Here are a bunch of sexy investment names, but check out this one’s performance!

This is just the initial excitement. Just wait until the “my experiences with companies” thread gets going.

Hey!

I’ve now read your message for the day, and I don’t understand your main point.

So, because you don’t want to burn your fingers, you’re blaming others for daring/wanting to seek higher returns with higher risk?

With a stock that doubled in three weeks, every second person on the forum is a millionaire. It’s great that as a dividend guru, you’ve bought Nordea for many years around ten euros and are now selling it with almost a 50% return (NOTE: excl. dividends ![]() ) I should probably tear my hair out now, because after a positive return, you come here to show off at others’ expense. Next, moving to the Cayman Islands with those profits?

) I should probably tear my hair out now, because after a positive return, you come here to show off at others’ expense. Next, moving to the Cayman Islands with those profits?

I also bought, for example, ABAT and even held onto it for half of yesterday in my greed. I should probably send hate messages to everyone who mentioned the stock, because after yesterday’s -17% day, I only made a 130% profit. It really makes me angry.

But happy Thursday everyone! If I lived in Helsinki, I’d go to Thursday-Kalle now to vent my frustration.

Good comment. In my opinion, such “hot,” rising stocks are the most interesting, and I’d be happy to continue hearing what forum members buy/sell and on what grounds/with what expectations. In my opinion, it’s more

This is what happens when we are close to the peak of a bubble. The name is indeed misleading, because it’s a battery company. Without such a catchy name, the stock price would hardly be rising so sharply.

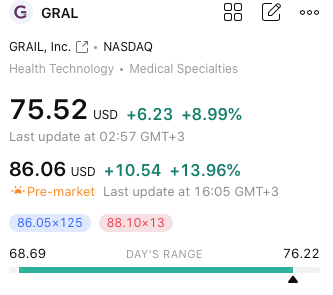

Foolish or smart? Yes, you can get returns from these bubble stocks, as long as you understand to sell before everything is gone. I’ve also traded these. The largest position in my portfolio is:

One could have, of course, also bought just Grail or both.

Deal with Siemens and pre thanks.

Siemens is active, didn’t a certain domestic health technology company just agree on cooperation?

I’m not blaming anyone else, just my own cowardice for not daring to participate in the meme stock lottery ![]()

Based on the response, my message apparently quite confused your way of thinking and peace of mind. ![]()

These US companies are really driving me crazy.

Today’s entertainment is provided by SLG. The company’s earnings reports are always like this nowadays:

And the reaction is like this:

It’s the same thing every time. I should probably just believe it and start playing along ![]()

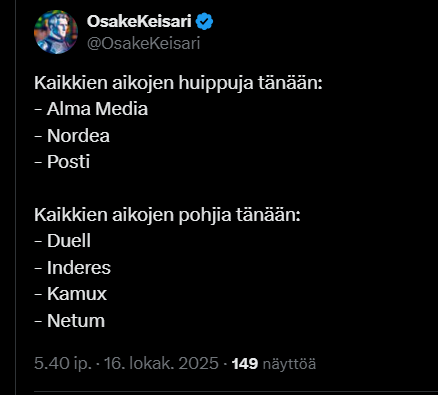

@OsakeKeisari’s picks from risers and bottomers ![]()

Global Atomic is again having its traditional -20% dip. New offering and dilution are coming. Otherwise, the uranium sector is doing well, but this one has been a sad performer.

This is a pretty sad story so far. Just a lot of going downhill day after day.

Quite a bloodbath going on in AI and crypto mining stocks. I considered ABAT and IREN too, but considering my own gut feeling and IT background, I bought NBIS earlier.

Fortum up almost 4% today. What am I missing? Q3 will only be released at the end of the month, no major electricity investments (data centers, aluminum plant, etc.) are in the headlines, at least…

Not that I’m complaining, as a shareholder, I’m certainly enjoying it ![]()

A price alert went off on my phone when VIX rose above 22. Now it seems to be already over 24 ![]()

At the same time, Fear/Greed has also dropped to the Extreme Fear side. A week ago we were bullishly heading into a bubble, now we are quite firmly in a bear’s den. Perhaps the Americans were scared by the green straight flush of OMXHPI’s time series?

Yesterday I reduced my Fortum holding at €16.99 and I think I wrote something like “don’t be surprised if it shoots to €18”. Well, of course, it looks like it will break €18 tomorrow.

Up about 100% from the lows of a few years ago. Not bad. I sold 1/7 yesterday, so there’s still some left. This is why I almost never sell everything at once. Not even half. Stocks continue to rise almost every single time I lighten my position. Most often, there’s even a surge like this one in Fortum.