Rarely do tenbaggers stay long at the valuation levels that made them tenbaggers, and one characteristic of this is a very high P/S. For example, QT is now only a sixth of its 180€ share price. So, markets should not be underestimated. It’s quite possible that Canatus will also see a massive overshoot upwards someday.

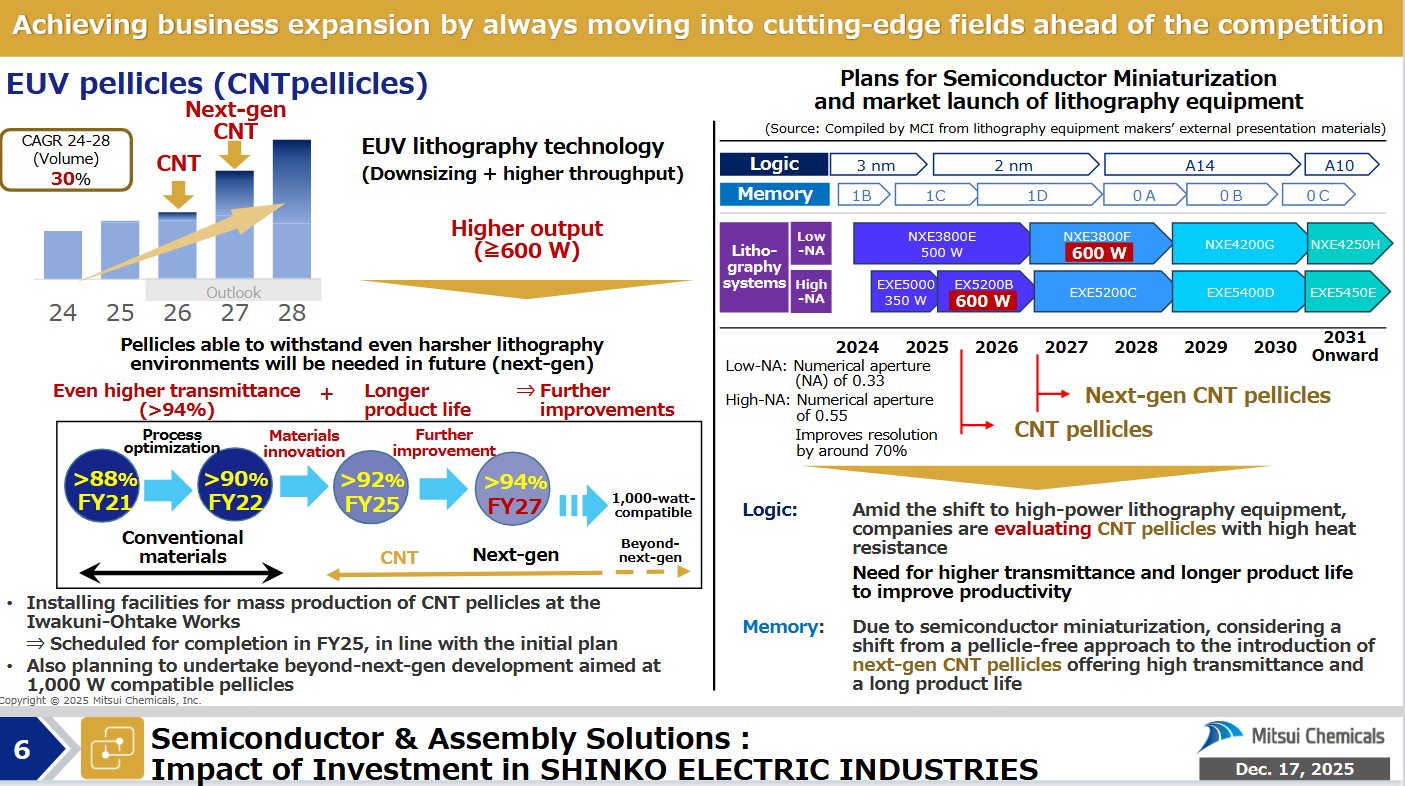

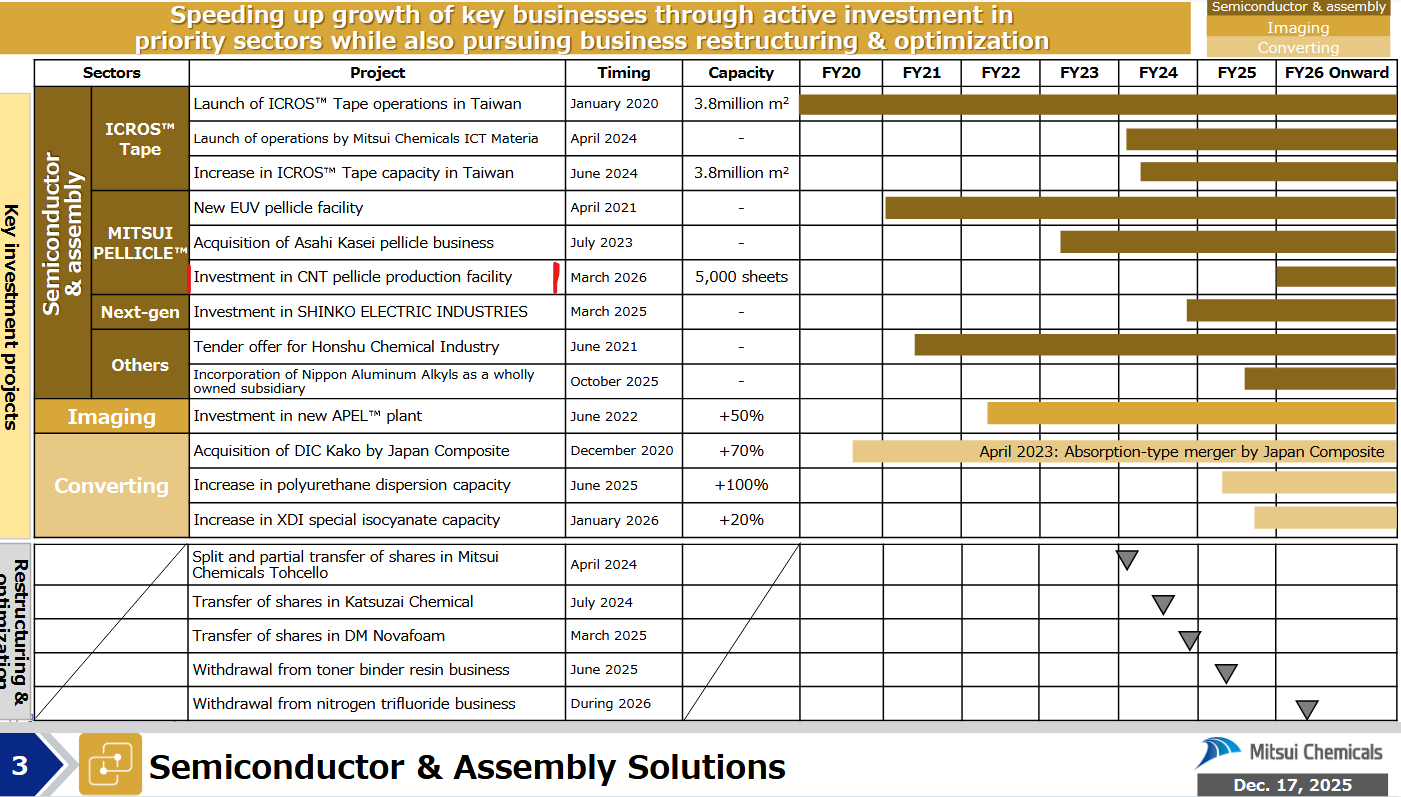

Yesterday, a strategy update presentation came from Canatu’s competitor, Mitsui Chemicals. There’s nothing in these that hasn’t already been covered here, perhaps the biggest observation being the start-up of a new pellicle factory, which will happen in March 2026, with a stated capacity of 5000 pellicles. The competitor heavily promotes in the presentation that they want to become the number one player in the market.

Samsung is expanding its offering in the GPU / ASIC sector. Probably no direct impact on Canatu, but it shouldn’t hurt either.

https://www.hankyung.com/article/202512244025i

Samsung Electronics succeeds in developing its own GPU…Expanding the AI ecosystem.

edit. there is a severe shortage of chips and memory in general

One industry insider said, “Big techs are currently placing open-ended orders with the three memory companies, effectively saying ‘Give us all the volume you can, regardless of price,’” adding, “Since both Samsung and SK’s advanced HBM and other cutting-edge process lines are already running at full capacity, it is physically difficult to meet all of these demands.”

TSMC is accelerating the ramp-up of its first 1.4nm fabs. Based on current information, this should be bullish for Canatu.

TSMC accelerates the construction of its 1.4nm fab in Central Taiwan Science Park.

TSMC (2330) announced yesterday (30th) that its 2nm technology will enter mass production as scheduled this quarter. TSMC’s supply chain indicated that due to yield rates exceeding expectations, the 1.4nm advanced process plant with a new architecture in the Central Taiwan Science Park is also expected to accelerate. It is understood that the new plant in the Central Taiwan Science Park is expected to complete risk production by the end of 2027 and begin mass production in 2028.

