Theon was briefly examined some time ago, and there are indeed justifications for that assessment. Over 50% of the crew night vision market is already controlled, so growth in that segment is practically limited to the market’s pace. The move into the equipment sector is still in progress, and success there is uncertain. The business model where technology and components are bought from others, assembled in low-wage factories in Greece, and then resold, has indeed been historically very profitable, but is largely already priced into the stock. Theon is rather a profitably and steadily growing dividend machine than a sexy defense technology company. So, not necessarily a bad investment at all, but from these starting points, it won’t get the highest multiples.

I would certainly see great opportunities for Theon’s growth. Acquisitions made in the Baltic countries, Germany, and Belgium create opportunities for new deals in old product categories, generate inorganic growth, and enable new innovations and product development. In my eyes, Theon’s management seems to be doing determined work to create value. And the role of a market leader is generally not a bad thing in investing. Huge sums of money will be poured into European defense in the coming years, so surely some of that will trickle down to Theon. Also great opportunities in Southeast Asia. Optics suitable for the US market are now also available (latest news). However, I am a bit skeptical about this location. The valuation is low enough that a few “surprising” deals could trigger quite a rally.

I’ve been debating for a week now whether to buy Thales or AeroVironment. Opinions? Already own Rheinmetall.

Theon also has a joint venture with Hensoldt in Germany. The purpose is to combine Theon’s ability to produce tubes cost-effectively with Hensoldt’s optoelectronics expertise (regardless of the system the tube is attached to, be it a reconnaissance or kamikaze drone, combat vehicle, fast attack craft, helicopter, soldier’s helmet, etc.). I see strong synergies for both partners, and the joint venture has already started to gain market share in Germany and Belgium with previous orders. Theon gains expertise, and Hensoldt gets a partner with mass production capability that enables competitive prices.

And such acquired system(s) are significantly German work, which is important when making procurement decisions. Theon recently acquired another German company that develops optical systems for vehicles. And a subsidiary has been established in Belgium.

*Both companies are already successfully cooperating within the framework of a bidding consortium for a contract to manufacture and supply 9.550 pairs of night vision goggles, (5.000 for the German and 4.550 for the Belgian armed forces) on behalf of the armament agency OCCAR. Now both partners are complementing their capabilities in the field of thermal imaging and night vision systems. Specifically, new products are to be created on the technological basis of THEON’s night vision goggles and HENSOLDT Optronics’ weapon-adapted night vision attachments.*

Rheinmetall has successfully used this kind of partnering tactic with many different operators. It speaks to the management’s capability to create growth. Now Theon is doing the same. Also, moving down the value chain through acquisitions strengthens Theon’s market position (manufacturing optics). Partnering brings exactly those new innovations as you mentioned (new applications) and indeed, at the same time, presence in the target country gets a foot in the door, making it easy to choose the operator.

Oh, and indeed, a subsidiary was established in Belgium, not an acquisition made.

Matias Asiakainen has written an article about the defense industry from an investor’s perspective. The article takes about ten minutes to read. ![]()

In this analysis:

- Defense industry stocks interest investors

- Germany invests in defense

- Defense industry stocks re-examined from an ESG perspective

- Defense budgets growing

- The share of equipment procurements varies significantly

- Production bottlenecks

- Risks of defense industry stocks from an investor’s perspective

- National interest at the forefront

- Consider the ethics of the defense industry before investing

- Comparison of six international defense industry stocks

- RTX Corporation (formerly Raytheon Technologies Corporation)

- Rheinmetall

- Northrop Grumman

- Lockheed Martin

- BAE Systems

- SAAB AB

- Analysts’ forecasts

- Buy company shares at low costs

And so it happened that Theon is delivering a large order from new product categories and new locations! I certainly didn’t expect such quick action.

Lockheed Martin’s Sikorsky won a $10.3 billion contract for the production of 92 CH-53K helicopters, with deliveries continuing until 2034. ![]()

How do you see Exosens’s situation? Is it already fully valued?

