This analysis would be interesting to read, so Goldman Sachs is still quite bullish on Elisa, and I understand they also favor other Nordic telecommunication companies. Andrew Lee seems to be the analyst, if anyone wants to get in touch ![]() . From Kauppalehti’s flash news: Goldman Sachs lowers Elisa’s target price to EUR 60.00 (previously EUR 62.00), reiterates buy recommendation.

. From Kauppalehti’s flash news: Goldman Sachs lowers Elisa’s target price to EUR 60.00 (previously EUR 62.00), reiterates buy recommendation.

I can personally give a purchase recommendation for a new subscription - why not from Elisa, for example ![]()

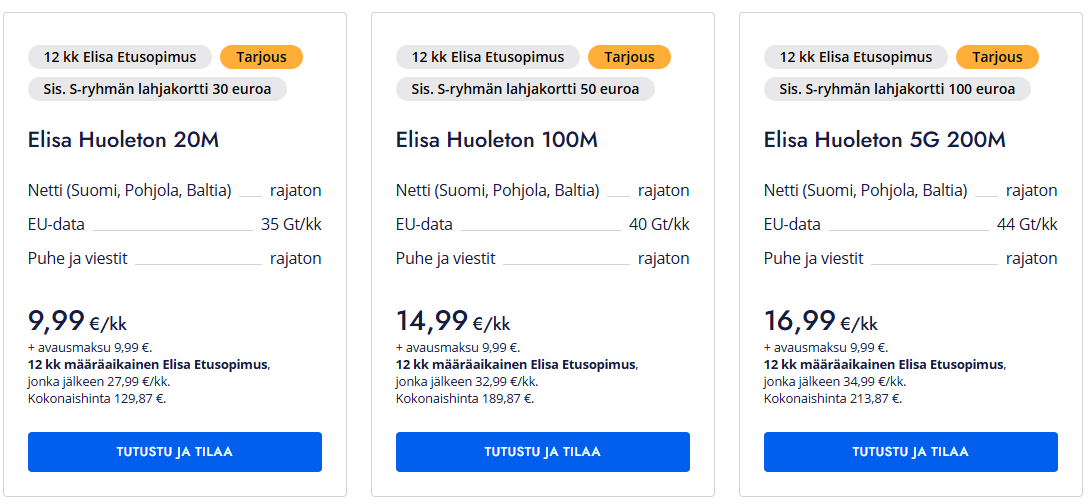

So, put the competitor’s subscription here: See secret offer - Elisa - Online Store and you will get the following:

Not everyone gets such good deals, here’s the secret “offer” I got:

You see, the way it works is that only new subscriptions get those cheaper prices, while old ones are allowed to continue with their current exorbitant prices. Go to a shopping center with several stores, switch your subscription to a new operator for a new price, then walk a couple of meters and switch back to your old operator for a better price.

On the corporate side, there’s a chilling atmosphere right now; costs are being cut everywhere. This is not good for Elisa, as everyone is doing the same everywhere at the same time. Price competition is fierce on the consumer side, and the fact that Elisa has had 11 restructuring talks this year is no surprise; results will drop sharply next year. Will the dividend also drop? Time will tell, but it doesn’t look good.

