(Avride is Nebius’s brand for autonomous driving)

I find Nebius’s story very interesting, which is why I started this thread. Here are a few things that piqued my interest in following the company. Yandex was founded on September 23, 1997, while Google was founded a year after Yandex, on September 4, 1998. Arkady Volozh is a well-known technology entrepreneur, best known as the founder and former CEO of Yandex, “Russia’s Google”. Now he is the CEO of Nebius and, through his company, holds 59% of the voting power in Nebius Group. And his share ownership is 15%. So, the management’s “CV” and share ownership are in order.

Arkady Volozh has publicly condemned the actions of his home country’s political leadership. Although Nebius can be considered a successor to Yandex, Nebius has severed all financial and legal ties to the Russian Yandex. Everyone should do their own analysis on this matter. Unfortunately, according to Nordea, Nebius, as a company with Russian origins, is still subject to sanctions, and Nordea does not allow trading in the company!

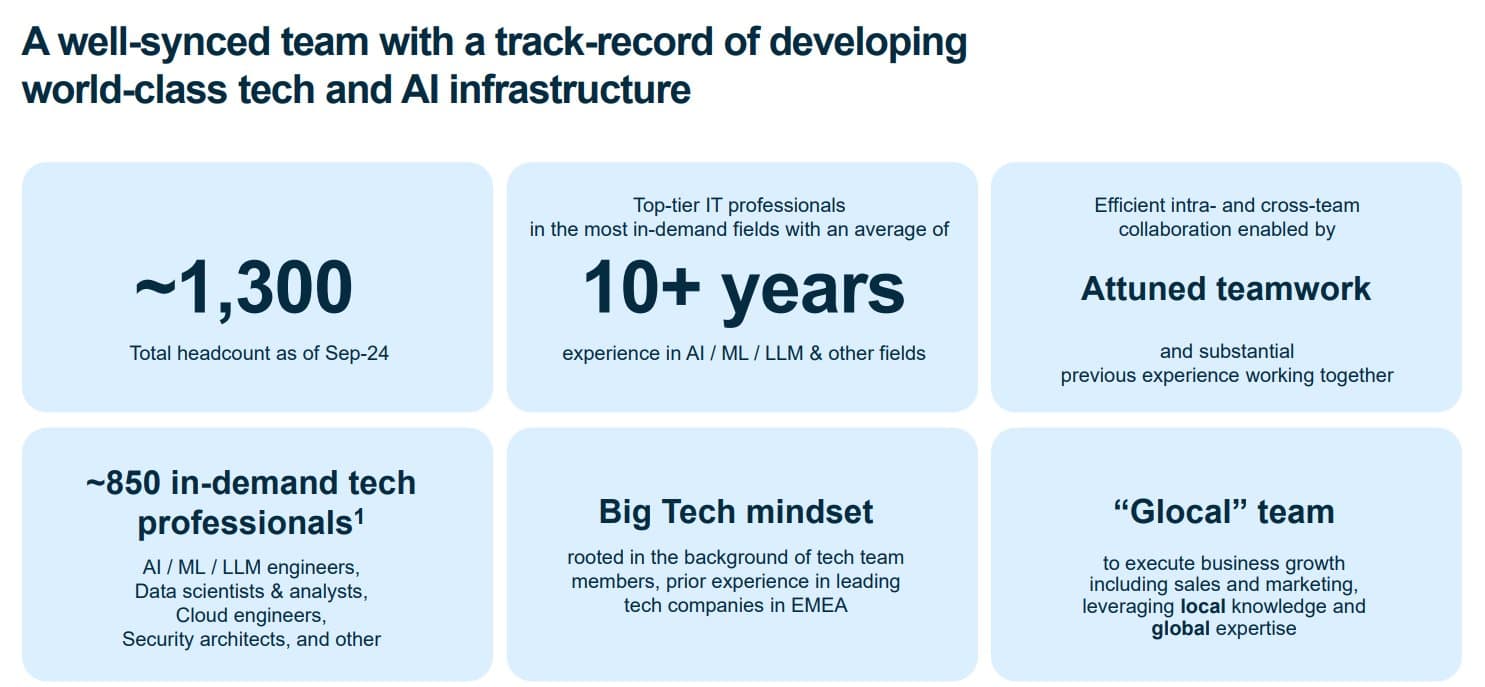

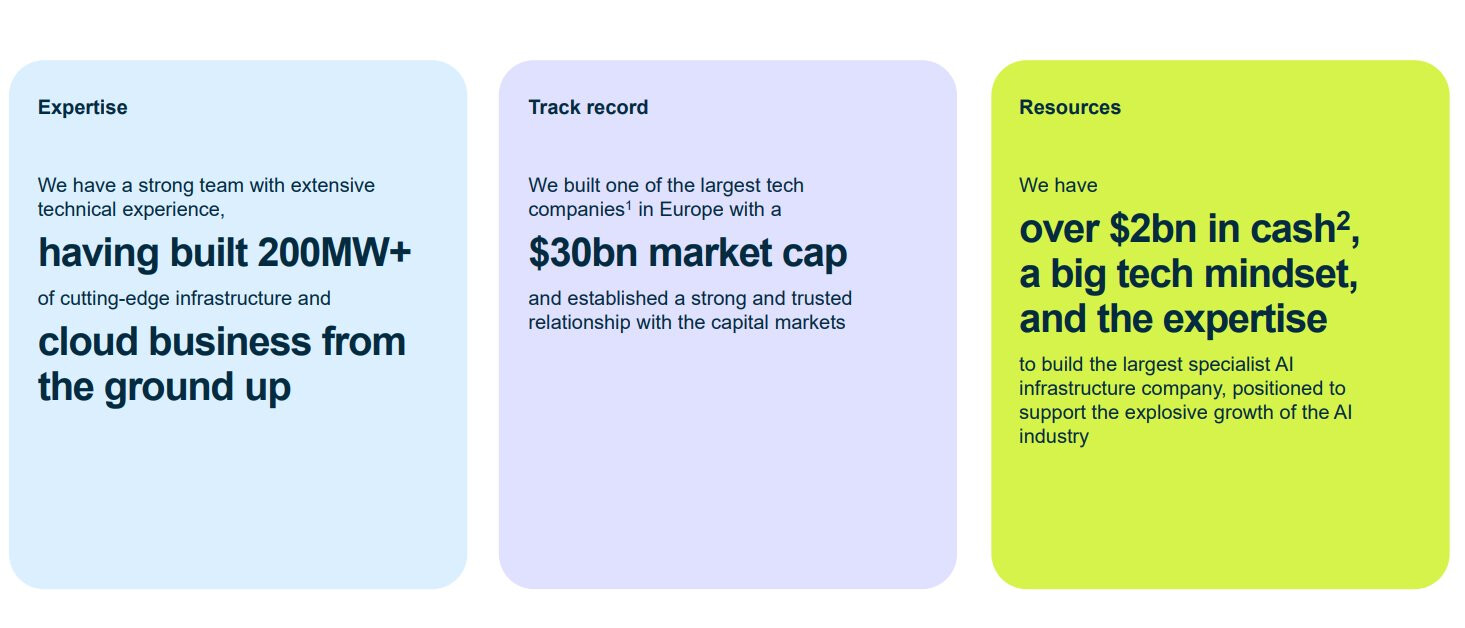

There are two reasons why Nebius is interesting. As I mentioned earlier, the CEO’s CV (founded “Russia’s Google”) and his share ownership in the company are solid. Another equally significant point is that after the start of the war in Ukraine, a large part of Yandex’s staff moved out of their home country. After various stages, the CEO of the originally Moscow-based Yandex company and about a thousand top professionals from Yandex are now working in Amsterdam, at Nebius Group. What happened here is that the “brains” of the Russian Yandex moved to Nebius, while Yandex’s capital and IPRs were transferred to Russia; they are not with Nebius.

Volozh is a strong leader for his people, and his staff trusts him. Nebius’s 1,000-person team has therefore already once built a service business comparable to Google. Now that team has started from scratch again. From Volozh’s speeches, I’ve heard that they still have top experts who have worked for Yandex for decades. Nebius is thus a high-caliber team of professionals starting from scratch to do what they do best.

