Clearly expressed goals, but the strategy itself remained completely in the dark. I don’t know why communication has to state that the strategy has been renewed if it is nevertheless desired (probably for very good reasons) to keep it a secret. Wouldn’t it be enough to say that the goals or management metrics have been renewed?

Heh, my CMD preview was published today at 7:00 AM, and immediately at 8:00 AM, a release about the updated strategy came out. Quite a timing ![]() Here’s also a comment on the fresh goals:

Here’s also a comment on the fresh goals:

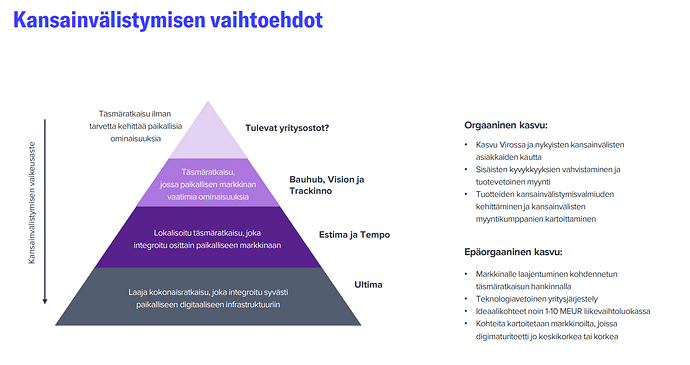

In the previous strategy and related messages, there has been a lot of talk about internationalization (see, for example, above), but these international openings are still being awaited from Admicom. Competitor Smartcraft expanded into the British market last year, and that opening has driven sales growth wonderfully. Admicom expanded… to Estonia? Well, that’s better than nothing and a good place to practice internationalization. Now it is stated:

In Finland and Estonia, we have a broad customer base, which puts us in an excellent position to grow together with our customers by serving them better and more broadly. We have also decided to continue international expansion. We will gradually strengthen our internal capabilities in international business while seeking opportunities to expand into new markets through acquisitions, as we did with the acquisition of Bauhub last year.

In the strategy, internationalization is formulated very timidly, even though the markets in Europe are still available for now, and competitors are snatching them up at the same rate as a middle-aged Finn grabs roe and sour cream at the Viking Line buffet. Those organizational games and exercises should have been done earlier, and now, after years of wavering and rowing, we should be able to achieve more active and faster growth abroad. If we now stay at the starting blocks tying our shoelaces and focus entirely on winning supremacy in the domestic, perhaps Europe’s worst, construction market, then this investment is pure trash. Dividends to zero and abroad, please!

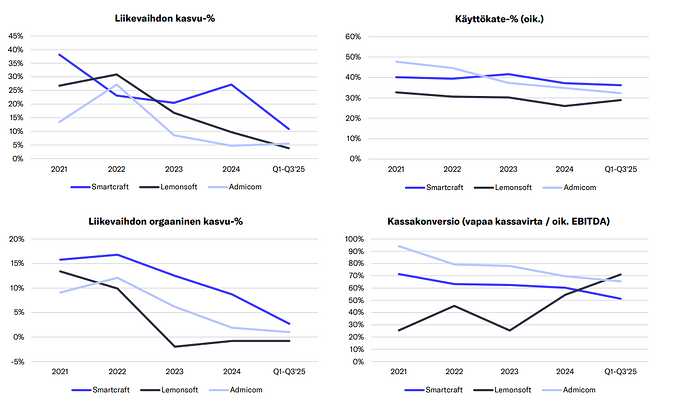

I agree that international acquisitions must be made if one wants to be involved in this game in the long run. But Smartcraft’s journey hasn’t been entirely rosy either. Organic growth has trended downwards in recent years. The company’s focus in Finland is still clearly the smallest, so they have been relatively least affected by the weaker-performing Nordic construction market. This certainly also shows that with acquisitions, there are always some leaks and challenges in the acquired targets, which then reflects in organic growth.

Admicom’s CMD (Capital Markets Day) today had a really good atmosphere, and the presentations added color to the company’s goals. Those interested in Admicom should definitely watch the entire CMD:

For those in a hurry, there’s also a more concise interview:

And naturally, tomorrow there will be my scribblings in the morning review!

