Approximately how much money has been put into the portfolio? I understood that the leverage has been ‘moderate’ the whole time?

Over my entire investment history of a few years, I’m still down by twenty thousand. Only in the last couple of years have I sought an accelerated exit, and leverage has been heavily utilized at times. So I finally got wiped out last year when Intrum was trading near 10 SEK. I temporarily took on more investment loans during the yen carry trade crash, and when the tariff chaos began, I briefly emptied my entire portfolio, etc. I might not comment in the future, but if this serves as an example of what can happen, then good.

The last year has been so strong that the index has indeed been beaten after a weaker start. ![]()

SoFi’s large weighting has been a fairly key factor.

Edit: I’ll also add that going forward, the plan is to mainly add to Investor, Berkshire, and index ETFs. If I could get about half the weighting, if not more, into those three.

The half-year performance for the portfolios isn’t particularly impressive. All portfolios are at least in the green, but more could have been gained. During the customs confusion, a partial shift to cash happened in completely the wrong securities. I didn’t sell anything completely, I only lightened my positions. Furthermore, certain Neste and Nokian Tyres have performed poorly. Neste has, however, recovered slightly. The largest portfolio’s MIND is at its early-year levels, so there are the reasons for the poor performance.

OST + 13.5

The company’s AOT shows +14%, though it doesn’t quite reflect the situation because an additional 20,000 capital has been added there. Of course, those investments have brought something, but without that addition, the development would be 20% better.

AOT + 4.6% (Largest portfolio) Last year’s nearly 30% development is very difficult to repeat, but it’s good that we are in this situation from April’s low (-15%).

Real estate investments: In Finland, development is estimated at 0%, abroad, development is +15%. This is pleasing as it has already clearly become the largest asset class.

Unlisted investments cannot yet be properly evaluated, though only 5,000 € is tied up in them. Excluding shares of my own company, whose value is probably pretty much the same as last year, though 51,000 in dividends came in, so I guess its value increased by 51,000 euros.

Wishing good picks for all of us, good luck and success for the rest of 2025.

This year has really brought a lot of trouble. Of course, we are still in profit, but over the last three years, Hesuli (Helsinki Stock Exchange) has already caught up with my own dividend portfolio.

It’s easy to be wise after the event, but two purchases that were almost made significantly ate into returns: Early in the year, Aallon Group should have been picked up for the dividend portfolio, and during the tariff confusion, Wärtsilä should have been aggressively bought.

Instead, early in the year, I once again bought Neste from the dip and, just before the tariff confusion, bought Detection Technology for the portfolio. Well, time to put on a dunce cap and face H2 with my chin on my chest.

My year-to-date return from stock market investments +1.2%. It’s been a difficult year. However, I haven’t sold anything, but have steadily bought more every month. Only ETFs and regular funds.

Best first half-year in my short investment “career”. It will probably traditionally slip into the red by December 31st.

The percentages could be even better, but unfortunately, the Nvidia and Rheinmetall purchases fell through in crazy April.

And the portfolio’s H1 return: + 9.79%

It’s positive that it’s positive, but the index(es) certainly show what level of stock-picking talent is managing this portfolio.

June is now over. There was a little turbulence throughout the month. We’ll see what July brings.

June 2025: -0.86%

Year to date: +4.19%

12 months: -0.50%

2 years: +19.64%

![]()

A year ago I was overly optimistic, but the eternal and rapid rise has now begun.

Also a strong H1 from my side. Last year, however, was -3%, so nothing to cheer about. In 2024, a five-figure loss was taken from Neste. They are still in the portfolio, so now this is boosting the result. The last 10 years’ CAGR is +8.78, so in the long run, this is indeed a profitable hobby.

Started in 2010 with exactly 500 euros. Stock saving hasn’t been very systematic every year (sometimes bought apartments etc etc).

