It depends on the situation, of course, but it can very well be. The market is not informationally perfectly efficient, and management/the board are much more aware of the business than we outsiders. Thus, share buybacks can actually create value if the purchases are made at a discounted price and, in the long run, the market price corrects to this “fair price,” which, in the view of management/the board, could be higher than the stock price. Share buybacks at this level also have a clear positive signaling effect, as Atte also wrote. If the board/management is correct that the share price is undervalued, then in these transactions, the only losers are those who sell at a “discounted price.” There are also many other possible reasons why dividends are not desired, and those interested can learn more about these with a quick Google search.

Here are Roni’s comments on the results of Lemonsoft’s change negotiations.

Atte has published a new company report on Lemonsoft. ![]()

We are revising Lemonsoft’s target price to EUR 7.0 (previously EUR 6.7), but due to the share price increase, we are lowering our recommendation to reduce (previously add). Lemonsoft’s share price has risen by approximately 20% since our update following the Q1 results, which has changed the share’s valuation to neutral. Thus, a small breather is in order in the short term, even though in the long run, the share still has potential as earnings growth continues. Lemonsoft is currently undergoing a transformation phase, where, led by the new CEO, things are being put in order regarding sales, implementations, product development, and the transition of technology platforms. So far, these have mainly burdened profitability, but this year they will gradually enable a return to the path of profitable growth.

Here are Ate’s comments as Lemonsoft reports its Q2 results this Thursday. ![]()

We expect the company’s revenue to have grown, driven by acquisitions, and organic development to have been slightly positive in the still uncertain market environment. We also forecast that profitability has moderately improved from the comparison period. Lemonsoft is currently undergoing a transformation phase, where changes are being made concerning sales, implementations, product development, and the transition of technology platforms. So far, these have mainly burdened profitability, but this year they will gradually enable a return to a path of profitable growth. We will therefore once again pay particular attention to the company’s comments regarding the progress of these projects and the development of the market situation.

Atte interviewed Lemonsoft’s CEO Alpo Luostarinen regarding Q2. ![]()

Topics:

00:00 Introduction

00:12 Q2’s main points

01:23 Organic growth negative

02:57 Technology platform costs

04:13 Transition phase concluded

05:18 Acquisitions

05:52 Share repurchases

07:04 Guidance unchanged

Here is also the company’s earnings release. ![]()

Lemonsoft Plc | Company Announcement | 14.08.2025 at 10:00:00 EEST

APRIL - JUNE 2025, IFRS

- Revenue grew by 5.3% and was 7,397 thousand euros (7,027)

- EBITDA was 1,618 thousand euros (1,578), 21.9% of revenue (22.5)

- Adjusted EBITDA was 1,619 thousand euros (1,592), 21.9% of revenue (22.7)

- EBIT was 939 thousand euros (1,153), 12.7% of revenue (16.4)

- Adjusted EBIT was 1,187 thousand euros (1,343), 16.0% of revenue (19.1)

- Result for the review period was 516 thousand euros (739), 7.0% of revenue (10.5)

JANUARY - JUNE 2025, IFRS

- Revenue grew by 7.6% and was 14,982 thousand euros (13,924)

- EBITDA was 4,562 thousand euros (2,976), 30.5% of revenue (21.4)

- Adjusted EBITDA was 3,644 thousand euros (2,992), 24.3% of revenue (21.5)

- EBIT was 3,359 thousand euros (2,095), 22.4% of revenue (15.0)

- Adjusted EBIT was 2,936 thousand euros (2,462), 19.6% of revenue (17.7)

- Result for the review period was 1,474 thousand euros (1,336), 9.8% of revenue (9.6)

Here is the company report on Lemonsoft after Q2, Atte Riikola style. ![]()

We reiterate our Reduce recommendation and a target price of 7.0 euros for Lemonsoft. The company’s Q2 figures were slightly below our expectations, but in the big picture, the development is in line with expectations. Lemonsoft’s transformation phase is nearing its end, and after organizational changes and the technology platform migration, the focus can be shifted to sales and accelerating product development. The market situation does not yet provide significant tailwinds in the short term, but with the actions already taken, the prerequisites for next year’s profitability improvement are good. The stock’s valuation (2026e EV/EBIT 17x) already prices this in to some extent, and in the short term, we see the risk-reward ratio as neutral.