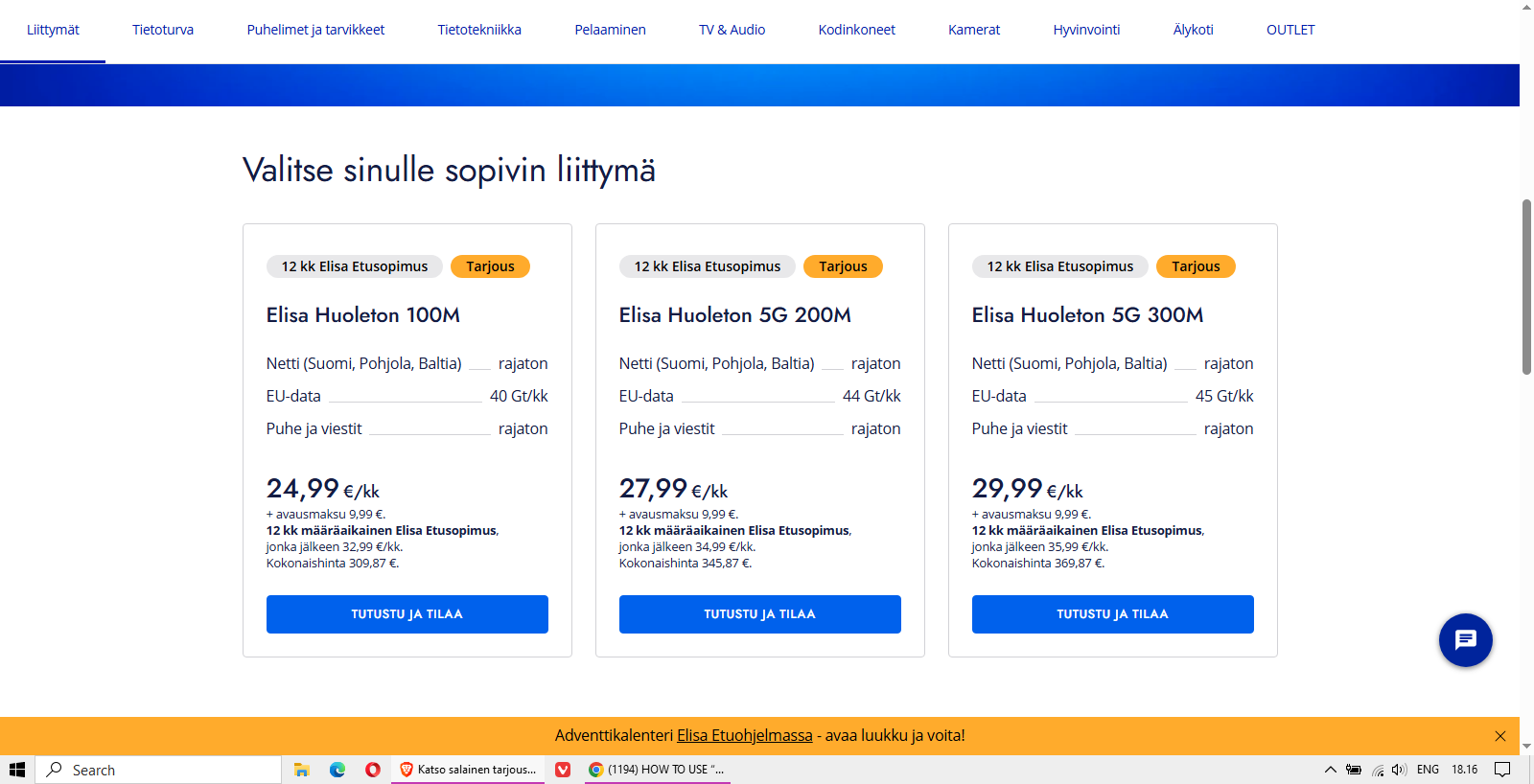

I currently have DNA and Elisa’s offers, which are those 25-30€. I have tried that automated offer system several times, and it has never offered anything cheaper than that.

