Viafin’s monitoring is shifting from Olli to Olli, meaning from Koponen to Vilppo, and regarding this, a visit was made to Viafin Gas’s office in Vantaa on Tuesday. Of course, the monitoring was also temporarily with Arttu in between!

@Sijoittaja-alokas already linked the interview filmed there, but that interview was preceded by almost an hour of fruitful discussion with CEO Heikki Pesu and CFO Eemil Kronqvist. I’ll try to summarize the main points from memory here; hopefully, you’ll find it useful! ![]()

Market and Business Areas

Viafin sees the market growth rate as very moderate, practically in line with inflation and general economic growth. However, this has not been an obstacle to growth historically, as its strong track record shows. Over the years, industrial pipeline maintenance and upkeep have been joined by mechanical maintenance and upkeep services, which has strengthened the company’s pillars alongside its strong history in pipeline business. In recent years, growth in areas such as electricity, wind power, and hydrogen has expanded the product offering and opened up a huge market for the company. Part of the expansion has practically been sensible to do through acquisitions, as, for example, maintaining wind turbines requires industry-specific training and permits, and not just anyone can start maintaining turbines, even if they are skilled with tools.

Regarding seasonal variation, Q1 is generally recognized as quieter for a few reasons: at the beginning of the year, only absolutely essential and acute maintenance is performed, because customers usually define their budget for the entire year, and larger actual works often fall into the second, third, and fourth quarters of the year. Another reason, though more of a nuance, is the weather conditions affecting the construction sector. For example, if asphalt has been torn up in connection with street work and pipes need to be moved or maintained, it’s difficult to do this in the middle of winter.

Currently, the weakness of the forest sector, in particular, has been reflected in customer decision-making, but this probably comes as no surprise to forum readers. Nor has the drop in interest rates to around 2% actually been visible in customer activity. At least not yet. On the other hand, maintenance is often something that must be done regardless of interest rates.

Now, we are also generally in a period of shutdowns in autumn or late summer, when there is more maintenance to be done. However, no major differences have been identified between the strengths of Q2, Q3, or Q4 that would allow one particular quarter to be singled out as the strongest.

Growth

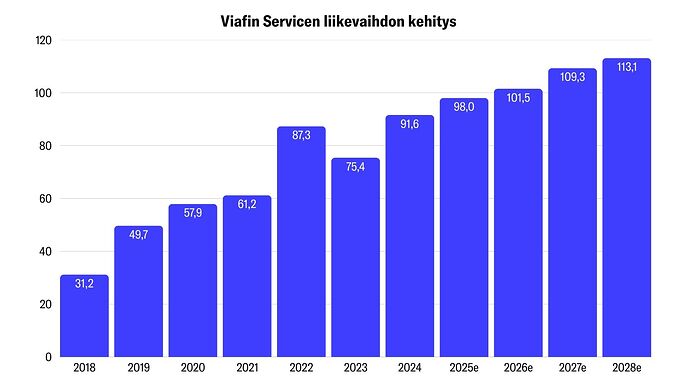

From 2018 to 2024, revenue has grown from 31 MEUR to 92 MEUR, an average of almost 20% per year. Not bad at all. Of course, some of this has been inorganic growth. I don’t remember if there was talk about how large a part.

In addition to inorganic growth, growth has come through the opening of new units. There are currently 34 units across Finland and about 685 employees, if I remember correctly. When opening a new unit, there are practically already at least some ready customer relationships and local knowledge, so units are not opened from scratch.

I also interpreted that Viafin Service is seen among professionals as a very attractive option to become part of a larger entity, and discussions are practically always fruitful and enthusiastic, and rarely (if ever?) has it been necessary to back down from plans to open a new unit, provided the right people are found. On the other hand, the bar is probably already high from the outset for what is expected of a new unit leader for discussions to continue.

The entrepreneurial spirit is also reflected in the fact that the local unit leader is often involved in the hands-on work, especially initially. Only when the unit grows to about 10 employees might there be a need to hire more supervisory staff to run the unit.