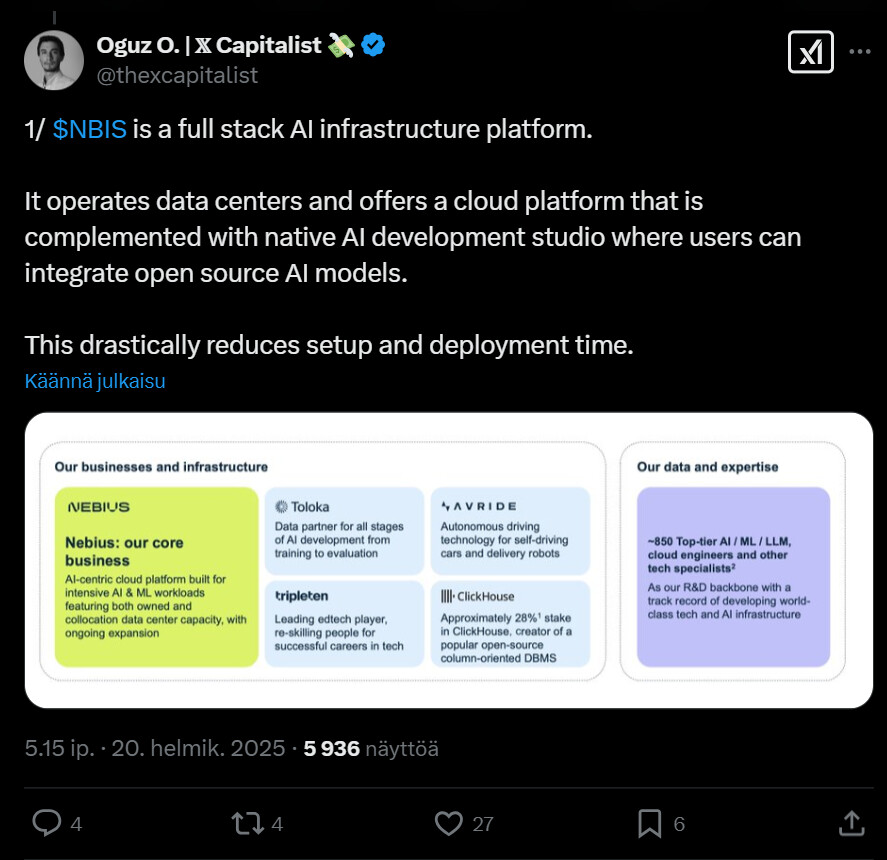

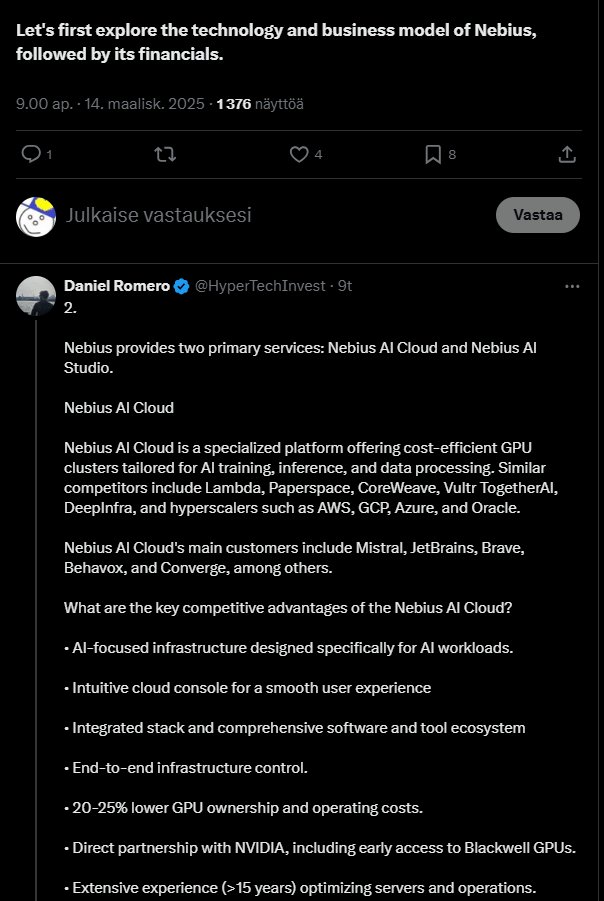

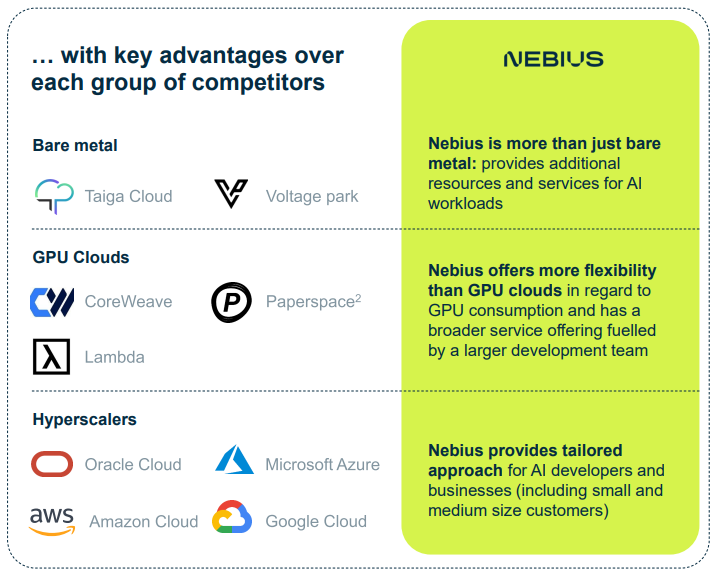

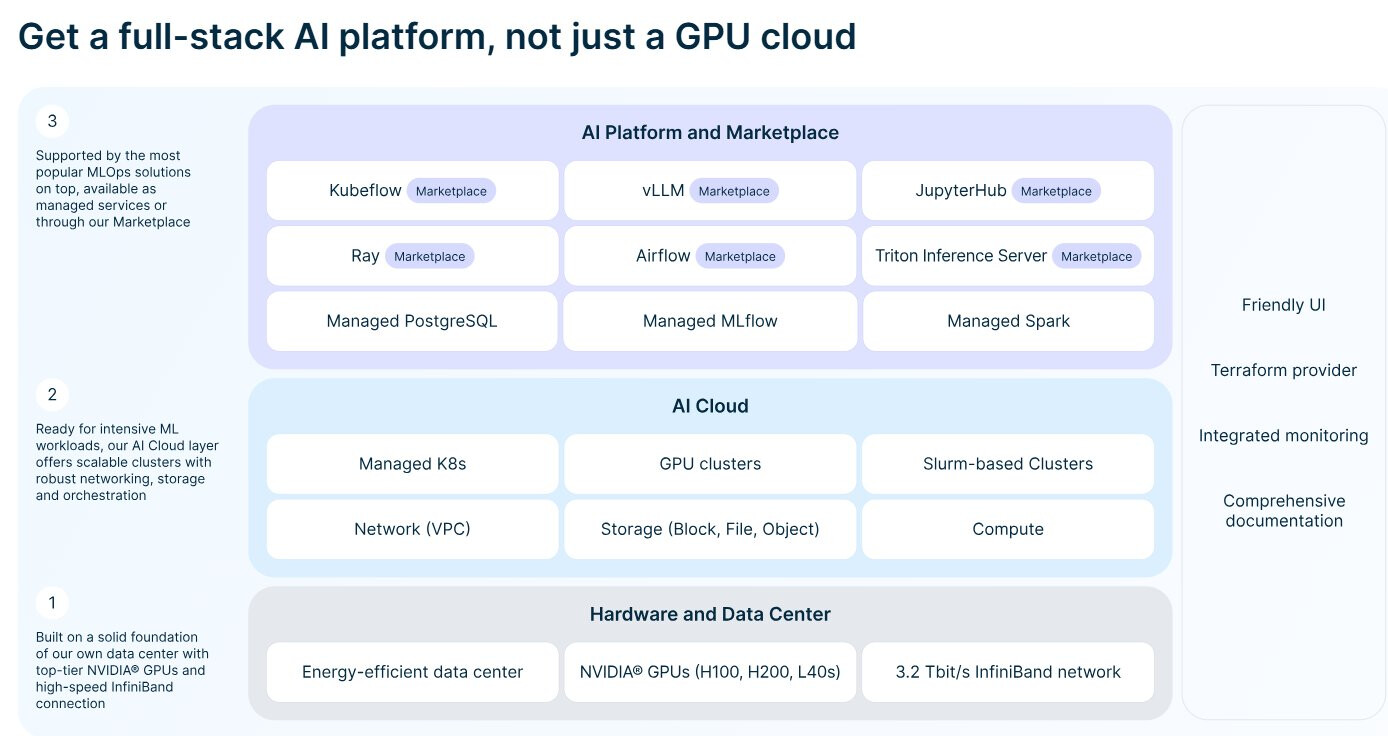

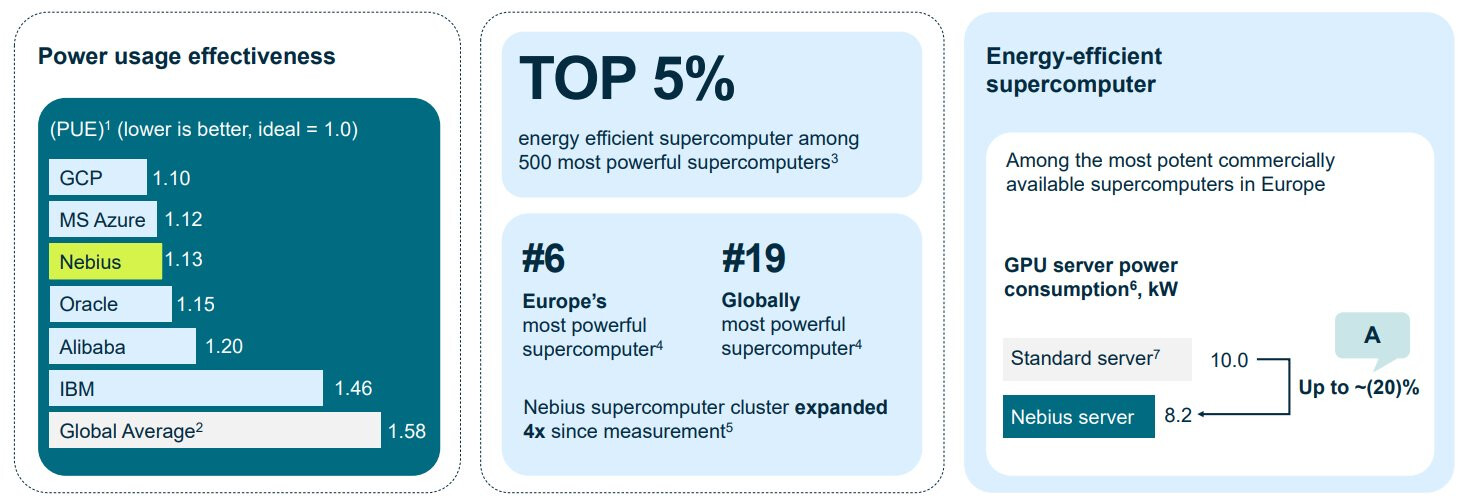

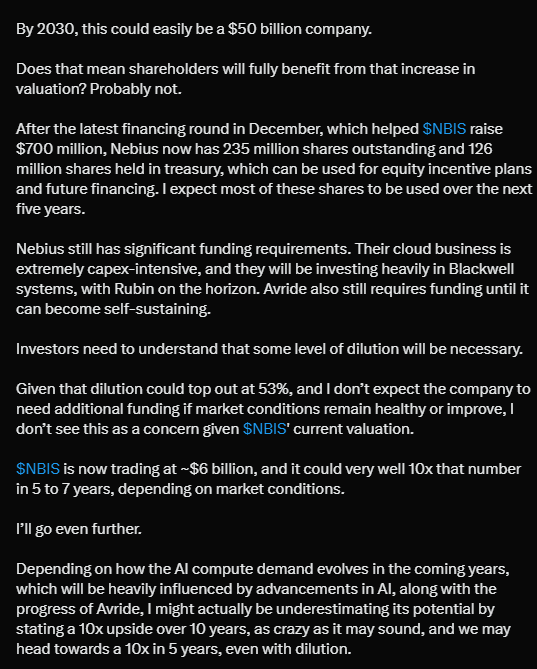

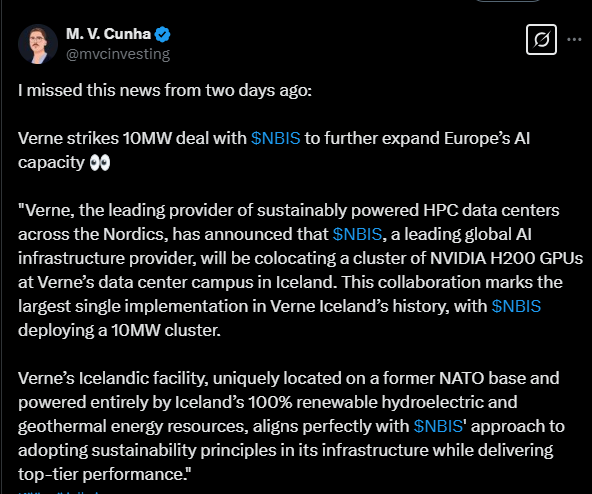

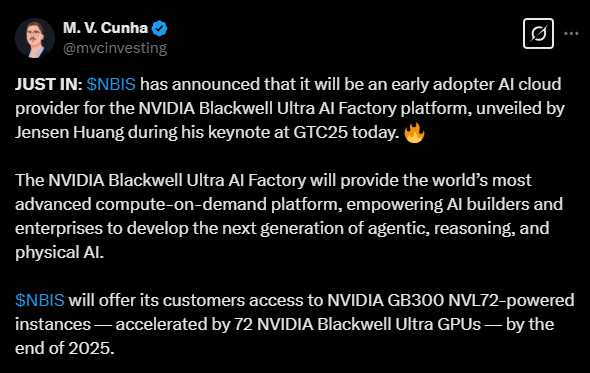

Nebius is still small, but through venture capitalists, it has gotten on its feet and is growing rapidly. Their core service is to provide AI computing capacity to independent AI developers. This, in my opinion, holds the biggest risk. American mega-firms certainly get Nvidia GPUs at more favorable prices than Nebius. This means tech giants can inherently offer capacity cheaper than Nebius. But I opened this thread precisely so that we could collectively understand how and how far Volozh intends to go with Nebius.