TSMC’s new 1.4nm process plant in Central Taiwan Science Park started foundation piling work in early November. The tender for the equipment building (CUP) has been completed recently, and the tender for the factory building (FAB) is expected to start soon.

The Central Taiwan Science Park Administration previously stated that when TSMC gave a land leasing briefing, it confirmed that the originally planned 2-nanometer process would be changed to a 1.4-nanometer process or a more advanced process.

According to relevant supply chain sources, TSMC’s new plant in Arizona, USA, will adopt the most advanced processes ranging from 2 nanometers to 1.6 nanometers. The 1.4 nanometer process will be mass-produced in Taiwan first.

edit.

https://www.tsmc.com/english/dedicatedFoundry/technology/logic/l_A14

edit 2

Building a bridge from that previous news of the day to this earlier news, which explains why the use of pellicles is ‘absolutely mandatory’ in sub-2nm production with standard EUV equipment.

Today, TSMC stated that yields are ‘better than expected’ in 1.4nm trial production. So far, I haven’t seen any other explanatory factor for this than the use of pellicles. This doesn’t provide certainty that Canatu’s pellicles are in use… but all the small hints are pointing in that direction, nonetheless.

Again, this is a costly move that is accompanied by a great deal of complications. For instance, when producing 1.4nm and 1nm wafers using standard EUV machines, more exposure will be necessary, meaning that the photomask will be used often to achieve success, which can compromise yields. During this phase, the use of pellicles will be absolutely mandatory to prevent the aforementioned dust particles and contaminants from entering the wafer-manufacturing stage.

Apologies for the flood. Apparently, Intel has put the first 5200B-series High NA EUV tool into operation / testing here at the end of the year.

I would think this is related to Intel’s upcoming 14A production… but we’ll see.

A new video on ASML lithography machines from Veritasium. This has received praise in the comments. For those interested in technology.

