Has anyone else here been following the “SPAC golden boy” from the US, namely Hims&Hers company?

The company was founded in 2017 and aims to be a digital front door to healthcare services. Currently, the company offers health services and products to American consumers online. To my understanding, the company also has its own products, but mostly it’s about connecting customers with healthcare professionals.

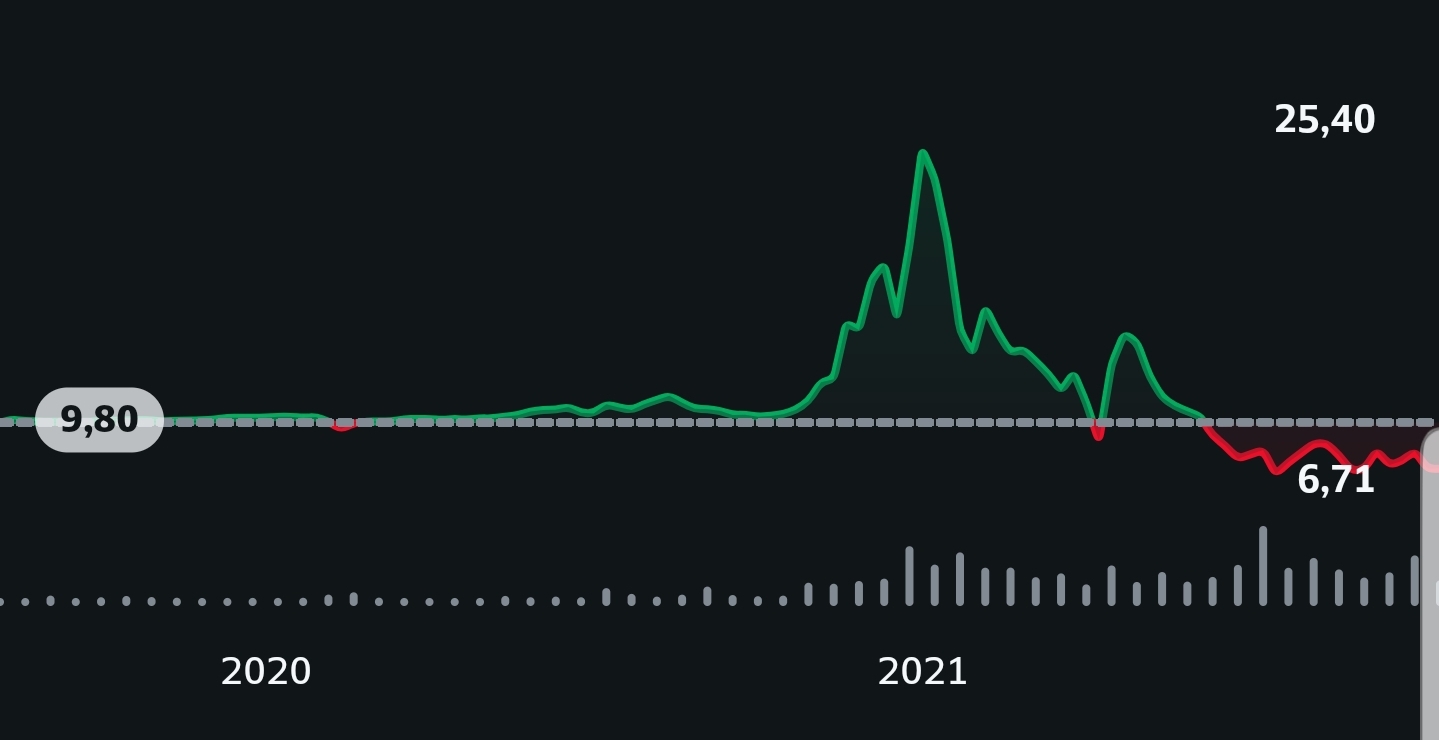

The stock price has been high and has now stayed around $6-8 for several months.

I bought an opening position today because the company has big growth plans and, admittedly, has seen successes:

