Nokia and Softbank have conducted field trials regarding spectrum for the 6G era. Softbank will be one of those operators testing AI-RAN and will presumably deploy it, as they had already demanded Nokia integrate Nvidia GPUs into their products even before the AI-RAN announcement (October 2025).

Summary.

SoftBank and Nokia conducted successful 6G field trials in Ginza, Tokyo, starting in June 2025. The trials demonstrated that the 7 GHz frequency band is one of the strongest candidates for next-generation mobile networks.

Key findings:

- Performance matches current standards: The 7 GHz frequency provides coverage and quality fully comparable to the current 3.9 GHz (5G), even though higher frequencies should theoretically attenuate faster.

- Urban “canyon effect”: In dense urban environments, signals reflect off buildings, which improved coverage more than expected. Hardly any dead zones were observed.

- AI era requirements: 6G networks require 200–400 MHz of bandwidth due to the growth of AI services. 7 GHz (centimeter waves) enables this high capacity without the coverage issues of 5G millimeter waves.

- Timing: The capacity of current 5G networks is estimated to be reached around 2030, at which point 6G networks must be ready for commercial use.

At the conference organized by Needham & Company on January 13, 2026, David Rothenstein, Ciena’s Senior Vice President of Strategy, provided an assessment of the competitive landscape following the merger of Nokia and Infinera.

Below is an AI-generated summary of his remarks.

1. Thinning of the competitive field

Rothenstein noted that the number of competitors in the optical networking (WAN) market has significantly decreased over the years. From Ciena’s perspective, there are currently only three major players (outside of China):

- Ciena itself

- Nokia, which is now strengthened by the Infinera merger

- Huawei (which remains strong globally but is restricted in certain Western markets)

2. Challenges of the Nokia-Infinera merger

Ciena does not seem intimidated by Nokia’s mega-deal; instead, it sees integration-related weaknesses that it can exploit:

- Integration work: Ciena believes that Nokia faces a massive task in combining organizations and carrying out portfolio rationalization.

- Historical competition: Rothenstein pointed out that Ciena has competed very successfully against both Nokia and Infinera when they were separate companies, and believes this will continue now that they are a single entity.

3. Technological comparison (Ciena vs. Nokia/Infinera)

Ciena emphasized its own leadership and market share:

- Market share: Ciena’s share of the global optical market (excluding China) has risen to a record 30 percent, and it expects its share to grow further in 2026.

- Innovation: While Nokia and Infinera together form a large and “well-resourced” competitor, Ciena is confident in its ability to stay ahead, particularly in the infrastructure required for artificial intelligence (AI).

4. Vertical integration and supply chains

The discussion also touched upon supply chains. Ciena mentioned that the industry is suffering from shortages of certain optical components (such as ITLA lasers). This is interesting because Nokia specifically acquired Infinera to secure its own optical component manufacturing (such as indium phosphide lasers), which Ciena does not have on the same scale. However, Ciena stated that it has not experienced significant disadvantage from this so far.

Edit:

More specifically, here is Ciena’s comment:

Outside of Huawei, who still exists and still does very well, we’re really looking at us and Nokia with a combination of Infinera. And what I would say about that combination is we competed very effectively against both when they were standalone companies. And we continue to compete effectively with them now as a combined company. They have some work to do, I think, in terms of integration and portfolio rationalization. But they’re a big, well-resourced competitor who we don’t take lightly.

Prior to this, analyst Ryan Koontz had sort of suggested that Nokia would have some integration issues…

You have Nokia, Infinera, combination. They’re probably going to go through some issues.

@Lexus an exceptionally strong closing auction today, especially since the US market at least opened significantly in the red? It would be interesting to hear tomorrow what the ADR chart looks like after tonight’s US close ![]()

At the moment, it looks like the entire sector is under pressure, and Nokia (at least for now, only slightly) along with it. However, the stock is really on the verge of turning towards some level of correction.

In the largest chart, I have outlined the daily trend. RSI development is also giving a negative signal as it has dropped from its upward trend. We need some bull volume now, but in my opinion, it is lacking. Let’s see if it emerges before a possible correction.

