All in @novo nordisk ![]()

As the turn of the year approaches, it’s crossed my mind after such an eventful year – I miss those boring bull markets, like 2021 ![]() – we’ve seen Intellegos, Trumpism, Nvidia’s tenbaggering (ok, this over 2 years), and the ~30% growth of Hesuli’s (Helsinki’s) OMX25, which however isn’t visible in any Inderes forum investor’s portfolio, because of the ever-lovely stock picking that will surely beat the index at least on one’s deathbed, and so that this sentence finally ends, I have to mention what was on my mind – not in the words of Seppo Räty, but…

– we’ve seen Intellegos, Trumpism, Nvidia’s tenbaggering (ok, this over 2 years), and the ~30% growth of Hesuli’s (Helsinki’s) OMX25, which however isn’t visible in any Inderes forum investor’s portfolio, because of the ever-lovely stock picking that will surely beat the index at least on one’s deathbed, and so that this sentence finally ends, I have to mention what was on my mind – not in the words of Seppo Räty, but…

…drums…

Could @Sijoittaja-alokas make a small compilation of the year’s best posts – either in his own opinion or the forum’s – and summarize the year’s events for all Inderes forum members (including the Inderes staff, I’m not leaving you out, no worries), possibly with a small introduction above the link to the post, for all of us to learn from for the coming year and for us to discuss with friends and family (who, inspired by example, are heavy consumers of the Inderes forum, of course) on New Year’s Eve with a top hat on, a cigar in mouth, and a glass of bubbly in hand. At some point before the turn of the year? ![]()

ps. I admit, I have a horse in this race, what else can you talk about with family and friends? ![]()

Thanks for your message Karibu! ![]()

I’m not the best to judge, but here’s a list of the most liked posts to start with. ![]()

1. Erkki Vesola, 541 likes

https://forum.inderes.com/t/analyytikkovaihdos/6096/63?u=sijoittaja-alokas

2. Olli Koponen, 275 likes

https://forum.inderes.com/t/analyytikkovaihdos/6096/81?u=sijoittaja-alokas

3. Tomi Valkeajärvi , 238 likes

https://forum.inderes.com/t/inderesin-kahvihuone-osa-9/50229/9371?u=sijoittaja-alokas

4. Mikael Rautanen, 235 likes

https://forum.inderes.com/t/inderesin-kahvihuone-osa-10/59288/7073?u=sijoittaja-alokas

Should we conclude from this that forum members are happy when someone from Inderes leaves or is away for a long time ![]()

Maybe I can compile something else later, but here are these to start with. ![]()

Have a nice Saturday!