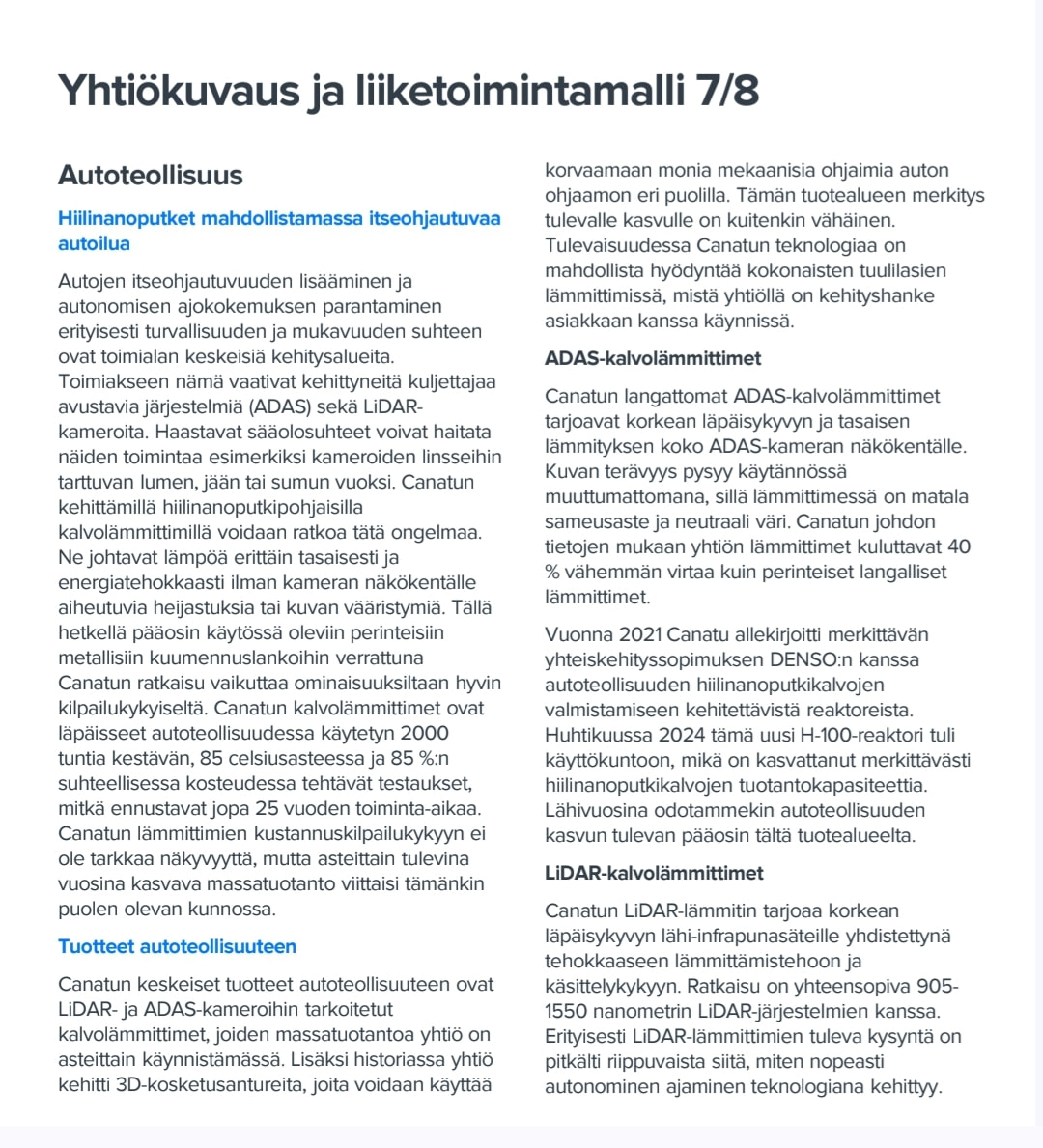

Canatu Plc (CANATU, Nasdaq First North, Finland) and DENSO Corporation (“DENSO”), a leading global automotive technology and component supplier, have signed a 17-month joint development agreement aimed at developing advanced production equipment for manufacturing larger carbon nanotube (CNT) films for automotive applications. Scaling the size of CNT films is crucial for the implementation of future applications, such as full windshield heaters.

The total value of the agreement is classified, in accordance with Canatu’s disclosure policy, in the lowest quartile of the “medium-sized” category (EUR 1.0-5.0 million), and the corresponding revenue is expected to be recorded mainly in the first half of 2026, subject to the achievement of defined milestones.

Here is the comment from Inderes and Antti Luiro regarding Friday’s press release:

Canatu and DENSO are deepening their cooperation to develop production equipment for the manufacturing of larger carbon nanotube films. The agreement is a concrete step towards the most significant long-term market potential in the company’s automotive segment, namely heaters covering the entire windshield. The news supports our view of the progress of the company’s technological development and our forecasts expecting strong growth in 2026.

Hi,

It’s still a bit unclear to me what this collaboration is about? Heated windshields and other automotive glass have been on the market for ages.

If carbon nanotubes can be used to create various displays on the windshield and other automotive glass, that would be a value-added feature, not just glass heating.

Here is a screenshot from Inderes’s comprehensive report discussing Canatu’s heating films:

As I understand it, the problem with traditional heating wires is that, in certain weather conditions, they are visible through the windshield, creating reflections and distortions for both the driver and the cameras and other sensors located on the windshield and inside.

I’ve listened to the CEO’s speeches multiple times across various presentations now, so I’m wondering how likely you think it is that Canatu would sell its reactor to its competitors and collect royalties through them as well? Would there be any real benefit to this compared to keeping pellicle production strictly in their own and their customers’ hands?

I think the CEO refers to competitors’ interest in buying Canatu’s reactor at least twice (the very first question from the Danske Bank analyst in the H1 2025 Q&A and around the 13:30 mark in the latest Inderes “Canatu as an investment” video). At that 13:30 mark, I feel like the CEO was about to let the word “agreement” or “to agree” (sopimus/sopia) slip before catching himself and using the word “wanted” instead. Just out of curiosity, do you think this would be likely or sensible?

Regards, a silent amateur

I personally think/consider it a bit foolish to sell the reactors. Does Canatu provide these as so-called turnkey versions including process parameters, or just as ”hardware”? If the parameters are included, that would eat away at Canatu’s own competitive advantage and the entire long-term future of the business.

But if I were in the buyer’s shoes, I certainly wouldn’t agree to buy without the parameters.

Sure, patents provide some protection, but some large players can be quite ruthless. For example, Samsung directly copied Oura’s ring idea and just lost. But that was a pretty clear-cut case. What if a similar legal battle arises with another comparable player? Can Canatu prove patent infringement? Are there loopholes?

In my opinion, it would be best if the reactors (and thus the technology) weren’t sold off. But perhaps Canatu is caught between a rock and a hard place because they need to generate sales.

