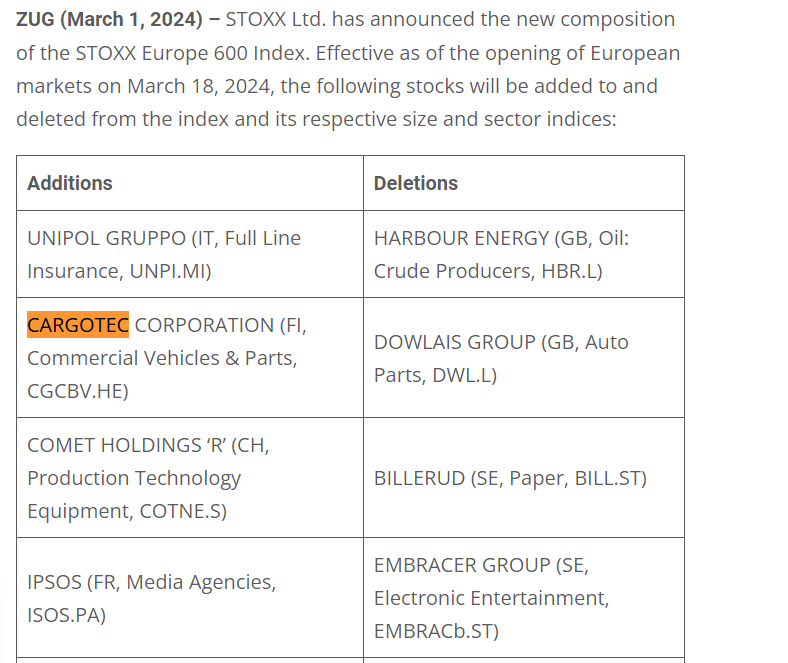

Inside information: Cargotec’s Board of Directors has approved a demerger plan to separate Kalmar into a new listed company

Key highlights of the arrangement

- Cargotec’s Board of Directors has approved a demerger plan to separate Kalmar into an independent listed company.

- The demerger is subject to approval by Cargotec’s Annual General Meeting to be held on 30 May 2024.

- The planned completion date of the demerger is 30 June 2024.

- Cargotec plans to publish a demerger and listing prospectus in May 2024, prior to the Annual General Meeting deciding on the demerger. The demerger and listing prospectus will contain more detailed information on the demerger and Kalmar.

- Certain major shareholders of Cargotec have expressed their support for the proposed demerger.

The Board of Directors of Cargotec Corporation (”Cargotec”), having assessed the strategic options for Cargotec’s core businesses Kalmar and Hiab, has approved a demerger plan regarding a partial demerger of Cargotec. According to the demerger plan, Cargotec will demerge in a way that all assets, debts, and liabilities of Cargotec relating to the Kalmar business area or mainly serving the Kalmar business area shall be transferred to a new company to be incorporated in the demerger named Kalmar Corporation (”Kalmar”) (the ”Demerger”). The class B shares of Kalmar are intended to be admitted to trading on the official list of Nasdaq Helsinki Ltd (”Nasdaq Helsinki”). Following the completion of the demerger, Kalmar would initially have the same ownership structure as Cargotec, and there would be no cross-ownership between Cargotec and Kalmar.

Cargotec’s Hiab business area would remain in the current company in the Demerger. As announced by Cargotec on 14 November 2022, MacGregor, which is currently one of Cargotec’s three business areas, will not be part of Cargotec’s portfolio in the future. Cargotec is therefore simultaneously focusing on finding a solution for MacGregor during 2024.

