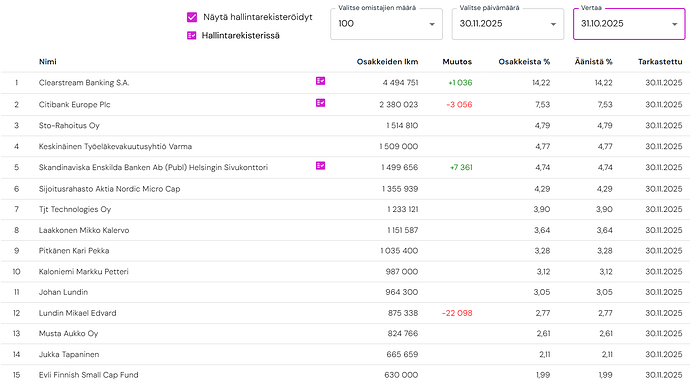

SEB continues to dump shares and Laakkonen has again taken a significant position following the previous month ![]() SEB has sold 2.5 million shares this year.

SEB has sold 2.5 million shares this year.

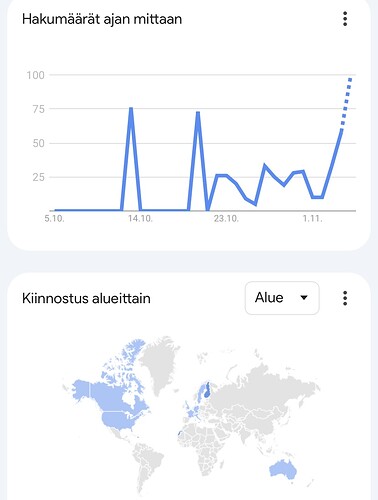

I admit it’s a bit lazy to use Google Trends for stock research, but I always check from time to time where in the world the company is generating interest. Of course, no conclusions can be drawn from this as to whether the region is interested in the software itself or just the stock as an investment.

However, it’s nice to play with the idea that there might be interest in Canada, Germany, and Australia in adopting Aiforia’s software ![]()

It’s very difficult for me to understand the company’s valuation level and the reasons why the valuation would be so much higher than similar early-stage software companies in other industries. The best Finnish software companies of this size grow at least 2x faster and burn 50-100% less cash per year, and even with those figures, an 80 million valuation is pure wishful thinking.

The share price has plenty of room to halve if growth doesn’t significantly accelerate next year. And in any case, a share issue is likely ahead, where current owners will be diluted again.

A share issue is certainly coming at some point, no one should be surprised by that anymore. Inderes also forecasts share issues of €20m for 2025-2026, of which €8m has now been completed on 28.5.

Otherwise, it’s a bit difficult to speculate on the valuation when I don’t know which software companies you are comparing it to. I do agree that the valuation cannot withstand revenue stagnation, even though some of it is due to a lack of scanners.

Aiforia, unfortunately, only reports twice a year, so here’s a small self-initiated interim review of how the company is doing.

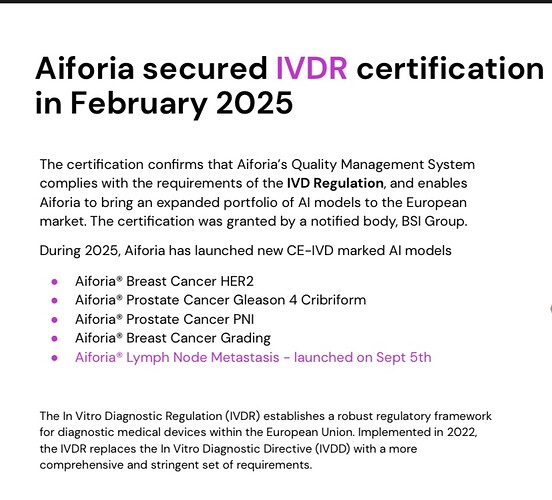

I couldn’t quickly find an answer to the first point anywhere regarding how many new AI models have been developed for pre-clinical or study-centric GLP.

For the second point, I found five new regulatory-approved clinical AI models.