Compounding, however, is now starting to swell the portfolio nicely. There are about 15-20 lines in the portfolio, which many might consider a lot, but we’re playing the long game and I sleep better this way. Only 36 years old, so time is still on my side. ![]()

I haven’t posted any returns here lately. However, the first half of the year has gone quite nicely, considering my own goals. We bounced quite quickly from the dip to the portfolio’s ATH figures, and then we sort of got “stuck” around those levels. If the rest of the year goes up similarly, I will be more than satisfied.

I refer to this “What do you have in your portfolio” message:

https://keskustelut.inderes.fi/t/mita-sinulla-on-salkussa/1246/4110

The portfolio’s YTD overall is currently 7.71%, also taking into account currency exchange rate changes.

Domestic stocks have yielded 5.88% + 2.51% from dividends = 8.39%.

Foreign stocks have yielded 18.44% + 1.41% in dividends = 19.85%, and when subtracting the effects of currency exchange rates -6.52% = 13.33%.

ETFs and funds have taken the biggest hit from currency exchange rates and are therefore at a loss of -0.57%.

The best-performing domestic stock is Nordea, with a 26.69% return. Among foreign stocks, Palantir has performed best with 23.75%. In hindsight, Palantir should not have been sold, of course, but I wanted to protect profits. And it is a high-risk stock. The second best performer is BAT with 20.23%.

The weakest link is Novo Nordisk with a -22.28% loss. Nokian Renkaat was also poor with -14.08% but it has already been sold.

The portfolio was at its worst with a -6% loss on 6.4.2025 during the stock market decline caused by tariff fears. We have recovered well from that in just over 2 months, and some additions were made around that time. Some of them can be found in the buy-sell thread.

Overall, I am quite satisfied with the first half of the year; investing has been profitable. If I could reach a +10% YTD balance by the end of the year, I would be very pleased with that.