The hourly chart in the bottom left basically reflects the daily observations. And the monthly chart in the bottom right shows a rising monthly candle, which is positive, and possibly suggests that if a correction were coming, it would try to stop before the @ 6.05 USD price level.

There is a real demand for some positive news right now. Perhaps the earnings season will bring some, or maybe the EU could provide some before then. Anyway, I’ll post before tomorrow’s open whether the situation has changed. Ideally, today’s low could stay at this @ 6.48 USD level and recover higher towards the evening..

Edit: Declining with the market and the day’s low is already at @ 6.41 USD. Without an evening miracle, we are strongly leaning towards some kind of correction.

Snap and a couple of others as new licensees

Could those couple of others be the ones mentioned earlier, Hisense, Acer, etc., or new ones?

Max pain for Friday is $5 by the way, and I think volumes have grown (OI); since the last time I checked, puts have clearly increased?

But it doesn’t look like it’s worth pushing all the way to 5 ![]()

AI Summary.

AI and the Optical Revolution in January 2026

AI and the Optical Revolution in January 2026

The massive growth of AI clusters has completely transformed fiber optics order books. Traditional copper cabling has reached its physical limits within data centers, moving optical technology ever closer to the computing units (GPUs) themselves.

Key points summarized:

- Optical infra at the core of data centers: Fiber optics is no longer just for traffic between data centers. AI requires optical solutions inside data centers, down to individual racks and chip-to-chip interconnects.

- Ciena’s meteoric rise: Ciena has become the industry “darling.” Its stock has risen over 160% during the past year, reaching a record level of $260. The company’s revenue in 2025 was $4.77 billion (up 19%), and it forecasts revenue of as much as $5.7–6.1 billion for 2026.

- Geographic fragmentation: Energy shortages are forcing the split of large AI factories into smaller regional units. For these to function as “one machine,” thousands of ultra-high-speed fiber connections are needed between them.

- Strategic acquisitions: Ciena acquired Nubis Communications (for $270 million in September 2025) to expand its expertise in intra-data center, short-range optical interconnects (such as CPO/NPO modules).

Connection to Nokia and other players

Connection to Nokia and other players

The article emphasizes that Ciena is not alone. Nokia’s network infrastructure unit has also benefited from this “AI supercycle.” Nokia has responded to the disruption by reorganizing its business (as of January 1, 2026) and highlighting optical networks as the core of its growth.

Technological shift in the market:

- From copper to fiber: Previously, the principle was “copper if possible, fiber if necessary.” Now, AI systems require fiber due to performance and power consumption requirements.

- Value shift: The “gold rush” for investors and companies is now targeting cabling, connectors, and optical packaging located closest to fragmented computing power.

| Ciena key figures | 2024 (actual) | 2025 (actual) | 2026 (forecast) |

|---|---|---|---|

| Revenue | $4.01 bn | $4.77 bn | $5.7 – 6.1 bn |

| Adj. EBITDA | - | $637 million | - |

| Operating margin | 9.5 % | 11.2 % | ~17 % |

Summary: Ciena has successfully capitalized on “catch-up” investments from hyperscaler customers (such as Meta and Amazon), which compensate for weaker demand from traditional telecom operators. Investors view the company as one of the best ways to profit from the physical build-out phase of AI.

Morning pick.

Morgan Stanley raises its recommendation for Nokia to overweight, with a target price of 6.50 euros.

This is according to an update.

Edit: There is now some potential for Nokia’s correction to turn out to be underwhelming thanks to Morgan Stanley’s analysis update. I am referring to Nokia’s technical picture, which was commented on above.

And then OP has released an earnings preview titled “Earnings turn to growth”. Here is a summary.

Expectations for Q4 results:

Revenue: 6.3 billion (consensus 6.1 billion)

Adjusted operating profit: 1.03 billion euros (cons. 1.01 billion)

Dividend: 0.15 euro dividend/share (cons. 0.14)

Guidance: OP anticipates adjusted operating profit guidance of 2.0-2.5 billion euros for 2026 (Consensus expects 2.41 billion euros and OP 2.36 billion euros)

Recommendation: ADD, target price €6.50.

AI boost: Network Infrastructure benefits from AI investments. In Mobile Networks, the Nvidia collaboration (AI-RAN) is seen as a potential long-term game changer.

