Heineken N.V. is one of the world’s most famous and largest breweries, originating from the Netherlands. The company was founded in 1864 when Gerard Adriaan Heineken, at just 22 years old, bought a brewery called De Hooiberg in Amsterdam. From the beginning, the company aimed to distinguish itself through quality and innovation. In 1869, Heineken switched to bottom-fermenting yeast, which improved the beer’s taste and shelf life. In 1886, “Heineken A-yeast” was developed in Heineken’s laboratory, which is still an important part of the company’s brewing process.

During its initial decades, Heineken expanded, opening a second brewery in Rotterdam in 1874. Over the years, the company grew and began exporting to various parts of the world. Heineken was the first foreign beer to arrive in the United States three days after the end of Prohibition, which helped solidify its position as an internationally recognized brand.

In the 1930s, Alfred Henry “Freddy” Heineken joined the family business and was a key figure in the company’s international expansion. Under his leadership, Heineken acquired several competing breweries and made significant investments to grow the company globally. In the 1960s, Heineken merged with its competitor Amstel, making Heineken a leading beer producer in Europe.

In recent decades, Heineken has continued its expansion through acquisitions and strategic partnerships. In 2008, it acquired parts of Scottish and English breweries, making it one of the world’s largest brewing companies. Additionally, the company has expanded its product portfolio to include specialty beers and ciders.

Heineken is particularly known for its green bottle and red star, and it is widely recognized as a symbol of quality beer. Today, Heineken beer is sold in over 170 countries, and it is known not only for its traditional lager but also for many other brands, such as Amstel and Strongbow. In 2023, the company continued its expansion by acquiring Distell and Namibia Breweries, among others.

Heineken is also committed to sustainable development and environmental protection. The company has set a goal to reduce carbon emissions and use renewable energy sources. Heineken’s breweries have reduced their water consumption and constantly strive to find new ways to reduce their environmental impact.

From an Investor’s Perspective

Heineken is not only a brewing company with a long history but also a modern and responsible player aiming for the future. Its success is based on its ability to combine tradition and innovation, making it one of the most enduring and respected brands in the beer world. It has managed to maintain its old reputation, but it knows how to live with the times.

