For the second time this week by the same newspaper. Unusually stupid from Kauppalehti.

In my opinion, the reputation as a crisis bank is fully deserved.

I would believe that in this situation, it has been easy for Huhta to negotiate even better than usual severance terms in case the foolishness at Aktia continued. There have hardly been a queue of competitors for the CEO position. Everything has its price.

If the compound word is reversed to ‘bank crisis’, the term usually refers to a slightly more serious situation than management blunders and poor communication. Then depositors’ funds begin to be at risk. However, in Aktia, the fundamentals are in order, and hopefully, the management blunders are over for at least a couple of years. It’s positive that there was a strong reaction to Haglund’s intolerable actions.

Well said. The term “crisis bank” can indeed mean many things. In this case, it has specifically referred to what you mentioned: management’s blunders and communication, or rather, the lack of communication. Things have been in disarray.

A listed company’s communication has a direct connection to trust. Trust, in turn, is an essential condition in the financial sector. It doesn’t necessarily threaten the current market position, but it can very well mean that the implementation of the recent strategy has become more difficult. It can, of course, also threaten the current market position if credit rating agencies consider the bank’s outlook to be negative.

Aktia announced new appointments to its management team today. All of these are internal.

The most noteworthy of these is Pasi Vuorinen, the new head of wealth management operations, who has served as interim acting director since Kati Eriksson’s departure. Now the position has been made permanent, so under Vuorinen’s leadership, the goal is to bring managed client assets and fee income back to clear growth. At least based on his experience, the choice seems appropriate, as Vuorinen has held leadership positions in wealth management at various companies for nearly two decades. He has a background particularly on the institutional client side, so there are certainly growth ambitions in this area. However, Aktia’s assets under management have decreased in recent years due to redemptions, especially on the institutional side, so turning the tide will not be easy.

Good morning @bottom-ditching,

Yes, such a decision was made regarding an error that occurred in January 2023. I want to emphasize that Aktia takes the incident very seriously and regrets the inconvenience caused. When the error occurred, Aktia reacted immediately to the data security breach and promptly took measures to minimize damages.

Yesterday, we published a press release on the matter, which also states:

“In Aktia’s view, the decision by the data protection authority contains erroneous interpretations of Aktia’s data security testing prior to the incident. Aktia considers the authority’s interpretations of the applicable regulation and the administrative fine to be severe in relation to an incident that is an isolated case and where Aktia has demonstrated its organizational-level data security through its responsiveness and speed. Aktia will appeal the decision to the administrative court.”

(Lehdistötiedotteet | Aktia Corporate Site)

Have a nice day everyone on the forum!

/OT

Here are Kassu’s comments on the latest news. ![]()

Here are Kassu’s preview comments as Aktia publishes its Q3 report on Thursday. ![]()

We expect Aktia’s earnings to have continued their decline due to shrinking net interest income. We estimate general loan demand to have remained relatively stable, meaning we do not expect the clear growth in the corporate loan portfolio seen in the previous quarter to have continued as vigorously. We would also gladly hear the new CEO’s comments on the lending outlook, as the messages provided by macro data have remained mixed. Furthermore, our interest is focused on new sales in wealth management, which is one of Aktia’s key earnings growth drivers.

https://www.inderes.fi/analyst-comments/aktia-q325-ennakko-ei-viela-asiaa-tuloskasvuun

Good evening from Aktia IR!

Everything is almost ready… Tomorrow, November 6, 2025, Aktia’s Q3 report will be published at approximately 8 AM. At 10:30 AM, a webcast will begin, where together with CEO Anssi Huhta and CFO Sakari Järvelä, we will go through the quarter’s results. Welcome to join us: https://aktia.events.inderes.com/q3-2025

Aktia IR - at your service

Linda Tuomela & Oscar Taimitarha

Aktia’s 3Q2025 interim report is out.

Net interest income decreased as expected, and specifically, it reduced earnings.

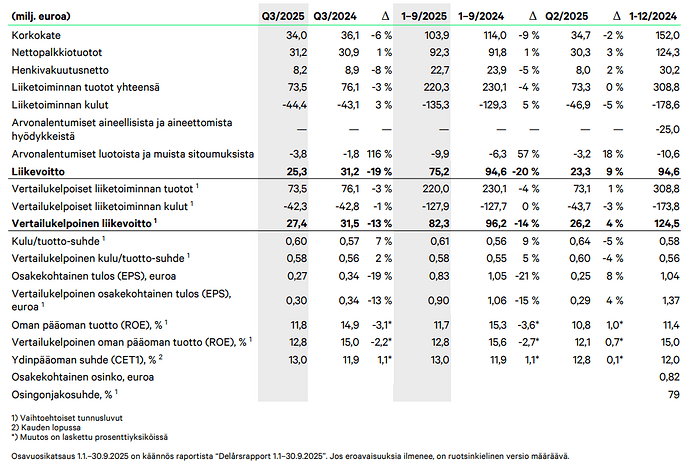

A quick look at what was left for us shareholders: EPS 0.34 (3Q2024) → EPS 0.27 (3Q2025) (0.30 adjusted). Correspondingly, 1-3Q2024 (1.06) → 0.83 (3Q2025) (0.90 adjusted).