Strategic rationale for the demerger

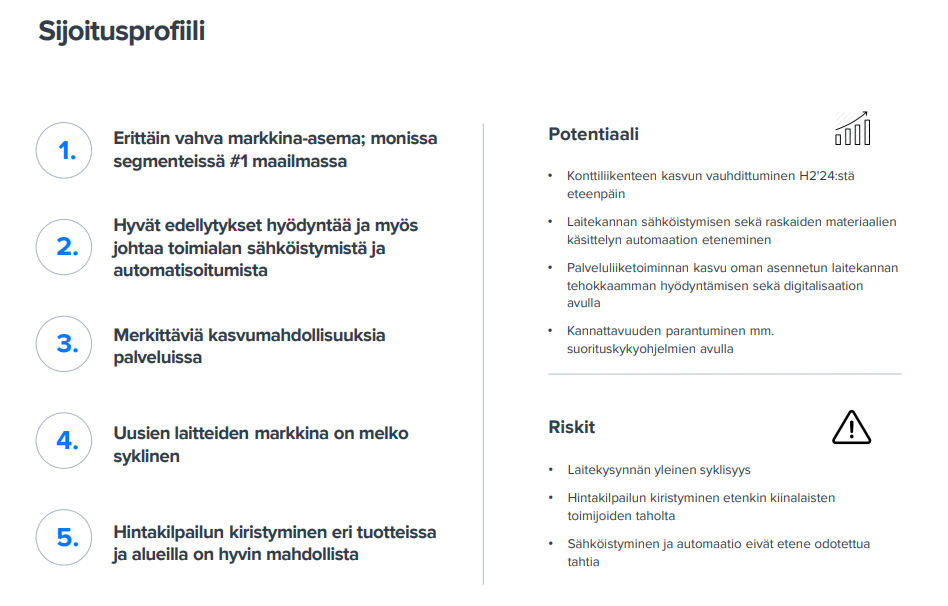

According to the assessment of Cargotec’s Board of Directors, the separation of Kalmar could increase shareholder value by allowing both businesses to independently pursue sustainable and profitable growth opportunities. The aim of the transaction is to create two world-leading focused listed companies:

- Kalmar, a technology forerunner in container handling and heavy logistics, with a strong market position and the potential to grow by electrifying the industry and making it more sustainable.

- Hiab, a pioneer in on-road load handling with a strong track record of profitable growth and attractive opportunities for M&A (mergers and acquisitions).

According to the Board’s assessment, the partial demerger is expected to improve the business performance of Kalmar and Hiab through enhanced agility, separated decision-making, and stronger management focus. As two separate companies, Kalmar and Hiab are also positioned to grow faster both organically and inorganically thanks to a more tailored capital allocation strategy and more flexible access to debt capital.

The Board believes that the transaction would increase the attractiveness of the companies and facilitate the valuation of the businesses. Furthermore, the separation would clarify management and simplify the structures of the companies, as well as increase transparency and clarify responsibilities.

”The assessment and planning of the partial demerger have progressed well. To increase shareholder value, the Board has, after careful consideration and supported by the largest shareholders, decided to propose a partial demerger to separate Kalmar from Cargotec,” says Jaakko Eskola, Chair of Cargotec’s Board of Directors.

General description of the demerger

The demerger would be carried out as a partial demerger in accordance with the Finnish Companies Act (624/2006, as amended) (the ”Companies Act”) and the attached demerger plan. Cargotec shareholders will receive as demerger consideration one new share of the corresponding share class in Kalmar (i.e., either class A or class B) for each class A and class B share they own in Cargotec (the ”Demerger Consideration”), meaning the Demerger Consideration is given to Cargotec shareholders in proportion to their ownership on a 1:1 basis. Kalmar will have two corresponding share classes as Cargotec, i.e., class A and class B, which have the same voting and dividend rights as the corresponding class A and class B shares of Cargotec. No action would be required from shareholders to receive the Demerger Consideration.

The completion of the demerger requires, among other things, the approval of Cargotec’s general meeting and the registration of the completion of the demerger with the Trade Register after the creditor hearing process in accordance with the Companies Act.

Cargotec’s Board of Directors intends to propose to Cargotec’s shareholders that they decide on the Demerger at Cargotec’s Annual General Meeting 2024 on 30 May 2024. The Annual General Meeting will decide on the Demerger as well as other Board proposals based on the demerger plan. Cargotec’s Board of Directors will publish a separate notice to the Annual General Meeting later.

