I bought 2000 euros worth of SoFi Technologies. Maybe I’ll buy three more such tranches or maybe not… and sell the first tranche tomorrow, only God knows. ![]()

Apologies, I wrote this quickly, so there are certainly errors and logical flaws. Deliberately made exaggerations and things stated “for sure”. ![]()

SoFi seems to be a versatile banking and financial company, but also a technology company, or rather, a fintech company. ![]()

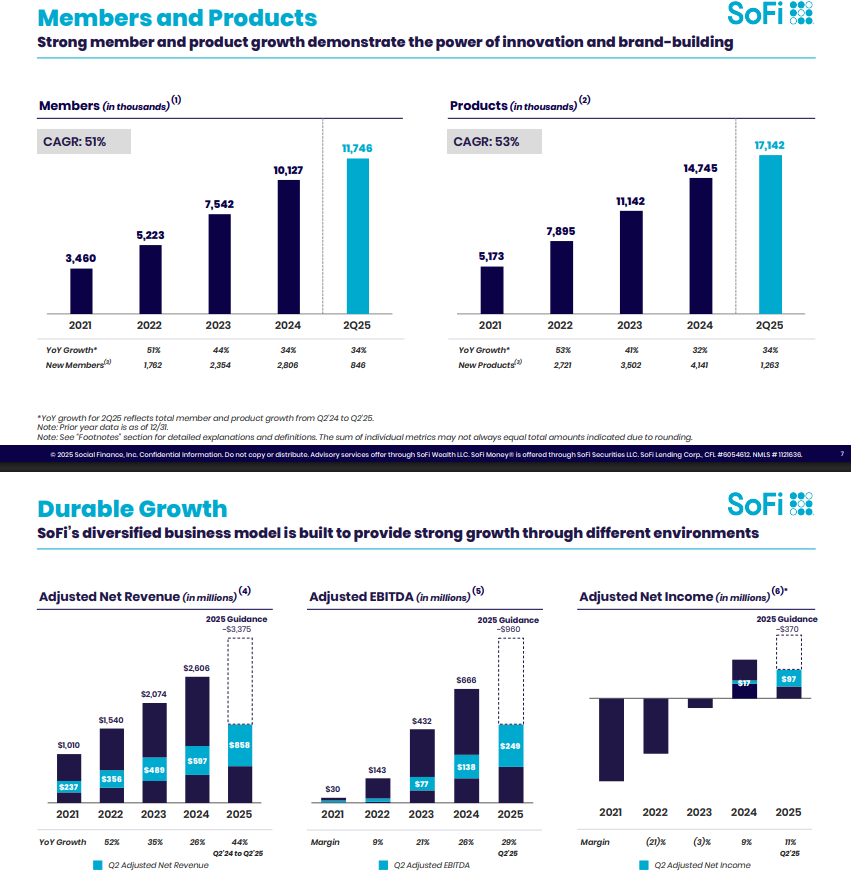

The company has turned profitable surprisingly quickly and is growing rapidly. Naturally, customer numbers have also grown at a considerable pace, and that’s not all – customers don’t just use one service, but often, upon joining SoFi, they quickly start using several of the company’s offered services.

The company had an offering, which brought flexibility to the firm, helping SoFi with debts and enabling, for example, more acquisitions. In addition to acquisitions, a new crypto service is also bringing growth, but time will tell whether it’s a good thing or not.

SoFi challenges old players and even newer ones; it offers more versatile services than the much-touted Robinhood, and SoFi is also more profitable.

An essential part of SoFi’s (potential) success is that there’s a lot of potential to improve profitability, for example, with a new lighter business model and continuously increasing scalability. I don’t see it as problematic that the balance sheet matters are also in relatively good shape now.

Things to consider

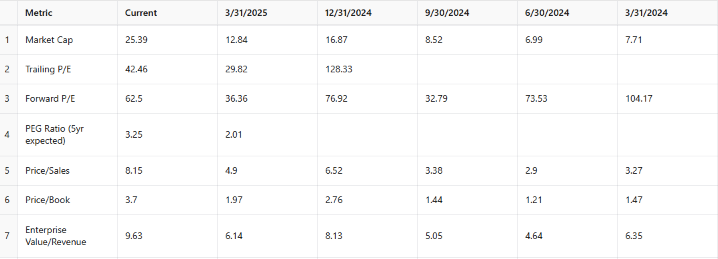

There’s no denying that, at least in some respects, the company appears expensive in light of the numbers. The company is growing organically and inorganically, and there’s sufficient growth potential in the markets and various industries. And let’s not forget that there’s a lot to be gained on the profitability side too. On one hand, expensive is expensive, on the other hand, it might just be “expensive”… that remains to be seen.

Even a blind person can see the numbers, but before commenting on the figures, it’s worth getting to know the company, so you can conclude:

“This is even more expensive than I thought” ![]()

(Data from Yahoo and then edited etc.)

Of course, SoFi’s industry also has various regulatory risks and legal issues that can significantly impact it, and the company often has no means to influence these. And yes… there are plenty of other threats and issues. ![]()

In short:

SoFi offers a wide range of services – practically everything from one place. It is one of the most comprehensive players in its field, if not the most comprehensive, and it also has room to grow in each of its segments. It is a fully integrated fintech platform, particularly popular with young people (will the old ones follow? ![]() ), who are constantly adopting new company services. The company has an efficient business model that is further developing with new structures and services.

), who are constantly adopting new company services. The company has an efficient business model that is further developing with new structures and services.

Growth has been very rapid, but only about 3.3 percent of Americans are SoFi customers. Financial services are performing particularly strongly, but there is significant potential in other segments as well. Furthermore, the company expects significant new customer acquisitions this year and next.

Scalability is constantly improving, and profitability is strengthening at the same time. Balance sheet growth has been managed wisely and moderately.

And an important note: SoFi has repeatedly exceeded analysts’ expectations, meaning the company does not live on promises alone. There will continue to be drivers, such as acquisitions, new Loan Platform agreements, the return of crypto services… the list goes on. ![]()

Let’s see if more of this comes into the portfolio. ![]() Waiting for dips…

Waiting for dips…