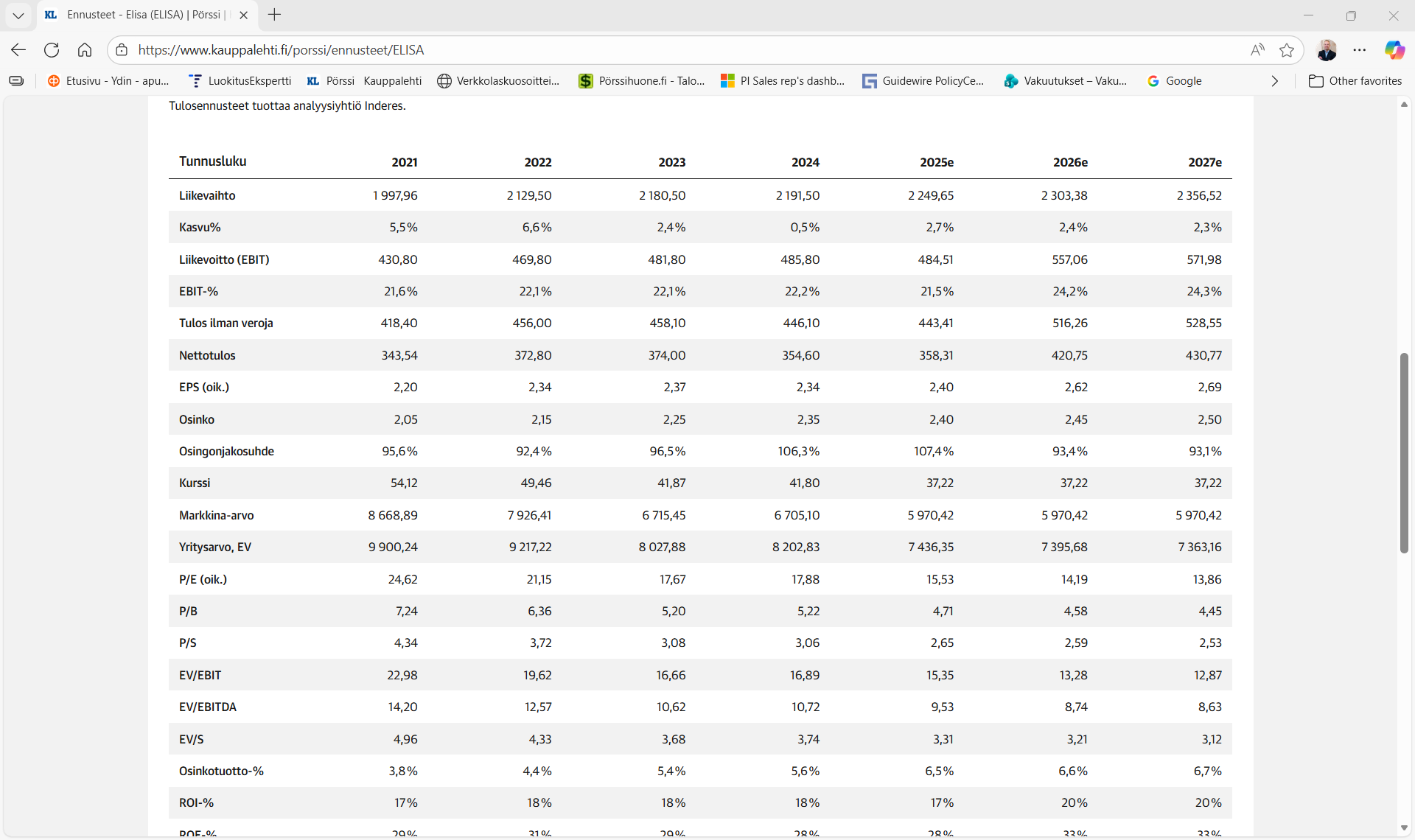

That subscription fee discussion is a bit pointless here… their fluctuation is a zero-sum game between companies, meaning market share isn’t quickly grown with it. What companies do is get customers to switch to slightly more expensive subscriptions across all companies and upgrade them to 5G subscriptions. Elisa has expanded its operations to other areas besides subscription sales, but that share is still small. The stock price drop is a bit puzzling, as nothing revolutionary has actually happened. There isn’t much growth, but this can rather be considered a bond-like investment with a good 6.5% dividend, and as a bonus, perhaps sometimes a rise to the +50 level predicted by analysts, or was there now a recommendation cut from 62 euros to 60 euros somewhere. I don’t know what the driver would be for it to rise there.

The market has started to view Telia as higher quality because it is valued at higher multiples. Elisa’s dividend yield is, for a change, better than Telia’s due to the share price drop. The gains from Telia were apparently realized a bit too early.

This price war is a bit out of control now. And this isn’t even the best offer. These 300M 5G have been sold for under 15€, and even with gift cards included.

By comparing market value instead of enterprise value, one quickly makes the mistake of not taking into account the company’s debt position in any way. Elisa is, however, quite an indebted company.

Elisa’s EV/EBIT seems to be somewhere around 15-16, and it describes valuation much better than market value/EBIT.

I’m trying to understand why Elisa was given a target price of 50 euros just a moment ago, and Barclays lowered its target from 62 euros to 60 euros the week before last. Looking at the income statements, only a good dividend yield supports that, along with very moderate, even small growth. Of course, it’s generally stable, even though the share price has now fallen from 45 euros to 37 euros. At this price, the dividend is quite nice, and perhaps small growth could encourage adding to the stock.