The planned completion date of the demerger is 30 June 2024, in accordance with the demerger plan. Trading in Kalmar’s class B shares is expected to begin on Nasdaq Helsinki on or about 1 July 2024. Starting from the first quarter of 2024, Cargotec will present the Kalmar business area as discontinued operations in its financial reporting in accordance with the IFRS 5 standard. Cargotec’s Board of Directors may decide not to implement the Demerger if it considers that, due to a change in circumstances or information emerged after the signing of the demerger plan, the implementation would no longer be in the best interest of Cargotec and its shareholders.

Financing arrangements

In its demerger preparations, Cargotec has secured sufficient financing for the demerging businesses under certain customary terms. To facilitate the demerger process, Cargotec also intends to seek certain consents, waivers, and amendments regarding its unsecured bonds totaling EUR 250 million maturing in 2025 and 2026, as well as certain Schuldschein loans. Before the completion of the Demerger, Cargotec intends to redeem at maturity in March 2024 an unsecured bond totaling EUR 100 million. If the consents are obtained, Cargotec’s loan portfolio will consist of EUR 250 million in unsecured bonds and EUR 25 million in Schuldschein loans. In addition, Cargotec has received consent from the current lenders to maintain the existing EUR 330 million revolving credit facility. The current EUR 300 million term loans will be transferred to Kalmar. Furthermore, Kalmar will have a EUR 150 million long-term revolving credit facility.

Kalmar’s Board of Directors and management

The Annual General Meeting deciding on the demerger will also elect the members of Kalmar’s Board of Directors for a term beginning upon the completion of the Demerger. Cargotec’s Board of Directors intends to propose that Jaakko Eskola be elected as the Chair of Kalmar’s Board and that Teresa Kemppi-Vasama and Tapio Kolunsarka be among the members elected to Kalmar’s Board. Contingent on the completion of the Demerger, it is intended that Jaakko Eskola, Teresa Kemppi-Vasama, and Tapio Kolunsarka will not continue on Cargotec’s Board of Directors. Proposals for the compositions of the Boards of Directors of Cargotec and Kalmar will be included in the notice to the Annual General Meeting.

Cargotec announced on 9 November 2023 that Sami Niiranen has been appointed as President of Kalmar and proposed as CEO of the planned independent Kalmar. He will start as President of Kalmar on 1 April 2024. Cargotec has also changed the composition of Kalmar’s leadership team ahead of the planned listing of Kalmar.

As of 1 April 2024, Kalmar’s leadership team will consist of:

Sami Niiranen, President and proposed CEO;

Sakari Ahdekivi, CFO;

Carina Geber-Teir, Head of Investor Relations and Communications;

Francois Guetat, Head of Integrated Supply Chain;

Mathias Höglund, Head of Human Resources as of 1 May 2024;

Tommi Pettersson, Head of Strategy, Sustainability and Technology;

Marika Väkiparta, Transformation Officer;

Alf-Gunnar Karlgren, Head of Counterbalanced business;

Thor Brenden, Head of Terminal Tractors business;

Arto Keskinen, Head of Horizontal Transportation business;

Shushu Zhang, Head of Bromma business;

Thomas Malmborg, Head of Service business; and

General Counsel to be appointed later

Shareholder support

Certain major shareholders of Cargotec, including Wipunen varainhallinta oy, Mariatorp Oy, Pivosto Oy and Koneen Säätiö, which together hold approximately 41 percent of Cargotec’s shares and approximately 75 percent of Cargotec’s votes, have expressed their support for the proposed Demerger.

Advance ruling

Cargotec has received an advance ruling from the Finnish Tax Administration, according to which the Demerger is treated as a tax-neutral demerger in accordance with Section 52 c of the Finnish Business Tax Act. In addition, Cargotec group companies may apply for local advance rulings related to the preparations for the Demerger.

Demerger and listing prospectus

Cargotec plans to publish a demerger and listing prospectus in May 2024 before the Annual General Meeting deciding on the Demerger. The demerger and listing prospectus will contain more detailed information about the Demerger and Kalmar.