A small follow-up comment on the report for those interested

Indeed, no major surprises emerged from Q3, meaning LeadDesk’s earnings growth is strong, especially supported by the Zisson acquisition and general cost discipline. Organic growth, in turn, was predictably weak, as the company’s investments in growth are still moderate.

However, the organic development of revenue was weaker than our expectations, and according to our estimate, it will be negative for the full year 2025. On this front, forecast calculations were made, which naturally flowed into the earnings forecasts.

A bit of a stream of thought behind this lowering of expectations.

The weakness in 2025 growth is also due to one-off drivers: at the end of last year, there was a churn of less profitable customer accounts, and large project revenues in Q4 last year make the comparison period difficult. There were also regulatory changes in Spain & the Netherlands that weighed on Q3 growth. And of course, LeadDesk’s focus in 2025 is not yet on growth, so the expectation level is also lower.

However, in recent years, various, in themselves one-off, growth inhibitors have regularly emerged (e.g., slowing purchasing decisions of large customers and a decrease in project revenue, churn of ‘temporary’ corona customers, shift in sales focus from fast SME business towards large accounts with longer sales cycles, weakening of crowns, churn of less profitable customer accounts, regulatory changes…), so it is necessary to leave room for small unexpected headwinds in the forecasts. In this lower growth phase, this has more significance than in a rising market, as their relative importance is slightly greater.

Another perspective is the prerequisites for growth to pick up. Fundamentally, I would think that before increasing growth investments externally, some early signs of organic growth picking up would be visible. This would indicate that a somewhat tested recipe for strengthening growth has been found, which could be reinforced by increasing investments in sales and marketing. Currently, there are no clear signs of this, meaning it is unclear how effectively increasing growth investments will take hold. Against this background, I believe it is good to keep expectations moderate. Olli did comment in the interview that investment targets have started to form, which is of course a good sign, although in my opinion, a better picture of their effectiveness will only be obtained once more time has been invested in them.

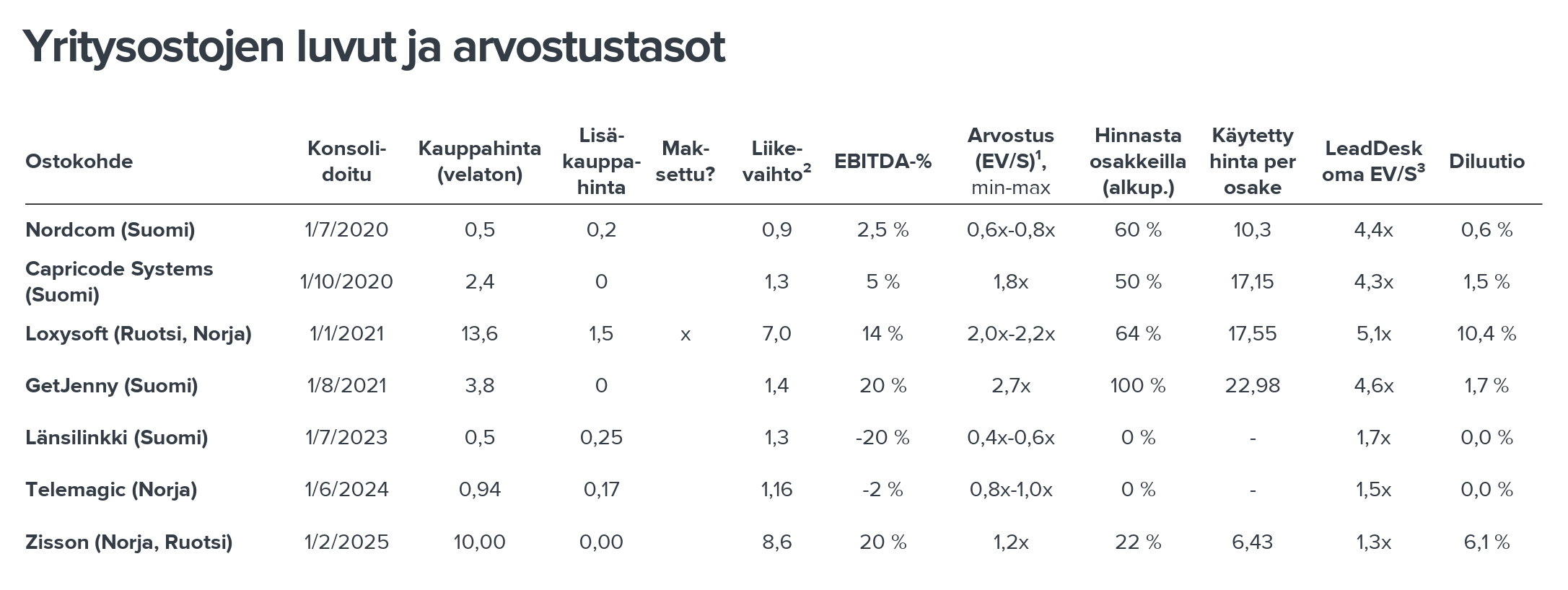

According to our view, the valuation is at a reasonable (2026e EV/EBIT 15x) or even very attractive level (DCF 9e/share vs. share price 6.9e/share), if the moderate organic growth pick-up to approximately 5% per year, as per our current forecasts, can be achieved. And on top of this, in my opinion, the company can be expected to make value-creating acquisitions, which are not yet included in the forecasts.

However, the brakes on our view are the currently weak visibility into the level of organic growth going forward (will acceleration succeed and how well), and on the other hand, the still low peer valuations, within which there are fewer upside drivers for the valuation.

If you have any further questions on other topics, please feel free to ask

![]() same interpretation.

same interpretation.