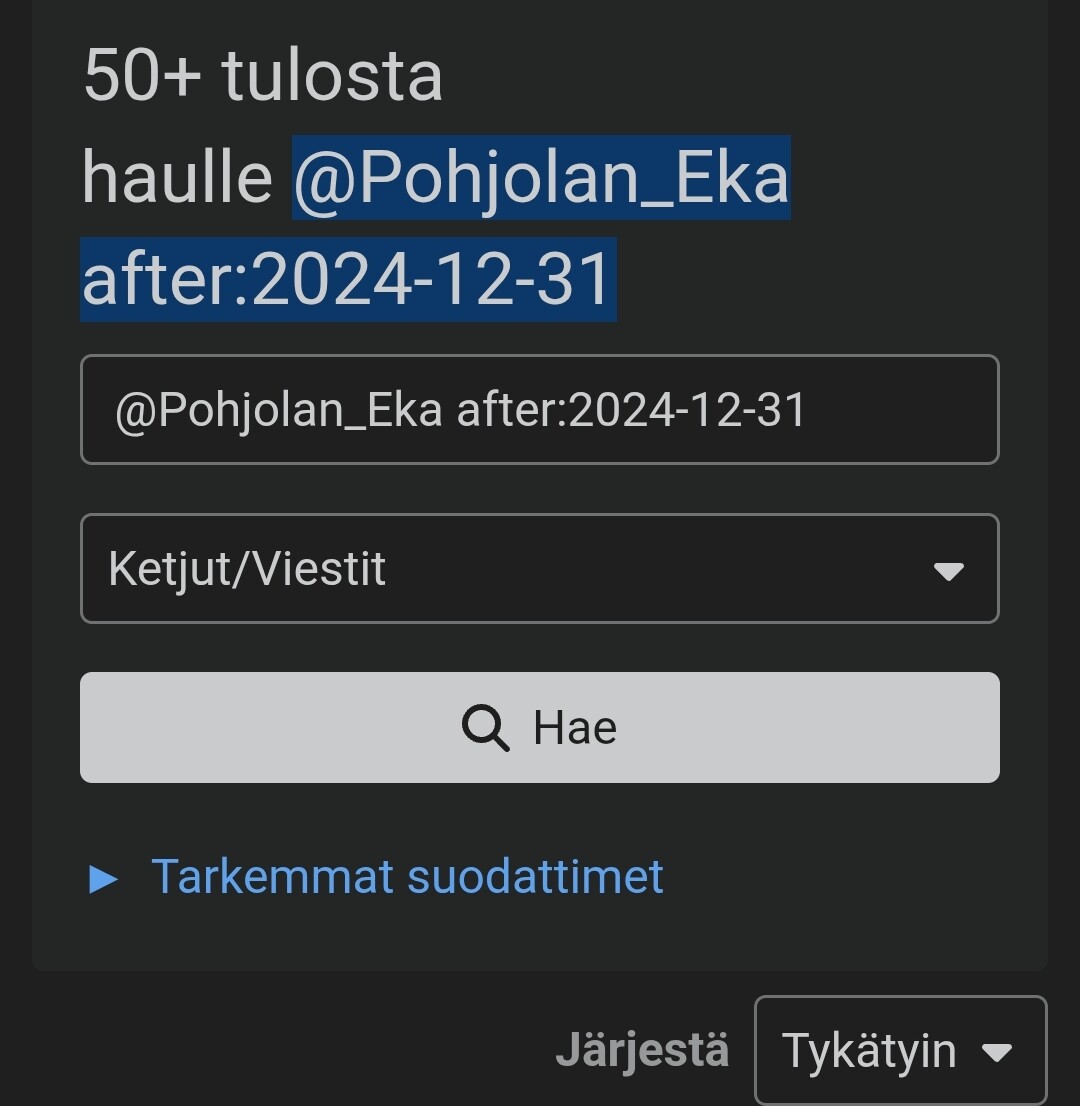

You can use this search term to explore the most liked posts of the year in threads: after:2024-12-31.

Additionally, you need to sort by likes.

after:2024-12-31

At least they have a sense of irony since Midsummer is holding an extraordinary meeting on the day before Christmas Eve ![]()

Here is one more tip for exploring a single user’s most liked posts.

In both scenarios, you have: 1. Huge country risk. 2. The risk of having all your money in one asset class (residential real estate).

If you want diversification, you sell your current investment properties and buy world indices, gold, bonds, and cryptos.

Back in the day, companies and other entities trying to appeal to the youth used to make bad rap videos:

Just when we finally got the boomers to learn that everyone thinks those are cringey as hell, they’ve now started coming up with putting out slang videos ![]()

I think it’s just humor and self-irony. Nobody actually thinks those will get the youth excited. That kind of language is a complete joke among 99.5% of young people too. At least my teen understood it that way. Of course, everyone sees it how they want.

Heiskanen delivers those lines damn well, though. It’s relaxed, no stumbling.

I agree about those rap videos. They were cringe! But anything poorly made is. If you want a good rap parody, I recommend Jope Ruonansuu’s “Aatteleppa ite” (Think about it yourself).

Fortunately, not everyone did rap

Henri Huovinen has been a mythbuster once again ![]()