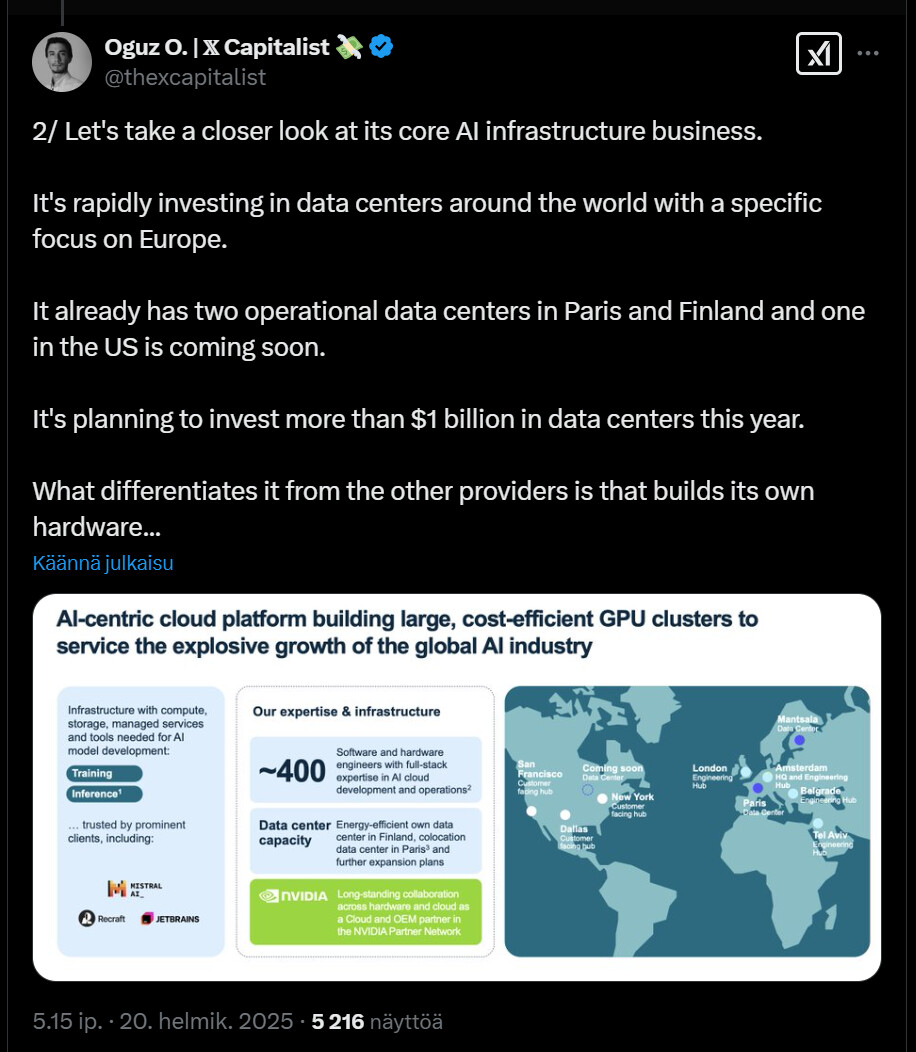

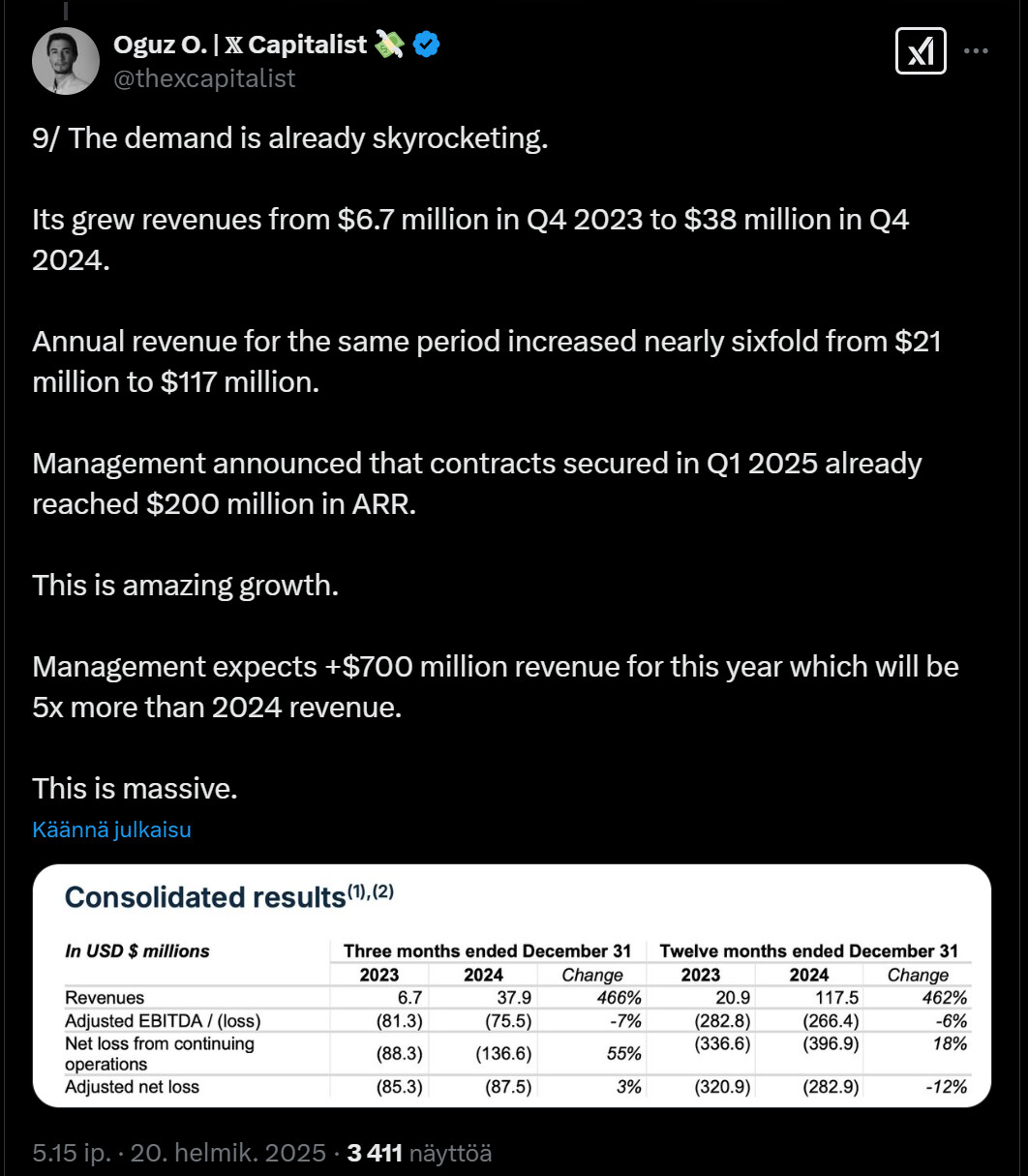

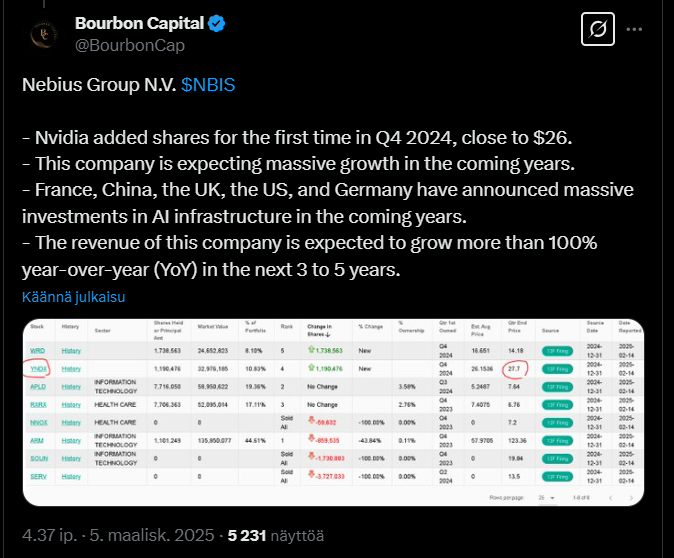

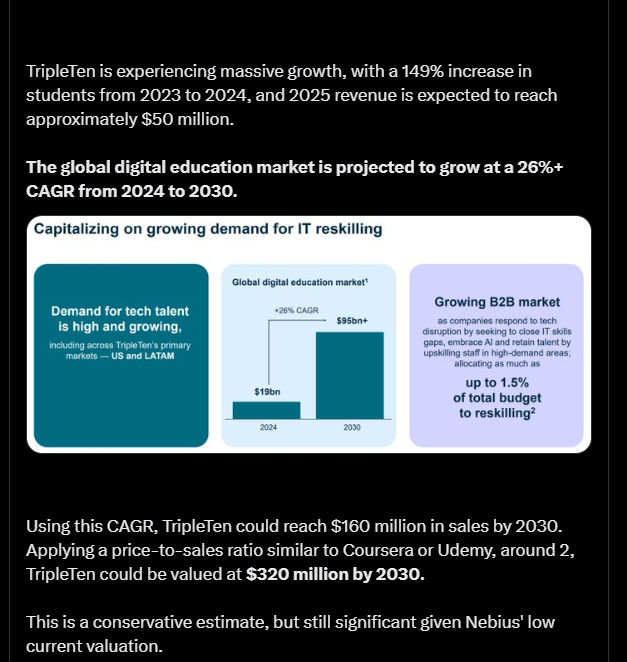

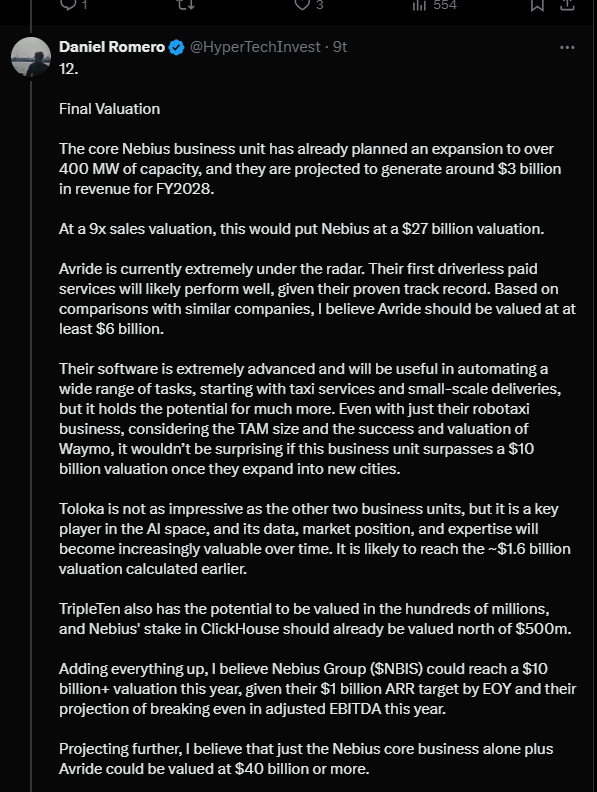

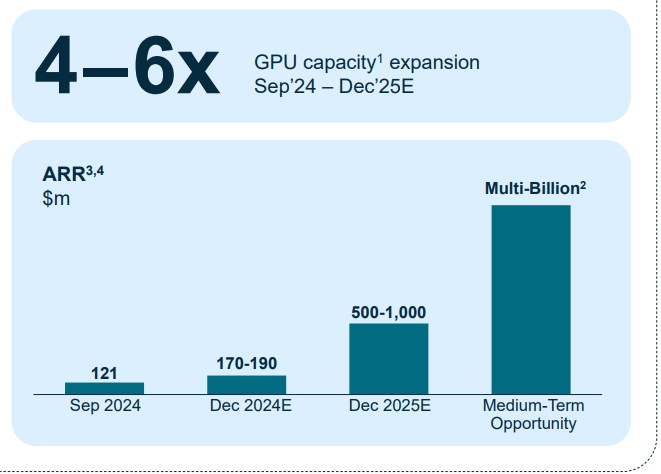

Financial figures can be examined in more detail online or from the link I shared below. At the end of 2024, the company had an annual turnover of approximately 200 million, and by the end of 2025, the company predicts an annual turnover level of one billion. The company predicts that adj. EBITDA will turn positive during 2025.