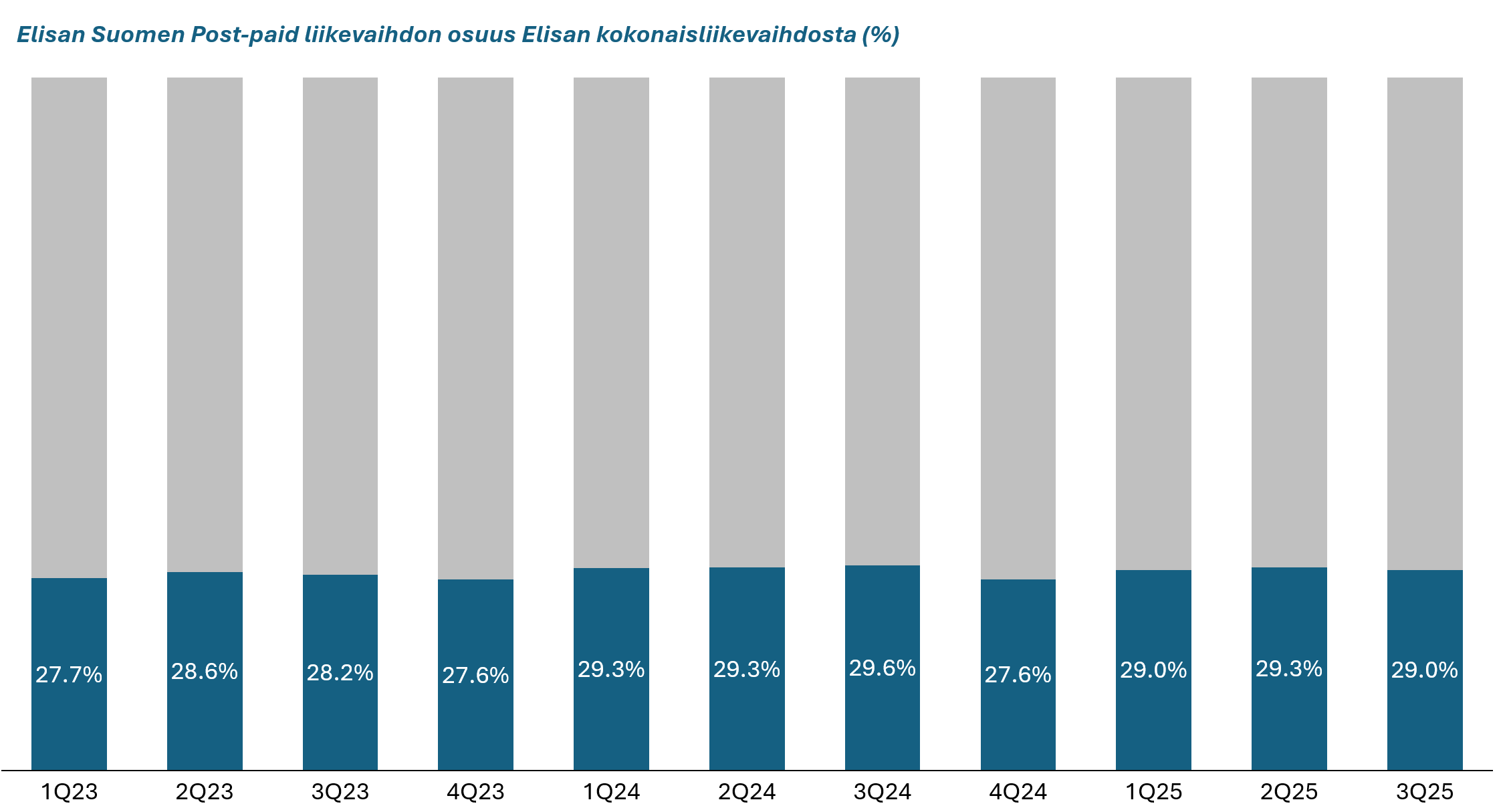

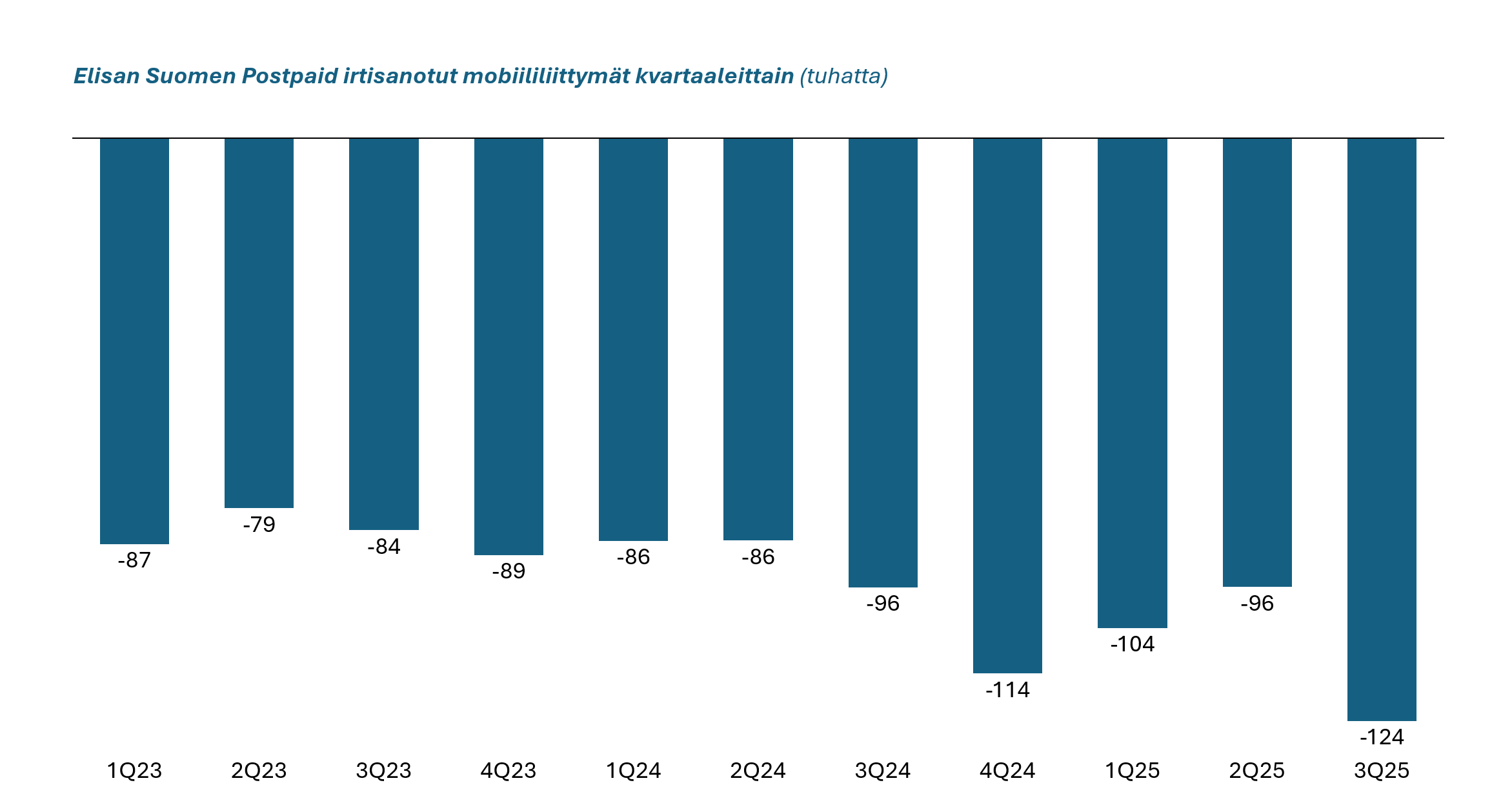

A good point of wonder! I could elaborate a bit on the significance of this subscription price situation. The data presented in the accompanying graphs comes from the “operational & financial data” file published in connection with Elisa’s interim report.

1. The problem concerns approximately 30% of Elisa’s business:

Finnish consumer postpaid mobile accounts for just under 30% of Elisa’s business.