That was very clear communication from the CEO. In my opinion, they also explained the growth path and strategy quite well, and how those growth targets will be achieved. It will be interesting to follow where the company progresses in the coming years. At least in terms of valuation, it’s a very attractive case!

Atte “Doesn’t Play” (Ei leiki) Riikola has written comments on Admicom’s Capital Markets Day. ![]()

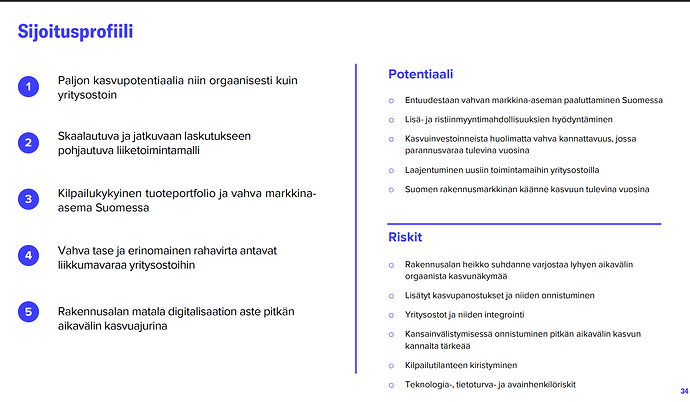

Admicom organized a Capital Markets Day on Tuesday, the recording of which can be viewed here. The company’s CEO’s CMD interview, in turn, can be viewed here. The day’s presentations added color to achieving the company’s ambitious growth targets, the realization of which depends on the company’s own actions, the gradual recovery of the construction market, and successful international acquisitions. During the weak construction cycle of recent years, Admicom has made significant investments in practically every area of its organization, and after strengthening its growth foundation, the prerequisites for accelerated profitable growth are in place. Our current forecasts are still clearly below the company’s target level after years weighed down by the weak construction cycle. If the targets are met, there would therefore be significant potential in the stock, as we already see the valuation as attractive with our current forecasts. Next, we will go through our key observations from the Capital Markets Day.

In recent days, this forum has also reported that the ECB might have to raise interest rates (next year?), and with the Finnish housing market already in a deep freeze, that certainly isn’t bullish for Admicom. In itself, that wouldn’t matter if the economy were growing, but Finland’s track record for economic growth is a bit weak.

I don’t currently own the stock (I sold earlier fearing a potential negative outlook), but I’m watching from the sidelines.

In the last quarter of 2027, so in a couple of years. A lot can happen before then. Admicom might not even be listed independently by then.

https://www.reuters.com/markets/europe/will-ecbs-good-place-turn-into-passive-easing-2025-12-09/

Atte has written a new extensive report on Admicom; as usual, this extensive report is available for everyone to read, so there are no paywalls. ![]()

We reiterate our buy recommendation and target price of EUR 55.0 for Admicom. In recent years, Admicom has been building its growth foundation during a weak construction cycle, and in our view, the company’s organization and product portfolio are now in great shape to accelerate growth as the market situation improves. In the short term, the weak market still hampers development, but we see good prerequisites for accelerating growth starting from H2’26. Relative to the accelerating growth we expect in the coming years, we find the stock’s valuation picture attractive.

Quote from the report:

In 2025, the gloom in the construction market has continued, but from a software sales perspective, Admicom has already seen budding signs of improvement. Uncertainty regarding short-term development remains elevated, but the worst phase nonetheless appears to be behind us. The market turnaround may still provide a good window for software sales, where construction entrepreneurs are not yet fully occupied with work, but as future prospects brighten, the willingness to invest increases. Thus, the software market may pick up even before other news flow from the construction sector begins to properly show signs of improvement.

Atte’s Q4 preview:

The earnings release is next Wednesday (Jan 21).

October-December 2025 (Q4) summary:

Annual Recurring Revenue (ARR) 1) grew by 6.0% and was 37.8 million euros (35.7). ARR growth was entirely organic.

Recurring revenue 2) grew by 10.1% and was 9.1 million euros (8.3). Of the recurring revenue growth, 0.4 million euros was inorganic due to the acquisition of Bauhub.

Revenue grew by 7.7% and was 9.5 million euros (8.8).