Profitability

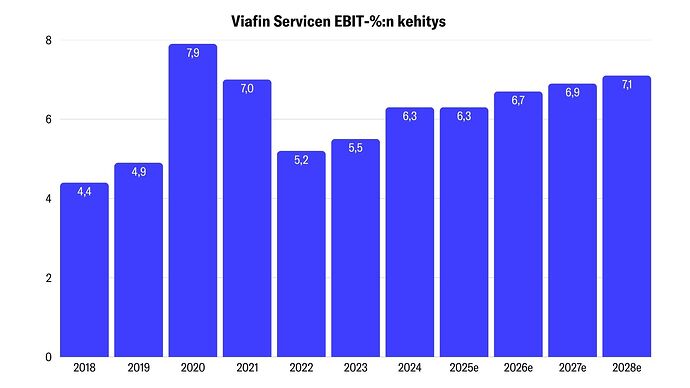

Viafin has been active on the acquisition front throughout its history, and @Verneri_Pulkkinen at the office pondered where the good profitability of the acquired targets has disappeared, as the figures have not converted into the profitability of the entire group. The acquired targets have reportedly remained profitable, and they are not to blame. Instead, profitability has been pressured by the opening of some new units. Thus, there has been satisfaction with the acquisition targets.

There are indeed big differences in how quickly the profitability of a new unit reaches the target level. Some start performing immediately and practically reach their targets right away, but others, on the other hand, require more time. This does not necessarily mean that they are making a loss, but they may remain far from the target level for a longer period. In some cases, apparently even for a couple of years. I tried to ask how many units are still in the ramp-up phase and profitability is far from the target level, but Heikki and Eemil could not answer this.

Another factor significantly affecting overall profitability was how efficiently, for example, shutdowns could be managed. An example used was an industrial company that wants to complete maintenance within a week. In such cases, Viafin may have to resort to subcontractors to stretch capacity for temporary demand peaks. Practically, during such a demand peak, employees might travel a long distance to the worksite and stay in a hotel. However, this is profitable if the job can be done efficiently in a short time.

What is not as efficient, however, is a scenario where employees travel the same distance, work 8-hour days from Monday to Friday, stay in a hotel, return home for the weekend, and the same thing happens the following week until the shutdown is complete. In this case, travel costs must be paid twice, and more hotel nights and daily allowances accrue.

The example mentioned above is a nuance in the overall picture, and CFO Eemil emphasized that everything starts with costs. When considering offers, costs must first be identified, after which the aim is to add one’s own margin. For this reason, for example, utilizing subcontractors is an important option for Viafin so that they don’t have to keep too many people on their payroll.

Personnel

Employee satisfaction with Viafin as an employer will most likely be reported in some form. Surveys have now been conducted for, if I remember correctly, 7 quarters, so data is starting to accumulate.

I interpreted the matter myself as satisfaction being at least at a satisfactory level, but general economic conditions fluctuate this in both directions. Quite understandable.

And how will the current number of personnel then suffice as the company grows? The current group of professionals cannot stretch to, for example, 20% growth; in this case, more workers would indeed be needed. However, administration would not need to grow; with the current administration, the company could grow significantly larger. In that respect, economies of scale would be achievable.

Guidance

The years are reportedly not brothers, and it is not necessarily possible to draw direct conclusions from the development of H2 in previous years about what kind of H2 will be achieved this year in relation to H1. The guidance for the rest of the year was kept unchanged, and no more specific hint was received in this regard, other than Heikki’s comments that Viafin wants to be as realistic as possible in its estimates.

Nor is it necessarily possible to draw direct conclusions about the relationship between revenue and profit, as revenue is seen as merely a tool for making a profit. In other words, a good profit can be achieved either with low revenue (profitable projects) or high revenue (less profitable projects).

So, we will wait and see what kind of H2 comes out. ![]()