Below are the soon-to-expire patents, directly generated by AI, so there may be errors:

| Patent Number | Title | Key Coverage | Adjusted Expiration Date |

|---|---|---|---|

| US8845995B2 | Single, multi-walled, functionalized and doped carbon nanotubes and composites thereof | Aerosol synthesis of carbon nanotubes, including functionalization and doping | May 13, 2029 |

| EP1948562B1 (representative) | Carbon nanotubes functionalized with fullerenes | Covalent bonding of fullerenes to carbon nanotubes to form NanoBud structures | June 15, 2026 |

| US8951602B2 | Method for depositing high aspect ratio molecular structures | Gas-phase deposition of high-aspect-ratio molecular structures (e.g., NanoBuds) | May 25, 2029 |

| US8518726B2 | Uses of a carbon nanobud molecule and devices comprising the same | Applications of NanoBud molecules for interaction with electromagnetic radiation | June 29, 2030 |

The first and third of these seem quite critical to me.

In Canatu’s case, it is also essential to note the use of trade secrets alongside patents. The company has spoken about this itself.

I spent a few minutes with Gemini; I’ll post the highlights below:

Summary

Canatu’s patent portfolio is divided into approximately 39 patent families, and at the end of 2024, the company held 137 granted patents and 76 pending applications. Key protected areas are:

- Dry Deposition process: This is Canatu’s most important technological differentiator. Unlike competitors, who often use liquid-based methods, Canatu manufactures CNT material directly from the gas phase. This enables cleaner, stronger, and optically superior films.

- Reactor technology (CNT100 SEMI): Patents cover equipment used in the synthesis of nanostructures, such as catalyst cartridges and injectors for gas supply.

- Application patents: Especially pellicle films used in EUV lithography, heaters for ADAS sensors, and electrochemical biosensors.

Patents are generally valid for 20 years from the filing date. Since Canatu was founded in 2004, the company’s earliest basic patents (related to the early stages of CNT manufacturing) are starting to reach the end of their lifecycle in the mid-2020s.

However, the company has actively prepared for this:

- Continuous innovation: Canatu has even doubled the number of its annual patent applications in recent years. For example, in 2024, the company filed 7 new applications and received 13 new granted patents.

- Incremental patents: The company continuously patents process improvements, new device components (such as the 2024 injector and catalyst cartridge patents), and new application areas. This creates a “patent moat,” where the expiration of an old patent does not give competitors access to the modern, efficient industrial process.

Protection Method Application at Canatu Benefits to the Company Patents Equipment, end products, and basic methods. Provide strong legal protection and enable licensing (e.g., FST agreement in Korea). Trade Secrets Precise process parameters, internal reactor adjustability, and “recipes”. Never expire and do not reveal technology to competitors through public databases.

Canatu’s competitive advantage does not depend on a single “silver bullet,” i.e., an individual patent, but is a combination of hardware patents, application-specific rights, and closely guarded manufacturing know-how. Although early patents are expiring, the company’s newer patents on reactor technology and EUV applications protect its current commercial core well into the 2040s.

Although the earliest patents for the basic manufacturing of carbon nanotubes (CNT) are entering the public domain, they concern technology that Canatu used 15–20 years ago.

- What a competitor gets: The right to build a first-generation basic reactor.

- What a competitor does not get: Access to the current CNT100 SEMI reactor platform, its precise process parameters, or the latest catalyst cartridges, which are protected by recent patents and trade secrets.

Factor Impact on Competitive Advantage Old Patents Minor weakening; allows copying of outdated technology only. New Patents (2020s) Strong protection; cover current flagship products (EUV, ADAS). Trade Secrets Critical protection; prevent competitors from achieving the same quality and yield. Licensing Model Strengthens position; ties partners to Canatu’s ecosystem.

But how does the reactor buyer actually manage to produce carbon nanotubes? Do they have to start developing from scratch, or does Canatu provide a turnkey solution in connection with the sale?

The latter, combined with the aging of core patents, gives reactor customers the opportunity to manufacture material comparable (or even superior) to Canatu’s CNT.

“In Canatu’s case, it is also crucial to note the use of trade secrets alongside patents. The company has spoken about this itself.”

And according to management’s comments, the “raw material” mix that is fed into the reactor also comes directly from Canatu and contains certain secrets.

I personally don’t believe they will sell reactors directly to their competitors. The stronger the end-to-end control over the entire process, the better the business case. Patents and their use through legal processes (e.g., injunctive relief) have been made so difficult that you can’t rely on them alone; trade secrets are a vital part of the business.

This

The raw material mix is quite easy to figure out if you have a laboratory and the equipment, unless the parameters specifically (how much, how long, at what stage) remain a “black box” for the customer. You would think that those could also be extracted from the electronic devices somehow if one really wanted to.