https://x.com/HenriHuovinen2/status/2002341553680101890

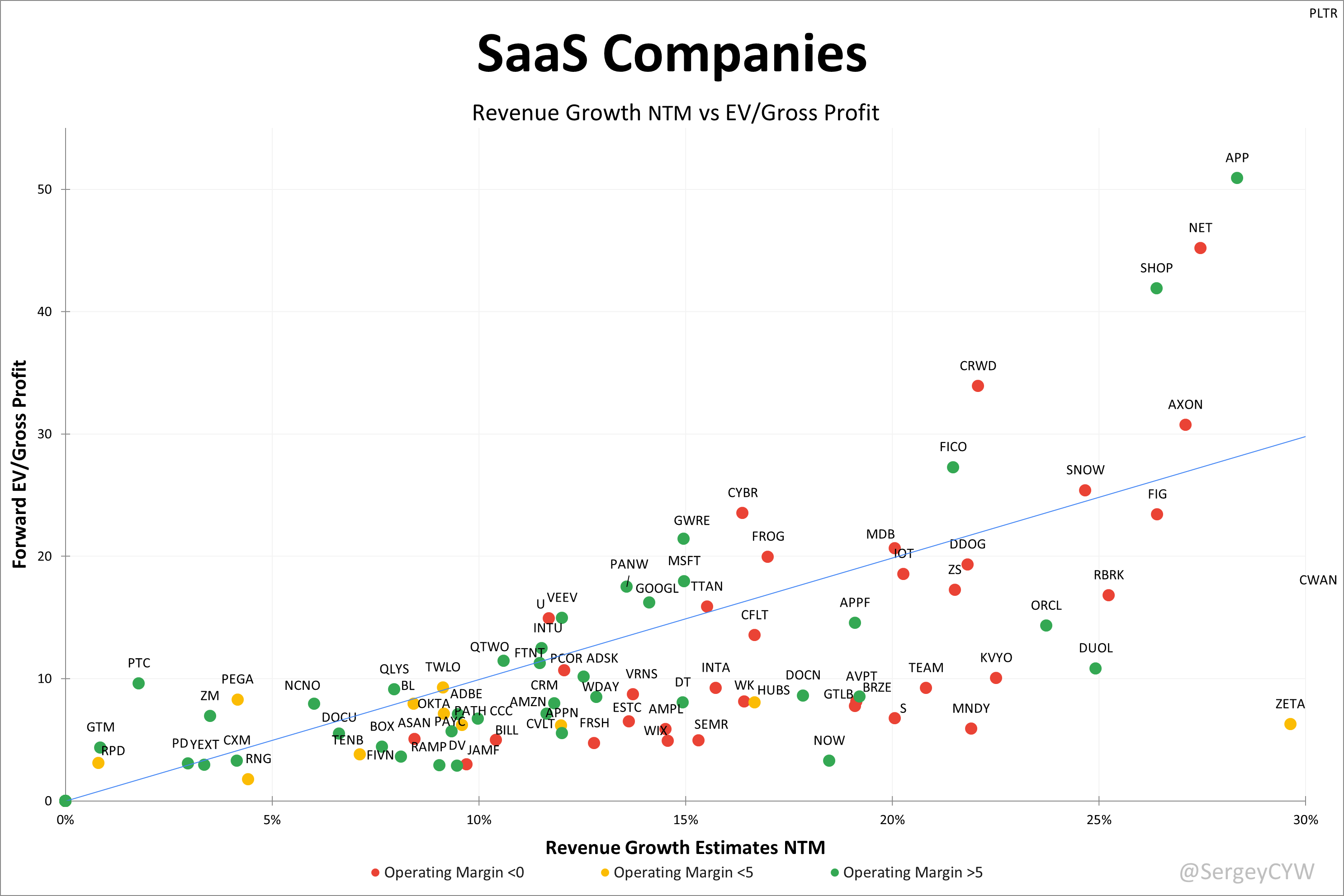

Below is a pretty interesting “visualization” of SaaS company valuations relative to growth and profitability.

These are always great! I’m a bit concerned about the trend of episodes getting shorter. ![]()

You could have talked even longer about Coffee Stain. A couple of comments regarding that:

- Cash EBIT is lower than EBIT. CS management isn’t interested in gimmicks. They present a Cash EBIT that has been adjusted for balance sheet capitalizations because they want to show conservative figures.

- The budget might start at an A-tier level, but the quality is ultimately at least AA-tier. Games are developed over approximately 5 years according to community wishes. The final version is released years after the early access version. The games are interesting, and on Steam, the average rating for the 5 biggest IPs is around 94-95, and the number of reviews is between 100-500k. These are Valheim, Satisfactory, Goat Simulator 3, Deep Rock Galactic, and Teardown. The company has grown significantly, although in bursts, as is typical for the gaming industry.

Moved from the Summa Defence discussions to the coffee room.