Strong cash position: Net cash is expected to be 4.4 billion euros at the end of the year, bolstered by Nvidia’s 0.85 billion euro equity investment.

New structure: Reporting will be simplified into two segments: Network Infrastructure and Mobile Infrastructure (which will also include the patent business).

Nokia’s Nvidia partnership strengthens its competitive edge, but the stability of the RAN market and growing R&D expenses will keep the profitability of mobile networks low (3–4%) in the coming years. Investors’ eyes are on Network Infrastructure, whose valuation gap compared to peers (e.g., Ciena) is expected to narrow if Nokia manages to accelerate its growth and improve its margins.

Ericsson is reducing its workforce.

Ericsson (NASDAQ:ERIC) today announces proposed staff reductions in Sweden as part of measures aimed at ensuring the Company’s competitive position.

The proposed staff reduction is part of global initiatives to improve cost position while maintaining investments critical to Ericsson’s technology leadership and the execution of the strategy to deliver high-performing, programmable networks that enable differentiated services and new monetization opportunities.

Initiatives to increase operational efficiency will continue across the Group but will not be announced separately.

Ericsson has submitted a notice to the Swedish Public Employment Service. Approximately 1,600 positions could be impacted in Sweden. The Company has initiated negotiations with the relevant Swedish trade unions.

New Zealand-based independent tower company Connexa named Nokia as its network operations centre (NOC) partner, outsourcing the running of its infrastructure to a global services provider rather than managing it in-house.

