siltanen opens his portfolio, it is his largest holding. He has already made a lot of money with this (congratulations). Antti is probably the most knowledgeable among forum members, and it would be nice to hear fresh comments on the H1 review, future prospects, and competitive situation. Do you still see an investment case here?

https://youtu.be/fpZQpeQtxJo?t=1393

Inderes’ @Atte_Riikola just recently added this to his portfolio as a ‘short consideration purchase’. He admitted this in the now legendary ‘No leverage, no benefit’ portfolio review:

https://youtu.be/0q3HEqiUhGM?t=5049

Pricing?

As Atte also stated in the video, this is priced below EV/S 10 and forecasts for 2027 are closer to EV/S 5x. So, it’s no longer cheap, but perhaps an opportunity for those who tolerate risk and look far into the future?

I don’t have much to add to this, but the case interests me and it is now in my portfolios with a few percentage points. Presumably, not much discussion will arise from this due to the company’s challenging comprehensibility, but let’s try to get started with this. Have a good weekend!