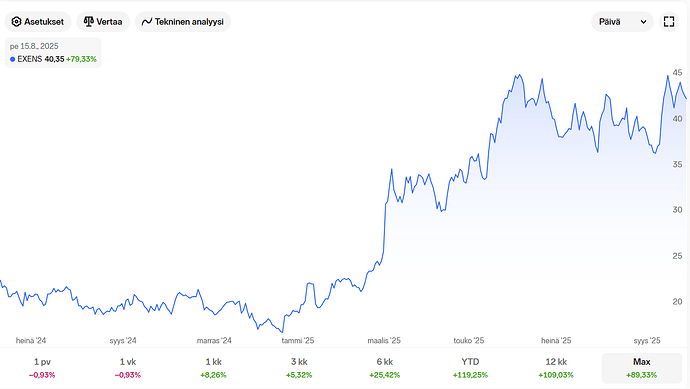

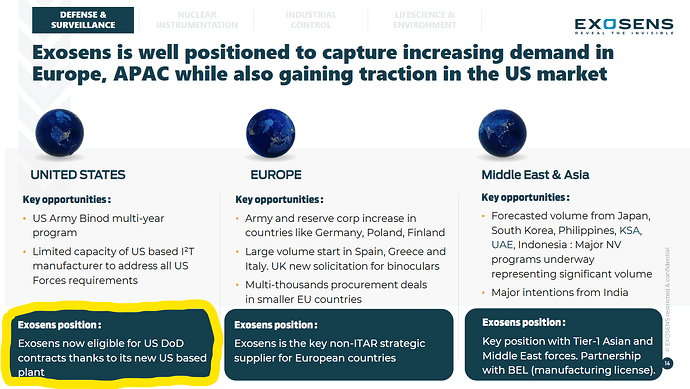

Exosens is a company that was listed in France a little over a year ago. The company’s stock market journey since its IPO has been quite successful, as can be seen from the image below. The company’s flagship product is image intensifiers. In early September, a new 5G image intensifier tube was launched on the market (I won’t even attempt a Finnish translation, so the meaning of the word isn’t lost in transit), which is touted as a game changer. The company could be seen as enjoying a monopoly position, given its market share of image intensifiers outside the United States. I haven’t found figures for the US market share yet, but the United States accounts for as much as 45% of the global image intensifier market. However, the company currently operates in the US market, and this market is quite significant for the company, according to the half-year report below. Furthermore, I believe there is ample room for growth in the US market as the company’s production capacity expands within the country, allowing for the production of Made in America products.

In light of this information, the company seems like an excellent opportunity, but then we come to a matter that is difficult for me, at least, to grasp: whether all of this is already reflected in the stock price. The company’s current P/E is 39 (closest comparable and the company’s largest customer Theon: 31) and Forward P/E is 27 (Theon 25). P/E is not necessarily the best metric for such companies to determine if the company is expensive or cheap, but I included it here to support my reasoning.

Image intensifier Valonvahvistin – Wikipedia

The article below explains how Asian defense companies are benefiting from accelerating military spending and the tightening geopolitical situation.

Morgan Stanley has highlighted strong players with a growing order backlog and a good position in international markets. South Korea’s Hanwha Aerospace, Japan’s Mitsubishi Heavy Industries, Singapore’s ST Engineering, and India’s Bharat Electronics are seen as key winners in the growth of the defense sector.

Asian defense stocks are gaining momentum as regional military spending accelerates amid growing geopolitical tensions.

According to recent analysis from Morgan Stanley, several key players stand out in this expanding sector. Here’s a closer look at the top performers positioned to capitalize on increased defense budgets across Asia.

Morgan Stanley’s latest rankings highlight companies with strong order backlogs, innovative capabilities, and strategic positioning in high-growth segments.

On the Perun channel, a summary of the Defence and Security Equipment International exhibition. DSEI is a defense industry event held every two years in London. This year, there were over 1600 exhibitors. Video duration 57 min.

