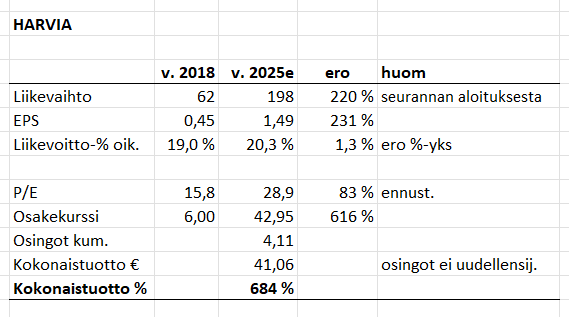

I made a small analysis of Harvia’s total return from summer 2018 - present, based on Inderes’ reports. Now I delved a bit deeper into the sources of shareholder return, hopefully it went at least roughly correctly, as I’m not very good at valuation. @Rauli_Juva if you wouldn’t mind taking a look at my thoughts, I’d love to hear your comments!

Harvia’s business has developed strongly:

- Revenue +220%

- EPS +231%

- Adj. operating profit % 19.0% → 20.3%

So, the business has performed excellently. Now let’s look at valuations and returns:

- Share price has risen +616% (since the start of coverage, i.e., €6.00)

- Dividends have totaled €4.11 over the entire period

- Total return is +684% if dividends were not reinvested

Now to an interesting figure, namely valuation:

- P/E has risen 15.8 → 28.9, i.e., +83%

In reports back then, an “acceptable P/E” ratio for Harvia was floated around the 14 level. Now the question is, what would be today’s “acceptable P/E” ratio?

Harvia has expanded quite a bit, so its risk profile has, in principle, decreased. Additionally, growth targets have been raised, and profitability is (slightly) better. So, by all accounts, one could assume the valuation level has also increased. But by how much?

Well, this was a brief outline but roughly illustrates how the company has grown and where the returns have come from.

A larger portion of the return has come from earnings growth (which is a good sign), but the increase in valuation has also brought significant gains. And dividends have been substantial (considering that the subscription price was €5.00 and dividends have already totaled €4.11).