Adjusted EBITDA 3) was 3.1 million euros (2.5), or 33.2% of revenue (28.4%). No adjustments were made to EBITDA (245 thousand euros in 2024).

Adjusted operating profit (EBIT) 3) was 2.0 million euros (1.5), or 20.9% of revenue (17.2%).

Earnings per share was 0.29 euros (0.19).

@Atte_Riikola, can you shed some light on these “investments” by Admicom that are cited as the reason for weakened profitability during the current financial year? The CEO says:

“Regarding profitability, we reached our targets, and adjusted EBITDA was 12.3 million euros, or 32.5% of revenue. Growth investments have been reflected in profitability, but as operating costs stabilize following the strategic investment phase, profitability has begun to improve again towards the end of the year.”

Should these investments be visible on the income statement anywhere else besides the personnel line? Other operating expenses (e.g., marketing, staff training, machinery and equipment purchases) were SMALLER than in 2024. One would think there would be an increase specifically in these areas?

Personnel costs did, of course, rise by about €2.3M as the headcount increased somewhat, but the headcount hasn’t even grown that massively, has it? On Dec 31, 2024, there were 306 employees, and now on Dec 31, 2025, only 310. Granted, the differences in the average headcount during the financial year were somewhat larger (317 vs. 289). Have these additions to personnel gone into sales or where? Personnel costs have risen quite a lot relative to the headcount; I suspect the “ROI” on these is pretty lousy. The increase in the amortization of consolidated goodwill is mainly related to corporate restructuring and is a much smaller item in terms of scale.

It would be nice to get some visibility into whether there have actually been any concrete investments made for future growth, or if this weakened profitability is really just a result of something else.

It remains to be seen how growth will develop in the coming years. As a user of the system, I have been wondering how the long recession in the construction industry and the resulting market changes will affect Admicom’s operations. In my opinion, the system is most beneficial if you operate as a direct-employing company (employees directly on the payroll) using Admicom as an ERP (Enterprise Resource Planning) system and an accounting office. For this way of operating, I feel that Admicom is excellent and that competing players do not have as practical a system available.

Now that so-called traditional direct-employing companies have gone under or ceased operations, my view is that new companies entering the field are small sole proprietorships, and larger startups do not hire directly but instead operate with leased labor or a light entrepreneurship (kevytyrittäjä) model. For this way of operating, I don’t see as much benefit from Admicom’s solutions because the activities can be managed with lightweight and affordable systems.

Many additional services have become available in Admicom in recent years… they certainly have their place, but construction industry profitability will remain under heavy pressure in the coming years, so I don’t believe it’s possible to get very high margins from these add-on products. Furthermore, there are many applications available for documentation, project management, property management, quantity takeoff, etc. (e.g., Dalux, SokoPro, Granlund Manager, Tampuuri).

In my opinion, Admicom’s strength has been an easy and functional system as well as reliable and simple pricing; hopefully, that core idea remains in the future.

Should these investments be visible on the income statement elsewhere than just the personnel line? Other operating expenses (e.g., marketing, staff training, machinery and equipment purchases) were LOWER than in 2024. You’d think there would be an increase specifically in these areas?

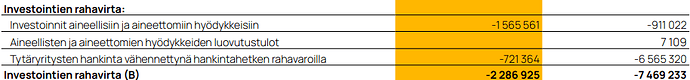

According to the cash flow statement, at least actual euros have started to flow into tangible and intangible assets during this latest investment phase. This item was pretty much at zero before the start of the investment phase, so things have indeed been done, but based on this, quite modestly relative to revenue outside of acquisitions.

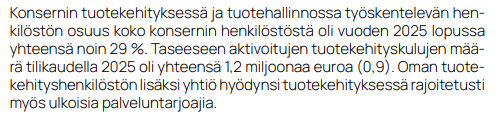

The company itself states where the growth investments have been focused: “Investments during the Focus for Growth strategy phase, particularly in sales and marketing as well as product development and product management.”.

However, I believe that instead of direct marketing expenses recorded in the income statement, those sales and marketing investments mean more reorganization and renewal of operating methods that do not directly flow through the income statement. The relative headcount in that function has actually even decreased slightly.