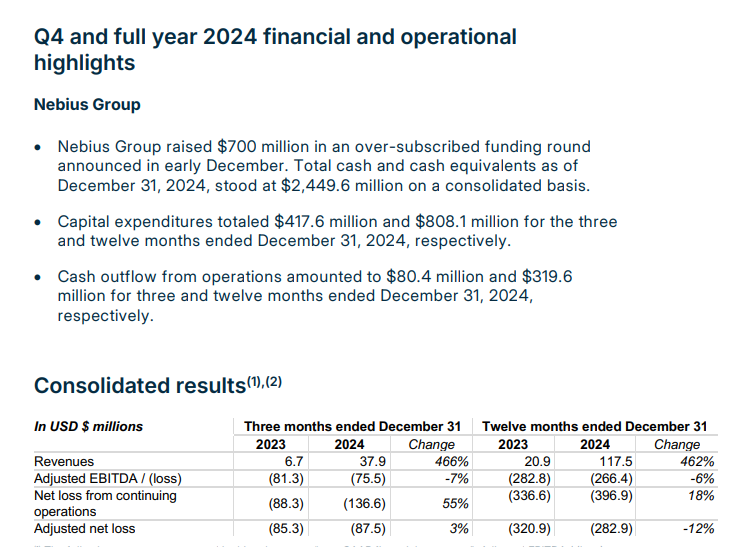

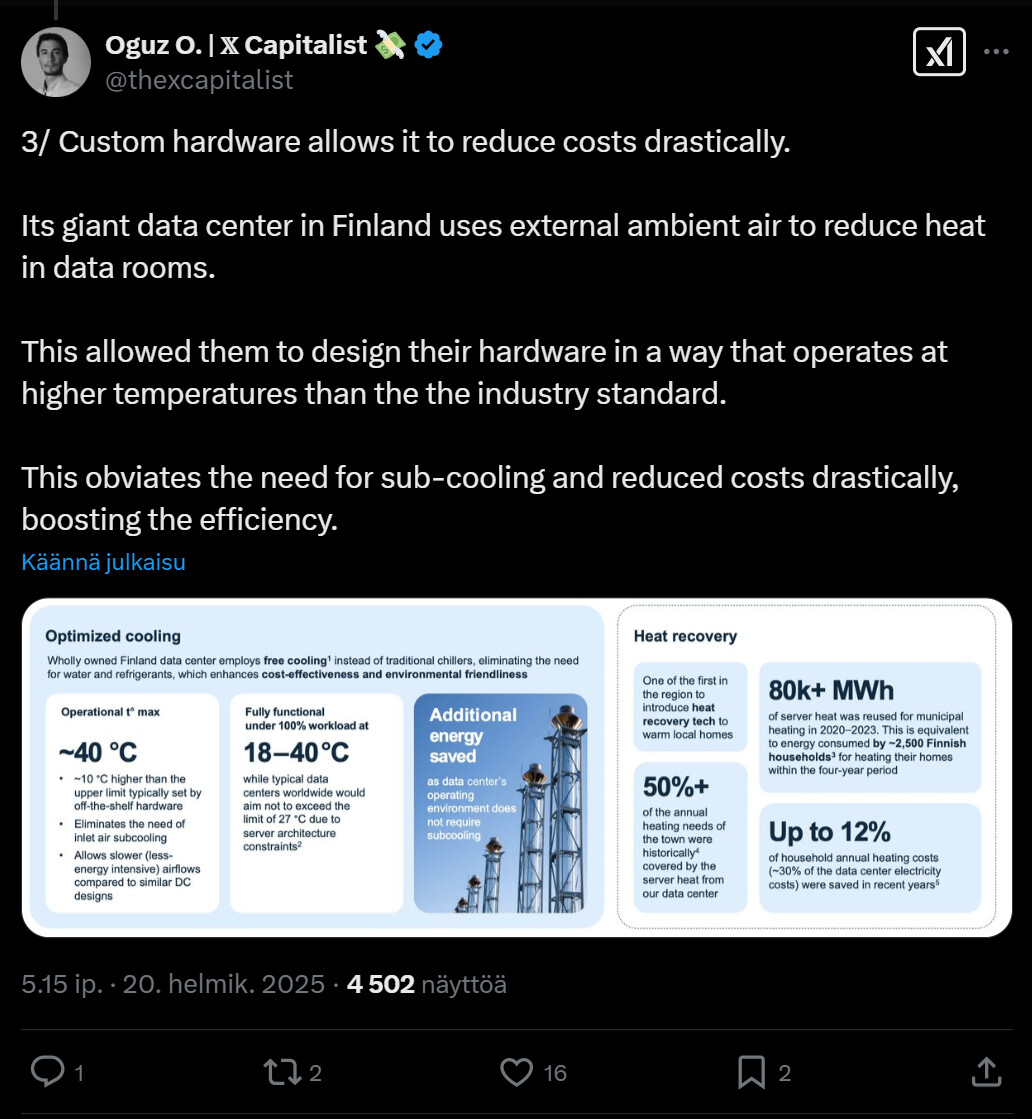

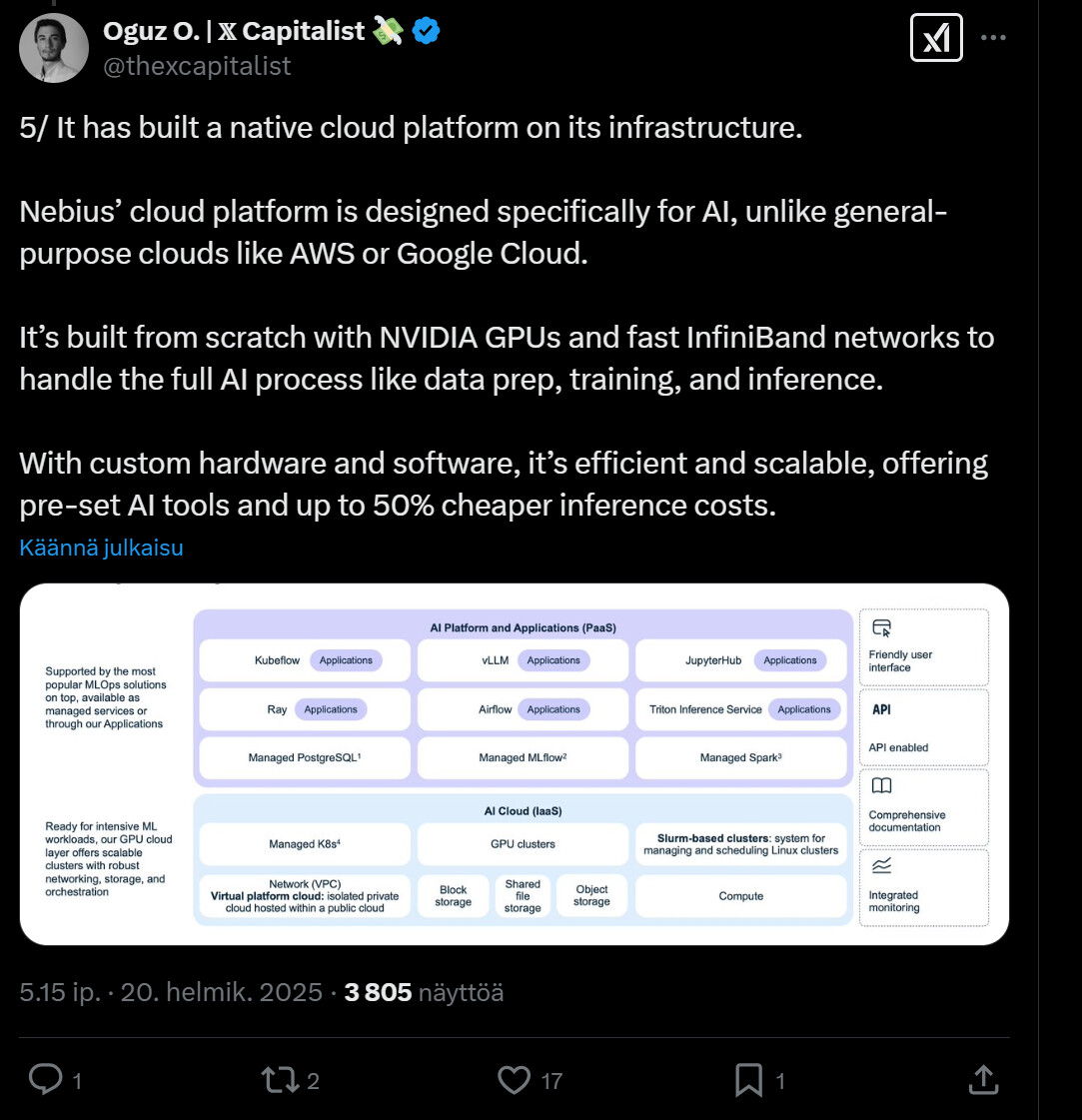

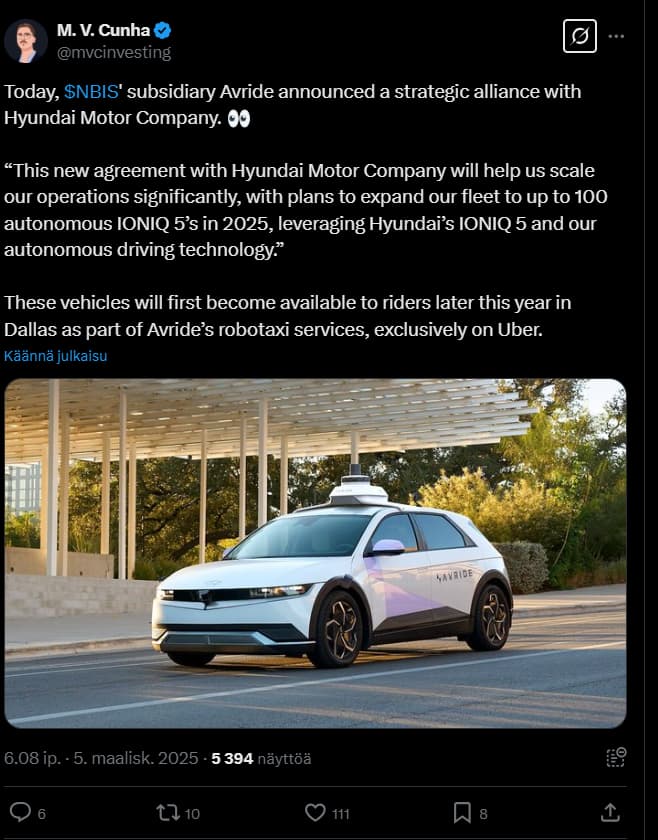

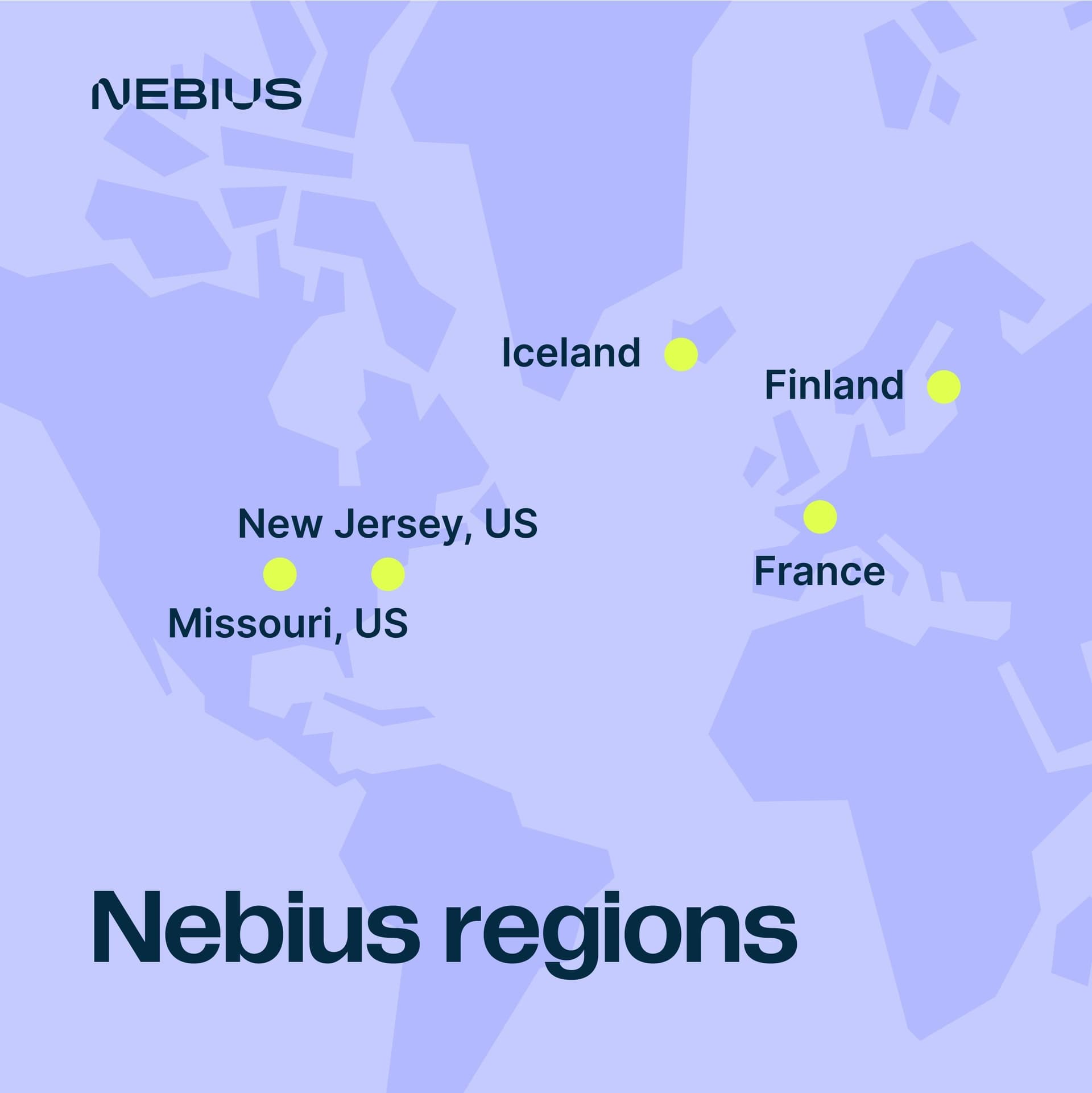

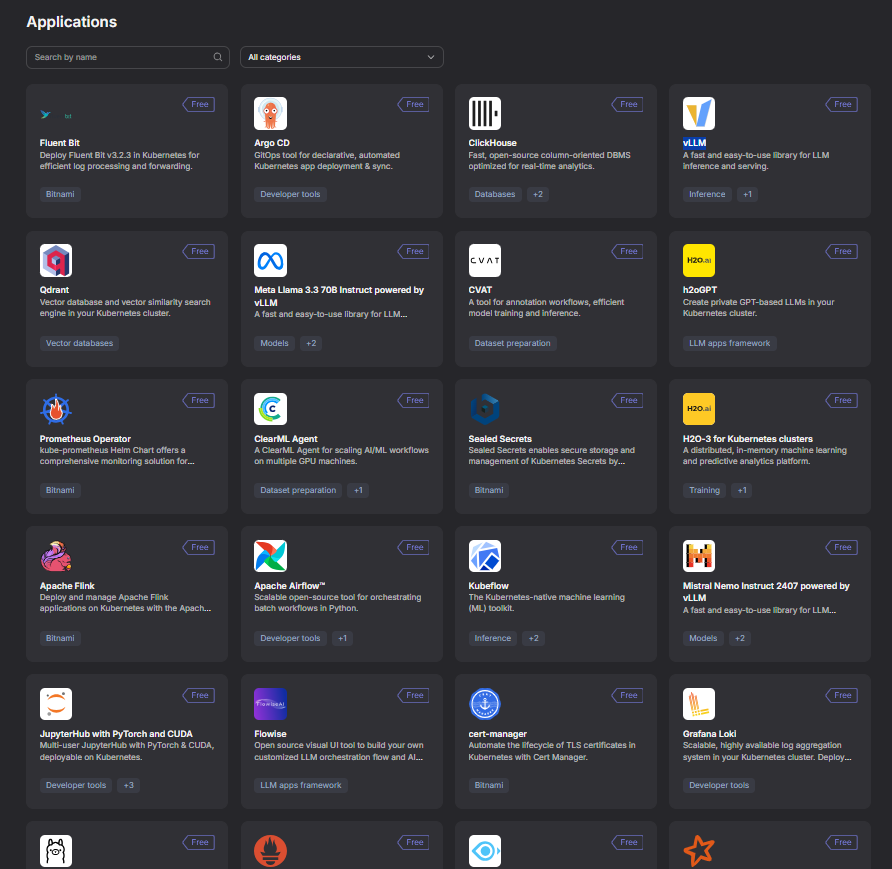

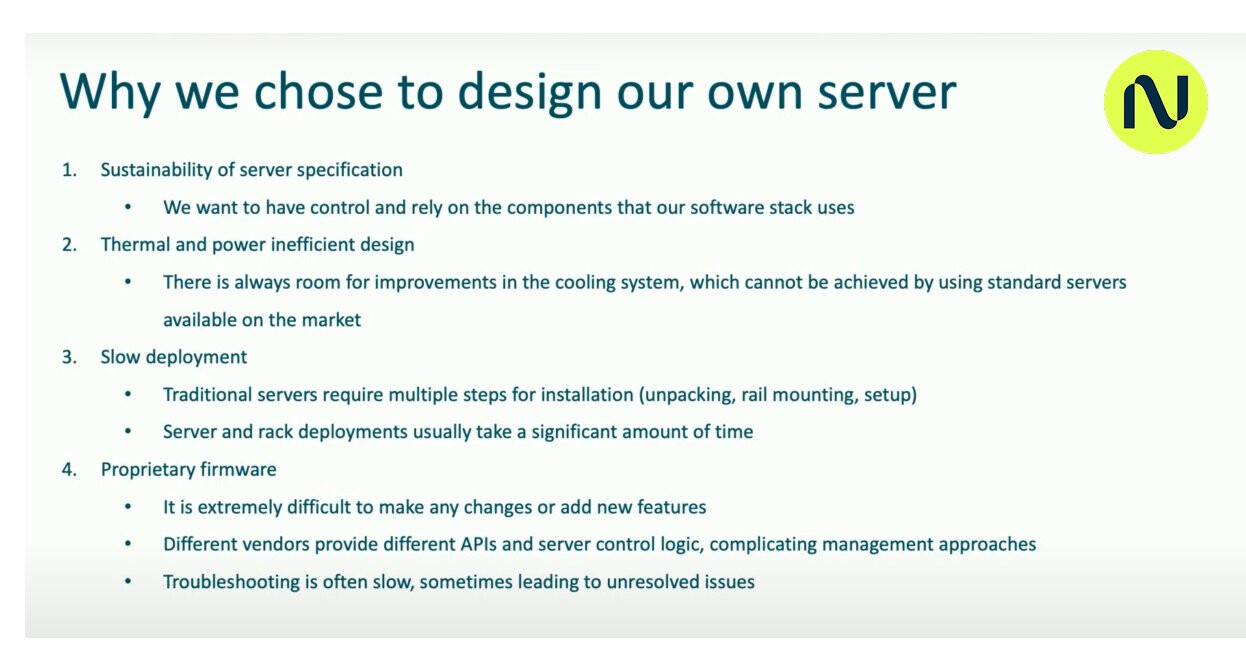

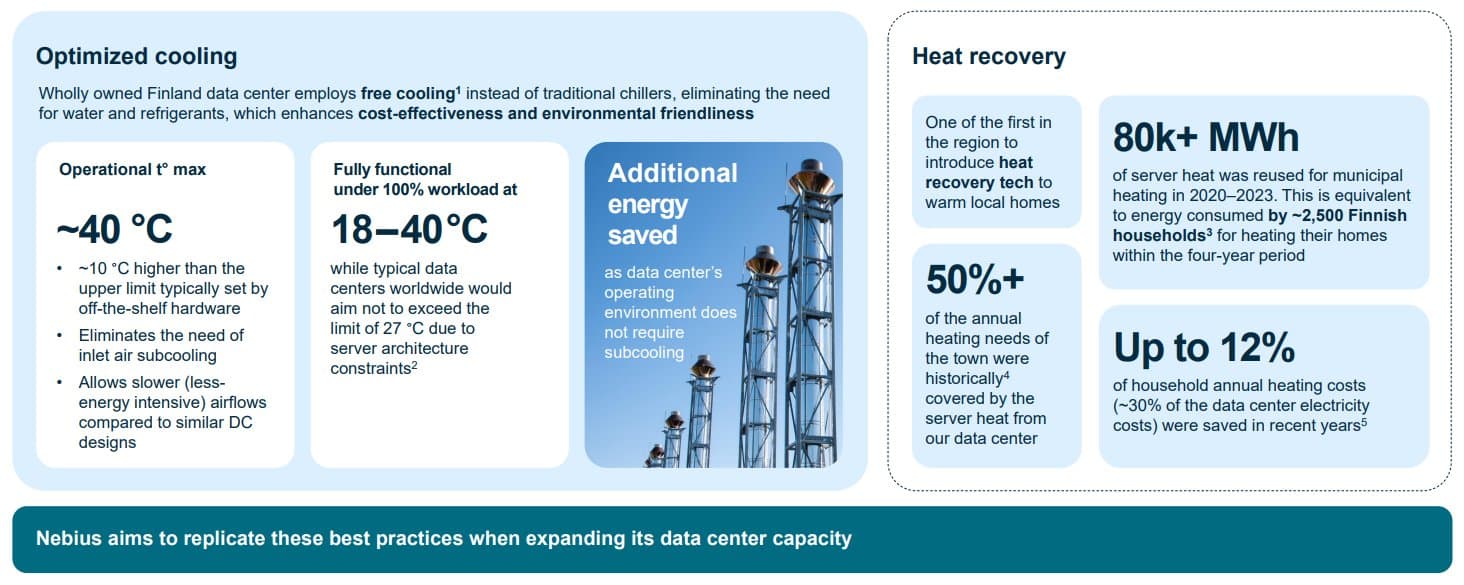

