Why would the quality of Elisa’s business have changed right now?

New CEO and his track record

Why would the quality of Elisa’s business have changed right now?

New CEO and his track record

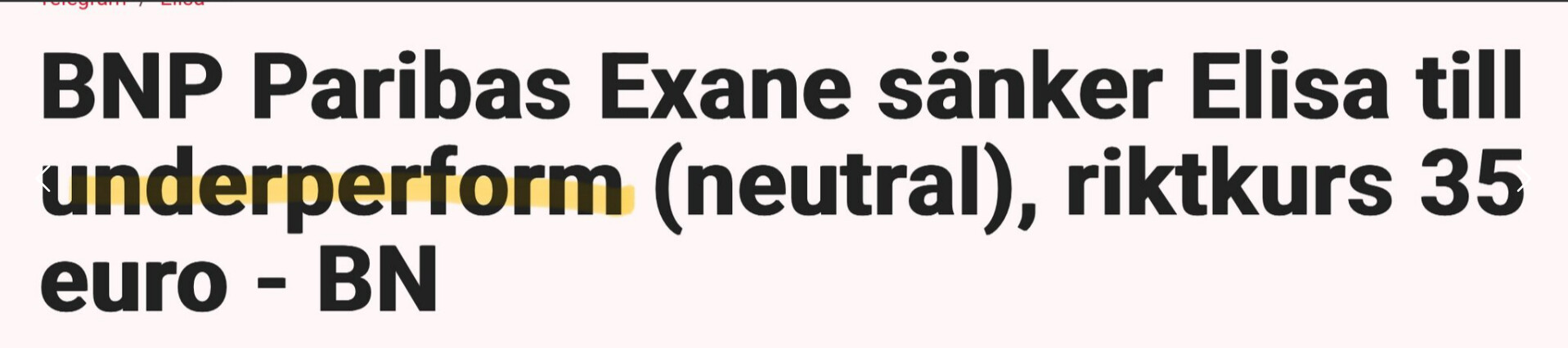

A couple of target price changes for Elisa.

![]()

There is no precise published information on these, but I would estimate that subscription competition is still intense or even more intense than it was in the autumn—at least judging by the discussions on Matkapuhelinfoorumi. For example, a 5G subscription (300M unlimited) could now be obtained from the market for €14.99/month with a nice gift card. This is being advertised quite openly. It’s worth mentioning that the so-called normal campaign price about a year ago for this type of subscription was around 24–27 euros per month.

Operator campaigns | Page 489 | Matkapuhelinfoorumi - The most popular mobile phone forum

Our family also jumped on this competitive bidding. DNA halved our household’s operator fees when we left Elisa. A 25-year customer relationship came to an end.

It’s also interesting now that I’ve tested the service and speeds; DNA is delivering about 2-3x the speed compared to Elisa… all subscriptions + home internet, which runs on the mobile network. The subscription types remained the same. Both operators have their masts in a cell tower 300 meters from the house.

Like a fool, I’ve been paying a high price for worse service.

Over the past year, competition between operators has intensified more than at any other time this millennium, and by switching, massive discounts are available regardless of your current operator.

It will be interesting to see where the breaking point is, now that subscription prices have been slashed to as little as a third of their original rates. You would expect this to be reflected in margins within a couple of quarters at the latest.

That’s how they always work during the cooling-off period stipulated in the Consumer Protection Act. Operators can prioritize customers, and new customers are at the top of the list initially. In uncongested areas, this doesn’t matter because there is enough bandwidth for everyone, but if the speed has previously been dependent on congestion—i.e., the time of day—then that explains it.

Yep. I think this is a very interesting situation to follow, practically illustrating why competing on price is a losing strategy in a saturated market – perhaps even to the point where everyone loses.

The mobile subscription market is saturated because practically every Finn already has a subscription and population growth is not very rapid. It is unfortunate, of course, that low prices also require cost leadership, which leads to adjustments in personnel costs – as they are a significant expense for operators.

I would wager that we will see some signs of strain in Elisa’s Q4 results. The number of subscriptions will continue to decline, and consumer postpaid ARPU will take a historic turn downwards.

Of course, in the contract business, KPIs are always reflected in revenue and earnings after the fact (e.g., if you cancel a subscription in month x, it usually only starts decreasing revenue in month x+1) – which is why the Q1 results will, in any case, be where this trend becomes more clearly visible.

Thanks for the post. Based on that, I had to go ask about subscriptions in the chat, and I eventually found a 300 Mbps 5G plan from Telia for €14.99 + a €60 Lidl gift card thrown in. At one point, I was considering investing in Elisa, but this current competitive landscape doesn’t exactly encourage it. Just a couple of years ago, customer retention was quite high and the situation was calm, but now there seems to be a price war going on.

Elisa’s Topi Manner-ization has indeed been startling to watch. Will there be any stone left standing once the dust has settled? The saddest position in the portfolio!

Of course, many are likely wondering: if everyone is losing, won’t this price dumping eventually stop at some point?

I’m afraid that recovery won’t happen overnight; a more likely scenario would be something similar to the current state of the housing market – a slow recovery.

There are a few main reasons for this:

If you find Elisa’s discounted share price attractive, it’s worth considering what an attractive P/E ratio would be in light of these facts. From the 37 euro price level, there is still some way to go to a P/E of ten, which could be the valuation multiple for flat growth.

I really don’t believe that Topi Manner has much to do with this development. In fact, quite the opposite – the building of a messy multi-department store and the hiking of prices, the hangover from which is being felt now, started and almost ended during the previous CEO’s tenure.

My portfolio has always contained a certain number of operators. The reasoning has been that entering the industry with one’s own base station network is extremely expensive, and operators are not forced to compete themselves to death or let virtual operators (MVNOs) into their networks at any price.

For years, prices were being raised, but now it seems they are backing off again. Fortunately for the bottom line, I understand there isn’t such high investment pressure on networks at the moment, as 4G networks have been built out quite nicely in the dead zones resulting from the 3G network shutdown. The fiber optic boom has also reduced the load on suburban base stations as home internet connections are being switched from mobile to fiber.

Elisa did indeed seem to reduce its CAPEX spending slightly in Q3. 5G networks are quite extensive, so one could imagine there is room for cash flow optimization in that area.

A lot of good points – thanks for that! I’ll just comment that I personally wouldn’t worry about it dropping all the way to a P/E of 10. Even if we assume zero growth, I believe a company generating such defensive and steady cash flow would be valued at a higher multiple. That would also be a very low valuation compared to its history. Even now, in a fairly bearish sentiment, the P/E is around 15. I would think that a P/E of 10 would require a significant rise in interest rates in addition to zero growth. I do follow news and discussion regarding Elisa closely, as it is one of my largest investments (approx. 3% of my portfolio), but I’m not very worried yet.

Elisa has an unusual stone in its shoe. Greenland-style cold winds usually favor operators. This happened globally; major operators are performing strongly today, e.g., Deutsche Telekom up over +3%.

However, Elisa has drivers leading up to 2026:

+€40m from staff reductions

+€8m from corporate tax reduction

+€2m from the slump in electricity futures (though I don’t know how savvy Elisa’s electricity buyers have been regarding the market and whether they managed to take advantage of the situation. But that would normally be a saving)

And the company could quietly explore a merger/sale of its International Digital Services. It’s hot stuff right now, but with Elisa’s bureaucratic organization, it will only result in losses.

Corporate tax won’t decrease in 2026 but in 2027. The benefits of the corporate tax cut will likely largely flow to customers because the tax will decrease for all companies, at least in theory, if competition works.