New contracts seem to be coming in quite nicely for e18 Innovation, acquired by Digital Workforce. NHS seems to be positive towards these services.

https://www.linkedin.com/company/e18-consulting/posts/?feedView=all

New contracts seem to be coming in quite nicely for e18 Innovation, acquired by Digital Workforce. NHS seems to be positive towards these services.

https://www.linkedin.com/company/e18-consulting/posts/?feedView=all

Here are Joni’s comments on how DW completed the e18 Consulting acquisition. ![]()

Digital Workforce announced yesterday, as expected, that it had completed the acquisition of e18 Consulting Ltd. The company had already announced the deal in connection with its Q2 report, and we had previously consolidated the deal into Digital Workforce starting from Q4. In our view, the acquisition clearly expands Digital Workforce’s international growth opportunities and market potential.

Joni has given his preliminary comments as Digital Workforce publishes its Q3 results on IT Super Thursday. ![]()

Digital Workforce, a specialist in automation utilizing software robotics, will publish its Q3 business review next week on IT Super Thursday, in the morning according to our estimate. We expect revenue growth to have remained strong in Q3. We forecast profitability to have improved significantly from the comparison period and slightly from the previous quarter due to cost savings. Additionally, we will be keenly following the company’s comments on customer demand in different geographies.

@Joni_Gronqvist and Frans have given their quick comments on this morning’s result. ![]()

Software robotics utilizing IT automation service company Digital Workforce published a slightly weaker Q3 report this morning than we expected. Revenue was at the previous year’s level and fell short of our expectations due to weaker development in continuous services. Adjusted profit clearly improved from the comparison period, supported by cost savings and a better sales margin, but was slightly below our forecast. The company is behind last year in its guidance for the beginning of the year, but the rather good outlook for the end of the year and the acquisition will, in our estimation, raise Q4’s profit and revenue significantly higher than last year.

In my eyes, the credibility of the management and financial targets was now definitively lost. There has been a strong sales pipeline for several quarters already, but it simply doesn’t show in the figures, and the management isn’t even interested in the stock.

Digital Workforce CEO Jussi Vasama was interviewed by Iikka. ![]()

Topics

00:00 Introduction

00:15 Q3 highlights

01:27 Development of expert services

02:51 Recurring revenue was declining

03:46 Impact of cost savings on profitability

05:17 Development in different markets

08:50 Outlook for the rest of the year

Joni and Frans have prepared a new company report following Digital Workforce’s Q3. ![]()

We reiterate our ‘add’ recommendation for the share and lower the target price to 3.7 euros (previously 4.30 €), reflecting reduced forecasts. Digital Workforce’s Q3 was slightly softer than our expectations. The turnaround in results has encountered some bumps this year and progressed slower than we anticipated. However, we expect the company to grow organically better than the IT service market in the coming years, and for this growth to scale into profitability. We find the share’s valuation (2026e EV/EBIT 11x, sum of parts 4.6 €) attractive.

The market remains difficult. Public administration has retreated into a “roach mode” (ruutanamoodi), which is reflected in the gloom of several IT consultants. Next year doesn’t look better, but not worse either, because demand is already so low.

Regarding agents, buyers have an abundance of choice. Various solutions are trendily marketed as “agents,” which tends to confuse potential buyers. The situation was like a taxi stand at the main railway station at its worst, to put it a bit hyperbolically. Promises are overly ambitious, but when it comes to replicable concepts, it’s quieter.

It’s easiest for those in the Microsoft camp to adopt one of the Copilot technologies, and other US giants offer similar plugin solutions for those who have chosen their ecosystems. A difficult David vs. Goliath situation for DWF.

So, I’m not putting on my buying pants yet. Some patient operator dreaming of cross-selling might buy DWF, but it’s difficult to justify purchases based on that card.

e18 Innovation (e18), part of the Digital Workforce Services (DWF) group, is delighted to announce a new partnership with NHS Humber Health Partnership (HHP), one of the largest healthcare providers in the NHS. Under this exciting new automation programme, e18 will deliver an ambitious outpatient transformation plan designed to free up more than 26,000 hours of staff time each year, and generate circa £1m of tangible financial savings over the three year contract.

Announcement:

IT service company Digital Workforce announces it has extended its agreement with Portsmouth Hospital University NHS Trust by three years. Under the agreement, the company will continue to deliver and expand automation services in cooperation with the Trust and another partner, PSTG.

The existing agreement will be expanded with business process management, orchestration, intelligent document processing, and a 24/7 incident management service.

According to Digital Workforce’s press release, the UK’s NHS, or National Health Service, is one of Europe’s largest healthcare systems in terms of scale and scope, covering services for 56 million people.

The value of the agreement was not disclosed in the press release.

A smaller renewal contract was announced last week. I don’t think it was here yet.

It has been quite quiet on the press release front from DWF. Finland’s social and healthcare sector has been a significant client, but for known reasons, even “drastic” budget cuts are mercilessly slashing consulting demand. It’s also sad how image-boosting efforts go down the same drain as automation projects that bring savings.

In press releases, they gladly lead with AI/agent initiatives, but it seems harder to convert that into revenue. So, things are going pretty much as expected.

The share price has steadily fallen towards the turn of the year, and this stock also seems to be one of those being sold off due to tax-loss selling. With thin trading volume, sales quickly impact the share price.

Already in Inderes’ stock comparison, the difference to the target price is worth a silver medal on the Finland list (+38 percent).

Joni has prepared a new comprehensive report on Digital Workforce, and as usual, this extensive report is available for everyone to read. ![]()

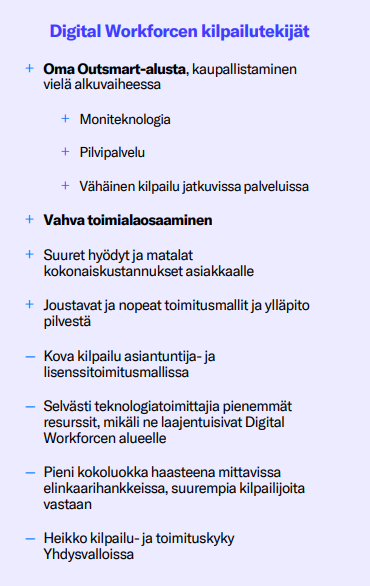

Digital Workforce automates clients’ knowledge work processes by utilizing software robotics and artificial intelligence. In recent years, the strategy’s focus has reasonably narrowed down to selected industries, chosen growth markets, and its own platform. The strategy resonates but still requires evidence of a breakthrough. Now, the company must demonstrate a return to better organic growth and its scalability to profitability. The stock’s valuation picture is, from several perspectives, at least attractive. We reiterate our ‘add’ recommendation for the stock and lower the target price to 3.2 euros (previously 3.7) reflecting a decrease in medium-term forecasts.

Quoted from the report:

Our forecast reflects better long-term growth and profitability than the IT services sector. Better growth is due to stronger underlying growth than the IT services market. Better profitability, in turn, stems from a more scalable business structure. However, the company still lacks evidence of stronger growth and especially profitability with the new strategy and structure in the 2020s.