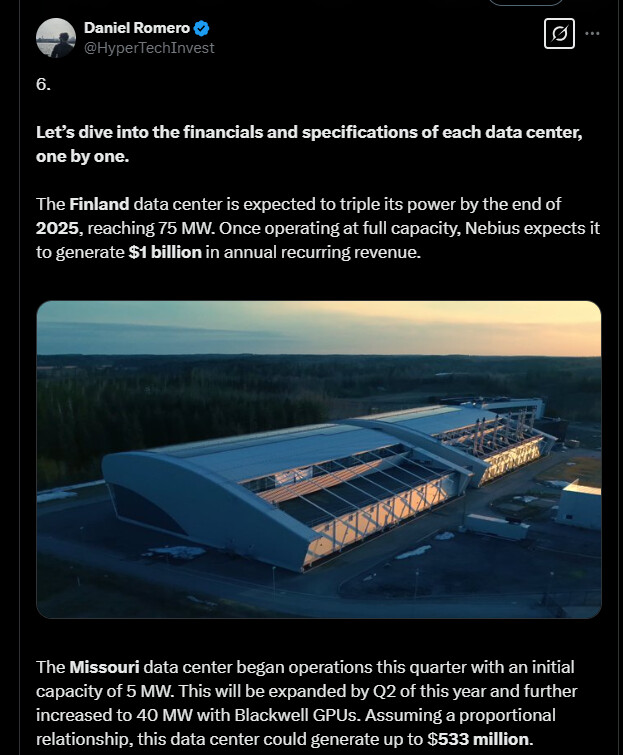

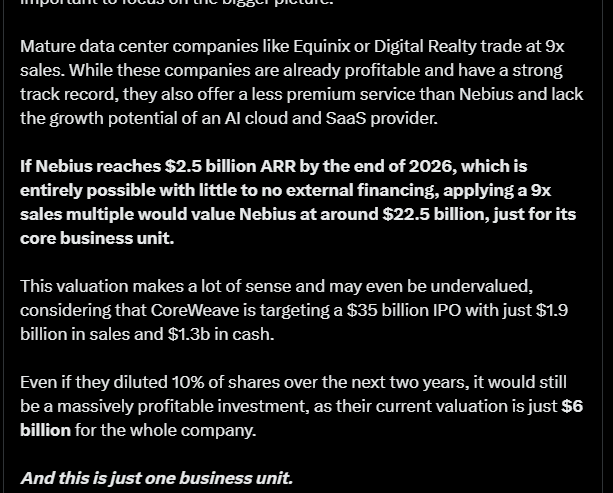

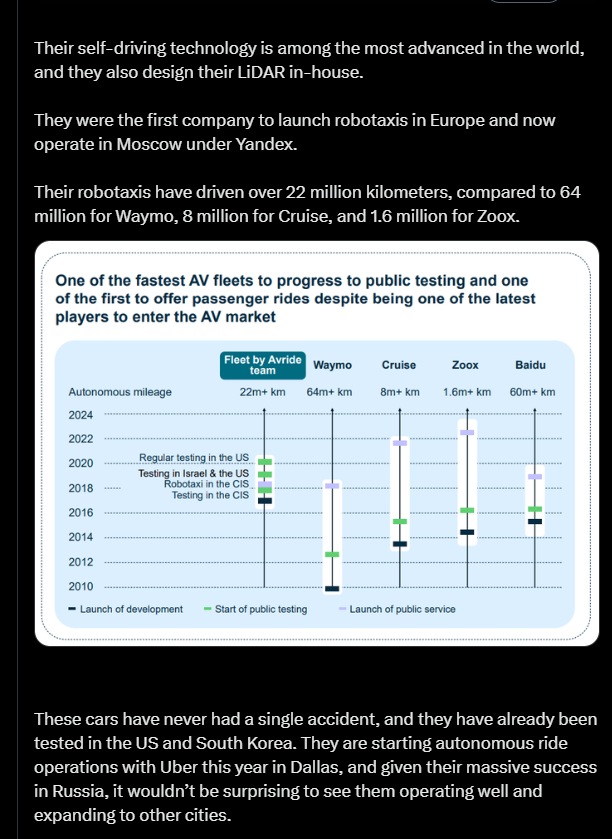

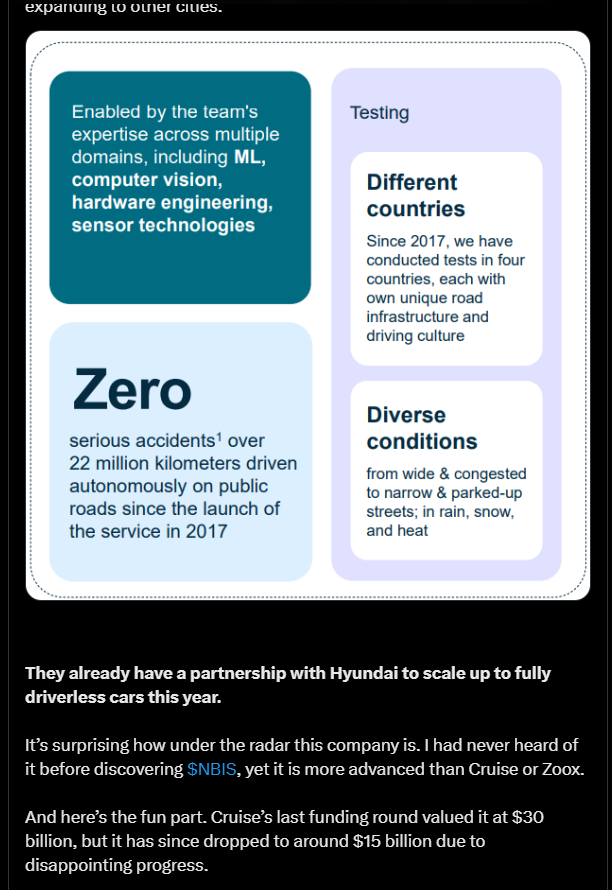

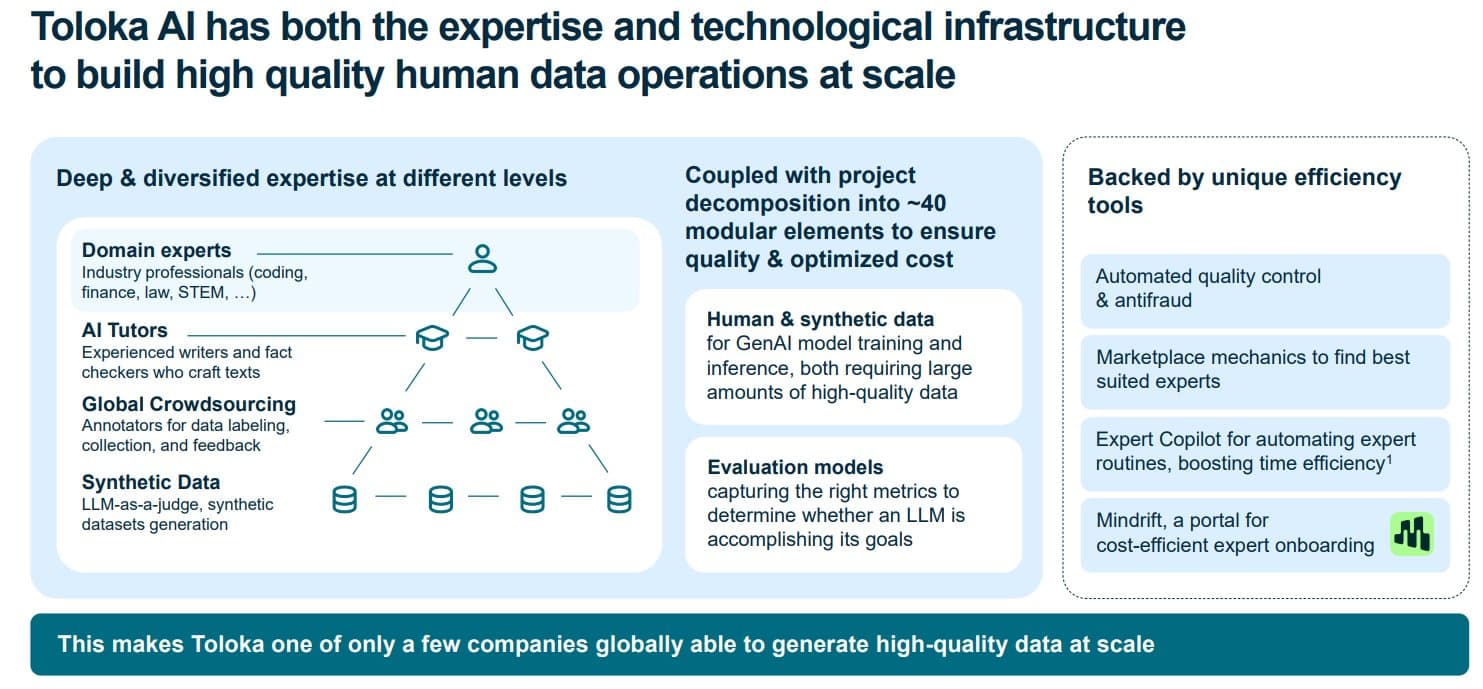

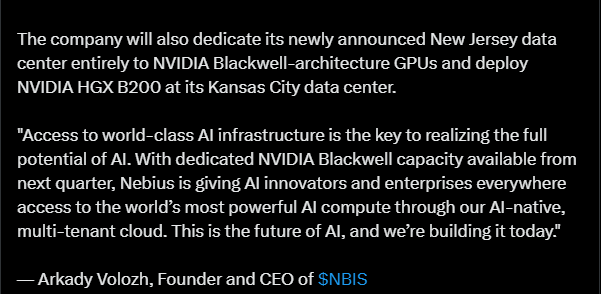

Nebius has a data center in Mäntsälä (with a lot of Nvidia inside), and new server centers are also emerging in Paris and Kansas City. Among the company’s clients is the French Mistral.ai. Furthermore, the company possesses expertise related to AI development and training. There is also expertise related to autonomous driving. A good set of information to get acquainted with the company is here:

Nebius Group Investor Presentation

It will be interesting to follow how the company fares. It is quite unprecedented for a team of a thousand professionals to physically change location, surrender capital and IPRs, but take their expertise with them to restart what they do best (i.e., AI cloud setup, development, and innovations), all done even better and from a clean slate.