So, not even half of Elisa’s total, but since the rest includes a lot of device business, lower-margin IT, and other non-scalable operations, this is a significant part of the overall margin. It should be noted, of course, that Elisa also has other significant mobile business – for example, in the corporate sector and Estonia, but their importance is small in relation to Finnish consumer mobile.

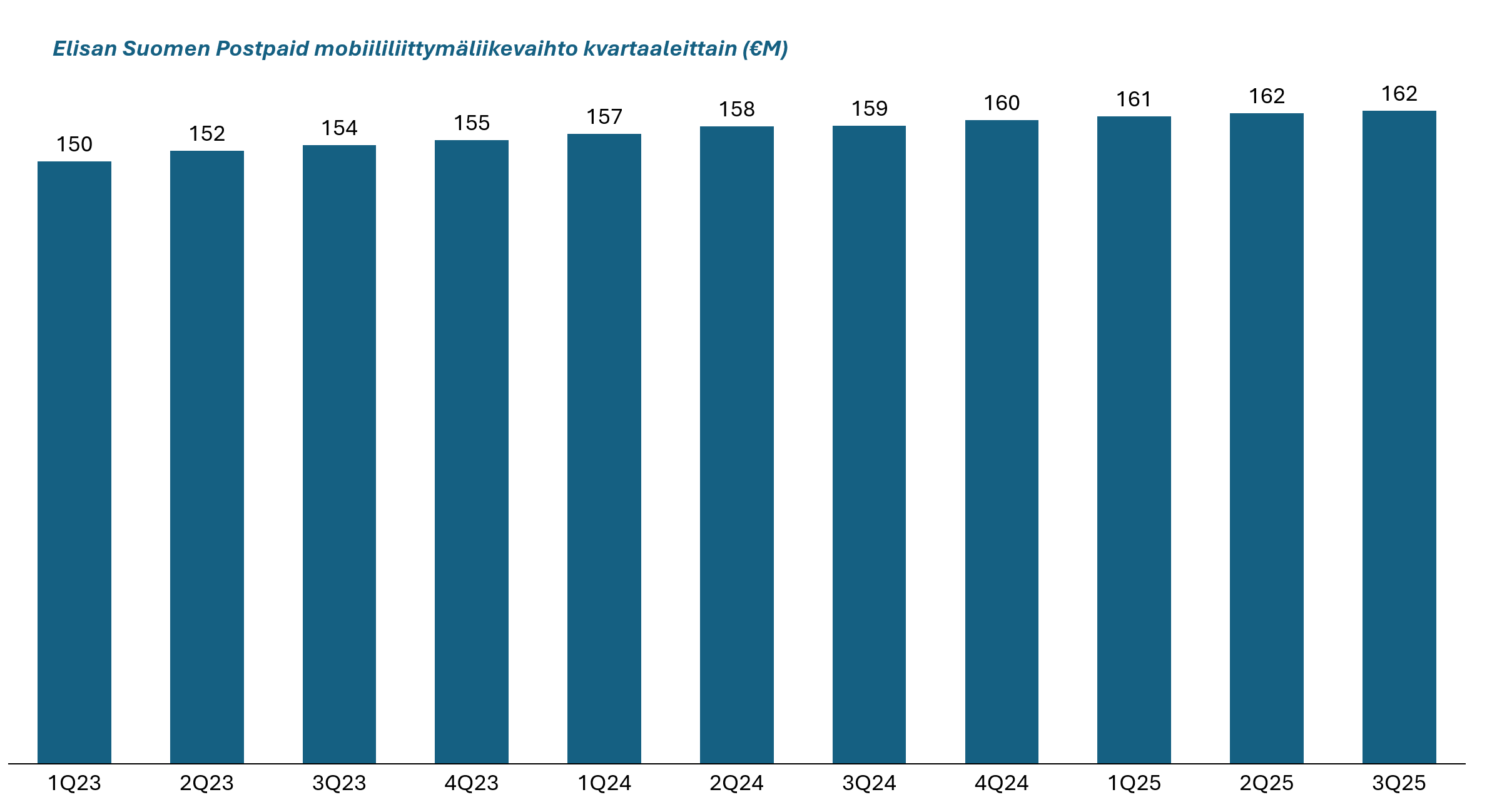

2. Revenue is over 160M per quarter

Elisa’s total revenue is over 2 billion, so that 30% is a significant sum.

