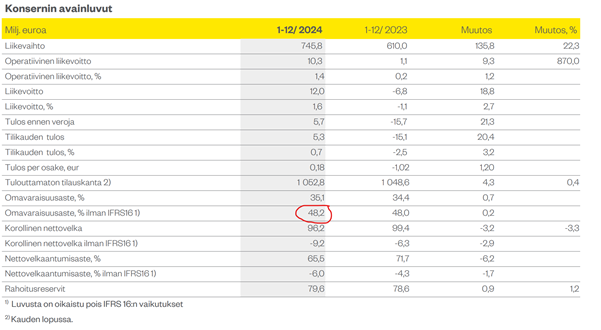

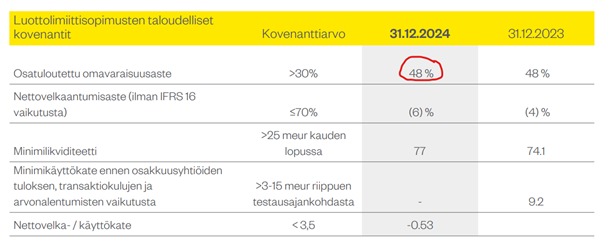

According to my understanding, the equity ratio is calculated without the impact of IFRS 16 in the company’s covenants. Based on my preliminary calculations, in the scenario you described, the company’s equity ratio excluding IFRS 16 would meet the covenant requirements. The calculation naturally includes, for example, the completion of the SRV Infra transaction.

Iikka interviewed Atte about SRV’s performance. ![]()

Topics:

00:00 Start

00:13 Sale of SRV Infra

02:02 SRV’s early-year development

02:42 Order book

03:48 When will construction pick up?

05:53 Oversupply in the Helsinki metropolitan area

07:23 Financing package

08:57 Financial targets

10:10 Reduce recommendation

SRV gets a new €22.5m hybrid with a 10.0% interest rate. At the same time, old hybrids are being bought back at a nominal value of €15.9m, but I couldn’t find the acquisition price in the release itself:

Here are Ate’s comments regarding the new hybrid bond. ![]()

*SRV announced yesterday it would issue a EUR 22.5 million green hybrid bond. At the same time, the company is repurchasing its existing hybrid bonds for a nominal value of approximately EUR 15.9 million. The arrangement was fully expected, and its terms were largely in line with our preliminary expectations. The financing arrangement strengthens the company’s balance sheet and enables the launch

Poor decision-making by the company if the loan terms (such as the conversion ratio) are not favorable to the company.

Now, a €15.9 million loan is being exchanged 6 months early at double the interest rate.

The pre-marketing of new developments is currently so slow that the company would have ample time to acquire the necessary financing once pre-marketing picks up.

Essentially, enough loan was drawn to cover the costs of the €15.9 million loan during its term.

I’d be happy to hear opposing views if others find any.

It would at least be a good start if both the company and Inderes commented on the transaction according to its factual nature.

A 22.5 MEUR transaction, from which 6.6 MEUR remains in hand after refinancing old hybrids, before considering transaction costs and rising interest burden. How does this strengthen the company’s balance sheet or improve its ability to carry out self-financed housing production (which the company itself, on the other hand, says is dependent on market conditions) given the scale of its business?

In itself, the transaction is quite understandable risk management for the company, considering its business risk level relative to the industry cycle. The conversion price would apparently have been quite high in summer 2026 from the perspective of equity investors’ dilution. It is indeed difficult to find many other reasonable grounds for this, and the hybrid’s coupon is in line with the company’s financial situation. From the perspective of strengthening the balance sheet, conversion could simply be allowed to happen; current shareholders would take the dilution, and the interest burden would also decrease. So, in the name of honesty, are we here preventing/reducing the dilution risk for equity investors in 2026, rather than strengthening the balance sheet? That is quite typical for a problem/crisis company, but it’s a different headline.

When the current cash reserves are supplemented by the sales revenue of Infra of €30 million and, in my opinion, approximately €16 million to be received from Oulu Torihotteli, the company will have no problem redeeming the VVL in full with account funds in June 2026.