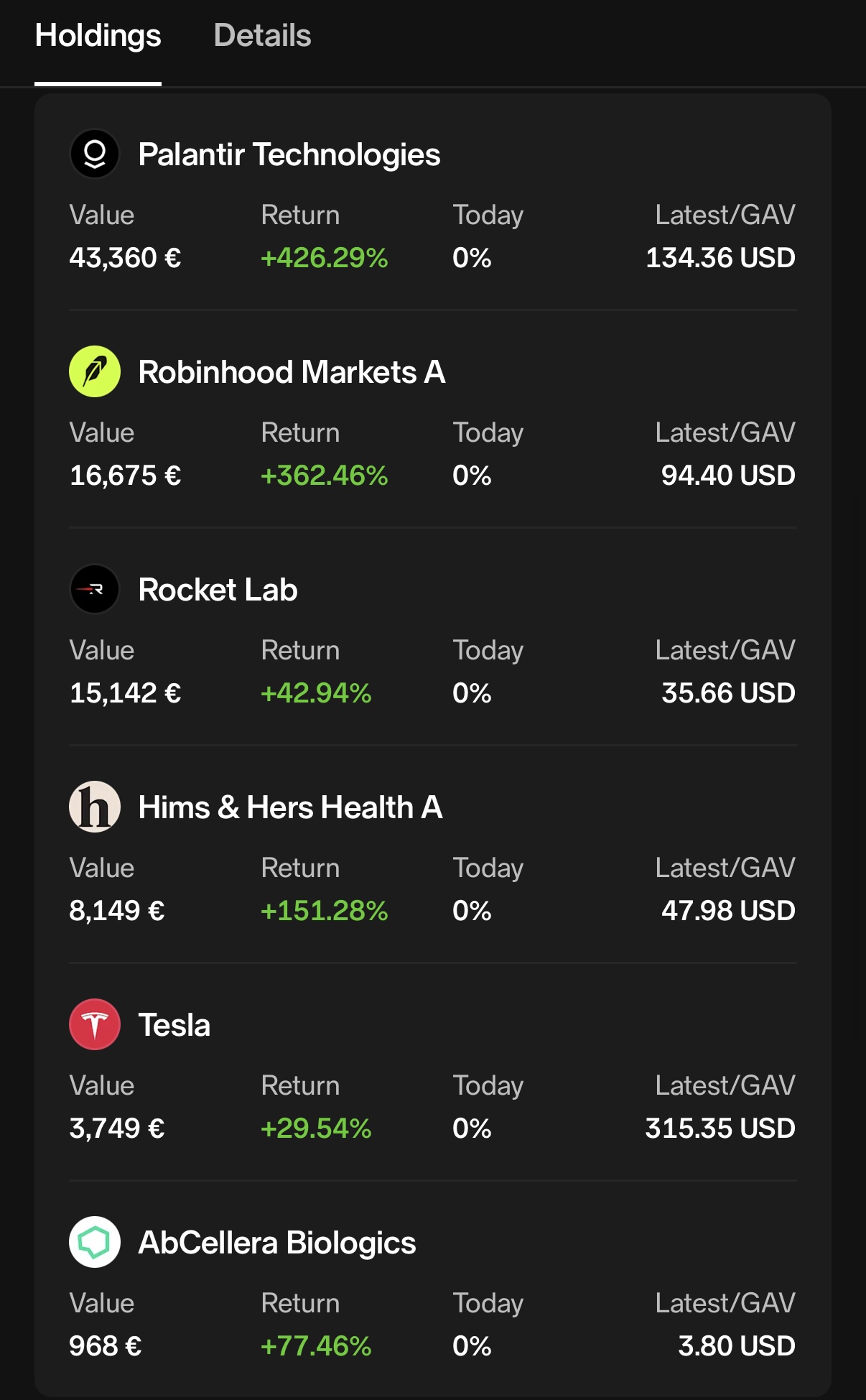

H1 2025 Portfolio Update ![]()

89 767 €

YTD + 55.44 % [31,890 €]

Best performing stock this year:

![]() $HOOD + 153 % YTD

$HOOD + 153 % YTD

$PLTR 380 @ 23.36

$HOOD 208 @ 18.73

$RKLB 500 @ 22.38

$HIMS 200 @ 17.64

$TSLA 14 @ 219.80

$ABCL 300 @ 2.05

![]() $RKLB has been the only stock where I’ve accumulated a position this year.

$RKLB has been the only stock where I’ve accumulated a position this year.

Next, the plan would be to start accumulating a $TSLA position within the next 12-24 months ![]()

Let’s also drop a link to an X post here, just in case I get motivated to create some stock/portfolio-related content now that I have more free time after graduating. The intention is to do everything as transparently and authentically as possible.

https://x.com/leemsegit/status/1941421551020278220?s=46&t=DphvCJ5ktD9n8H4iVde4VA

YTD quite a pleasing figure at this point of the year. NN portfolio essentially:

Zaptec

Evolution

Emerging markets fund

I’ve been adding Zaptec at prices below 20NOK. I strongly believe that the stock’s price will be closer to 40NOK by the end of the year. I’d like some new stock ideas. I missed Intrum.

I’ll have to make a quick follow-up update, because the first €100,000 has been reached!

https://x.com/leemsegit/status/1945110366507426040?s=46&t=DphvCJ5ktD9n8H4iVde4VA

Capturing this, as the main portfolio broke through 120k ATH. Successes for this year include Iren, biotech bets Elicio Therapeutics and Senestech, and the Uranium ETF; all of these remain held for now. A large Faron position was also sold with approx. 60% profit, and it’s being watched from the sidelines for now.