Quoted from the report:

The weak economic outlook has recently slowed Lemonsoft’s growth, in addition to which the major changes made in the organization and regarding the technology platform migration have caused discontinuity. The biggest changes are now behind us, and the reorganized sales team will be better able to focus on sales work towards the end of the year. In addition to new sales, one of the key goals is to improve add-on and cross-selling.

What stood out in the interim report was the -2% organic growth. I.e., market share was lost. And in the financial figures, expert services fell short of the target, meaning projects have been quiet?

What concerns me most is Lemonsoft’s nature as a “software general store.” They’ve had to buy companies to show growth. And not all acquisitions have been gems, as the CEO stated. And regarding Lemonsoft, the company’s core, competitors are pushing past from left and right. At the smaller end, Odoo is capturing market share, and at the larger end, industry-specific software. Nowadays, a mediocre general-purpose software is no longer enough; there needs to be specialization and specific industry expertise, not just in PowerPoints.

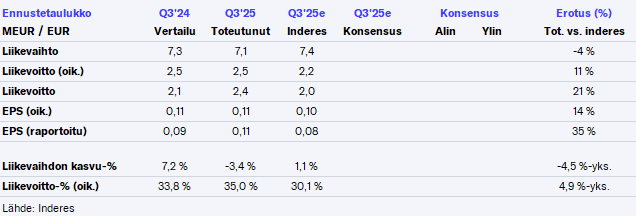

Atte has written his preliminary comments as Lemonsoft reports its Q3 results. ![]()

We expect revenue to have grown slightly in a market that has remained weak. We expect profitability to have weakened slightly from the comparison period, although our earnings forecast may prove conservative if the cost savings implemented by the company have already fully materialized in Q3. Lemonsoft’s transformation phase was nearing its end around the time of the Q2 report, and after organizational changes and the technology platform migration, the focus can be shifted to sales and accelerating product development. We will therefore be following the company’s comments on the progress of these, in addition to the market outlook.

Lemonsoft’s Q3 revenue fell short of our expectations across all lines, but the decline seen particularly in consulting and transactions was steeper than we anticipated. SaaS revenue development (+2%) was more stable (our forecast +5%). However, the company’s profit lines were better than our expectations, and as we highlighted as a possibility in our preliminary comment, cost savings had already come through well in Q3.

The market situation has, as expected, remained uncertain, and Lemonsoft’s major transformation phase also affected sales efforts in Q3. However, the profitability base is now strong, and going forward, focus can increasingly shift to sales work. The prerequisites for earnings growth in the coming years are therefore good if this succeeds, and at the same time, hopefully, the market situation will provide at least some tailwind.

Atte has made a new company report following Lemonsoft’s Q3 results. ![]()

We reiterate our Reduce recommendation for Lemonsoft and revise our target price to EUR 7.1 (previously EUR 7.0). The cost savings implemented by the company came through better than expected in Q3, and despite the decline in revenue, the result exceeded our expectations. Lemonsoft’s major changes in organization and on the technology platform side continued to divert the company’s focus in Q3, while the weak market situation complicates sales. However, the situation regarding the changes has now stabilized, and going forward, the company can focus on accelerating the pace of sales and product development. Looking to next year, however, the growth outlook is still cautious in our opinion, and in this regard, the stock’s valuation (2026e EV/EBIT 15x) is neutral.

Atte has once again updated Lemonsoft’s company report. ![]()

We reiterate Lemonsoft’s target price of 7.1 euros, but due to the share price decline (-13% after our Q3 update), we upgrade our recommendation to ‘add’ (previously ‘reduce’). Lemonsoft’s year 2025 has been characterized by significant changes in both organization and technology platform. Based on the Q3 report, the transition phase is nearing its end, and going forward, the company can focus on accelerating sales and product development. Looking ahead to next year, the growth outlook is still cautious according to our estimate, but with the stock’s decreased valuation (2026e EV/EBIT 13x), expectations have also moderated. Thus, the risk-reward ratio now leans to the positive side.