In my opinion, the company’s balance sheet position is very good. A significant portion of the balance sheet assets consists of bank receivables.

The interest rate on the hybrid loan is high considering the company’s current situation, which only lacks market-driven self-developed housing production.

Conversion would be unfavorable for shareholders. The company’s management has announced that the company will redeem the VVL in June 2026.

In my opinion, the company would not have needed a new hybrid loan, at least at this stage when self-developed production starts are not happening anytime soon and advance bookings are moving rather slowly, so that financing could be arranged when it is actually needed.

I’m circling back to an earlier discussion from a few messages ago. Looking at the sale of SRV Infra and the issuance of this new hybrid, I see that both are behind these transactions: strengthening the balance sheet and redeeming existing hybrids, thereby avoiding conversion. Existing hybrids can indeed be converted into shares at a price of 4.0 euros, in which case the number of shares could increase by approximately 14 million shares (the number of shares would increase by 84%). Now, of course, existing hybrids with a nominal value of approximately EUR 15.9 million were repurchased (after the transaction, approximately EUR 41 million in nominal value remains outstanding), so some of that dilution risk has been managed. In my view, the primary reason for the issuance of this new hybrid is still that the company’s balance sheet and its key figures can withstand the initiation of new self-developed and self-funded projects (when the market allows), despite the redemptions of existing hybrids.

Well well well,

transparency should be at a high level when hybrid loan transactions are carried out with

I also refer back to the previous discussion on loan covenants, and it seems to me that the effects of IFRS16 are also taken into account in the equity ratio calculation. Net gearing ratio and net debt/EBITDA are defined accordingly without IFRS16, but the equity ratio including:

must also withstand the debt burden brought by project financing. Furthermore, it must be remembered that in addition to self-initiated housing projects, the company’s self-developed projects also tie up capital in the form of plots. The company is moving well ahead of the market regarding financing, but on the other hand, I believe it is good to arrange financing before there is an urgent need for it. Naturally, the new hybrid bond has a higher coupon than the previous one, where the coupon rate was very low in the current environment.

Ok, that clarified a lot. In the table I linked, there was no mention of “without the impact of IFRS16” for the solvency ratio, as there

In a normal market, buyers pay the mentioned 6-8 million euro “share” already during the construction period, meaning that during the 1.5-year construction period, the average construction company’s “equity burden” is significantly smaller than this.

I understand well that the readiness for financing is negotiated well in advance, but raising it in a situation where 1-2 new self-developed "Niittykumpu

SRV seeks listing for a new hybrid:

The listing prospectus will be published on the company’s website later today, meaning it is not yet available via the link below. The listing prospectus should contain much more comprehensive information about the company’s current state than the interim report, but it is quite heavy reading and will only be available in English.

Tuomas Kokkila has sold just under 10k shares. SRV’s shares are apparently traded elsewhere than in Helsinki:

What is the logic when a new loan of 15 million euros is taken out instead of repayment, and shares are sold for 45,000 euros?

Forgot to reply to this:

100 pct in this context means that the price of the loan was 100% of its nominal value. So Kokkila sold old hybrid bonds for a little over a million and subscribed for new ones worth €0.5m. The difference went into his own pocket.

Who subscribed for €15m?

Where has it been stated that the nominal value of one bond in both loans would be one euro?

If in both loans the nominal value of one bond were one euro, then as for Kokkila, he would have received redemption for over half the value, and less than half of the old loan’s value would have been “paid” with a new loan.

Nowhere, and no one has claimed such a thing. I don’t feel like digging up the size of the tranches for those loans now, but in the old one it was something like 760€, because it was backed by very complex arrangements related to debt reduction. The tranche of the new hybrid is divisible by 100.

You are confusing things now. Kokkila sold old hybrids with a nominal value of just over one million and received 100% of their nominal value for them. After this, he subscribed for new hybrids worth 500k€ at 100% of their nominal value.

If the value of the hybrids redeemed from Kokkila had been half of the nominal value, the stock exchange release would have stated 50 pct instead of 100 pct.