I personally believe that large one-off investments are not available for these ventures in Finland, and therefore, one must take what is available in smaller increments. The same pattern repeats in practically all our businesses that require continuous additional funding, though exceptions certainly exist, of course, but none immediately come to mind for me.

That is also possible, but it’s difficult for an outsider like me to say for sure how things stand (and with which companies). My experience is that in companies at this development stage, management’s view of their company’s value is almost without exception higher than the share price. This also applies to the majority of listed companies and is probably at least partly due to the fact that they believe more in their own work than the market does. But this would suggest that the motive for smaller raises could just as well be management’s confidence in potentially better terms available in a later round, rather than limitations in funding availability.

I’m almost a complete novice when it comes to Aiforia, but at a quick glance, the company raised a decent sum during its IPO, which carried it a good way forward. After those funds evaporated, financing has had to be sought in smaller tranches, and the share price development hasn’t been helpful either:

With the IPO price being 5.01 euros, many investors have been bitterly disappointed here too.

At what point does Inderes expect the cash flow to turn positive, in other words, how long will this still be on life support?

So, the operating profit would be positive in 2030. However, a few years ago Inderes predicted this year’s revenue to be 16 million, but it will be about 3.3 million ..So, the CEO is at least good at talking ![]()

As I recall, the CEO expects 27 items to turn positive regarding operating profit.

Should this be updated, as it was already the same in 01.2024. One could reach a profit with about 20 million in revenue, which is “only” 6 times the current one. In God’s hands ![]()

This case study published on Aiforia’s website at the end of November was interesting. In this study, a deep learning model created and trained with Aiforia Create successfully predicted the effectiveness of chemotherapy better than previously possible based on traditional clinical data. As I understand it, competitors haven’t really offered such deep learning AI.

When one really doesn’t want to trust only the company’s own announcements… Inderes, of course, also hypes it up, but but.. a feather in their cap, of course, if it breaks through. Or their reputation goes, if they still have any ![]()

Also here, just among other players

Tomorrow, Aiforia will participate in Inderes’ company evening, which includes the company’s presentation and a Q&A session. Questions can be submitted via chat during the event or through the forum. Messages sent here by tomorrow morning will still be received.

Questions:

- Sales efficiency, i.e., LTV growth, but how does this scalability efficiency factor develop? (Scalable SaaS company: customer value vs LTV growth and cost of acquiring growth)

- Partnerships, integration, and ecosystems with large equipment suppliers: how does partner sales develop (bottlenecks, ecosystem, Aiforia integration & switching cost)

- Cash flow development: Is the current cash sufficient for cash flow to turn positive?

Question:

Scanners have been a bottleneck for customers. Will Aiforia in any way support its customers in the scanner procurement process (e.g., centralized procurement from specific suppliers regionally → with benefits such as potential volume discounts and faster deliveries based on forecasts) to accelerate adoption?

There has been no intentional hyping here, at least. If I’ve thrown out positive views with poor reasoning, I’d gladly welcome challenges on them. In that Lumea listing, no justifications were visible, and it seemed to be mostly their list of players operating in the field ![]()

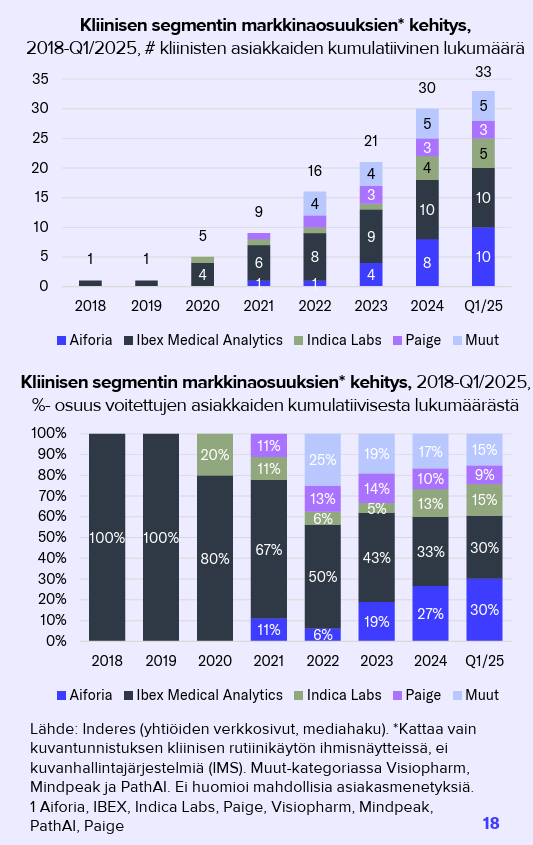

Independent data on the market can be obtained, for example, by comparing deals won by competitors to Aiforia. Based on this, Aiforia is the market leader, meaning there has been no need to rely solely on the company’s own announcements and messages ![]() This in itself doesn’t make the company a good investment; it’s influenced by the progress of market formation and especially the duration of onboarding won customers (these affect, for example, the amount of funding to be raised) - I have actively highlighted these as risks.

This in itself doesn’t make the company a good investment; it’s influenced by the progress of market formation and especially the duration of onboarding won customers (these affect, for example, the amount of funding to be raised) - I have actively highlighted these as risks.

Question -

Aiforia has announced Europe and the USA as its main market areas, so at what stage is the FDA approval application.

Were these in Europe?. How can all of them be published? Was this, for example, included and I guess it counts ![]()

Aug. 12, 2025 — Fujifilm Healthcare Americas Corp. has announced that a leading health system with hospital sites spanning five different geographic regions on the East Coast has selected Fujifilm’s Synapse Pathology solution and Amazon Web Services (AWS) to transform their pathology delivery and reduce diagnosis timelines through digitalization. The implementation of Synapse Pathology will take place across the health system’s five sites, supported by a fully cloud-based infrastructure using AWS.

PS. For an investor, perhaps a bit too many different variables, and might be better suited for some non-profit billionaire.. Your guess of 40 million in operating profit 10 years from now is still quite bold..and would mean the stock price multiplying.