The American company Epirus has developed such a microwave/EMP weapon against drones.

The same news in video format if the above article has a paywall:

New Weapon Downs Dozens of Attack Drones in Stunning Display

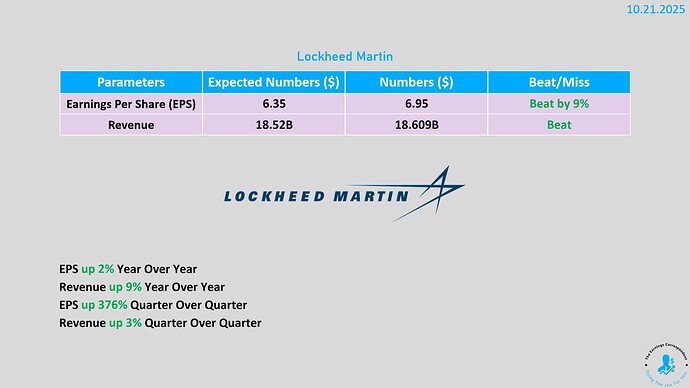

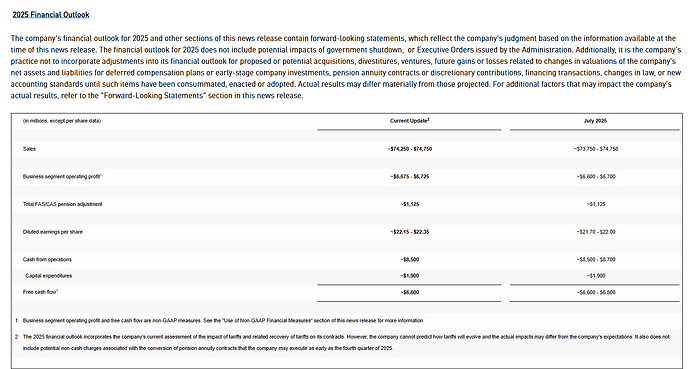

Lockheed Martin reported strong results, and demand for its weapon systems is higher than ever in both the United States and its allied countries.

The company plans to significantly increase its production to meet the surge in orders, and its massive order backlog provides a stable foundation for long-term growth.

The company is investing heavily in both new technologies and production capacity to remain at the forefront of the defense industry. The company emphasized its role as a leading player in air defense, space warfare, etc.

https://x.com/earnings_guy/status/1980597367071023246

Company’s Own Materials

Heikki Keskiväli has written a good article on the drone countermeasures market: threats, solutions, and the most interesting points from an investor’s perspective. Definitely worth reading:

The article below states that the drone market is growing sustainably, meaning it’s not just a bubble.

Cheap and efficient drones have become a core tool in warfare, and their demand is strong and will continue to be so, at least according to this article. Small companies are bringing new solutions, but competition is shifting more towards software and system integration. At the same time, counter-drone technology is also growing.

Here is Juho Toratti’s article about KNDS Group, which may go public in the near future. ![]()

Together, the KNDS Group develops and manufactures equipment, technology, and ammunition for the land operational needs of the defense sector. In practice, this means armored vehicles, artillery systems, unmanned vehicles, ammunition used by all of these, and bridge systems. In addition to physical equipment, KNDS offers technology solutions and equipment training services needed by the industry. The company’s solutions and products are used by the armed forces of over 30 countries. KNDS is a partner company of the German and French armed forces.

https://theon.com/theon-announces-q3-2025-trading-update-and-fy-2026-revenue-target/

Good development from Theon. Guidance raised for the rest of the year, strong guidance for 2026. Cash used for acquisitions, but value has been/is being created quite well with them. Software Backlog slightly lower than Q2, but an upward change is anticipated for this by the end of the year.

Soft backlog looks much better now after a 100 million euro order.

Trump confirmed that the United States will sell F-35 fighter jets to Saudi Arabia ahead of the crown prince’s visit.

The announcement slightly raised the company’s stock price. There are no further details on potential deals.