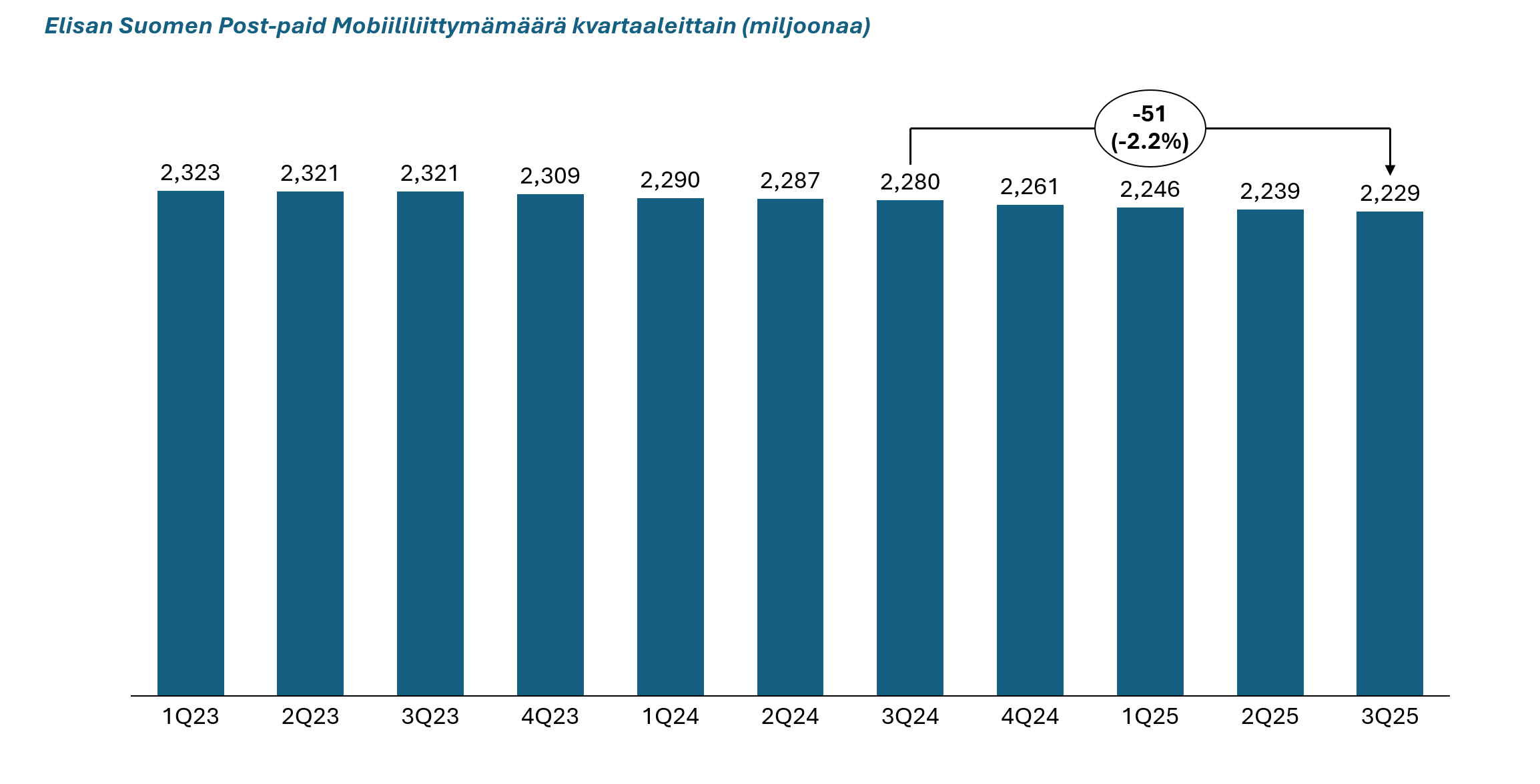

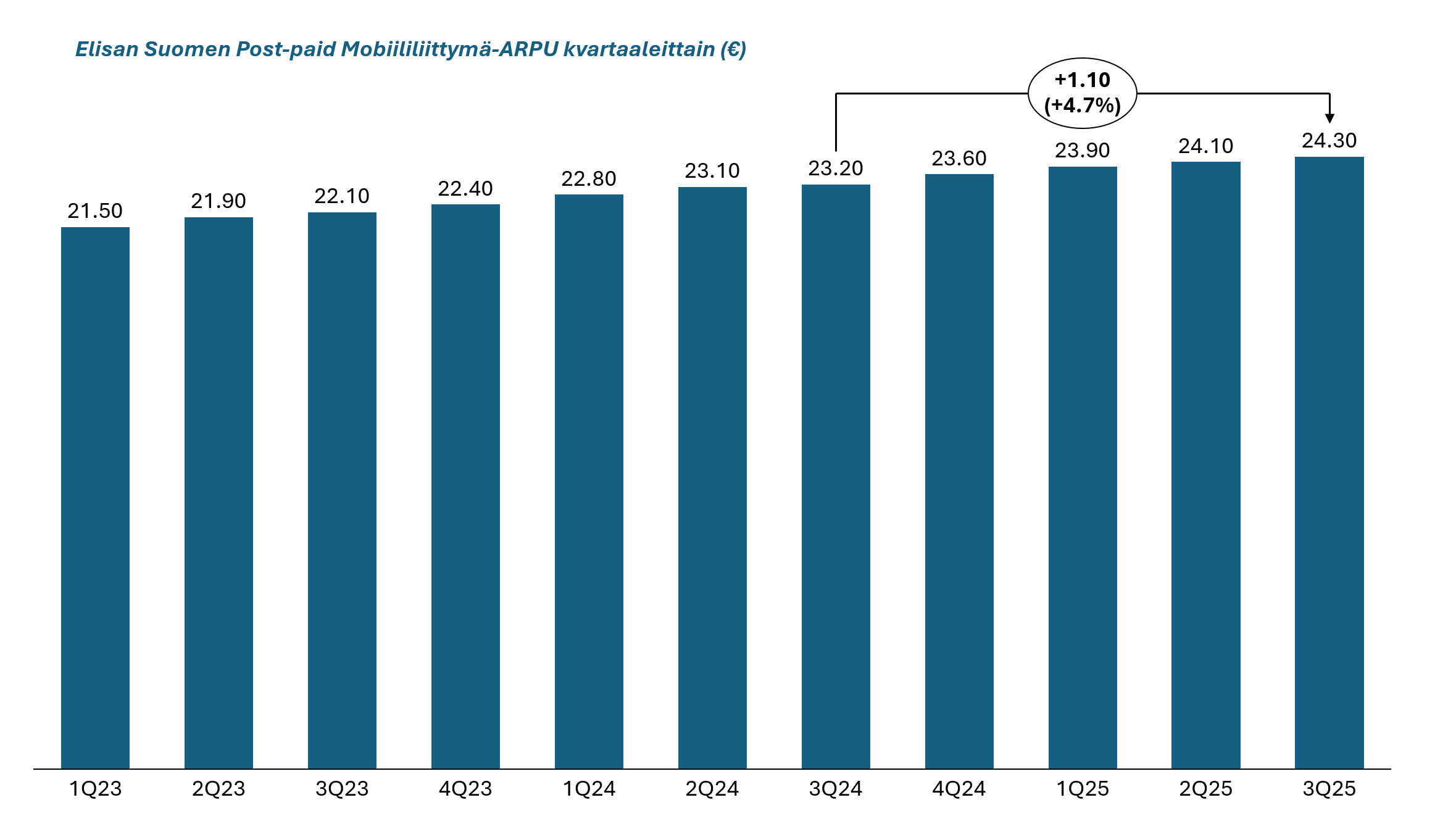

- Mobile revenue can be expressed as the product of ARPU (average revenue per user) and the number of subscriptions. Elisa’s ARPU has risen sharply in recent years, but the number of subscriptions is declining.

