INTRODUCTION

In February, during a break between hockey games, I spent some time at Harvard Business School, where there happened to be a book launch for Space to Grow: Unlocking the Final Economic Frontier.

The topic itself hasn’t been a major interest of mine, but since it was the only somewhat interesting event on any campus and I could also satisfy the needs of a real dividend hawk, why not go and listen to what the gentlemen had to say.

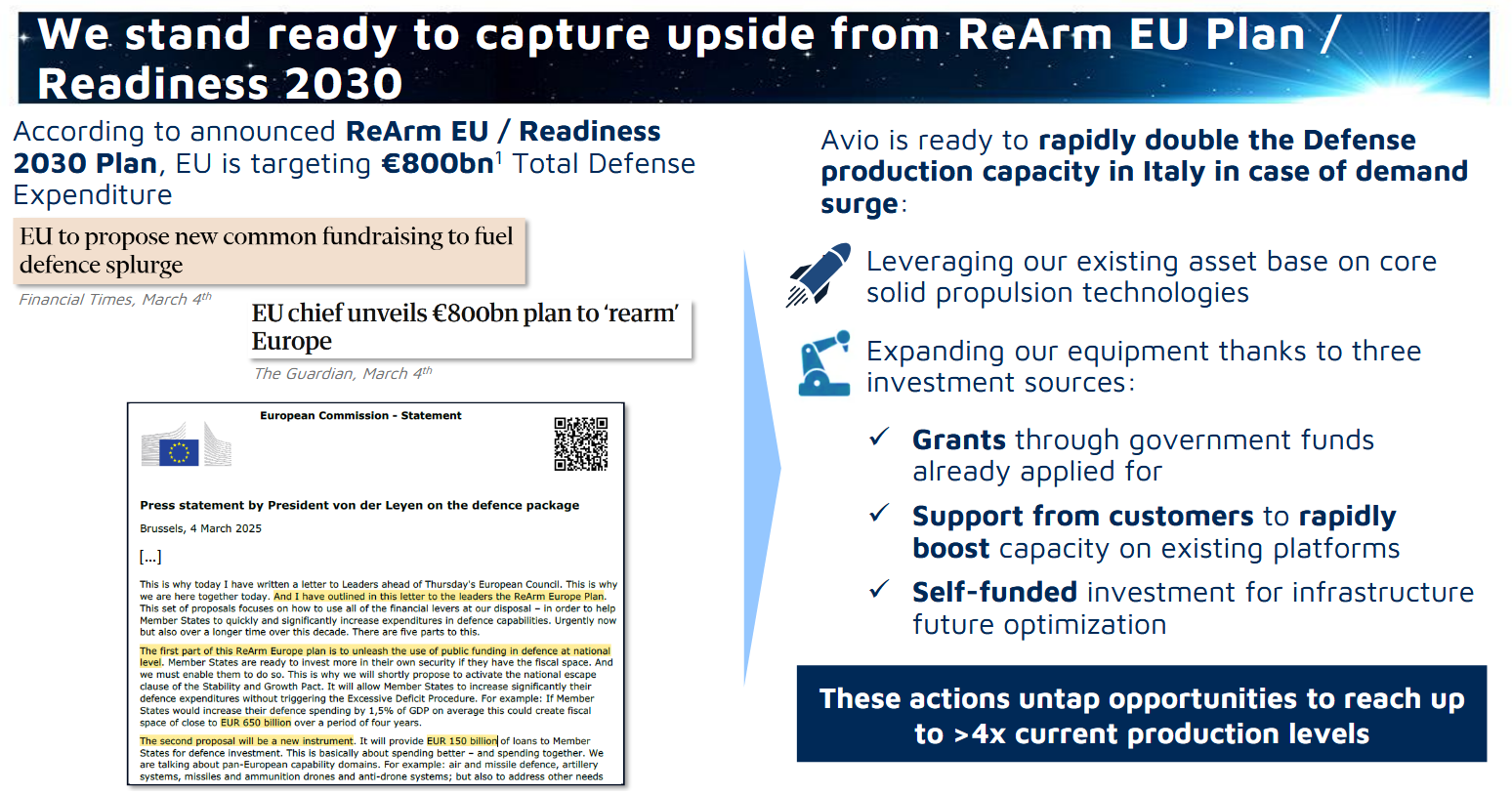

Space is fascinating due to its mystique, but I’ve rarely considered it as an investment target. Previously, space technology was developed by saber-rattling states, and since then, probably for the same purpose, by billionaire men.

However, the industry has gradually commercialized and thus probably started to attract more investors. Space is infinite, so in principle, the sector’s EV/TAM (TAM = Total Addressable Market) is 0. The sector should therefore also be suitable for value investors!