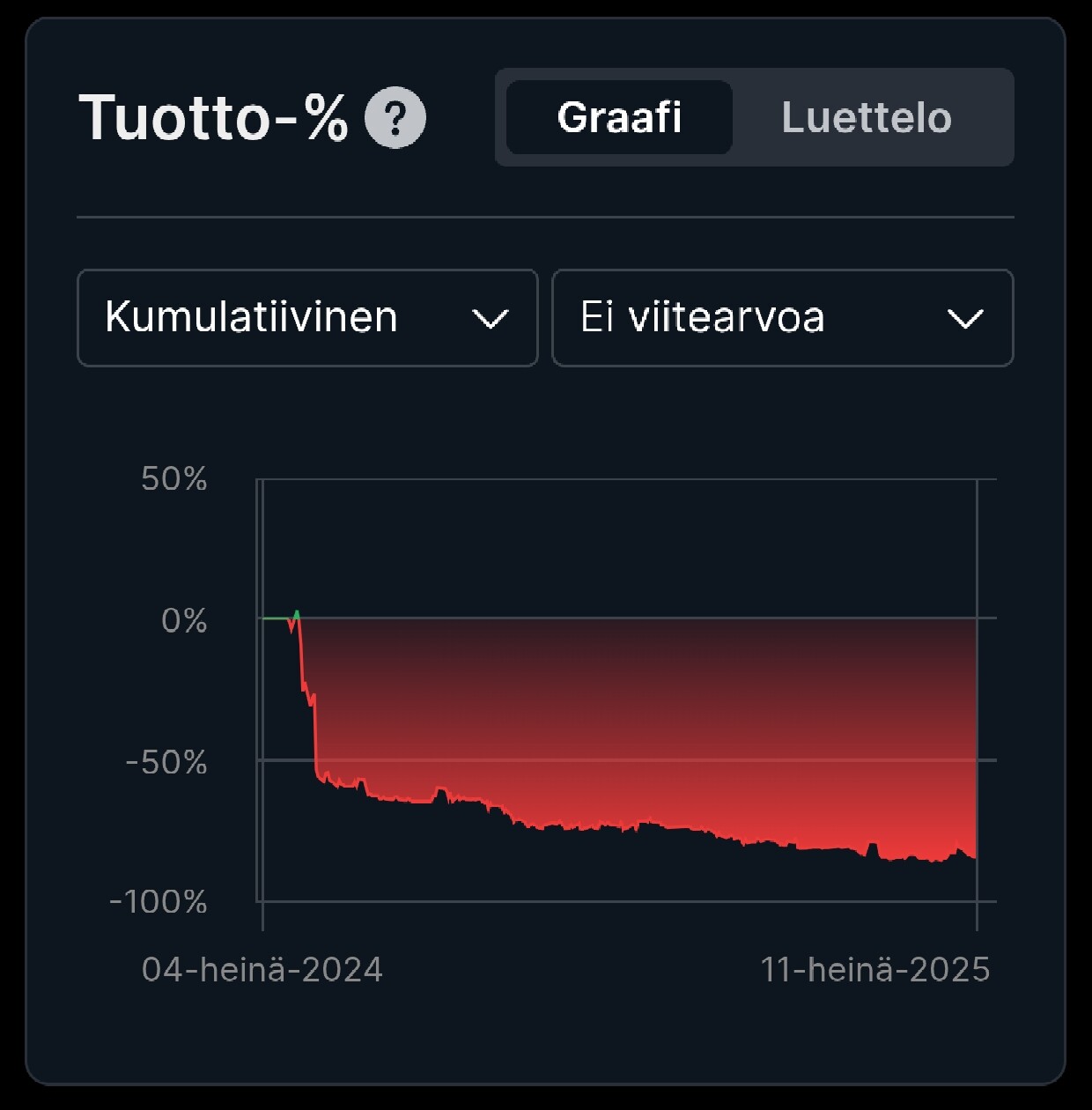

Additionally, as a lighter note, the secondary portfolio in Mandatum, i.e., me as a mining magnate and options speculator. Fortunately, the total loss is only approx. 5k, even though the curve is terribly ugly ![]()

In just over a year, the portfolio has grown by 30,000€, with a little over ten thousand euros of new money added. As the portfolio grows, you can clearly see how money starts working for you, and the portfolio grows as if by itself ![]()

There’s been some serious tough going in the Nordnet portfolio lately, but those records are slowly breaking. Fortunately, the US market boom has performed a bit better in the IB portfolio.

Last year ended with +52% figures,

continuing that, this year the stock portfolio is currently at +23%, which is also the highest quotation for this year.

I have now lightened individual positions and am moving money into interest-bearing investments and funds. An autumn dip is expected, we’ll see if it materializes.