AQ Group AB is a Swedish contract manufacturer that designs, manufactures, and assembles electrical and mechanical components and systems for demanding industrial customers. The company was founded in 1994 under the name Aros Quality Group by combining Aros Kvalitetsplast AB, ABB Industrial Systems’ transformer business, and ABB Relays’ accessories department. Since its inception, AQ has grown steadily and profitably. AQ has production in 17 countries in Europe, Asia, and the Americas, supporting “near-customer” deliveries.

What does AQ do and what does it consist of?

AQ has two reporting segments:

-

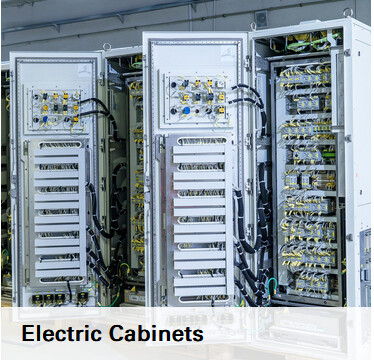

System – Electric Cabinets and System Products: electrical cabinets, control and automation systems, complete deliveries according to customer specifications.

-

Component – Injection Molding, Inductive Components, Wiring Systems, Sheet Metal Processing (+ Special Tech & Engineering). In practice, plastic and metal components, wiring harnesses, and inductive components.

These may not necessarily mean anything as such, so let’s briefly open up a few sections and what AQ bills its customers for: AQ is not an own-brand equipment manufacturer, but rather makes parts and assemblies according to customer specifications that are needed within industrial machines and systems.

1) Electrical Cabinets and Control Panels (Electric Cabinets / Systems)

Acts as a full-service partner in electrical systems: design, procurement, assembly, testing, documentation, and installation if required.

Deliveries include ready-made electrical cabinets and control panels, as well as related control and power transmission systems.

Examples:

• Control cabinets meeting the requirements of the food industry

• Automated Teller Machines (ATM)

• Control and power equipment cabinets for ship cranes

• Control equipment for automated cargo handling in ports

• Control systems for large motors and generators

• Frames and interiors for ticket and parking machines

• Packaging machines, printers, and passport automation equipment

AQ designs/dimensions, procures components, assembles, tests, and documents; the customer receives a “plug-and-play” cabinet that meets standards (CE, UL, railway/defense-specific norms). Quality and safety standards are high; the systems are often the “brains” of the customer’s process.

2) Wiring Systems

Supplies wiring harness systems (cable harnesses) and electromechanical modules to demanding customers.

• Customer industries: automotive and commercial vehicles, railway, mechanical engineering, etc.

• Global footprint, local service: design and assembly in different markets close to the customer.

Why do customers buy these from AQ?

Customization: designs and assembles all types of wiring harnesses and ready-made electromechanical modules according to customer specifications.

“One-stop”: design + procurement + assembly + testing → easy to integrate into customer products and production.

3) Injection Molding

AQ manufactures and assembles thermoplastic plastic components for demanding industrial customers. The equipment includes 120+ injection molding machines (clamping force 25–1500 t), covering everything from small series to annual volumes in the millions. The material range extends from structural plastics (PC, PA, PBT, PC/ABS, PP, ABS, TPE, TPU, POM) to high-performance plastics (PES, PEI, PEEK, >200 °C resistance). In addition, AQ performs multi-component molding – up to 4 different components in the same part. Customers include the automotive, medical, and mechanical engineering industries.

4) Sheet Metal Processing

This section briefly covers the subcontract manufacturing of sheet metal parts and assemblies for industrial customers, from single pieces to series.

Production is found in Sweden, Estonia, Finland, Bulgaria, China, India, etc. → “near customer” cost optimization.

5) Inductive Components

AQ designs and manufactures transformers and inductors for demanding industrial applications: connections for frequency converters and large motors/generators, high-speed trains, solar and wind power, marine/offshore and process automation, as well as protective relay systems, defense, and aviation. The product range includes 1- and 3-phase transformers and coils, reactors, chokes, filters, toroids, and traction transformers – also with integrated coils.

Summary Q2/2025

- Revenue grew by 4%: 2,344 MSEK (2,254)

- Operating profit (EBIT) decreased by 2%: 218 MSEK (222)

- Profit before tax (EBT) grew by 5%: 228 MSEK (218)

- EBT margin was 9.7% (9.7)

- Net profit was 189 MSEK (181)

- Cash flow from operating activities was 232 MSEK (301) – weakened mainly due to an increase in trade receivables

- Earnings per share (EPS), undiluted: 2.06 SEK (1.97)

Business Comments:

- Organic growth came from segments: heavy vehicles, construction machinery, electrification, and defense.

- Weakness in bus components in USA/Mexico.

- Demand for inductive components remained strong globally.

- Integration of acquisitions (mdexx, Riedel) progressed slower than expected; –1 percentage point impact on the group’s margin in Q2.

- The capital gain of 22 MSEK from the sale of the Gävle property improved financial items and increased EBT-% by ~1 percentage point during the quarter.

AQ as an investment?

Strengths: multiple business areas and customer industries → less dependence on a single cycle.

Value is created from long-term customer cooperation, co-development, documentation, and certifications making supplier changes costly → long lifecycle and recurring invoicing, a global factory network, and the ability to deliver higher value-added system deliveries, not just individual parts.

Near-customer network: Europe/Asia/Americas → delivery reliability and cost flexibility.

Mix driver: the share of system deliveries (electrical cabinets, modules) supports the margin.

The company has emphasized operational discipline and cash flow, and its results have been exceptionally stable in recent years despite cycles. A high-quality, cash-generating industrial subcontractor.

Key risks:

Cycle: exposure to commercial vehicles, construction machinery, and general industry → utilization rate sensitivity.

Customer concentration: changes in individual major customers/programs can fluctuate volumes.

Materials & components: metals, plastics, electricals; price transfer delay and availability.

Integration and transfer risks: streamlining acquisitions and production transfers must succeed without compromising quality.

Currency & regulation: USD/EUR/SEK fluctuations; changes in standards and regulation in defense/rail sectors.

Technical Analysis

The stock has just reached new ATH (All-Time High) figures, and from a technical analysis perspective, a larger downward correction is very likely. Looking at daily candles, I consider it possible that the stock will find support at the 185-187 SEK level, but if that doesn’t hold, I see the next stronger support level being around 175.5 SEK.

Finally, a few bonus facts you can show off with in the office coffee room ![]()

- “Best in class” from Siemens – two years in a row. The inductive components units have received the Best in class recognition from Siemens for two consecutive years.

- AQ acquired Finnish Trafotek in 2019, simultaneously gaining the company’s subsidiaries in Estonia, China, and Brazil; the purchase price was 28 M€ (EV).

- In 2024, AQ acquired Rockford, which has roots in British aero and defense connections (e.g., demanding wiring harnesses). This brought AQ additional specialized expertise in the defense and aerospace sectors.