INCREASING INTEREST

The book launch itself didn’t bring any mind-blowing observations and thus didn’t evoke strong emotions. However, the topic has been on my mind, for example, when the Startup Ministry did a couple of episodes on it.

And now that @Ilkka6’s post related to the topic sparked discussion…

…@Heikki_Keskivali also tweeted about the topic…

https://x.com/hkeskiva/status/1914199671309840483?t=f_BNwFfWKrQqKYgkAoM33r&s=19

…and @everlaastia is also bullish

…so perhaps the topic deserves its own thread on the forum as well.

COSTS ARE DECREASING

At the book launch, it was mentioned that cash flows in many space businesses are still far in the future. My notes indicate that the cost of launching a satellite has decreased to one-hundredth over time, which naturally increases their popularity. Currently, several launches are made per week. This video illustrates the matter quite nicely.

https://www.youtube.com/shorts/JFKA2w-Xyi4

Google states that there are already over 5200 of Musk’s Starlink satellites alone.

SEGMENTS

Primarily, the sector naturally aims to produce technologies that help people. Currently, this is mainly done by satellites.

Since the sun will explode in a few billion years, at some point we will also have to leave this planet. Musk has spoken about moving to Mars initially, and once I attended a TedX event where they discussed building such a space ring, whose rotational motion would also create gravity there. They had even calculated a somewhat understandable budget for it.

However, if we stick to cash flows related to the near future, the sector currently includes, for example, the following industries:

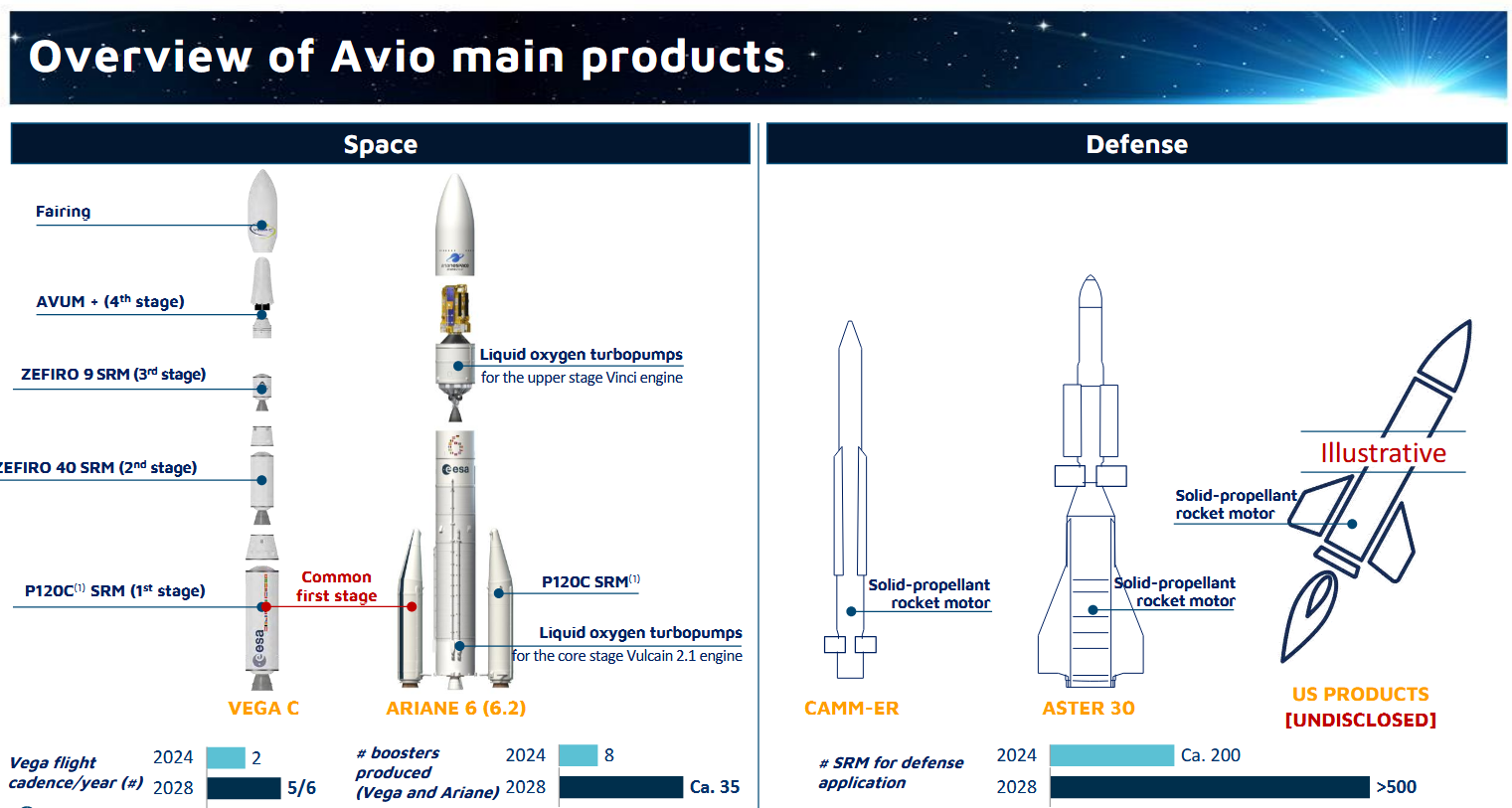

- Satellite manufacturing, sales, and maintenance

- Launches

- Communications

- Earth observation

- Space tourism

In the future, there could be industries such as:

- Space debris cleanup

- Mining

- In-space manufacturing

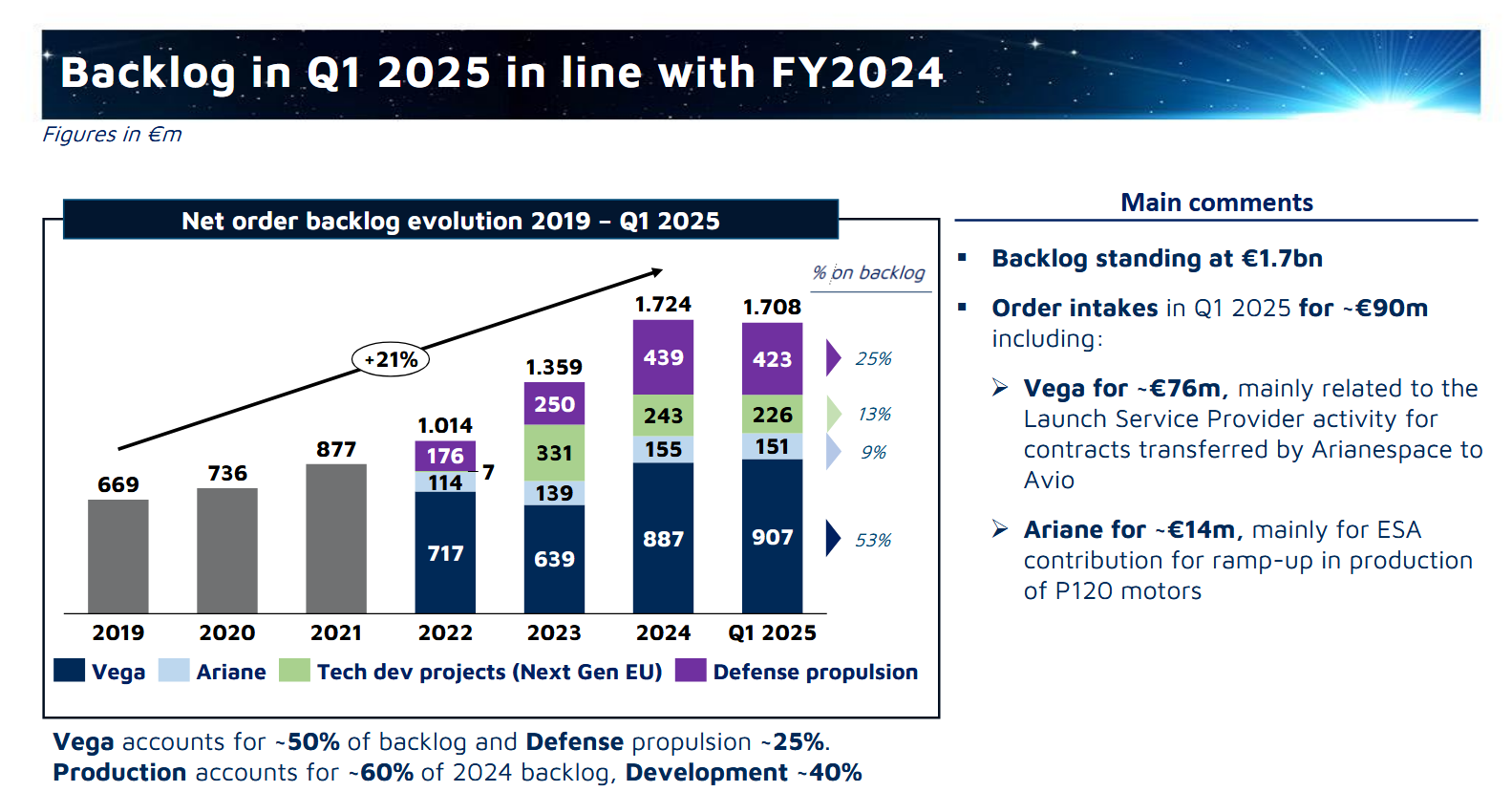

COMPANIES IN THE SECTOR

Since I haven’t actually delved into this topic more than writing this, I won’t try to be any wiser but will leave their presentation to other forum members. Let the discussion begin!