For the third point, strategic partners. ![]()

-

Paige 4.11.2024

-

Techyte 21.3.2025

-

Dedalus 1.9.2025

-

Siemens Healthineers 9.9.2025

For the fourth point, 10/15 new deals have been secured.

In my opinion, the fifth point, positive cash flow, can be directly thrown in the trash, unless some great miracle happens in H2/2025. In H1/2025, however, we were 3.5m€ in the red ![]()

Tldr: A lot of catching up remains for the final months if Aiforia intends to achieve its own goals.

If you are better informed and find more information, feel free to add to this ![]()

Svenska Enskilda Banken (SEB) is aggressively selling shares at the moment. I don’t know if the intention is to dump shares and push the price down to participate cheaply in a future offering, or just to divest ownership ![]()

Insiders have bought:

Board member Tuomas Tenkanen 18900 pcs @2.6€

Tuomas Tenkanen also subscribed in the offering for 937,500 pcs @3.2€ in the name of TJT Technologies Oy

CEO Jukka Tapaninen

3795 pcs @3.42€

3188 pcs @3.43€

8578 pcs @3.56€

3298 pcs @3.58€

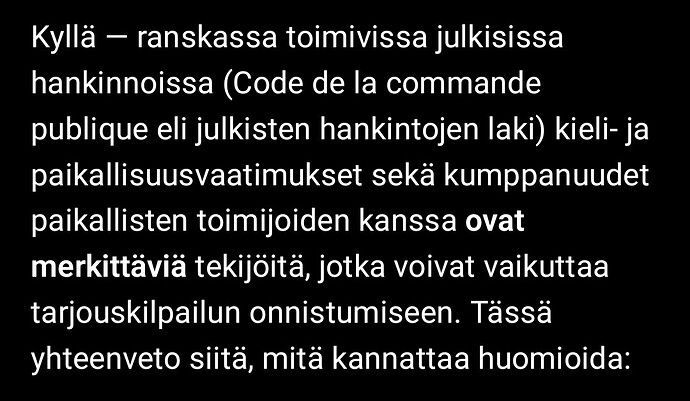

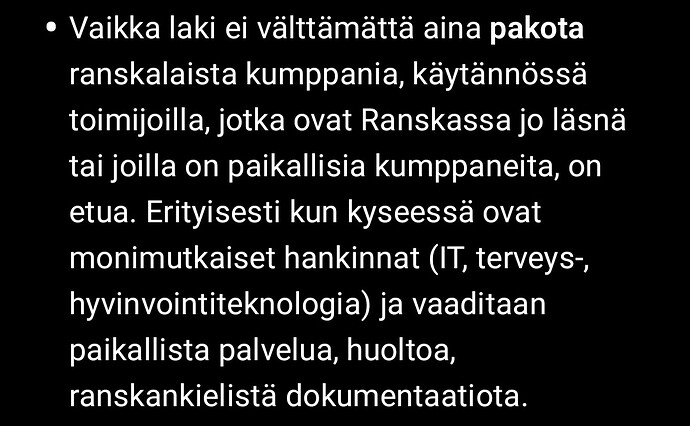

AI talks quite a lot about those French language requirements and local partners etc. related to public procurements. Now I understand a bit better why it’s good to have such a strong presence in France as Aiforia has and why the CEO talks about it so much. A couple of excerpts from the AI, no point in putting everything.

That was a good interview from Jukka. Somehow much clearer communication than before. I think partnerships and future plans were addressed concretely. It calms the owner’s mind at least a little, as the stock price has unfortunately dived so much.

That was a good interview. A lot of practical information for investors, the best Aiforia interview in a long time from Jukka’s part. There was a lot of new important information to give, you can tell that scaling is starting. Fimlab has started nicely and monthly volumes have increased from 1600 in September to 3500 in October. And the customer is reportedly very satisfied. Business is progressing, there are products, demand does not need to be created, all competitors will be beaten. Institut Curie is part of a group of 19 hospitals, it is assumed that Aiforia will gain more foothold.