Here are Ate’s comments on Lemonsoft’s updated strategy. ![]()

Knowing the industrial segment better, I can state that Lemonsoft will not achieve any organic growth whatsoever. The product has fallen badly behind competitors, and the back end is leaking badly. They should change that future organic growth target in those forecast Excel sheets.

There are certainly challenges with new cases, as its reputation among customers is gone. Many medium-sized industrial companies don’t even include Lemonsoft in their tenders, having heard so much negative feedback.

If I could short the stock somewhere, I would definitely do it.

Lemonsoft mentioned Oscar Software as a competitor somewhere. Can you tell me anything about its product? As an owner of Panostaja, I’m interested.

Oscar’s reputation is almost as shaky. Oscar’s product is slightly better for an industrial company than Lemon’s, but it’s not good either. Many companies are also switching away from Oscar because the product is undeniably old.

If it turns out that their new P1 is just a user interface facelift, and the software under the hood hasn’t been completely re-coded, then I wouldn’t dare to invest. Many problems lie ahead if the re-coding hasn’t been done.

I personally don’t believe they have re-coded it, because they are releasing features incrementally on top of the old one. If it had been re-done, they

Oh, just when I bought Lemon, and Kakkonen’s wife recommended it ![]()

There’s also quite a lot of angry talk on Suomi24, for example, about Admicom’s and Visma’s products. And someone generally said that people are never fully satisfied with them.. Lemon’s customer churn, according to Inderes’ papers, was small..

In the last report, organic growth was -3% or something like that. In my opinion, that’s not exactly small, especially when many competitors are growing by double-digit percentages at the same time… But indeed, looking at the matter from within the market, there will be unpleasant earnings reports next year, unless they go and buy some companies to disguise that organic performance. The number

They have performed surprisingly well, and customer acquisition has not yet been the main focus..

Inderes: “Despite the decrease in revenue, the result exceeded our expectations. Lemonsoft’s significant changes in the organization and on the technology platform side continued to take the company’s focus in Q3, and at the same time, the weak market situation makes sales difficult.”

Which competitors do you think are currently doing well in the industry? Lemonsoft has identified Monitor, Oscar, and Odoo as key competitors. You already grouped Oscar into the same category as Lemonsoft, so are it those two others or some other players?

Lemonsoft’s recurring revenue has shown slight growth this year as well, and negative development has mainly come from transactions and consulting. Therefore, in terms of numbers, the ERP side is not particularly struggling. Customer churn has also been at a quite reasonable level. Lemonsoft has previously stated that the company’s ERP software has a total of about 700 core customers in the industrial and wholesale sectors. Across all products, the total number of customers is several thousands. Thus, on an annual basis, it is quite normal for dozens of customers to be lost, and in return, the company also gains new customers. But it remains to be seen whether the issues you raised will be reflected in the company’s figures in the future.

On what, then, do you base the assumption that Admicom will grow slightly more than Lemon next year? Is the assumption that the construction industry will start performing better than other sectors? Currently, Lemon is supposedly planning to step on the gas on the sales side, now that internal matters no longer take up all the attention. Lemon is slightly cheaper than its peers, as Kakkonen’s wife also mentioned ![]()

KL: In Lemonsoft, Rite is the clear main owner, and Häggblom chairs the company’s board. Lemonsoft is not familiar to the general public. The company sells enterprise resource planning systems to small and medium-sized companies in many different industries using a recurring revenue SaaS model.

Lemonsoft’s stock performance has been subdued, even though the company has grown its earnings. The collapse in valuations of small software companies due to the jump in interest rates has had an impact, but according to Häggblom, the company also needs to look in the mirror.

“Especially organic growth has been slower than what we believed at the time. We are a market leader and very strong in the industry, and there is still a lot of market for us there,” says Häggblom.

“For example, we can articulate even more clearly to customers that our solutions are developed precisely for the business of our core customer group and how great the value of our software is in improving the efficiency of customers’ businesses.”