Quarter in brief

Comparable operating profit: EUR 27.4 million, 13 percent lower than last year (31.5) mainly due to the changed interest rate situation.

Comparable return on equity (ROE): 12.8 (15.0) percent.

Net commission income: 1 percent higher than last year mainly due to the growth in income from structured products.

Net interest income: Decreased as expected and was 6 percent lower than last year due to the decline in market interest rates.

Net life insurance income: 8 percent lower than last year, which was due, among other things, to the decrease in real estate values. Insurance operations developed well.

Comparable operating expenses: Decreased by 1 percent from last year; focus on cost discipline continues.

Credit losses: EUR 3.8 (1.8) million mainly due to individual impairments of some loans.

Assets under management: Grew by 2.3 percent during the quarter to EUR 16.3 billion due to positive net subscriptions from all key customer segments and favorable market development.

Here are Kassu’s comments on the morning’s results. ![]()

Aktia’s Q3 results did not offer any significant surprises. Revenues declined as expected along with the net interest income, which also kept comparable operating profit down. Both asset management sales and demand for new loans remained at a rather subdued level. However, the quality of the loan portfolio deteriorated, which also led to an increase in credit loss provisions.

Kasperi interviewed Aktia’s CEO Anssi Huhta after the Q3 results were released. ![]()

Topics:

00:00 Introduction

00:17 Q3 highlights

00:45 Development of loan demand

02:04 Growth in leasing, factoring, and hire purchase portfolios

03:15 Credit loss levels

05:06 When will the interest rate margin bottom out?

06:01 Improving asset management sales

07:00 Competitiveness of the product range

07:46 Impact of personnel changes on the organization

09:57 Impacts from the perspective of personnel and customer relationships

10:53 Does Aktia need something new in its operations?

Kassu has made a new company report on Aktia after Q3. ![]()

Aktia’s Q3 results did not offer any significant surprises. However, we slightly raised our earnings estimates for the coming years, especially due to the well-developed life insurance net. We still consider Aktia’s valuation to be inexpensive and see the dividend yield, together with the potential for valuation multiples to rise, offering investors an attractive return expectation. We reiterate our add recommendation and raise our target price to EUR 11.0 (previously EUR 10.5) in line with the forecast increases.

Quoted from the report:

We have examined Aktia’s valuation through balance sheet multiples, Nordic banking peers, and a dividend model. The methods indicate a share value of EUR 11.3–12.7, with the midpoint being approximately EUR 11.8. Overall, we still consider Aktia’s valuation to be inexpensive, and we see the potential for multiples to rise and a strong dividend yield (~8–9%) offering investors a good return expectation. However, the subdued development in wealth management and discontinuities due to personnel changes may delay the progress of the growth turnaround, which in turn dulls the sharpest edge of the return expectation.

I don’t doubt Aktia’s traditional banking operations, but for me, the most important question regarding Aktia is, by what means will the 2029 strategic goal of 25 billion in assets under management be achieved?

From the current approximately 16 billion, reaching the target would require an average annual growth of about 12% over each of the four years. If successful, that would probably enable an increase in valuation level as well, but by what means is that feat intended to be accomplished?

Even in Kasper’s analysis, it is stated that assets under management have grown mainly with the market, but that is not enough to reach the target; new customers are needed. With what product will they be acquired?

To this, I would point out that the last few quarters have not been bad in terms of sales; quite reasonable amounts have been sold to private customers. But as you said, to reach the targets, the pace should be accelerated, and preferably, assistance should be sought from the institutional side, where capital has continuously decreased in recent years.

Perceptions, perceptions.

This hopefully does not mean that the profit will be used for new acquisitions.

They are hardly at the top of the plans, at least after the Taaleri deal. Now the management has left the door open for an even larger profit distribution, and I understand that they do not want to publicly anchor investors’ expectations to any specific level. In the coming years, however, profit distribution must increase if they want to maintain their solvency at their target level (~4% above the regulatory requirement). With a 60% payout ratio, the balance sheet is constantly strengthening, and I don’t see a need for this, especially since the intention is to grow in capital-light asset management. Of course, some changes may come from the regulation side; for example, the Financial Supervisory Authority has recently raised the capital requirements for some banks. However, this should not have a dramatic effect on the outlook for profit distribution.

Here’s one observation from the loan market, by the way. After this Helsingin Sanomat article, I dug up information on Ylva’s financiers, and at least in the 2021 financing package, Aktia was involved based on information available from public sources. Could this then be the single real estate sector player that has accounted for 40% of Aktia’s loan loss provision growth this year (EUR 4–5 million)?

This is mainly an interesting observation, as I don’t believe that significant loan losses will arise from this anymore, even if this particular case is in question. However, the selling price was largely known during Q3, and Aktia’s loan loss accounting policy has never surprised me. Large individual loan losses certainly explain, in part, why the bank aims to reduce its corporate customer sizes in the future.

Here are Kassu’s comments after the Financial Supervisory Authority slightly raised Aktia’s capital requirement ![]()

The 0.25 percentage point increase in the additional capital requirement is small, and its impact on the bank’s overall solvency is minor. Therefore, the announcement does not affect our assessment of Aktia’s dividend distribution potential.