Additionally, that Siemens partnership seems particularly interesting. A country-specific business plan will be made, and through that, profits will be sought. Jukka was already expecting 1-2 contracts to come through Siemens by the end of the year.

It was new to me that Aiforia is now part of Siemens Healthineers’ product portfolio, with the European staff trained and ready for sales. I thought that with the partnership, countries would be opened up more slowly with country-specific agreements, like in Finland, but Aiforia is now being sold and offered as a solution across Europe. A big deal.

Here is a new company report on Aiforia from Antti and Frans following the latest developments. ![]()

Aiforia’s implemented cost savings help manage its financing needs in the coming years, while the strong customer base turning into accelerating revenue growth will take time. In our opinion, the value of the company’s very strongly developing market position is priced moderately, even though the risks of delays in growth acceleration advocate for withholding a stronger positive view. For the risk-hungry, we still find the risk-reward ratio attractive. We revise the target price to 3.2 euros (previously 3.4 €) due to valuation scenario updates and reiterate our Add recommendation.

Jukka’s interview from LinkedIn:

NuWays video interview that, like Inderes, follows Aiforia. I haven’t watched it yet.

(I’ve scrolled through this year’s forum threads and haven’t found an answer, so I dare to ask…)

According to analysts (Luiro, Rostedt), Aiforia is expected to conduct share issues in '26 and '27. Is there a reason to conduct annual issues and keep the matter repeatedly on management’s agenda? Trust (or signaling of it) in business development and stock price appreciation between issues → less dilution for existing shareholders?

I follow the Norwegian market somewhat, and growth companies there tend to seek more substantial funding at once. A larger single funding round is likely a bigger one-time hit to the share price, but at least it removes the dilution concern from the share price for a longer period.

In the same breath, I note that Aiforia seems to favor directed share issues, and the risk of depressing the average price before an expected issue is thus smaller.

No major changes in November’s ownership listing.

SEB’s nominee register also no longer continued sales (-200k October, -400k September). Earlier in the year, in April, based on the figures, approx. 1800k transferred from SEB’s register to Citibank’s register.

Edit: It should also be added that SEB’s sales project may, of course, still be ongoing, or it may have been completed. Presumably, so-called smart money knows the situation with their buying services, but for us ‘bulleros,’ dark trading, alternative trading venues, and the secrets of nominee registers – which stock market gentlemen praise as enhancing market efficiency – leave the situation to speculation. Presumably, however, SEB holds shares for several clients, and even a large client may have wanted to lighten their position for one reason or another.

I am eagerly awaiting to see if there will be any business announcement via Siemens Healthineers by the end of the year. Jukka Tapaninen said in an interview published on November 12th that he expects 1-2 deals before the end of the year, and as a reasonably large player, one would expect it to be quite a significant piece of news regarding Aiforia. Hopefully, it progresses favorably.

It’s hard to say how big a deal it would be. Jukka, I think, said that one is certain and the other might go into next year? Many deals go below the reporting threshold.

Watched all those videos from this year about Aiforia, it left a good impression of a confident CEO and a company that is constantly winning customers. Looking at that market, it’s in a really good position, and once the customer growth foundation is built, then one would expect it to make a profit. ![]()

December is ending soon, if there’s anything else to hear? Hats off to the consistently buying Aiforians, I’m done. ![]()

A share issue on top of this and twenty million from somewhere, hospital acquisitions are bureaucratic (read: slow)… what do others think? What’s the mood like regarding the company’s direction? I myself give three lions to the CEO, a man of peace. I should rewatch the interviews and absorb lessons for myself from his way of communicating.

Have a good weekend! ![]()

I would think so, meaning management believes they will provide such evidence that better financing terms will be obtained for the next round ![]() In 5/2024 the price of money was 3.5 €/share, in 5/2025 3.2 €/share, and now the share price is below these levels. So far, a large one-time pot in 2024 would have performed better, but hindsight is the easiest form of wisdom.

In 5/2024 the price of money was 3.5 €/share, in 5/2025 3.2 €/share, and now the share price is below these levels. So far, a large one-time pot in 2024 would have performed better, but hindsight is the easiest form of wisdom.