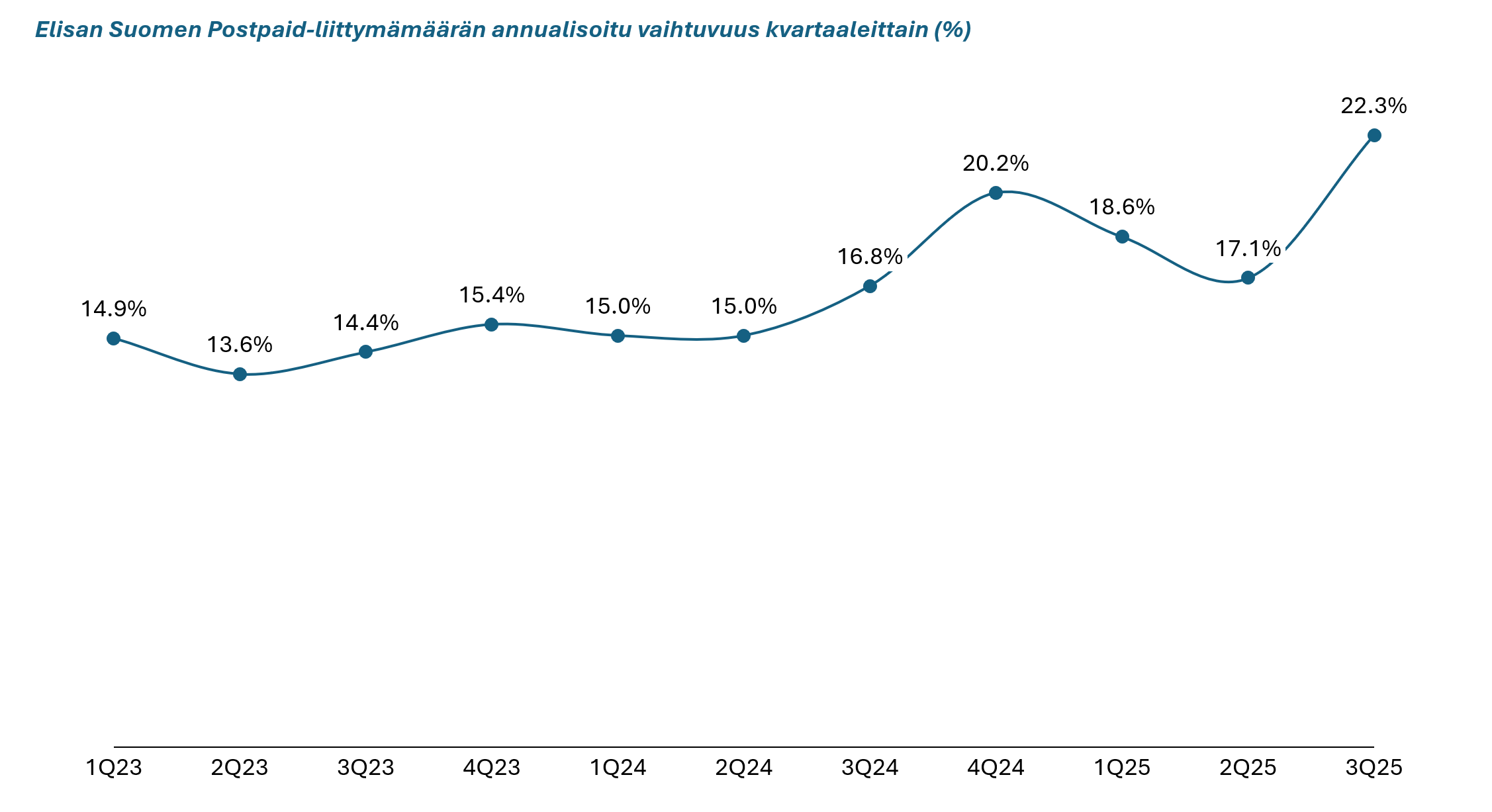

4. Recently, the competitive situation has intensified, which practically means that the churn rate of subscriptions has increased. Elisa saw approximately 124 thousand subscriptions terminated in Q3.

And now we get to why this subscription price situation is significant. To replace that churn, Elisa needs to ideally sell at least the same number of new subscriptions – or try to save more subscriptions.

However, the situation now is such that if you want to sell a subscription, it must be offered at an average price of around 15 euros or less (VAT 0), and if you want to save it, then the price must be dropped to around 12 euros.

In addition, sales (sales commissions) and perks must be paid at the same per-transaction prices as before – perhaps even more if we are talking about perks.

Indeed, we are still talking about a 30% share of Elisa’s revenue, but if we now assume that the average price, which was 24.3 euros, would drop to 23 euros next year as competition continues, and Elisa continues to lose subscriptions, e.g., to 2.2 million subscriptions, then the total revenue impact of this component next year would be -40M, which would be reflected quite directly in cash flow or EBITDA, as this is scalable revenue. That seems to be precisely the savings effect of that co-determination negotiation (YT-urakan) effort.

According to Kauppalehti’s information, Elisa would be publishing the results of the co-determination negotiations tomorrow, and 400 people would have to leave. If this is true, then the outcome is as previously predicted.

There’s at least a minor crisis going on at Elisa. It comes to mind that they have lost market share/lost to competitors recently. Telia has been rising for a couple of years, Elisa has been falling all the time. These companies are in completely different realities now. The roles have changed; this is an inevitable conclusion.

Telia is undeniably doing okay, especially considering its share price was around 1.6x€ a couple of years ago in the summer. Now Telia is at 3.52€ and on its way to a nice 6% dividend yield on top.

Compared to Elisa, Telia benefits from its low dependence on a single market. Finland accounts for about 15+% of revenue and, in my estimation, even less of operating profit (EBITDA). Of course, Sweden’s weighting is significant, but it also seems to be under 50% by both metrics. Telia also gets a nice bonus from the developing markets of Lithuania and Estonia.

Compared to Elisa, which has a strong dependence even on the fickle Finnish consumer market alone, I would say Telia is now a less risky option, as its TV and other past issues are behind it.