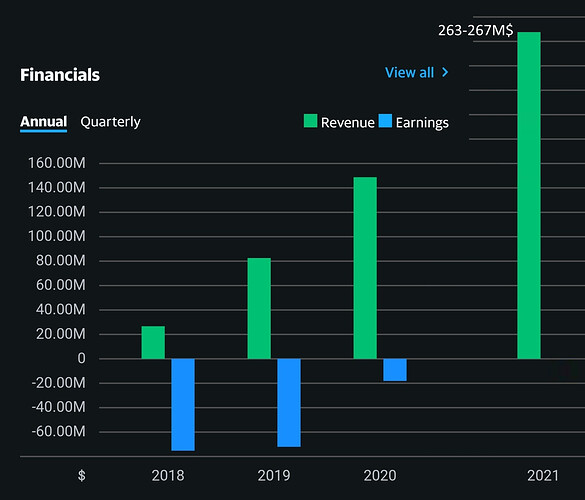

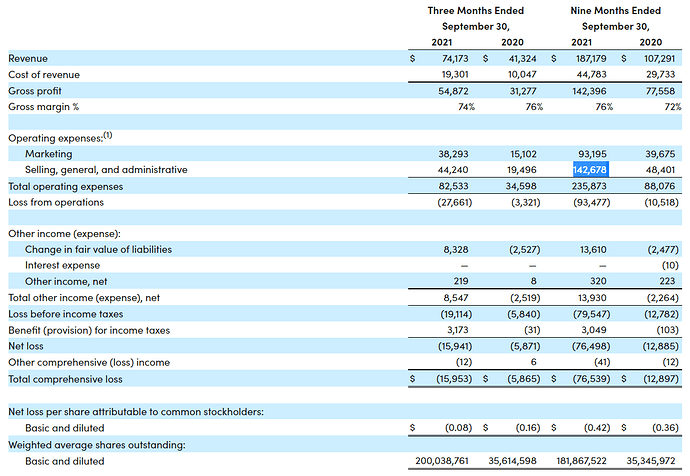

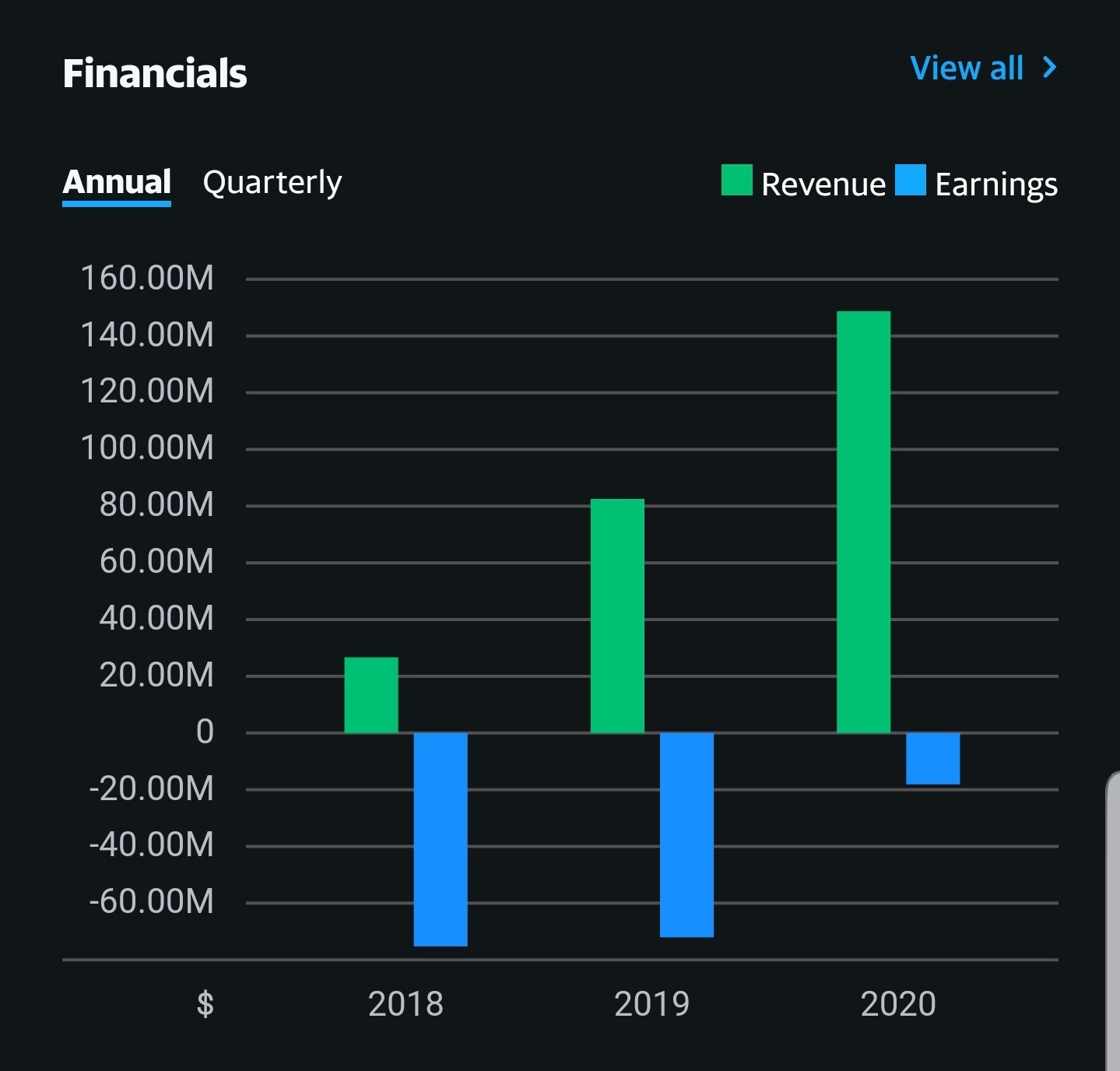

Exceeded revenue guidance for Q3/2021 and simultaneously raised full-year 2021 revenue guidance.

Y-O-Y growth 79% (Q3/2020 → Q3/2021)

EBITDA positive (Q3/2021 $9.8M vs. Q3/2020 $1.6M)

Number of subscribers grew 95% Y-O-Y (Q3/2020 → Q3/2021)

Multiples:

Forward PE -20.95

P/B 5.08

P/S 13.32

Recommendations according to WSJ:

Buy 3

Overweight 0

Hold 1

Underweight 0

Sell 0

The average target price is $12.25, meaning approx. 65% upside based on the closing price on 12.11.2021

The company’s business scales reasonably well, due to its fundamental nature: software and digital services for customers are at its core.

The company’s defensiveness is enhanced by, among other things, its consumer business and the fact that it operates in the healthcare sector where there is naturally demand even during difficult times.