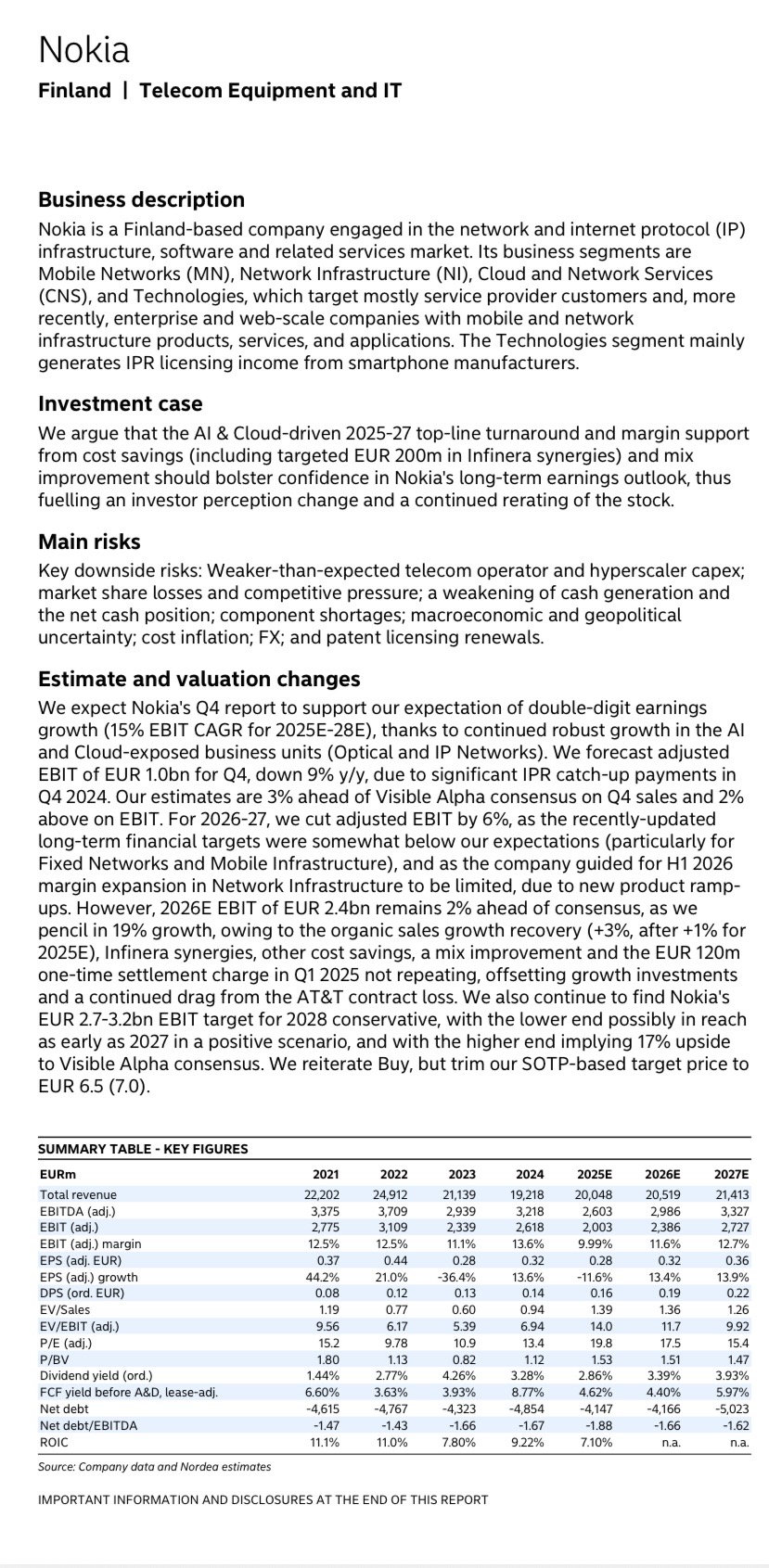

Nordea’s analysis —->

NOKIA 12.1.2026

Nokia (NOK) +3.8% - Shares rose after Morgan Stanley upgraded the stock from equal weight to overweight and raised its price target to EUR6.50 from EUR4.20. According to the brokerage, AI and Cloud now represent 6% of Nokia’s revenues and are growing approximately 1 percentage point every quarter.

https://seekingalpha.com/news/4539312-biggest-stock-movers-thursday-dell-lrcx-tsm-and-more?mailingid=43543553&messageid=2900&position=rta_news_bankr_control_main_2_textlink&serial=43543553.2476&source=email_2900

more on Snap and other patent deals here

and Tejas Shah’s thoughts on his new role (Chief Licensing Officer)

https://www.nokia.com/blog/first-impressions-on-nokias-technology-standards-business/

An updated outlook from Goldman Sachs is likely still missing; they seem to be at a pretty low level with their target prices?

maybe not brand new, but news out today; I have an impression that there was something about this earlier.

Skydweller Aero, in partnership with Nokia Federal Solutions and Tangram Flex, has been awarded a U.S. Air Force contract to demonstrate a rapidly deployable airborne private network — essentially a flying 5G cell tower. The technology could provide flexible communication for military and commercial operations.

As I recall, it was the marine corps, not the navy.

The article below contains more of those justifications, and I think there’s some other writing related to Nokia there as well. Apparently, Nokia was added to the top pick list by MS, and the volume yesterday was accordingly just over 50 M. The share price did, however, dip slightly from its peak gains during the evening - likely following the market as profits were being taken.

In a significant move, Morgan Stanley recently upgraded Nokia to an “overweight” rating and raised its price target to €6.50. The firm cited the company’s increased exposure to data center and AI-driven demand as a core reason. This upgrade, which also added Nokia to its Top Pick list, signals a growing institutional view that the revenue mix is changing faster than consensus earnings estimates reflect.

Morgan Stanley explicitly argues that valuation levels remain similar to historical averages during previous technology cycles, at about 9 times EBIT, and this does not fully reflect Nokia’s increased exposure to AI-related network demand.

In other words, the stock trades at a multiple that discounts its current 6% AI/cloud segment, not its projected 30% future profile. This disconnect is the opportunity. The company’s financials are being built for a high-growth future, but the market price has not yet fully priced in that dominance.

Investors must watch three critical checkpoints.

The catalysts are clear: quarterly growth rates (AI/Cloud segment’s explosive growth is paramount), capital expenditure execution, and margin defense.

Ericsson’s layoff announcement signals that 5G is a lost mobile generation.

Despite years of promises regarding new business opportunities and groundbreaking use cases, the telecommunications industry continues to stagnate. As Ericsson announces further layoffs, 5G increasingly looks like a mobile generation that fell short of its potential.

It’s hard to completely disagree with this. However, a positive perspective offers a bright future. If bringing AI computing to the network edge becomes a reality and use cases are found for it, there is massive upside for Nokia’s share price.