Taseko Mines Long and Copper Short

First, apologies for the length of the post, but due to the background and structure of the trade, it’s difficult to avoid.

Taseko Mines is a Canadian copper miner with an operating open-pit mine, Gibraltar, and the Florence Copper project, which is in the early stages of construction.

There are many really interesting features in Taseko that can affect the expected return. At the turn of the year, Gibraltar was still owned by a Joint Venture, of which 75% was held by Taseko and 25% by external entities. Taseko purchased the 25% stake in two tranches, the last of which was in Q1, thus owning all of Gibraltar. I am gradually starting to believe that in the mining industry, the dissolution of a JV is a potential source of alpha (ylituotto). One example of this from the past year is Galiano Gold, which, after buying out the other party, took control of its own share of a significant cash pile that was in the JV.

From a technical perspective, there is also an opportunity for alpha here for a fundamental investor, as screeners will only later begin to show the higher earnings capacity of the consolidated entity, making the company look more attractive.

1/4 of Taseko’s enterprise value is debt; 900 mcap, 1300 EV, so there is also a nice amount of leverage as the company pays off its debt and the equity gains the value previously held by debt. The debt load looks heavy and off-putting for the company, but this is about to change.

Florence Copper is an ambitious growth project that, if successful, will turn Taseko into a cash machine. Instead of an underground or open-pit mine, Florence will use in-situ technology for copper recovery. In practice, this means that wells are drilled into the ore into which a solvent is injected, bringing the copper to the surface more affordably. Most uranium is mined using this technology, but for copper, the technology is more experimental, as I’ve found only a few mentions of its use on the scale Taseko is attempting. The production costs of $1.1 per pound mentioned in Florence’s technical report vs. Gibraltar’s costs of $2.5 per pound (which are already among the industry’s lower) put things into perspective.

The company refinanced its previous $400 million debt with a 2030 maturity and set price hedges for the entire 2025 production with $4-5.5 collars. There is practically no external reason why the company wouldn’t be able to build Florence.

Now for the second part of the trade: the copper short. I like the copper story in the long term, as the investment deficit for new mines is massive and the incentive price for new mines is, according to industry commentators, significantly higher, while bureaucracy slows down the permitting of projects already in development. In the short term, shorting copper seems like an interesting way to hedge the portfolio against a possible economic slowdown. What slowdown? Europe is recovering, right? Yes, but the US is starting to slow down gradually, and the economic development of China, which accounts for 50% of copper demand, is more uncertain. If the Fed starts cutting rates as the economy weakens, I’m not at all sure if the Nasdaq or S&P 500 will fall as a result, but I am fairly certain that cyclical commodities will. The timing seems sensible now that no one is talking about a recession anymore and indices and commodities are hitting new highs. On the other hand, there really seems to be enough demand at the moment, with TC rates being negative and the Chinese only increasing their copper stockpiles, which I believe is a sign that the government expects a copper deficit in the near future and thinks it’s worth hoarding while it’s cheap.

The trade could be executed well even without the short, but I consider the expected return to be positive. I started the short today at 12:00 and added a bit to the position at 17:00 after concluding that the trend has turned, at least in the short term.