Additionally, investments have been made partly using external resources.

The business is steadily ticking in the right direction, despite the weak market. If profitability returns to growth as promised by the CEO, the P/E 20 (adjusted) for this year predicted by Atte doesn’t seem very steep yet.

PS. In accordance with @Pohjolan_Eka’s wishes, dividends were cut, if not to zero, at least closer to it. Let’s see if those acquisitions start coming ![]()

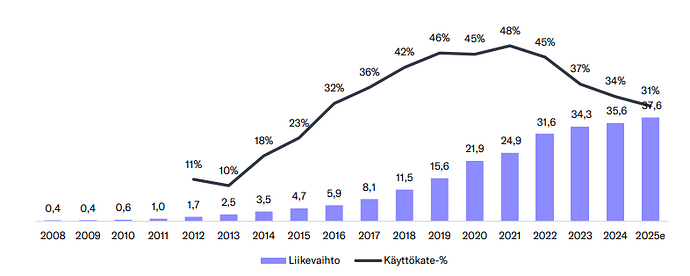

The largest growth investments were already made during 2023–2024, when additional staff was recruited for practically every area of the organization. For the most part, these were done to enable the next growth leap and internationalization. However, it was also necessary to invest in the organization, systems, and processes, as these investments were likely somewhat neglected during the most aggressive growth phase, when the focus was on sales and implementations. So, the organization was creaking at the seams to some extent, but investors only saw the massive earnings growth figures from the outside ![]() Then, when the weak market slowed growth to single digits while costs increased, the profitability development of recent years has indeed looked unpleasant compared to historical peaks—which, in hindsight, were somewhat unsustainable in the long run.

Then, when the weak market slowed growth to single digits while costs increased, the profitability development of recent years has indeed looked unpleasant compared to historical peaks—which, in hindsight, were somewhat unsustainable in the long run.

Some costs from the 2024 investments also carried over into 2025, and for example, Q1’25 profitability was even softer (EBITDA 24%). In Q2, the result also weakened compared to the reference period, but in Q3, the situation stabilized, and now in Q4, we saw a clear improvement over the reference period. One investment made in recent years has been the gradual wind-down of external software development at Aitio Finland (acquired at the end of 2021) and the reassignment of developers to internal projects. This reduced last year’s EBITDA margin by about 1 percentage point. That decline in software services is visible as the shrinking of the light blue revenue bar. SaaS revenue has grown quite nicely even in recent years.

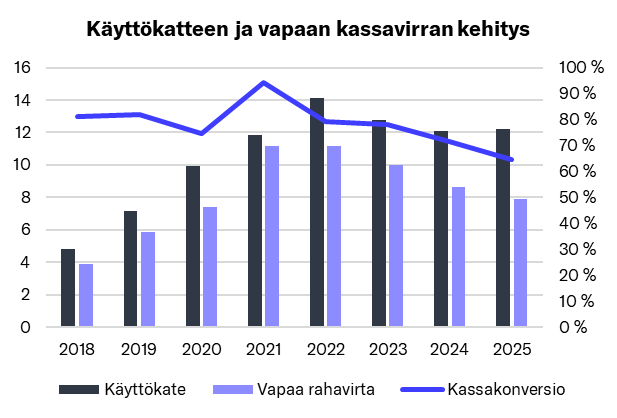

And as also noted in the previous message, product development investments have also begun to be moderately capitalized in recent years, as the company has also developed entirely new products for its offering. Due to this and other investments, the trend in free cash flow has been downward, but the direction should turn in the coming years along with revenue growth.

Edit. Here is also an updated analysis report regarding the results:

Almanakka has also written about Admicom following the Q4 results. ![]()

Admicom’s results were mixed. Revenue grew by more than 10% despite the weak market conditions, and there was also organic growth. Profitability also improved after a long period of weaker performance. However, after reading further, I found more negatives than positives in the report.

The headline summarizes the case. Once the construction slump eases, Admicom is a good investment. Of course, the stock market is already sniffing out this turnaround a bit.

Someone is selling off Admicom shares through block trades:

![]()

I wonder who might be letting go of their shares? In any case, Admicom is now “on sale” for those interested, compared to last week’s prices.