Now, I don’t know if you’re blaming Summa’s CEO for only responding to one media outlet’s interview request, or Kauppalehti for publishing the story behind a paywall. But you managed to draw me—someone who makes paywall decisions for a living in the media—into the conversation.

Paywalls are now an essential and often even the primary way for media to generate revenue. There was a somewhat awkward phase lasting years where media outlets produced a lot of free content for the internet, while print newspaper circulations declined. For understandable reasons, the outcome wasn’t profitable for media companies as their income dropped, but on the other hand, the workload might have even grown as the web had to be managed and maintained alongside print.

Now, over the last ten years or so, media outlets have successfully brought the subscriptions familiar from print newspapers into the digital age. You take out a subscription and pay for it, and then you get to read. That’s how it worked in the old days with print newspapers too. If you pay, you get to read. If you don’t pay, then you either ask your friends or rely on information summarized by others. Simple.

This logic is somehow funny—that people expect to receive information that has ideally been specifically sought out, analyzed, and perhaps even questioned, and then presented to the reader in an easily understandable way. And then all of this should be shared with readers for free. Why on earth?

I’m not just picking on you; this kind of strange attitude is still relatively common today. It hasn’t been many days since I saw an interesting article on Facebook. The sharer was some smaller local media outlet, I don’t even remember which one. However, in the Facebook comments, it caught my eye that several people were complaining about the paywall. “Why on earth does even a small local media outlet have to use a paywall? Don’t you understand that you would get more readers without a paywall?”

Media doesn’t earn anything from readers alone, just as it doesn’t earn from reach or any mystical reputation. In fact, a high number of readers can even just increase media costs, as traffic spikes require more bandwidth from online media, which in turn often costs more money.

It’s somehow curious that this perspective is constantly emphasized in online articles. It’s hard to imagine people at the door of a movie theater or a concert venue being outraged that seeing a new movie or a favorite band costs money. Hardly anyone in that situation would start explaining that you would get a bigger audience if these performances were shared for free.

When we look at the world of investing, even the smallest investments are hundreds, and more likely thousands of euros. In the long run and across an entire portfolio, we’re often talking about tens or hundreds of thousands of euros. That Kauppalehti article, which discussed Summa Defence’s complicated current situation behind a paywall, can be accessed for as little as 2.9 euros (an offer, likely for a new customer) and at a standard price of 35.90 euros. In my opinion, that’s not an impossible price, especially if an investment of hundreds or thousands of euros in the company is on the other side of the scale.

Because of that, I don’t quite fully understand what is so completely incomprehensible about this equation.

At least I understood it to be simply that the matter is not being clarified to all investors equally through the company’s own announcement.

The correct way would have been to issue a press or stock exchange release OR hold a press conference for all interested media outlets, from which the media could then write stories for free access or behind a paywall.

Instead, they stay silent for 3 days at a critical moment for the company and finally share information with only one person (a Kauppalehti reporter).

You don’t see a problem with this?

Of course I see it. But Summa’s own blunders and totally failed communication have nothing to do with the media’s paywall, which I gathered was the biggest issue in your message given your use of caps lock.

Edit: I’ll add this: the media’s job isn’t to be a PR agency that helps push a company’s message forward if they haven’t been able to do it themselves. That’s why a paywall is a perfectly understandable solution.

The paywall is highly relevant. An interview given to commercial media implies a commercial motive, which leaves market participants with the assumption that they likely didn’t speak for free, considering they didn’t even have the energy for a press release.

A party seeking personal gain by restricting communication is unlikely to enjoy anyone’s trust.

A listed company has a disclosure obligation, for instance, regarding material inside information. Information must be released to all investors simultaneously and not behind a single media outlet’s paywall, even if it only costs €2.90.

Well, was it material inside information? In my opinion, it was, because there was no public information on why trading had been suspended. The FIN-FSA (Fiva) probably disagrees, but at the very least it is clear that the company lacked the judgment regarding the publication of information.

(I do not own and have not owned shares in the company).

Regarding Kauppalehti, if there happens to be someone here who has something to do with the content, it’s annoying on the website when the same news/headline is in like 7 different places on the page. If it feels like it’s better because the page looks fuller with stories that way, it isn’t. It’s just annoying.

Yeah, and I have a paid subscription too, so I should be allowed to complain.