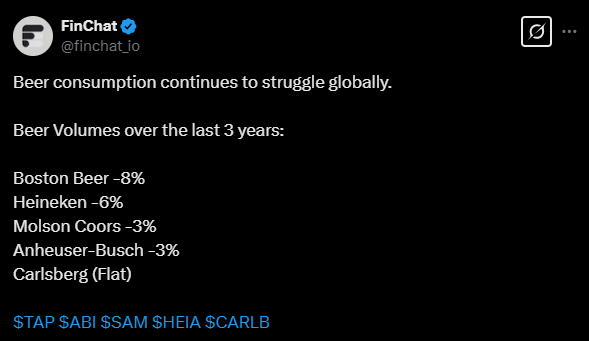

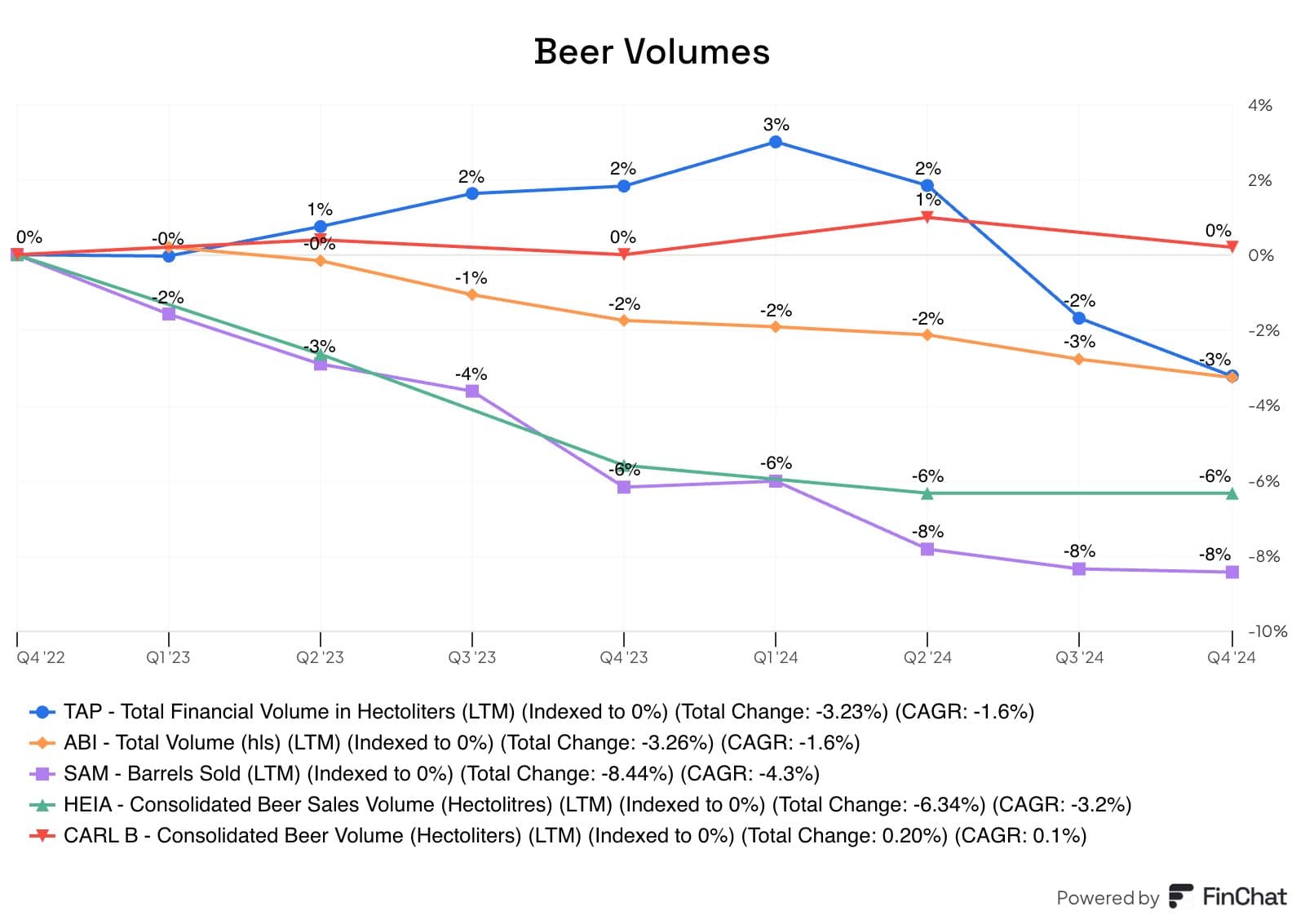

Heineken’s broad “portfolio” includes various beers and non-alcoholic beverages, which allows for risk diversification. The company is known for its quality and innovative products, which helps it remain competitive. Heineken’s strategic expansion into emerging markets such as Asia, Africa, and Latin America offers significant growth opportunities, even if drinking has not been as popular in some older regions, it has conversely been guaranteed elsewhere. In these new regions, growing purchasing power and demand for premium beers support Heineken’s long-term growth.

Heineken also adapts to changing consumer preferences, such as the popularity of craft beers and non-alcoholic options. This allows the company to attract new customer segments. Additionally, the company continuously invests in research and development, enabling the launch of new products and flavors.

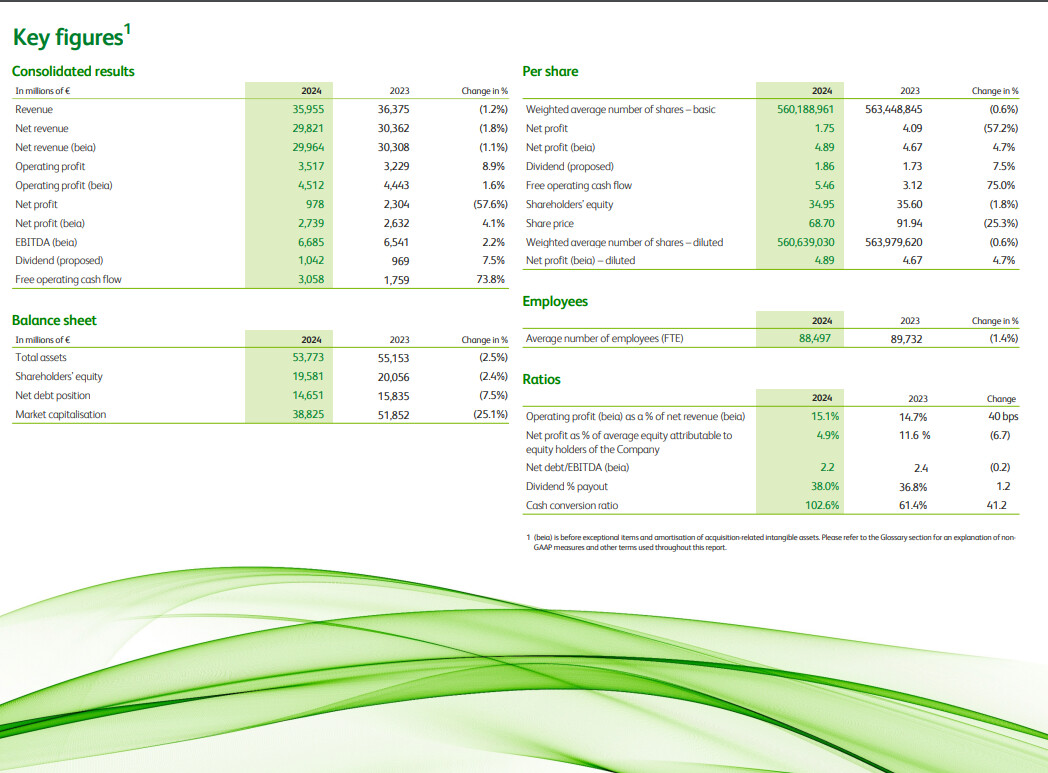

Heineken’s strong financial results and stable growth make it, in some opinions, an attractive long-term investment. The company’s ability to innovate and adapt to a changing market environment is crucial for its success.

Reading Material:

Q2/2024

https://x.com/Quality_stocksA/status/1817825568009712056

Heineken announced that it has recorded an impairment of 874 million euros on its investment in China Resources Brewery, China’s largest brewery. This is due to weakening consumer demand in China, which has put pressure on the share price. The impairment has resulted in a net loss of 95 million euros for Heineken in the first half of 2024. This is a significant change compared to the 1.1 billion euro profit in the corresponding period last year. ![]()

The situation highlights the challenges in the Chinese market, where macroeconomic factors, such as an economic slowdown, affect consumer spending. Although beer sales growth exceeded expectations at 2.1 percent, it still fell short of analysts’ forecast of 3.4 percent growth. This underscores the challenges and uncertainties of global operations. Heineken must adapt its strategies to better respond to changing economic conditions and consumer behavior to sustain its long-term growth.