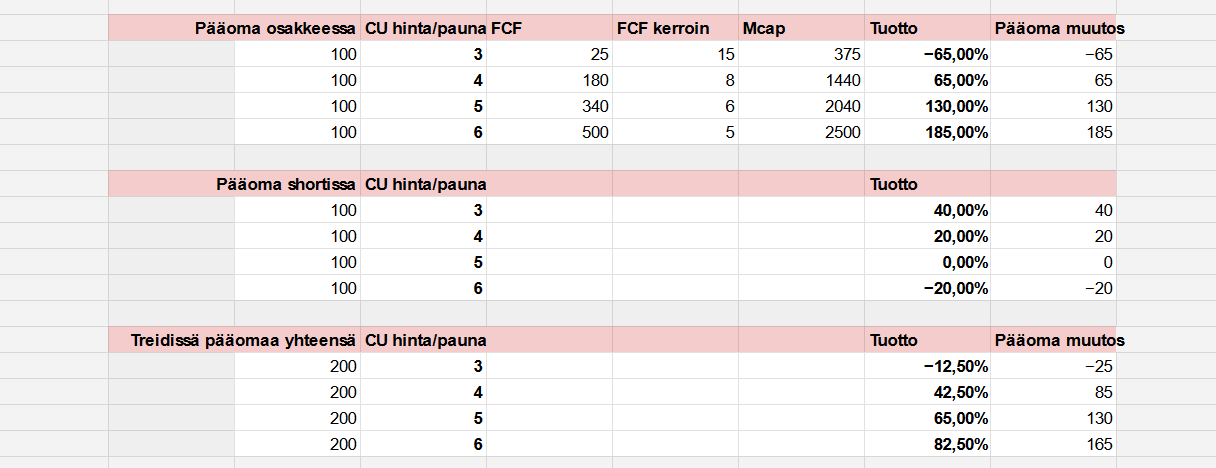

Different scenarios and how I’m structuring this: I have an equal share of the commodity short and the stock in my portfolio. 100 “money” in both. If the copper price falls, the short should protect against most losses. I’ve scribbled a small calculation on how the stock could be priced when the mine is completed in 18 months under different copper environments.

In the model, I’ve used $2.5 as the 2026 Gibraltar C1 production costs, $1.6 for Florence, $60 million in financing costs, and a somewhat inflated $60 million capex. It’s a fool’s errand to try to give a precise value to a cyclical, but it’s worth noting that relatively few mining companies trade at a reasonable cash-flow-based multiple. My assumptions may be incorrect.

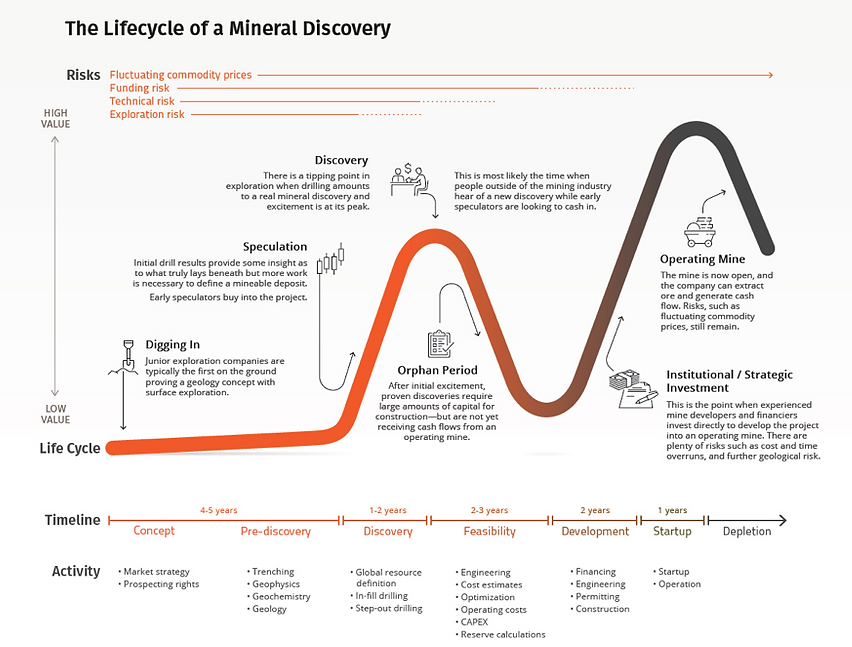

I believe the trade will progress something like this: If the copper price falls, the stock falls with leverage. If the copper price doesn’t crash, the stock price will stagnate or decline until the company’s story reaches the final 6-12 months of the development phase on the Lassonde curve.

At that point, the market will start taking an interest in the company again, and Florence’s cash flows will begin to be priced into the stock. When the first copper enters production, it’s time to sell this, unless you want to take the risk of whether the production ramp-up succeeds. It’s possible, of course, that I’ll sell everything as early as tomorrow.